Financial

capital

Manufactured

capital

Intellectual

capital

Key enablers

- Global category

structure - Enhanced, digitally enabled consumer insights

- Democratising our brands

- Enhancing go-to-market

- Laying the foundation for future growth possibilities

Risks identified

- Changing consumer preferences

- Hyperinflation and currency devaluation

- Commodity price volatility

Our aim is to achieve consistent, double-digit volume growth by capitalising on our existing market leadership and deepening category penetration, thereby creating long-term value for all our stakeholders.

10

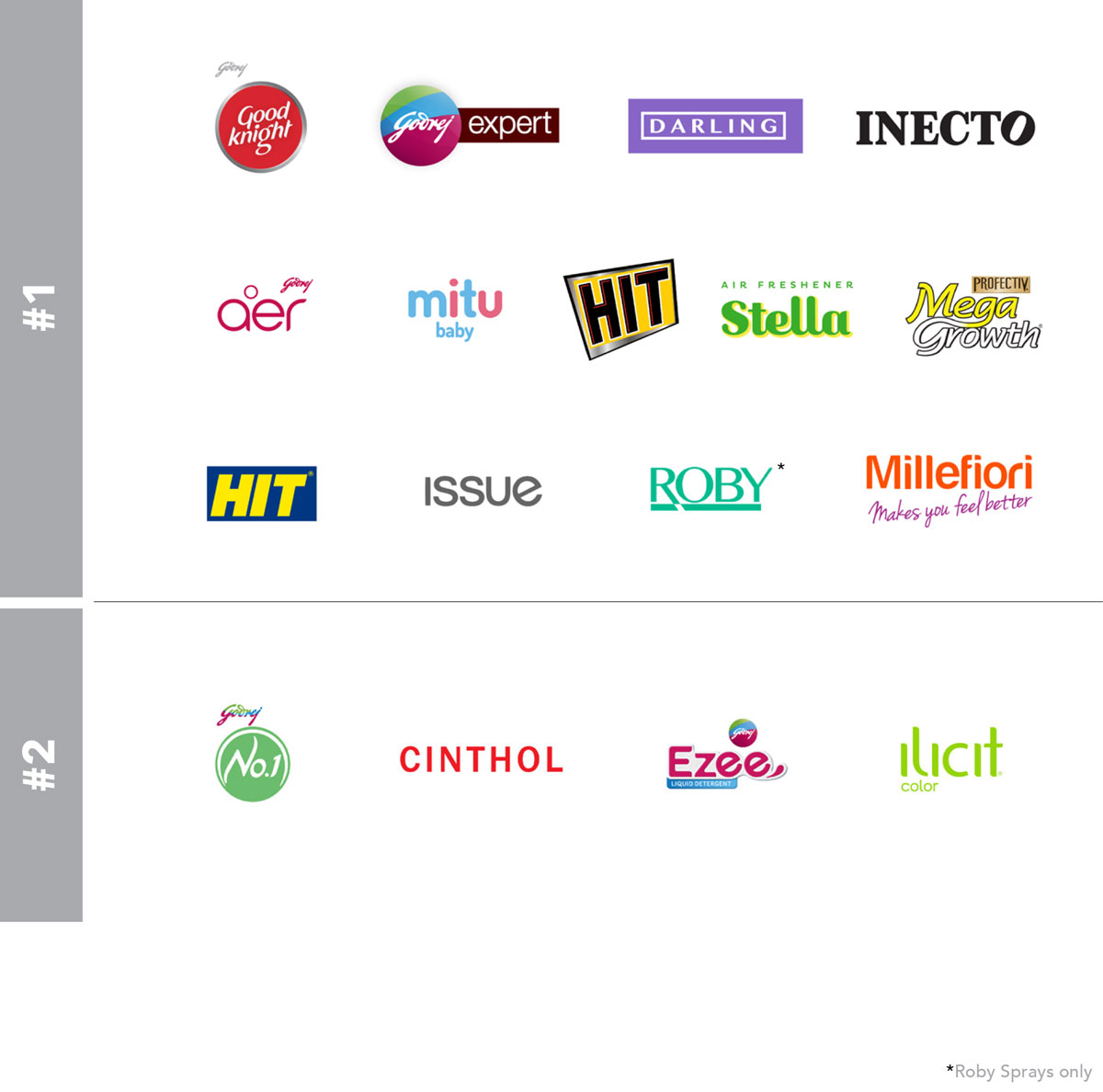

#1 brands

across 4 clusters

13.34%

Return

on equity

33%

Growth in

e-commerce

in India

₹13,199

Crore in

revenue

Our chosen

portfolio

At GCPL, we are deeply driven to create affordable, delightfully designed products. Our consumers are at the heart of everything we do, and serving them is what makes it all worthwhile.

As category leaders, our strategy is to increase innovation-led growth and discover new ways to disrupt our product portfolios. Democratisation and accessibility are important while creating superior quality and delightfully designed products, given our focus on emerging markets.

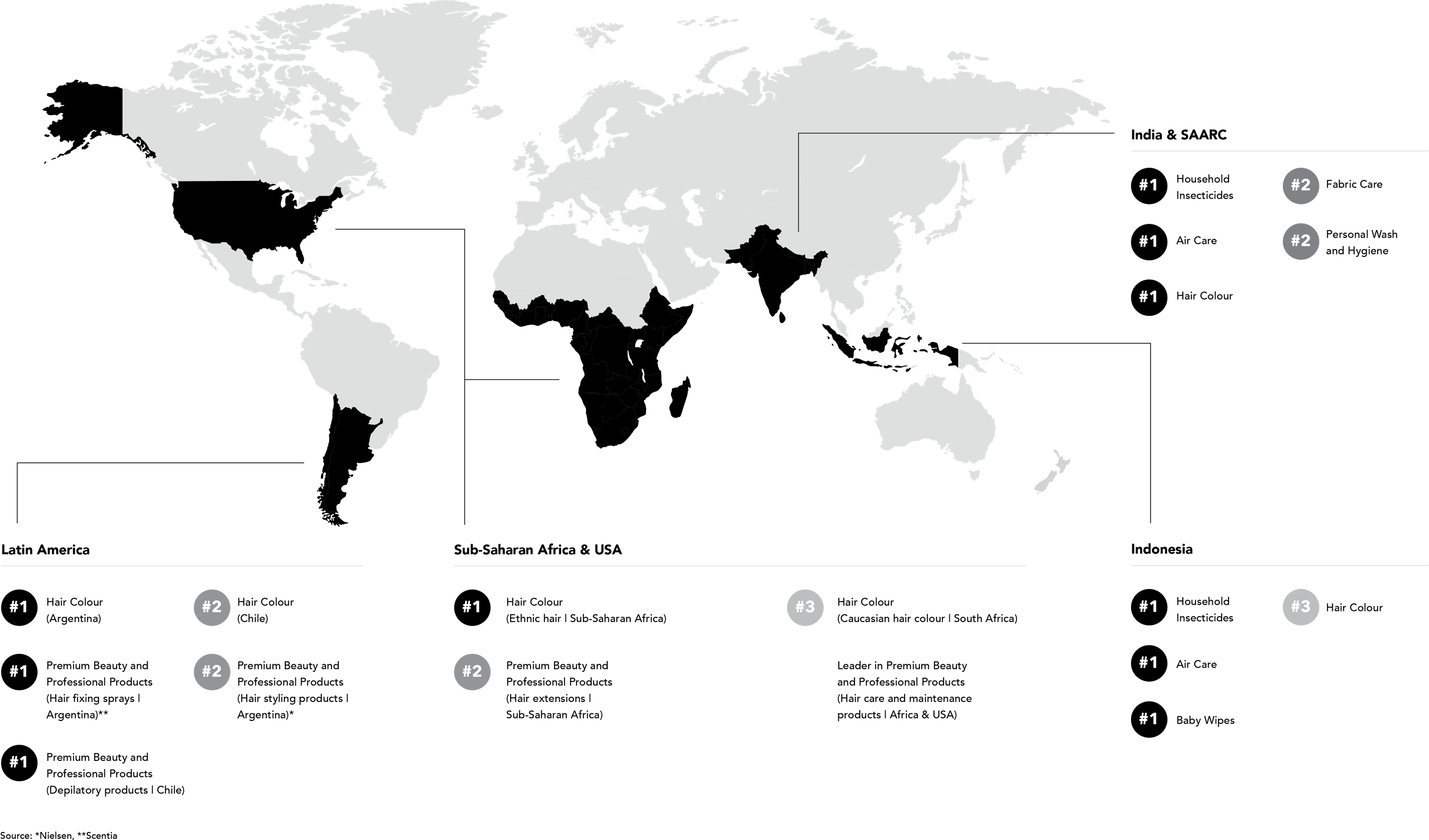

Our geographic footprint comprises some of the largest and fastest growing emerging economies in the world. However, our top categories in these countries, such as Household Insecticides, Air Care, and Hair Colour, are underdeveloped, with substantial headroom for growth. We view this as a huge opportunity for value creation by applying our winning strategies for category development through our know-how in product, communications, and activations.

Our aim is to achieve consistent, double-digit volume growth by capitalising on our existing market leadership and deepening category penetration, thereby creating long-term value for all our stakeholders.

India & SAARC

- Improved distribution reach, with a focus on enhancing coverage in underpenetrated areas

- Rural substockist network in India grew by 10%

- Modern trade channel in India delivered a high double-digit growth trajectory

- E-commerce in India grew at 33% with a 2-year CAGR

- Doubled down our efforts on quick commerce

- In India, we have geo-tagged all our general trade urban outlets, enabling optimal utilisation of our resources

Indonesia

- In Indonesia, we outsourced the entire distribution for general trade to large-scale distributors to reduce operational complexity, significantly increase direct coverage, and reduce the cost of operations

- Multiple initiatives have been launched to leverage digital technologies and build closer connections with different partners

Our strong product portfolio in the Home and Personal Care categories continues to help us bring the goodness of health and beauty to consumers in emerging markets.

However, in terms of market penetration, we are not where we would like to be. Goodknight Liquid Vaporizer’s market penetration in India is still only 25%, and in Indonesia and Africa, it is between 1% and 2%. We view this as a tremendous opportunity to accelerate growth in our existing categories and to foster long-term economic value creation.

While we continue to innovate and create brilliant products in our emerging categories, we will focus heavily on increasing the footprint of our flagship products and categories, which, as market leaders, have high profitability and growth potential. This will be driven by doubling down on our marketing and distribution to really accelerate volume growth in these sectors over the next 5 years, in all the markets in which we operate.

Africa & USA

- Strong e-commerce focus in the USA, accounting for ~6% of the total business

- Nigeria’s van model continues to increase our direct reach

- Top line online revenue grew by 11% YoY to USD 3,60,000, while traffic remained flat

- We moved to a self-sustainable model in which the platform was funding itself by spending the profit for next months’ expenses and marketing

- The advertising cost of sales reduced from 100% to 30%, which made the platform profitable

- Repeat customer rate increased to 25% from 19% in the fiscal year 2021-22

- Direct-to-consumer (D2C) made a 16% contribution to key NPDs across Premium Beauty and Professional Product categories

Our globalisation strategy

A broad emerging

markets portfolio

In the fiscal year 2012-13, 44% of our overall

revenues came from international businesses.

In the fiscal year 2022-23, it was 44%.

Geography Salience

Category Salience

Portfolio of our

power brands

₹1,000 crore+

₹500-1,000 crore

₹200-500 crore

Top 11 brands contribute ~75% of revenue

Strengthened brand positions

across key markets and geographies

Renewed global

category structure

In the fiscal year 2021-22, we created a renewed global category structure. This new structure will power our global categories in Household Insecticides,

Air Care, Hair Colour, and Hygiene and will build on product development (innovation and renovation) and brand equity (brand strategy and advertisement), enabling three critical sources of value:

Coherent global strategy and

cross-geography synergies

- Goodknight Liquid Vapouriser, a successful product in India for the last decade, is now being further scaled up in the region, as well as in new markets like Indonesia, Bangladesh, and Nigeria.

- Godrej Shampoo Hair Colour, which is currently being scaled in India, has now been launched in Indonesia too, with the same basic technology but significant variations in product, packaging, and positioning.

- Goodknight Smart Spray in India, Goodknight Power Shots in Africa, and HIT Fast Insect Killer have all been created using the same technology. Launched in India with Smart Spray, the product has seen success in Nigeria with Power Shots, and we’re now back in India with a smaller SKU, which is being further developed for other geographies.

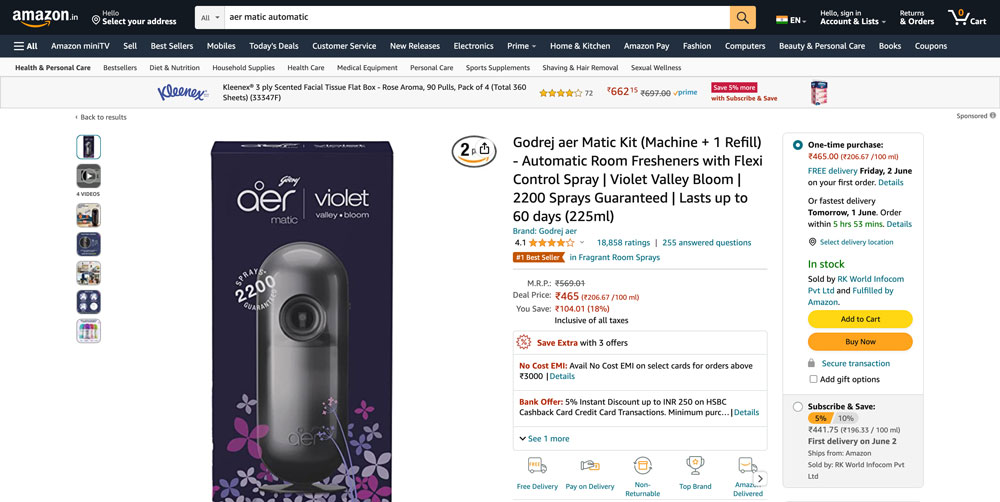

- We cross-pollinated aer Matic from Indonesia to India, and with great success; alternatively, we are taking aer Power Pocket from India to Indonesia, along with Bangladesh and the Middle East.

Scaling up products across our

categories and geographies

Deeper capability on product and

communication development

We are very focused on formalising our global innovation and renovation pipeline across categories, which is being managed through a structured stage-gate process.

There is a renewed focus on renovating our core to ensure a winning product portfolio.

We are centralising communication development with the help of in-house creative teams: Light Box (our media development studio) and Design Lab (a creative space that leads new product development across geographies).

Globally, we are standardising our approach to advertising development. For example, in Air Care, we built on the insight that the category is typically adopted when guests visit home. So we took the idea of ‘talking rooms’ and used it in advertisements in India (aer) and Indonesia (Stella).

Better alignment across product

development and brand equity

Our Product and Equity teams are structured to be lean and flat with both reporting to the Head of Global Category and Innovation and work jointly on most projects. Cross-training efforts include training on operating principles for decision-making and other functional training. The basic principle is to train our Marketing team on all core principles of the function.

Strengthening of brand codification also occurs with brand leaders acting as guardrails for both sets of activities.

We understand local consumers’ behaviour and preferences and use ideas and know-how from around the globe to innovate and develop products that cater to the evolving needs specific to regions and markets.

Our global footprint is our asset as we use our experience to solve common challenges across similar markets, which may be worlds apart on a map. We are also investing heavily in expanding operations and recruiting locally for our emerging markets to leverage local expertise and experience.

Adopting global synergies for product development

Enhanced, digitally

enabled consumer insights

By taking a step back and looking at the landscape more broadly, considering current performance, trends, and changes in consumer behaviour, we could understand how things might pan out, and how both categories and brands can evolve to meet consumer needs in the future. This helps us identify

opportunities to achieve the trifecta—right for the consumer, right for the brand, and right for the category. From the technology perspective, we aim to continue to invest in consumer research and data analytics, which will allow us to identify trends and drive category growth.

Consumer obsession:

A sustainability lens

Long-term brand tracking is a valuable tool for measuring if our brand values resonate with our consumers and translate into awareness, preference, and ultimately, loyalty.

Brand perception surveys help us to define our top consumer segments and understand what they care about, why they shop, and the best way to capture their attention. These insights enable us to better comprehend the trends of consumers.

Brand perception tracking is traditionally performed through a scientific process of meeting a randomly selected relevant target group (typically category users) at their homes. A survey is conducted to understand their levels of awareness, perception, and usage of brands in the category, as well as their salience of advertising for the brands.

In today’s rapidly changing market, we are also adopting a more agile approach. Our company is leveraging new technologies to continuously measure brand performance and tap into consumers’ sentiment, whenever required. We are tracking consumer preferences on various metrics—from awareness to product feedback to usage behaviour and appeal for various new ideas.

In the fiscal year 2022-23, we covered over 50,000 consumers and their perception of our brands. We reached these consumers through various channels, online and offline, randomly at their homes or at central locations to gather insights. This survey covered nearly 60% of our brands by revenue.

Gathering consumer insights

across various channels

By incorporating a sustainability lens into our existing surveys, we gained a deeper

understanding of the role sustainability plays in shaping consumer preferences.

We engaged our consumers to:

1. Assess attitudes

towards sustainability

We asked questions that helped us understand how sustainability factors into our consumers’ priorities and values, and how it influences their perception of our brand.

2. Identify opportunities

for innovation

We asked questions to explore consumer values and preferences that could drive brand differentiation and provide us with a competitive advantage.

We recently commissioned a brand perception survey among 21-45 year olds in India. In the survey, 67% of the people found ‘reusability’ and 32% found ‘less plastic waste’ to be relevant. This drove a perception of being an eco-friendly product among about two thirds consumers.

Using an agile brand perception-tracking approach, we are working to ensure that our brands remain relevant and resonate with our consumers. We aim to make more informed decisions that foster long-term growth, enhance our reputation, and contribute to a more sustainable future for all.

Democratising

our brands

Our purpose has always been to serve the needs of consumers above everything else. We innovate continuously to create versions of our products in different sizes and at multiple price points to cater to as big a net of consumers as possible. Smaller value pack offerings such as HIT No-gas Spray in India and Indonesia, Goodknight Mini Liquid Vaporiser in India, and Godrej Expert Rich Crème in India have revolutionised the market and made our products more accessible to a larger section of consumers. This also increases consumer loyalty, when they see a bespoke creation of a beloved brand that works for them specifically.

HIT No-gas Spray (India)

Goodknight Mini Liquid Vaporiser (India)

Godrej Expert Rich Crème (India)

Enhancing

go-to-market

As we delve deeper into emerging markets, ensuring that consumers have access to our products on a regular basis is vital to our goal of achieving increased penetration. We are continuously expanding our distribution channels to increase our consumer reach, with a greater focus on unserved or poorly served rural and remote markets.

We are rapidly increasing our presence across multiple platforms—traditional and modern retail channels, e-commerce, and digital marketplaces—to ensure our products are always available to serve our consumers, regardless of where they are located.

We continue to leverage

traditional kirana stores in India

Channels of

the future

New technologies are transforming the sales and distribution landscape. In India, they are growing more than double than that of traditional channels, with quick commerce gaining significant popularity. Additionally, e-commerce has seen strong growth across India, Indonesia, and the USA, and modern trade, Cash & Carry, and, more recently, eB2B continue to grow.

In India and Indonesia, it has also refocused attention on the role of traditional kirana or neighbourhood convenience stores. Similarly, in Africa, we have seen the acceleration of proximity shopping to overcome the challenges posed by the pandemic. This has reinforced the importance of last-mile distribution. New models will now be omnichannel, straddling a pyramid of online and offline sales.

In Bangladesh, the focus continues to be on building the traditional kirana (modir dukaan) backbone because modern trade and e-commerce are limited to urban centres. In Sri Lanka, we continue to focus on all channels, including traditional, modern trade, and, more recently, the e-commerce channel too.

Our leadership engages with

our partners on ground

Shopper

behaviour

Regarding an assortment mix, the shift in shoppers’ demand for health and hygiene that we witnessed in the fiscal year 2020-21 across markets sharply reversed this year. In India, for example, the spike in both handwash penetration and Household Insecticides consumption observed during the COVID-19 pandemic began tapering off significantly in the fiscal year 2022-23.

However, during the year, we have seen a global economic slowdown and high inflation impacting consumers’ purchasing power. This has impacted volumes across geographies, as consumers have been leaning more towards ‘value’ buys. We have been meeting this consumer need by making our products more accessible and affordable. We launched access packs of Godrej Expert Rich Crème, Goodknight Mini Liquid Vaporizer, and HIT No-gas Spray in India.

However, during the year, we have seen a global economic slowdown and high inflation impacting consumers’ purchasing power. This has impacted volumes across geographies, as consumers have been

leaning more towards ‘value’ buys. We have been meeting this consumer need by making our products more accessible and affordable. We launched access packs of Godrej Expert Rich Crème, Goodknight Mini Liquid Vaporizer, and HIT No-gas Spray in India.

In Indonesia, we relaunched an access pack of our hero brand HIT Aerosol. We also launched a low-cost hair colouring solution to cater to consumers’ shopping through general grade.

Partnerships

The interdependencies of our networks have always been crucial for the business. For the system to deliver successfully, we need all partners to be enabled and benefited. In addition to continuing our support towards our suppliers, distributors, wholesalers, and modern trade customers globally, we are establishing deeper partnerships with large-scale salons across Africa.

Building partnerships with

salons across Africa

Expanding

penetration and reach

In India, we continue to focus on deepening our penetration in traditional trade. Specifically, we aim to expand our reach in underpenetrated areas of the country by driving rural reach and penetration through the launch of lower priced stock-keeping units in our key categories, which will result in greater accessibility of our products to rural consumers.

In the past year, we created a blueprint of the ideal rural coverage along with our external partners. Guided by this blueprint, we have grown our rural substockist network by 10%. We have further leveraged external partnerships in rural India and worked closely with an emerging player in the rural eB2B space. The partnership has helped us reach villages with a population of less than 3,000, where we could not reach directly through our substockist network. This has significantly complemented our rural distribution, and the initiative has now been expanded to approximately 15 states in India.

To strengthen our in-market execution, we are now tracking tertiary sales in rural areas, measuring sales from substockists to rural retailers, and using that as a key performance indicator (KPI) for rural sales team members. We launched the tertiary sales tracking system in the past year, which made us one of the first FMCG companies that not only tracks tertiary sales but also uses this data as a crucial KPI for our rural sales ecosystem.

We have experimented with moving the frontline salesforce to third-party payroll, which has resulted in improved productivity and reduced attrition. We have now moved 40% of the business with frontline salesforce to third-party payroll and plan to continue this transition going forward.

Tapping into the emerging opportunity of a growing chemist channel remains a key strategic lever for us. To achieve this goal, we have created a strong network of pharma/over-the-counter drug distributors, and accordingly, created a new revenue stream. This channel helps us expand our reach into the previously untapped chemist outlets.

Our focus in Bangladesh remains on becoming one of the top FMCG companies through category development and strengthening of our go-to-market in the top 175 towns.

In Sri Lanka, our team is driving productivity and expanding reach through a cloud-based distributor management system and salesforce automation. Our focus is to ensure that we reach a good mix of traditional and modern trade stores across the country.

In Indonesia, we significantly accelerated our go-to-market transformation in general trade by outsourcing our direct operations to distributors. This transition has significantly reduced our operational complexity and released our Sales team’s bandwidth to focus on business development activities. In addition, this has reduced the cost of operations and allowed us to deepen our direct coverage.

Going forward, we aim to continue the momentum on distribution expansion and double down on new outlets while maximising output from our existing distribution base.

We are ramping up our go-to-market efforts across Africa. In Nigeria, where trade is largely unorganised and wholesale-led, we are scaling up our last-mile distribution through van models, subdistributor models, and salon advocacy.

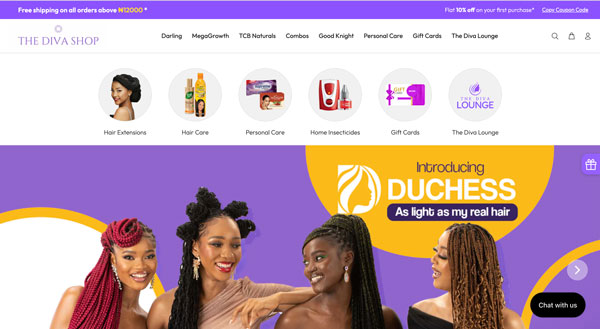

Our experiment of launching a D2C channel aimed at seeding new products, experimenting with untested price points and product bundles, leveraging consumer analytics, and potentially providing distribution in white space regions, with retailers coming onto the platform, has been faring well.

Diva Shop, our multi-brand

D2C channel

We continued our door-to-door sampling drive to build demand and educate consumers on our recently launched Household Insecticides portfolio, in addition to expanding distribution to modern trade. This resulted in a significant shift in our non-wholesale channel contribution. We aim to continue the momentum in Nigeria and strengthen fundamentals at an accelerated pace in South Africa and Kenya to unlock the full potential over the next few years.

We have expanded the distribution of our Hair Extensions business in the USA. Alongside Walmart, we have now expanded into other retail partnerships such as Target. Hair Extensions is a USD 1 billion market in the USA, and this offers a tremendous opportunity with significant consumer synergies. We are the only end-to-end hair player (Hair Extensions and Hair Care) catering to the African-American community.

Expanding our Hair Extensions

business in the USA

Laying the foundations for

future growth priorities

Improving

efficiencies

We are driving efficiency across the value chain and improving sales productivity by leveraging analytics and technology. Reducing sales losses through auto-replenishment and enhancing salesforce effectiveness through technology remain the critical levers of future growth.

Building an

omnichannel play

Given the changing shopper trends and environments, we are ramping up capabilities to service the demands of an omnichannel play. Externally, this translates into servicing and solving channel conflicts. Internally, it means implementing the right team structure to service this channel with agility.

Exploring new

go-to-market formats

In Nigeria, we continue to explore the D2C channel and are seeing strong wins, given the overall shopper preference for online purchasing.

Transforming

modern trade

Modern trade is a key driver of growth across geographies, and we intend to ramp this up. Building blocks include account and portfolio prioritisation, category management, fill rate improvement, and strong partnerships with customers through joint business planning.

In India, we are investing in category management to build new-age categories such as Air Care and Household Insecticides. To this end, our teams are sharing and learning on category management best practices from our Indonesian and Latin American businesses.

We are also investing in developing modern trade-specific analytics and shopper marketing capabilities.

Modern trade accounts for nearly 65% of our business in Indonesia. We continued our long-term journey to drive modern trade excellence, with a continued thrust on strategic investments, prioritising winning accounts, which was particularly relevant with shopper shifts post-COVID-19, and focusing on joint business partnerships, which were crucial to winning in an unprecedented macroenvironment.

In Africa, given that modern trade continues to be key, we are leveraging availability, strong in-store presence, and competitive pricing to build on the opportunity, particularly in South Africa. Our entire business in the USA is modern trade-led, with the channel split into retail and beauty stores. We continue to leverage strong channel partnerships and joint business planning to drive distribution and new product listing, compelling in-store presence and competitive pricing.

Building on the

salon channel

We are moving beyond traditional retail to build other new-age channels such as a salon. Restructuring of our salon channel in Africa will be a big focus as salon partnership programmes are key to creating influence, driving penetration, and generating demand in hair fashion as well as hair care. We intend to leverage this channel to drive last-mile distribution.

Training and capability

building for frontline teams

Equipping our team members to best serve the changing landscape is critical. We continue to drive multiple capability-building initiatives, which were enhanced over the past year and were moved online.

In India, our in-house training academy, the ‘Godrej Sales Academy’, was moved completely online to encourage easy access and on-the-go learning. In other geographies too, we have leveraged online training modules for continuous skillset improvement in a tough macroenvironment, while also focusing on team engagement and motivation.

Ramping up

e-commerce

In India, we fully integrated e-commerce more closely with our overall sales structure, building synergies on the omnichannel nature of shopper behaviour of our customer base. We embarked on the journey of leveraging e-commerce to expand our more premium categories such as Air and Household Insecticides and saw some great results. This encouraged us to explore more of the channel’s potential to sharply target an audience base with higher spending capacity along with a bigger appetite for experimentation.

E-commerce represents strong opportunities to win in a fast-growing channel, while leveraging its unique reach to bring innovative products and brands to market.

Underpinning this benefit, in India, we are building a strong data backbone to leverage the data-rich environment of e-commerce and drive our efficiency and effectiveness across the board. We are investing in expanding capabilities in the e-commerce function by insourcing capabilities such as graphic design, content writing, and search engine optimisation as well as performance marketing. We have a dedicated shopper marketing team to distil insights from e-commerce brands and platforms to extract the maximum efficiency from our visibility and promo spends. To improve operational efficiencies, we are also automating our processes from the order-receiving stage to the billing stage and leveraging data analytics to improve our forecasting methods. Our objective is to improve margins in the e-commerce channel through a better mix and optimisation of operational efficiencies.

Through joint business planning, promotion strategies, and online content, we have made substantial upgrades to our capabilities, which are yielding results in terms of on-platform conversion rates and off-takes. We continue to deliver strong performance on e-com-focused product innovations such as Goodknight Mosquito Nets, HIT Anti-mosquito Racquet, and aer Matic.

aer Matic, our e-commerce-first launch

In Indonesia, our e-commerce business grew by 40% after COVID-19. The focus has now shifted to our main platforms where we are collaborating for joint business partnerships, which have translated into new product launches, catalogues, and programmes. Driving focused digital activity on online and offline platforms helps in creating a seamless consumer experience: from digital awareness to e-commerce purchases. We also began creating special e-commerce-only products to serve large online consumer segments, thereby increasing the basket size across transactions.

In the USA, our efforts to strengthen e-commerce fundamentals paid off with the business growing strongly to become nearly 4% of our overall USA business this year.

E-commerce in Africa has noteworthy headroom for growth, particularly in the fashion and beauty segments. Given limited resident traffic on third-party platforms, in Africa (unlike in India, Indonesia, and the USA), we launched our own D2C platform in Nigeria.

This has been more than just a sales channel, with substantial upsides to leverage, like the immediate availability of new products, controlled brand building, consumer data, seeding new products, ability to cross-sell/upsell, experiment with untested product bundles, price assessment, and opportunities for focused consumer research. We have established a new e-commerce team in Latin America and are investing in multiple ways to grow our presence on different digital platforms and marketplaces.

Leveraging

brand advocacy

Car Fragrance is a 30% penetrated category in India. Headroom is available to grow the category by building relevance for the format and getting new triers into the category.

Digital as a medium gives one the opportunity to share their message with the target audience, while minimising wastage. For our brand Godrej aer Twist, we leveraged deterministic data signals on digital mediums, with the objective of maximising reach, while directly reaching out to the product users: car owners. We identified key platforms to target car owners through digital channels such as fuel payments and fast tag transactions. The results and learnings have been very encouraging.

India’s rural areas have a bigger and more rapidly expanding digital universe than urban areas. In line with our increased focus on scaling up our reach in rural markets, for brands like Godrej Expert Rich Crème and Godrej No.1, we continue to have sustained digital investments on leading video platforms. We have been actively leveraging advanced targeting capabilities, specifically designed to target rural markets, at scale, through negation of urban areas.

With consumer journeys becoming increasingly complex and non-linear, activating touchpoints and being present in consumers’ purchase journey, when they are seeking decision-enabling information on digital mediums, are important.

Quora, being an intent-driven search platform, allows consumers to educate themselves on numerous topics, hence playing a key role in influencing purchase decisions. Consumers on the platform are at the mid stage of the funnel, and this makes Quora an apt platform for getting new users into the category, especially for a brand like Godrej Expert Rich Crème. Through a combination of targeting options and ad formats, we actively answered hair colouring-related queries and addressed top searched queries from consumers looking at covering grey hair.

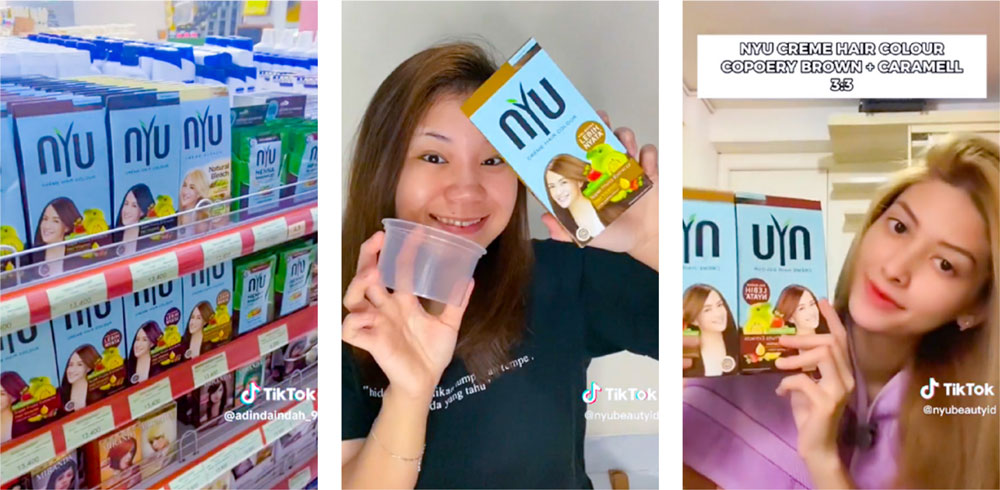

Our digital penetration in Indonesia reached 77%, which is 10 million (5.2%) more than that in 2022. We partnered with content creators and influencers to create content that showcased our products. We also chose different personas for different brands that catered to different consumer interests.

Ampifying our digital

presense in Indonesia

TikTok alone has been a big success in building our digital presence in Indonesia. Indonesia is now the second largest region with the most active users, after the USA. We leveraged the platform by using it to create content related to hair colouring for our Hair Colour brand NYU, whose target audience comprises women in their twenties, who also constitute a majority of TikTok’s users.

In Africa, we moved our Nigeria D2C business to a self-sustained model, while continuing to provide world-class customer experience. This resulted in an impressive 25% repeat customer rate. It has also clocked upwards of 16% saliency in the launch of premium new products across categories.

In Africa, our categories are heavily driven by the visual content and influencers. We plan to scale-up our strategy of co-creating content with influencers to enhance believability and impact, while driving new products and styles. We have partnered with macro, micro, and nano influencers across markets to drive new product awareness and considerations.

We have also leveraged celebrity partnerships to amplify our digital presence. Darling Nigeria partnered with Ayra Starr, an international pop sensation from Nigeria, who is immensely popular among our core target audience of young women across Nigeria and other African markets.

Darling Nigeria collaborates

with pop sensation Ayra Starr

Leveraging TikTok to

build brand advocacy

In Argentina, our Hair Styling brand Roby started a campaign to strengthen our consumers’ self-esteem to embrace whoever they want to be. The brand launched a campaign called ‘You Have All What You Need’ and built partnerships with influencers by using our products to achieve different types of hairstyles to enhance their unique personalities. We partnered with nano, micro, and macro influencers, which allowed us to reach a larger audience in an organic manner.

Our Hair Styling brand Roby partners

nano, micro, and macro influencers

Issue’s ‘It’s Natural to

Choose’ campaign

Our Hair Colour brand Issue launched the ‘It’s Natural to Choose’ campaign, which amplified the reach of the brand, enabling other points of contact with the target audience and, as a whole, achieving better results than estimated.

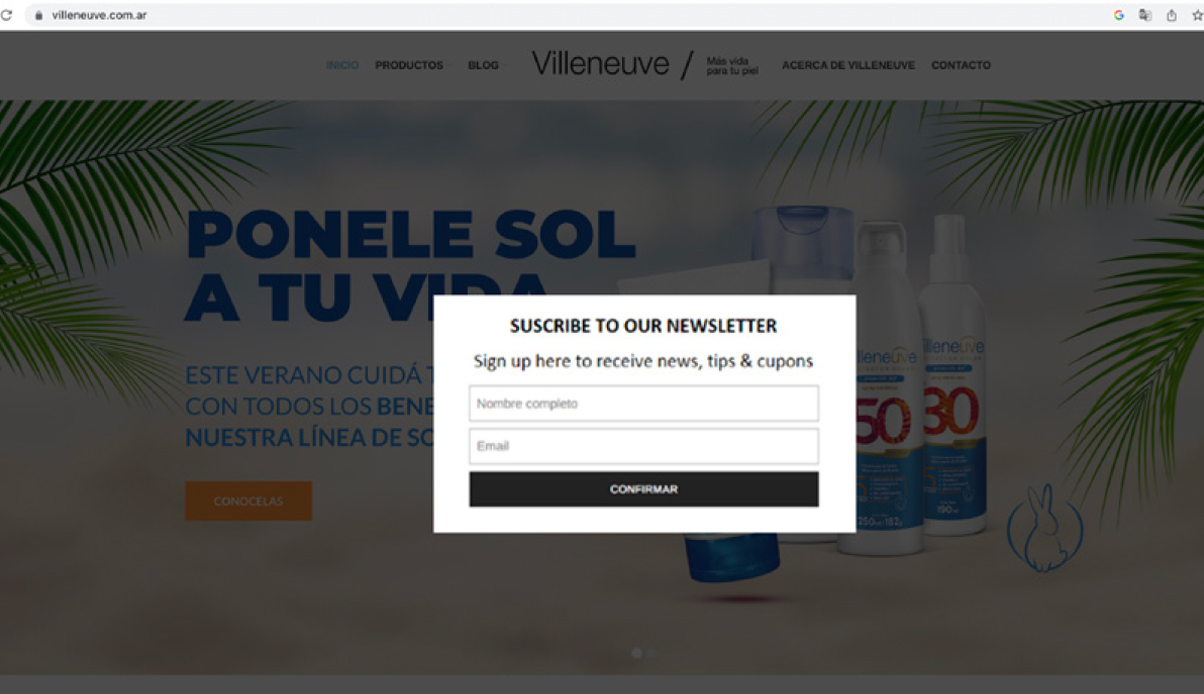

As a media best practice, in Latin America, we worked an ODR with Issue. On apps like Meta and TikTok, this tool capitalises on influencer-created content, helping to develop the credibility of the message with the public through collaboration. Consequently, we have seen double-digit growth in some of our main campaign KPIs. This consumer-centric way of thinking led Villeneuve to achieve a 2.5× growth in the number of Instagram followers, in addition to an improvement in content quality, leading to better delivery on KPIs.

Leveraging analytics to enhance

campaign performance

First-party data has become more relevant than ever before. Our Villeneuve brand has been gathering simple but important information on visitors. This tiny step will allow us to enhance consumer experience by providing relevant and personalised messages.

Experimenting with

customised content

Leveraging technology

and analytics

We have integrated different technology solutions across the value chain in India, starting with our sales people on the ground, through our many channel partners. Predictive analytics enables our urban sales people to sell the right assortment in a store. We are moving our distributor billing software and hand-held terminals to cloud-based servers to bring more agility to the sales ecosystem. We have completed cloud transformation for our urban and rural businesses. We are currently exploring the usage of Global Policy and Strategy locations to drive the in-market execution of our Sales team both in urban and rural markets. We also have ready plans to move our distributors to an automated replenishment system by the end of the coming year, thereby minimising sales loss due to stock-outs.

Going forward, we are building a strong analytics platform to forecast sales with higher accuracy levels by considering both external and internal factors. This is a key organisational priority and will enable us to predict demand better and thus improve operational efficiency.

Technology continues to play a key role in improving field-force productivity in our Indonesian business. Hand-held terminals guide and track on-ground decision-making, and analytics and dashboards help drive sharper execution. Regional distributors are connected and serviced through an online portal with simplified e-claim settlements.

A trade spend optimiser tool helps drive return on in-store investments for modern trade. We aim to continue to integrate technology across all execution touchpoints. We have also built stronger visibility in e-commerce analytics on Amazon, which we are translating into action points.

In SAARC, we are leveraging the potential tech partnerships and analytics to help augment our traditional trade expansion through systems such as cloud-based document management systems, micro-targeting, SOQ, and TPM.

Through this, we intend to ensure that our primary aim remains to expand distribution in traditional trade in both Bangladesh and Sri Lanka and drive efficiencies in penetrated stores. We are also leveraging automation to streamline other functions such as inventory management and claims management.

In Africa, salesforce automation has been expanded to cover most feet-on-street in South Africa and Nigeria. This has helped expand coverage and improve brand visibility across the subcontinent. We now focus on scaling up distribution, extracting efficiencies, and building accountability across all channels and regions.

We have also leveraged technology in consumer insights, for example, taking consumer insights from the D2C channel in Nigeria to product bundles and price points that can work, and shifting to virtual consumer and stylist interactions to continue having a strong pulse of the on-ground trends and for agile action planning.

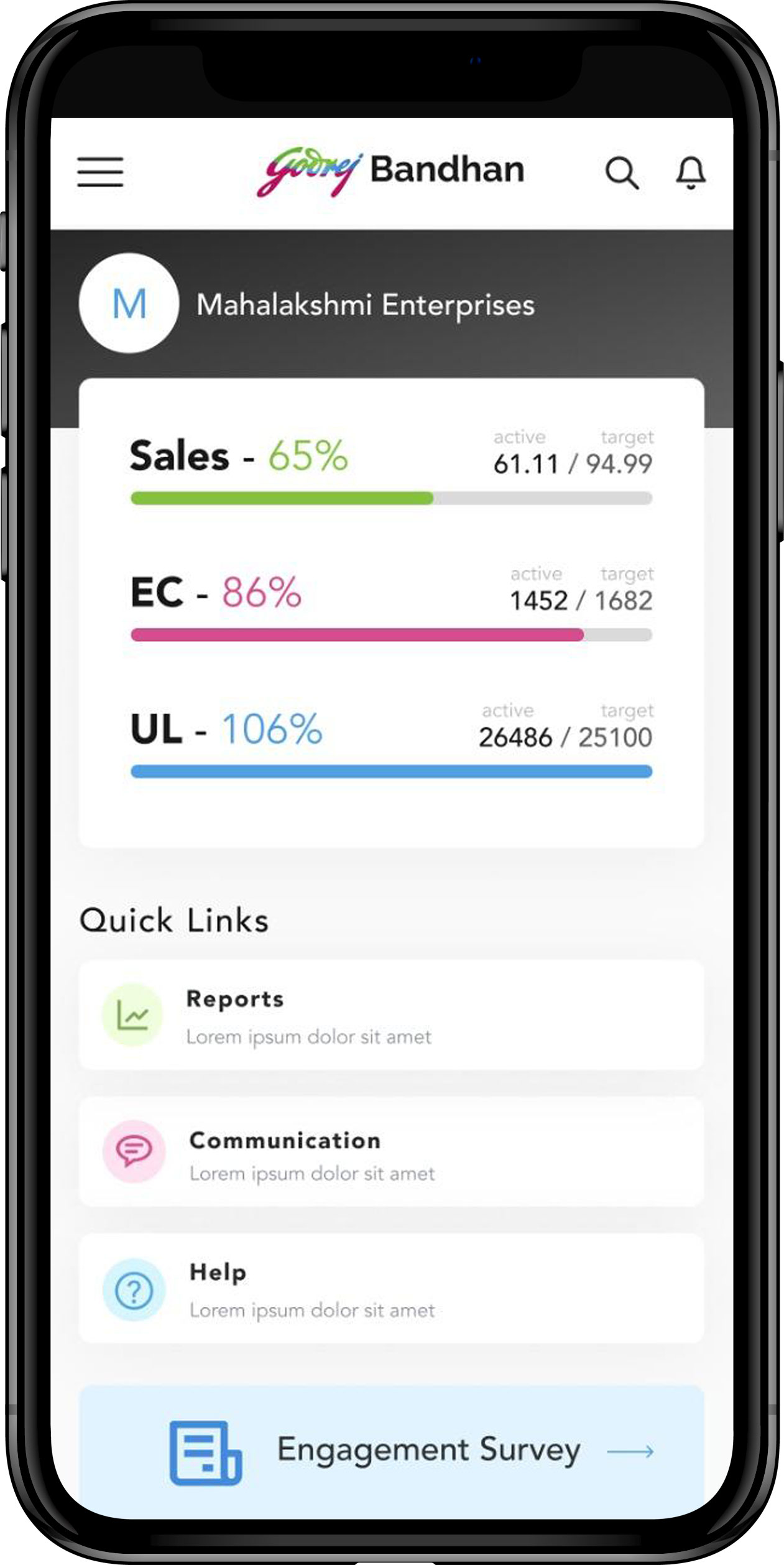

Fostering win-win

partnerships

To increase digital connect, we scaled up our industry-pioneer android app called ‘Bandhan’, which is a one-stop app for all GCPL-related information, communication updates, and training for all our distributors. We have also adopted a comprehensive approach to improve return on investment for our distributors to enhance engagement.

Bandhan, our industry-first

app, that fosters better

connect with distributors

Investment in media

and communication

In this age of information overload, it is absolutely critical to ensure that our brand, values, and offerings are communicated frequently, clearly, and through as many different platforms and media as possible. In the fiscal year 2022-23, we increased our investments in brand communication across multiple media to facilitate continuous dialogue with our consumers.

With the launch of Goodknight’s new TVC ‘Neendo Ko Nazar Na Lage’, we launched a month-long social media campaign to invite user-generated content from parents who captured adorable papa–baccha sleeping moments. A large number of parents tuned into our endearing lullaby and

sent pictures and videos. We collated these beautiful moments through a digital film, stitched with the lullaby in the background and pictures and videos sent in by them, which were published on Goodknight’s social media channels.

Goodknight’s ‘Neendo Ko Nazar Na

Lage’ social media campaign

Godrej aer Matic seized Durga Pujo as an opportunity to create a larger 360-degree campaign. In line with the objective of amalgamating digital and the Durga Pujo on-ground activation, the digital leg of the campaign leveraged polygon technology to retarget users who witnessed and experienced the on-ground activation at the pandals. This is one example of how we leveraged technology to create an impactful integrated marketing communication for the brand.

Godrej aer creates a special

360-degree marketing

campaign for Durga Pujo

With communities becoming the next big thing on digital platforms, and consumers actively participating in them to seek information and advice, share their experiences, and be a part of conversations around a topic of interest, we leveraged women-centric Facebook communities around beauty and hair for Godrej Expert Rich Crème.

The campaign was executed during the wedding season, a time when new consumers are highly likely to enter the category. We enlisted group admins and evangelists to create a buzz around the category in the context of weddings. The activity propelled user-generated content, with users sharing their first-hand experiences related to hair colouring using Godrej Expert Rich Crème. This resulted in a positive movement in the share of voice and engagement metrics for the brand.