Strategic Priority

Our objective is to capitalise on the ongoing consumer shift towards digital media consumption and digital commerce by assuring brilliant basics, effectively leveraging data, maintaining the highest levels of customer experience, and ensuring agile execution. We are also making digital investments in a focused and balanced manner, in accordance with our overall brand strategies and consumer tasks.

Capitals Impacted

-

Social and

Relationship

Capital -

Intellectual

Capital

Risks

- Nimble e-commerce/digital-first brands

- Emergence of consolidated customers owning first-party consumer data

- Impact of economic environments on consumer behaviour

Enablers

- Strong internal, global, and regional structures to support bold ambitions

- Agility of teams to rapidly execute plans

- Selective media investments to drive growth and penetration

- Bespoke approach: Country roadmaps to reflect brand and regional stages of development

- An agile test-and-learn approach

- Upskilling marketing teams to have a digital-first approach

Key Focus Areas

- Building an e-commerce business organisation

- Launching and scaling up direct-to-consumer (D2C)

- Doubling down on data-driven marketing

- Leveraging digital brand advocacy

- Scaling up brand communities

Material Issues Impacted

- Responsible marketing and communication

- Skill development and training

Value Created

The acceleration in digital adoption over the past year has been a shot in the arm for our digital ambitions. We are integrating and ramping up capabilities across different aspects of our business, with a focus on building relevant digital platforms for the future and stronger Social and Relationship Capital through partnerships and more meaningful consumer connects. We are also investing in building internal capabilities and Intellectual Capital through focused talent, trainings, and infrastructure.

We are also investing in building internal capabilities and Intellectual Capital through focused talent, trainings, and infrastructure.

- In India, the e-commerce business now contributes 5% to the overall business.

- The HIT Anti-mosquito Racquet, our e-commerce only launch, has garnered an 80% market share online and has scaled up to USD 5 million in top line sales across online and offline platforms.

- E-commerce business in Indonesia has grown by 25% post COVID-19.

- E-commerce business in the USA has become nearly 4% of the overall USA business.

- 3 new D2C brand channels have been introduced in India, including Godrej aer, which has seen USD 6,50,000 in top line sales in spite of COVID-19-related disruptions.

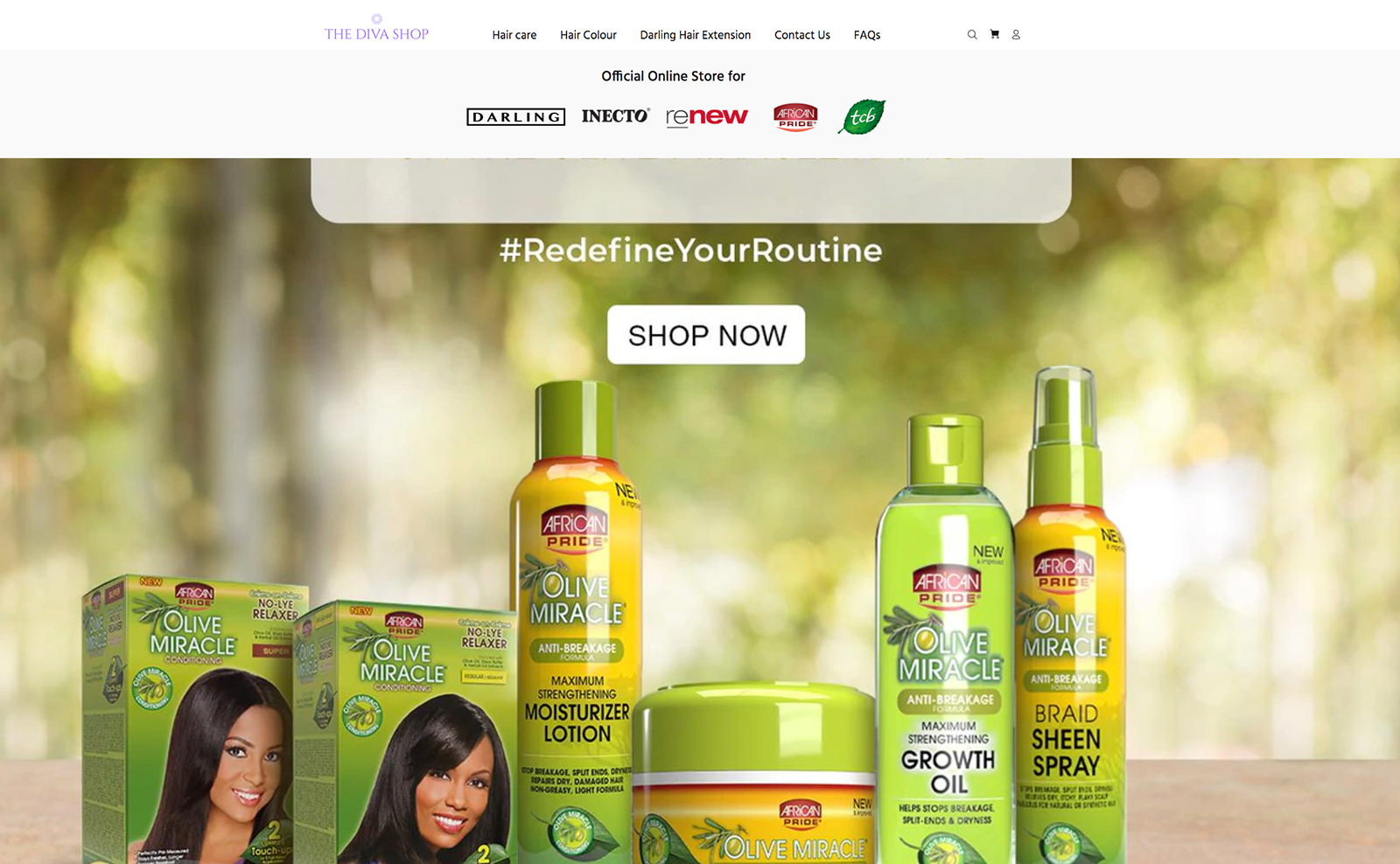

- D2C in Nigeria sees an exponential growth:

- Top line revenue grew by 45% YoY to USD 3,80,000, while traffic grew by 52%.

- The conversion rate increased to 0.82% from 0.66% in the fiscal year 2021-22.

- The repeat customer rate increased to 25% from 14% in the fiscal year 2020-21.

- D2C had a 7% contribution to key NPDs across Premium Beauty and Professional Product categories.

- D2C contributed to 37% of Hair Care combo pack NPD sales launched for modern trade and e-commerce in Nigeria.

- D2C business launched in South Africa witnessed a 20% QoQ growth since its launch.

- Approximately 10 million first-party data points have been gathered from consumers and users in India.

- Over 60,000 stylists connected through brand community platforms in Africa.

- Darling reached over 27 million women across Africa through various digital campaigns.

Building an e-commerce

business organisation

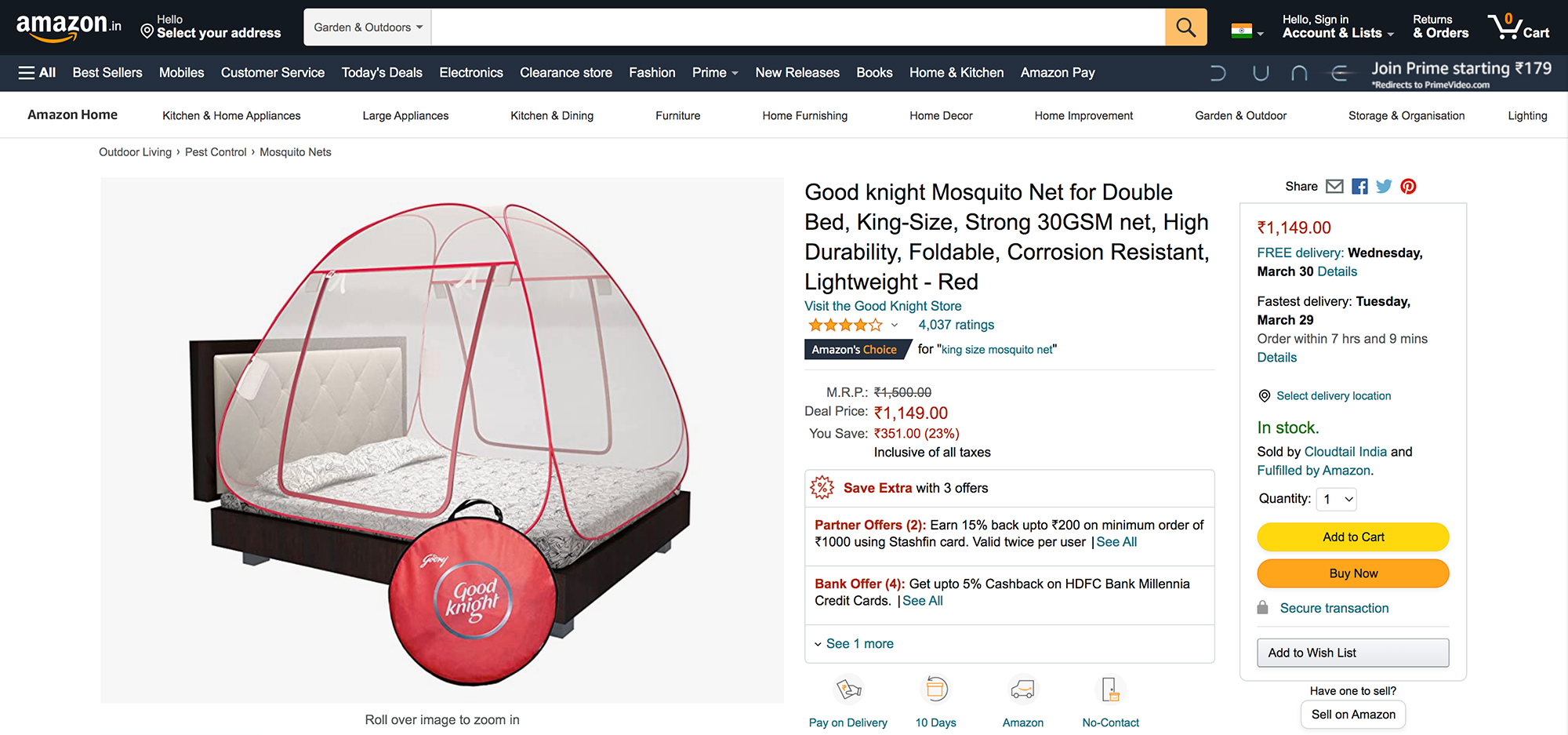

In India, our incubation of e-commerce as a separate business unit has enhanced our e-commerce capabilities and salience and significantly improved profitability. Capabilities have matured to the point where we can now re-integrate e-commerce more closely together with our overall sales structure, reflecting the increasingly omnichannel nature of shopper behaviour and our customer base. We continue to support significant e-commerce-first product launches such as our HIT Anti-mosquito Racquet, Goodknight Mosquito Net, and aer Smart Matic room freshener.

In Indonesia, our e-commerce business grew by 25% post COVID-19. We have significantly scaled up our investments in key platforms backed by strong joint business partnering, new product launches, strong cataloguing and store management, and a steep jump in leveraging analytics. Driving focused digital activities on both online and offline platforms helps create seamless consumer experiences: from awareness in digital to purchase in e-commerce. Stella Smart Matic Parfumist, for example, was launched exclusively on Shopee. Our new Saniter brand levered digital technology to generate stronger sales through e-commerce. We have also started developing e-commerce-only products to cater to the big segments online, starting with the HIT Anti-mosquito Racquet.

Our Africa cluster has evolved its structure from a digital-first marketing function to an e-business function, which combines digital marketing and e-commerce to leverage and scale our digital capabilities.

In the USA, e-commerce is now nearly 4% of our business in an acceleration made possible by the investments and ground work in previous years.

We have set up a new e-commerce team in Latin America and are investing in multiple ways to boost our presence on different digital platforms and marketplaces.

Goodknight Mosquito Net, our

latest e-commerce first launch

Launching and

scaling D2C

In line with our increased focus on building first-party data and the need to have a complete view of a consumer’s purchase journey, we have been successfully launching new adjacent business channels for D2C.

We leveraged D2C for Godrej aer, conducting an exclusive launch of Smart Matic, one of the brand’s best-selling products. Since its launch in September 2019, aer has clocked top line sales of USD 6,50,000, with an above industry benchmark ROAS and healthy repeat customer rate of 15%.

Following the pandemic, consumer trends like online shopping have accelerated with significant momentum. More consumers are now turning to online shopping and choosing to interact with brands directly through their D2C channels. This traction has been very encouraging, and we have been able to derive learnings across multiple brands and categories. Our return on ad spend has been very encouraging, too. We have also experimented with exclusive launches of some of our new product variants on these platforms, through which we have witnessed a positive consumer response.

In Africa, we scaled up our Nigeria D2C business to a 45% year-on-year top line growth, while also providing world-class customer experience, which resulted in an impressive 25% repeat customer rate. This year, we further scaled up our D2C businesses; we launched Diva Store, a D2C store in South Africa, and entered into a partnership with a beauty and personal care online marketplace, ‘BeautyClick’, in Kenya to further our e-business ambitions.

It has also clocked upwards of 10% saliency in the launch of premium new products across categories. We aim to leverage this extensively to test and launch new products and gather customer intelligence going forward.

Diva Shop, our multi-brand D2C platform

Doubling down on

data-driven marketing

In the past year, we collected first-party data from multiple platforms through our in-house cloud-based Central Data Platform in India. We now have over 10 million first-party data points from consumers and users, which we are expecting to further scale-up.

These rich and actionable insights based on audience interests, shopping/purchase behaviour, demography, appography, and location history are critical for us. Backed by this data, we are now building

These rich and actionable insights based on audience interests, shopping/purchase behaviour, demography, appography, and location history are critical for us. Backed by this data, we are now building use cases, which have not only helped us optimise our media for efficiency and effectiveness but also allowed us to gain a deeper understanding about our end users, establish cross-brand interest, and further expand our user base.

use cases, which have not only helped us optimise our media for efficiency and effectiveness but also allowed us to gain a deeper understanding about our end users, establish cross-brand interest, and further expand our user base.

We are now working on an Audience Intelligence Platform to further enrich the collected data, which will help us deliver actionable insights for our brands and categories and enhance consumer experience by providing relevant and personalised messaging.

Leveraging digital

brand advocacy

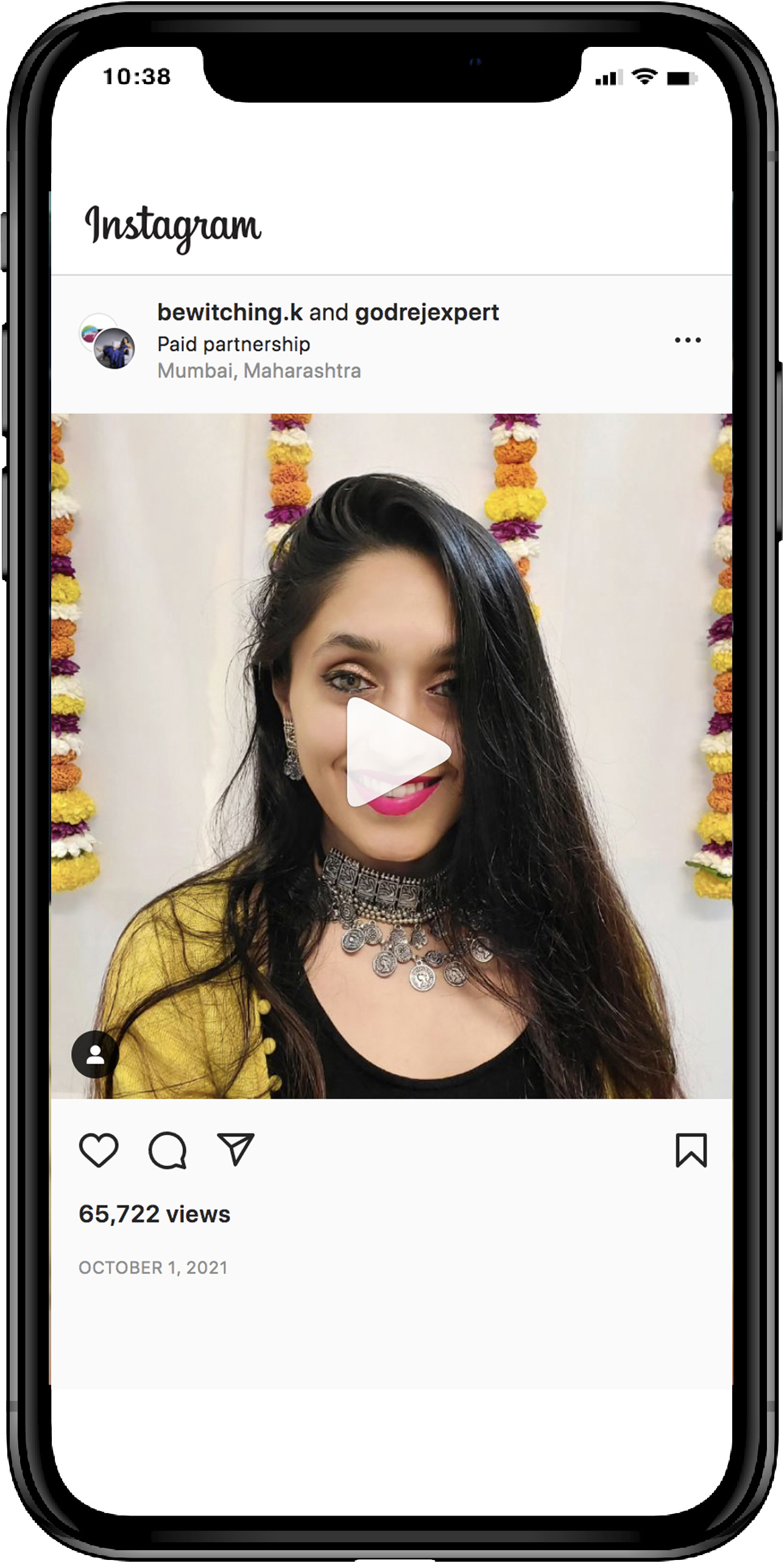

An exponential increase in time spent on social media and content platforms in the past year has reinforced the importance of digital brand advocacy, propelling us to make it a key pillar in our overall marketing and communication strategy.

In addition to partnering celebrities and influencers to drive key messaging around our brands, we are also tailoring our approach to focused markets and are collaborating with regional content creators on YouTube and social media platforms.

We have leveraged large digital content platforms like Glamrs (Indian beauty, style, fitness, and lifestyle video platforms for women) for Godrej Expert and Shitty Ideas Trending (YouTube channel with funny relationship sketches) for Goodknight. Food has been a big trend this year, and therefore, we also partnered with celebrity chefs.

Mothers in the age group of 25-44 years are a key target audience for our different brands. We have been actively engaging with large-scale mom communities to drive brand advocacy across categories, specifically for Hair Colour. We partnered mom influencers to create content ideas that address the specific barriers to trial for Hair Colour, driving occasion-led triggers and establishing the beauty imagery for Godrej Expert.

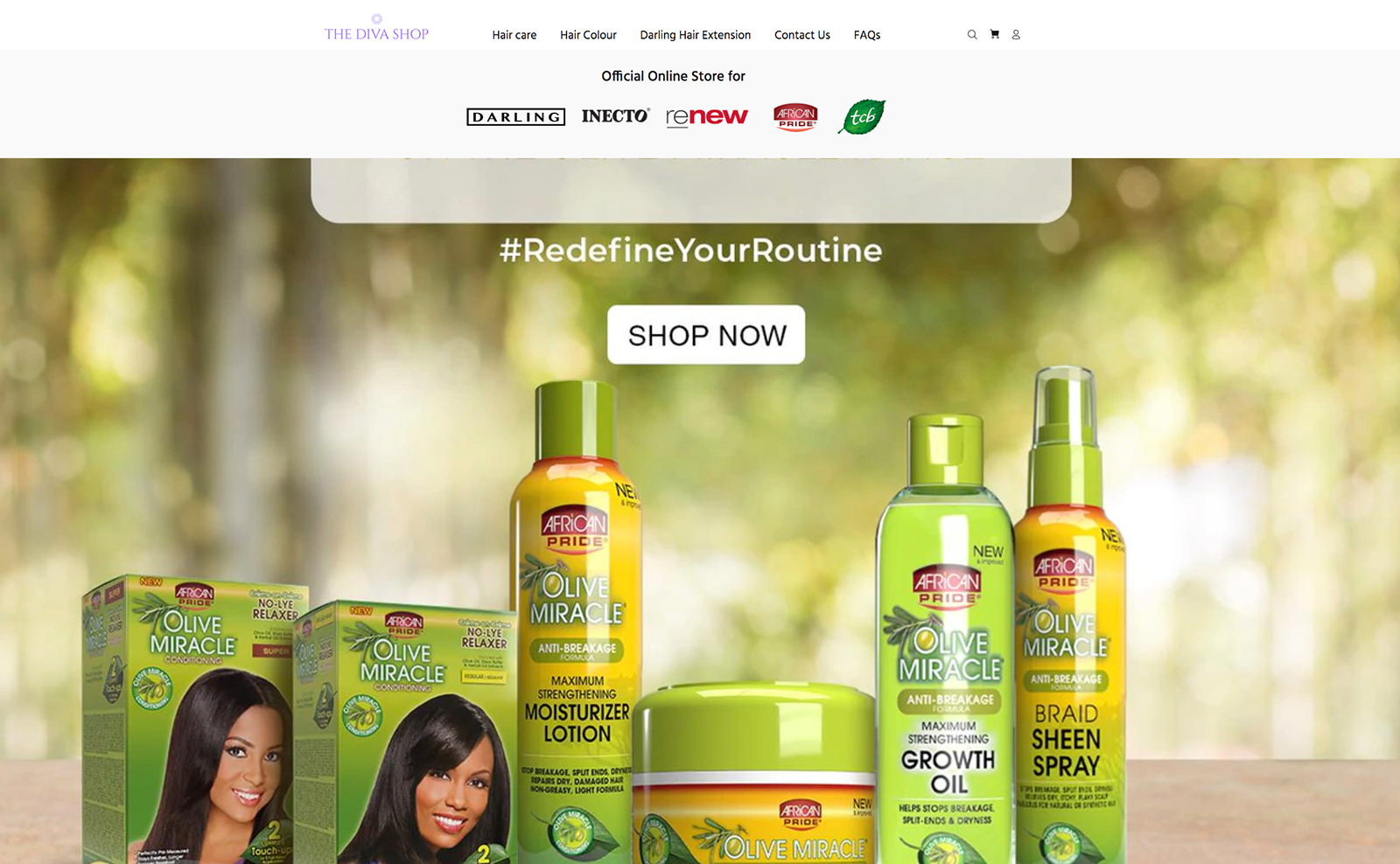

For Cinthol, we have been actively working on creating a community of Cinthol Awesome Explorers, a tribe comprising off-beat travellers, adventure sports enthusiasts, mountaineers, rock climbers, surfers, etc. from India who are bringing to life the ‘Alive is Awesome’ philosophy.

This is a small example of how we are using influencer marketing in a highly integrated manner to build the brand’s exploratory image.

Our Cinthol Awesome Explorers community partners with off-beat travellers

In Africa, our categories are heavily driven by visual content and influencers. We plan to scale-up our strategy of co-creating content with influencers to enhance believability and impact, while driving new products and styles. We have partnered with macro, micro, and nano influencers across markets to drive new product awareness and considerations.

We have also partnered with popular women-centric communities like ‘She Leads Africa’ to create a series of stories

We have also partnered with popular women-centric communities like ‘She Leads Africa’ to create a series of stories about women who have become successful despite facing societal and personal challenges. This was followed by a free course for our community on how to prepare for job interviews and an online summit where experts spoke about various topics on building confidence, upskilling, and being prepared for the real world. This was a year-long programme by Darling in partnership with ‘She Leads Africa’, where we were able to help over 5 million women across Kenya, Nigeria, and South Africa.

about women who have become successful despite facing societal and personal challenges. This was followed by a free course for our community on how to prepare for job interviews and an online summit where experts spoke about various topics on building confidence, upskilling, and being prepared for the real world. This was a year-long programme by Darling in partnership with ‘She Leads Africa’, where we were able to help over 5 million women across Kenya, Nigeria, and South Africa.

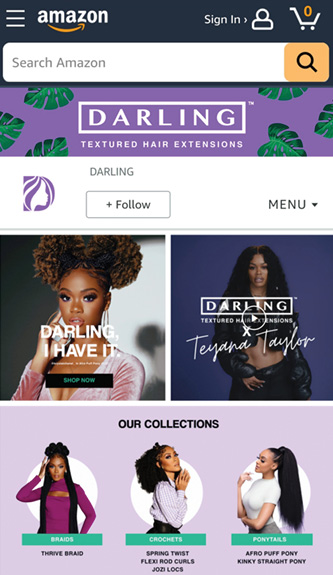

In the USA, we launched the Darling brand store on Amazon USA and a brand campaign with popstar Teyana Taylor for the launch of our hair fashion category.

Our Darling brand campaign

with popstar Teyana Taylor

We launched the

Darling brand store

on Amazon USA

We launched the Darling brand

store on Amazon USA

Our Darling brand campaign

with popstar Teyana Taylor

Scaling up

brand communities

With online communities becoming the next big thing on digital platforms, we aim to scale-up our brand communities and tribes.

Our other brands will also build communities by using social media platforms such as Facebook groups and WhatsApp.

Currently, we have stylist Facebook group communities in Kenya, South Africa, and Nigeria, with over 60,000 stylists connected through the platform. We aim to double down on efforts to build these communities and create long-lasting, meaningful relationships with our consumers and partners.