Strategic Priority

Integrating our go-to-market approach and leveraging technology for strategic decision-making

Capitals Impacted

-

Intellectual

Capital -

Manufactured

Capital -

Social and

Relationship

Capital -

Financial

Capital

Risks

- Competitive market conditions

- New entrants into the market

- New online, offline, and omnichannel go-to-market models and channels such as e-commerce

Enablers

- Brand reputation

- Affordable pricing

- Superior quality products

- Continuous innovation in products and processes

- Strong long-term partnering focus

- Distribution footprint

Key Focus Areas

- Enhancing our go-to-market strategy in the context of the COVID-19 pandemic

- Expanding penetration and reach

- Laying the foundation for future growth priorities

- Ramping up the e-commerce business

- Leveraging technology and data analytics

- Fostering win-win partnerships

Material Issue Impacted

- Sustainable packaging

Value Created

Our agile go-to-market approach is the backbone of our business. We are leveraging data and technology, innovating for local contexts, and building more agility across multiple routes to markets to serve our consumers with greater purpose and focus.

We aim to continue to invest in enhancing our Intellectual Capital, making our Manufactured Capital more agile and creating joint value with our partners to maximise our Social and Relationship Capital. This, in turn, will translate into a stronger Financial Capital value.

- With continued focus on strengthening our distribution reach in urban and rural India; we increased our chemist distributors by nearly 30%.

- The modern trade channel in India has bounced back, growing at high double-digit values after contracting in the past year.

- Direct distribution, through active registered outlets, in Indonesia continued to grow strongly to reach nearly 1,75,000 outlets.

- Rural sub-stockist network grew by 5%.

- We continued our focus on last-mile distribution.

- Nigeria’s van model has increased our direct reach significantly, gaining salience at a breakout pace. The contribution of van sales to the Nigerian business has almost doubled.

- E-commerce in India continues to grow faster than traditional channels, with a 2-year CAGR of approximately 60%.

- Strong e-commerce focus in the USA, accounting for nearly 4% of the total business.

- Multiple initiatives launched to leverage digital technologies and build closer connections with different partners.

Enhancing our go-to-market

strategy in a post COVID-19 world

Innovations and start-up efforts in the last-mile distribution of FMCG have been altering the overall sales and distribution landscape over the past couple of years. Shifts in consumer behaviour and digital acceleration following the COVID-19 pandemic have only added to this, opening up significant opportunities to scale, transform, and make our sales organisation more future-ready.

We are adapting and innovating, leveraging technology across our operations, and building new capabilities, particularly the muscle to be more agile. Our approach hinges on close connections with our markets, consumers, partners, and communities to understand and better serve evolving needs.

Channels

of the future

New technologies are transforming the sales and distribution landscape. Additionally, e-commerce has seen strong growth across India, Indonesia, and the USA, and modern trade, Cash & Carry, and, more recently, eB2B continue to grow. COVID-19 has accelerated digital adoption across shoppers, retailers, and the FMCG network.

In India and Indonesia, attention has been refocused on the role of traditional kirana or neighbourhood convenience stores. Similarly, in Africa, we have seen the acceleration of proximity shopping to overcome the challenges of the pandemic. This has reinforced the importance of last-mile distribution. New models will now be omnichannel, straddling a pyramid of online and offline sales.

In Bangladesh, the focus continues to be on building the traditional kirana (modir dukaan) backbone because modern trade and e-commerce are limited to urban centres. In Sri Lanka, we continue to focus on all channels, including traditional, modern trade, and, more recently, the e-commerce channel too.

We continue to leverage traditional

kirana stores as a sales channel in India

Our leadership actively connects

with our partners on ground

We continue to leverage traditional

kirana stores as a sales channel in India

Our leadership actively connects

with our partners on ground

Shopper

behaviour

The fiscal year 2021-22 saw a partial return to normal business operation in India and Indonesia, interspersed with milder COVID-19 waves, as compared with the previous year, which was affected severely by the pandemic. Africa and the USA were minimally affected, except for South Africa that witnessed 2 COVID-19 waves.

In terms of an assortment mix, the shift of shoppers’ basket to health and hygiene that we witnessed in fiscal year 2020-21 across markets sharply reversed this year, with consumers spending heavily on these only during the COVID-19 waves. In India, for example, the spike in both handwash penetration and Household Insecticides consumption during the peak of COVID-19 began tapering off significantly in fiscal year 2021-22.

High inflation together with the global economic slowdown is affecting consumer purchasing power, adversely impacting volumes across geographies.

Partnerships

The interdependencies of our networks have always been crucial to the business. For the system to deliver successfully, we need all partners to be enabled and benefited. In addition to continuing our support towards our suppliers, distributors, wholesalers, and modern trade customers globally, we are also building deeper partnerships with large-scale salons across Africa.

Expanding

penetration

and reach

In India, we continue to focus on deepening penetration in traditional trade. We aim to expand our total reach from 6 million outlets in fiscal year 2020-21 to 7 million outlets in the next 2 years. We are, particularly, focused on driving rural reach and penetration by launching lower priced stock-keeping units in our key categories, which will result in greater accessibility of our products for rural consumers.

In the past year, we created a blueprint of the ideal rural coverage along with our external partners. Guided by this, we have grown our rural sub-stockist network by 5%. We have further leveraged external partnerships in rural India and worked closely with an emerging player in the rural eB2B space. The partnership has helped us reach villages with a population of less than 3,000, where we could not reach directly through our sub-stockist network. This has significantly complemented our rural distribution, and the initiative has now been expanded to approximately 15 states in India.

To strengthen our in-market execution, we are now tracking tertiary sales in rural areas, measuring sales from sub-stockists to rural retailers, and using that as a KPI for rural sales team members. Tertiary sales tracking was launched by us in the past year, which made us one of the first FMCG companies that not only tracks tertiary sales but also uses it as a crucial KPI for our rural sales ecosystem.

We have experimented with moving the frontline salesforce to third-party payroll, which has resulted in improved productivity and reduced attrition. The pilot was successfully completed in Mumbai, and we are now scaling up this model to towns with a population of over 1 million.

Tapping into the emerging opportunity of a growing chemist channel remains a key strategic lever for us. To achieve this goal, we have created a strong distributor network of pharma/over-the-counter drugs distributors and through them created a new revenue stream. This channel helps us expand our reach into previous untapped chemist outlets.

Our Bangladesh team is expanding its direct reach to 1,00,000 outlets and driving salesforce automation through handheld devices for salespeople. Our focus remains on becoming one of the top FMCG companies in terms of reach. Moreover, we are piloting various tech-based interventions to increase our width of sales in the stores that we reach. This will help us in improving our returns tremendously.

Leveraging technology to

enhance last-mile distribution

Leveraging technology to

enhance last-mile distribution

In Sri Lanka, our team is driving productivity and increasing reach through a cloud-based distributor management system and salesforce automation. Our focus is to ensure that we reach a good mix of traditional and modern trade stores across the country.

In Indonesia, we significantly accelerated our go-to-market transformation. Our efforts on route-to-market consolidation in the previous year have stabilised well. Direct distribution, through active registered outlets, continued to grow strongly to reach nearly 1,75,000 outlets. We have also expanded alternate channel distribution in pharma and health and beauty, which have strong synergies with our Baby Care and Hair Colour portfolios.

Going forward, we aim to continue the momentum on distribution expansion and double down on new outlets while maximising throughput from our existing distribution base.

Going forward, we aim to continue the momentum on distribution expansion and double down on new outlets while maximising throughput from our existing distribution base. We are ramping up our go-to-market efforts across Africa. In Nigeria, where trade is largely unorganised and wholesale-led, we are scaling up our last-mile distribution through van models, sub-distributor models, and salon advocacy.

We are ramping up our go-to-market efforts across Africa. In Nigeria, where trade is largely unorganised and wholesale-led, we are scaling up our last-mile distribution through van models, sub-distributor models, and salon advocacy.

Our experiment of launching a D2C channel aimed at seeding new products, experimenting with untested price points and product bundles, leveraging consumer analytics, and potentially providing distribution in white space regions, with retailers coming onto the platform, has been faring well.

We continued our door-to-door sampling drive to build demand and educate consumers on our recently launched Household Insecticides portfolio in addition to expanding distribution to modern trade.

We continued our door-to-door sampling drive to build demand and educate consumers on our recently launched Household Insecticides portfolio in addition to expanding distribution to modern trade. This resulted in a significant shift in our non-wholesale channel contribution. We will continue the momentum in Nigeria and strengthen fundamentals at an accelerated pace in South Africa and Kenya to unlock the full potential over the next few years.

This resulted in a significant shift in our non-wholesale channel contribution. We will continue the momentum in Nigeria and strengthen fundamentals at an accelerated pace in South Africa and Kenya to unlock the full potential over the next few years.

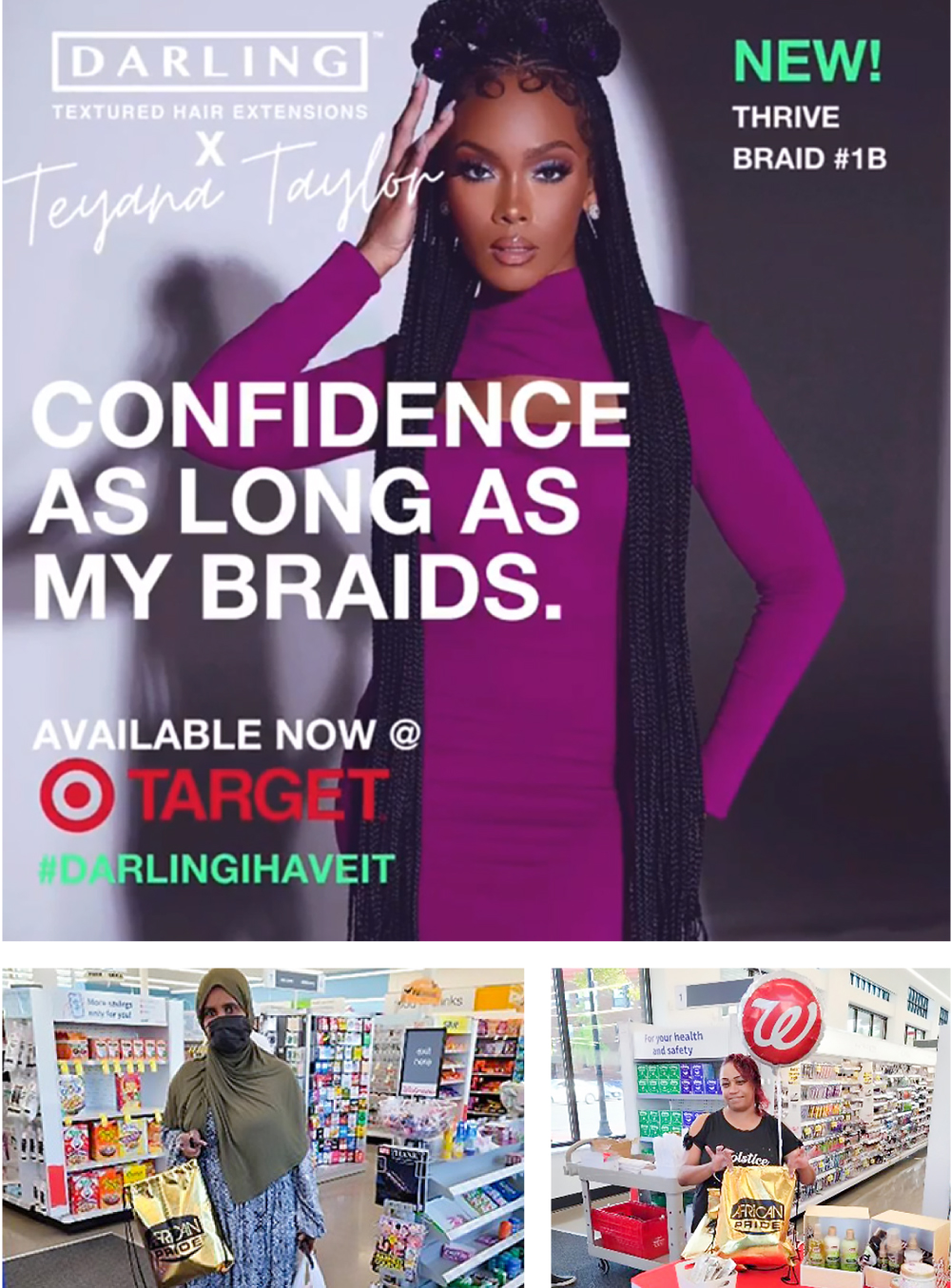

We have expanded the distribution of our Hair Extensions business in the USA. Alongside Walmart, we have now expanded into other retail partnerships such as Target. Hair extensions is a USD 1 billion market in the USA, and this offers a tremendous opportunity with significant consumer synergies. We are the only end-to-end hair player (Hair Extensions and Hair Care) catering to the African-American community.

Partnerships with Walgreens and Target in the USA

to launch our range of hair products

Partnerships with Walgreens and Target in the

USA to launch our range of hair products

Laying the foundations for

future growth priorities

Improving efficiencies

We are driving efficiency across the value chain and improving sales productivity by leveraging analytics and technology. Reducing sales losses through auto-replenishment and enhancing salesforce effectiveness through technology will be critical levers of future growth.

Building an

omnichannel play

Given the changing shopper trends and environments, we are ramping up capabilities to service the demands of an omnichannel play. Externally, this translates into servicing and solving channel conflicts. Internally, it means putting the right team structure in place to service this channel with agility.

Exploring new

go-to-market formats

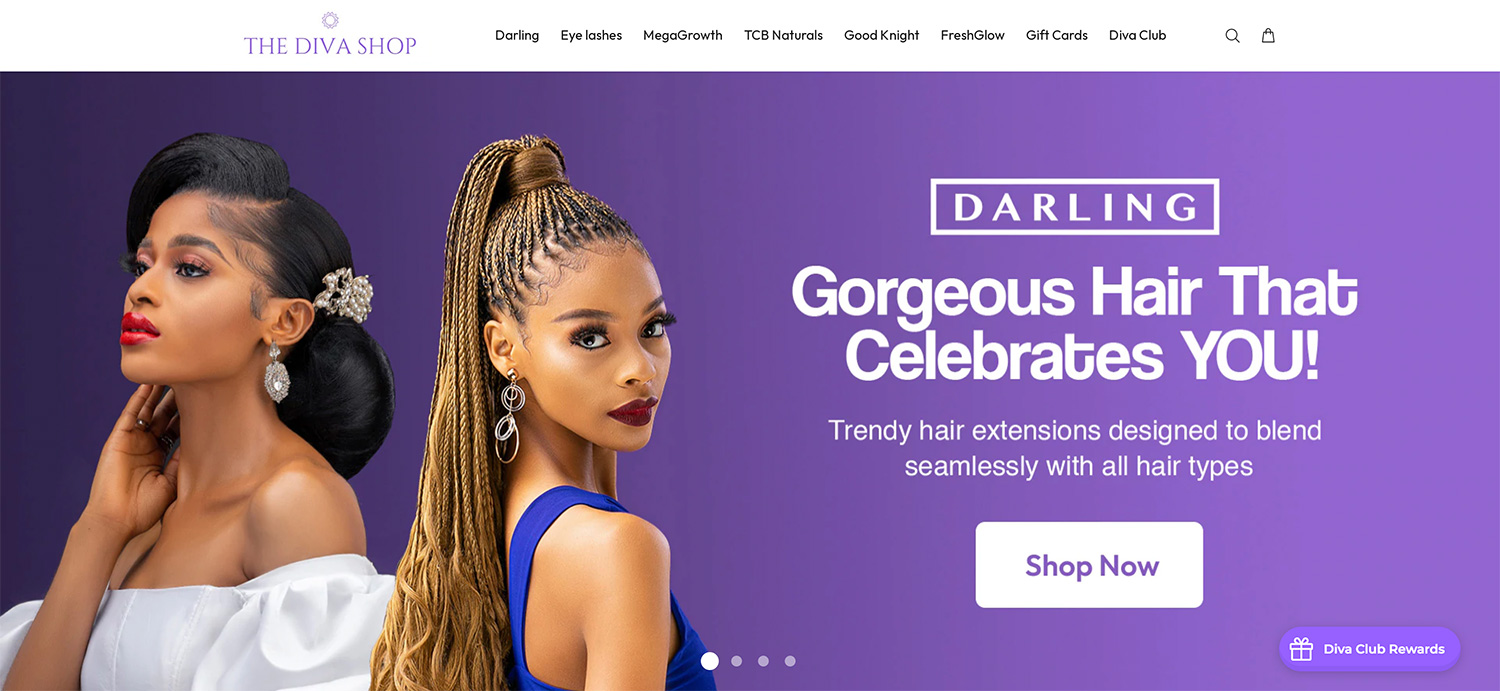

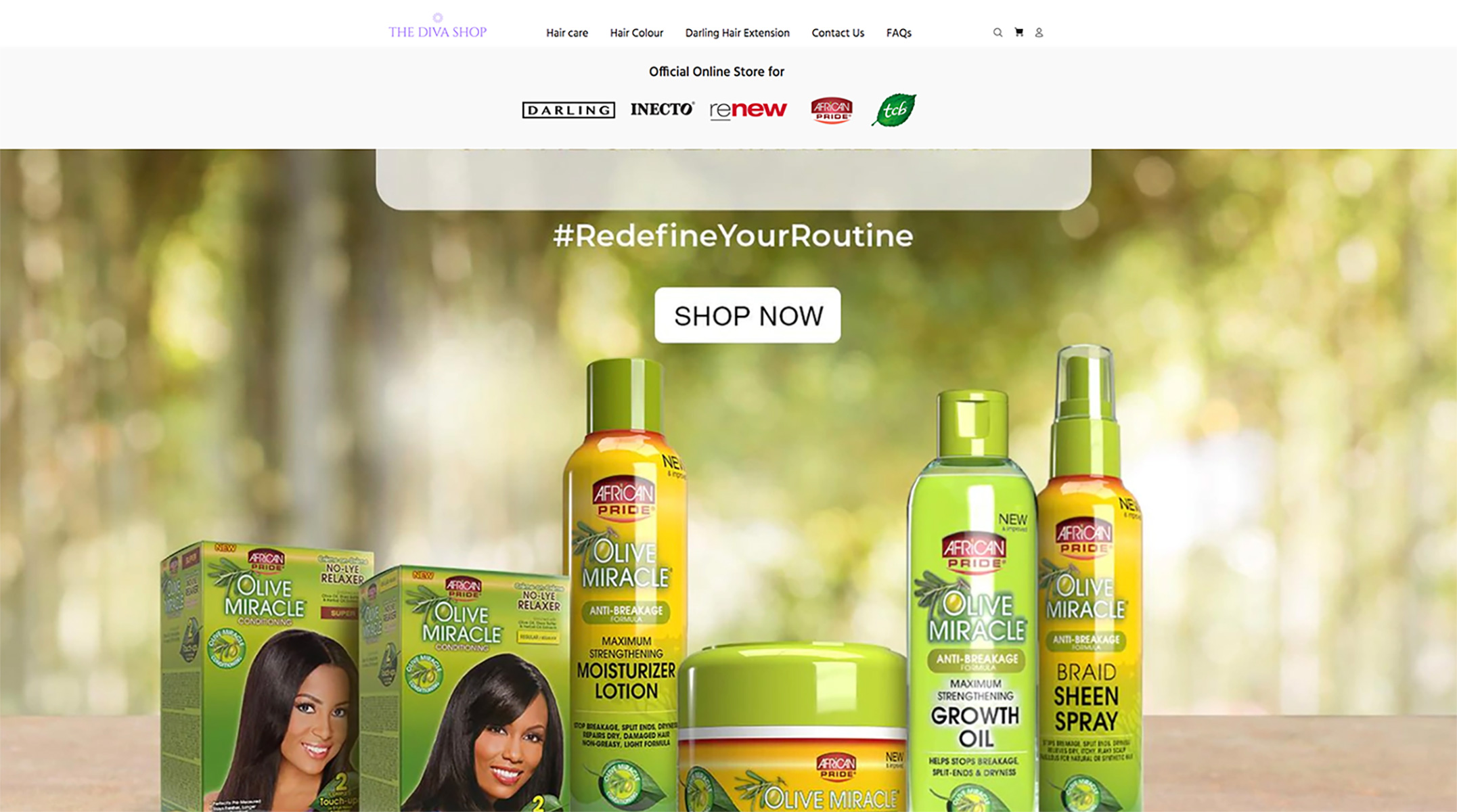

In Nigeria, we continue to explore the D2C channel and are seeing strong wins, given the overall shopper preference for online purchasing.

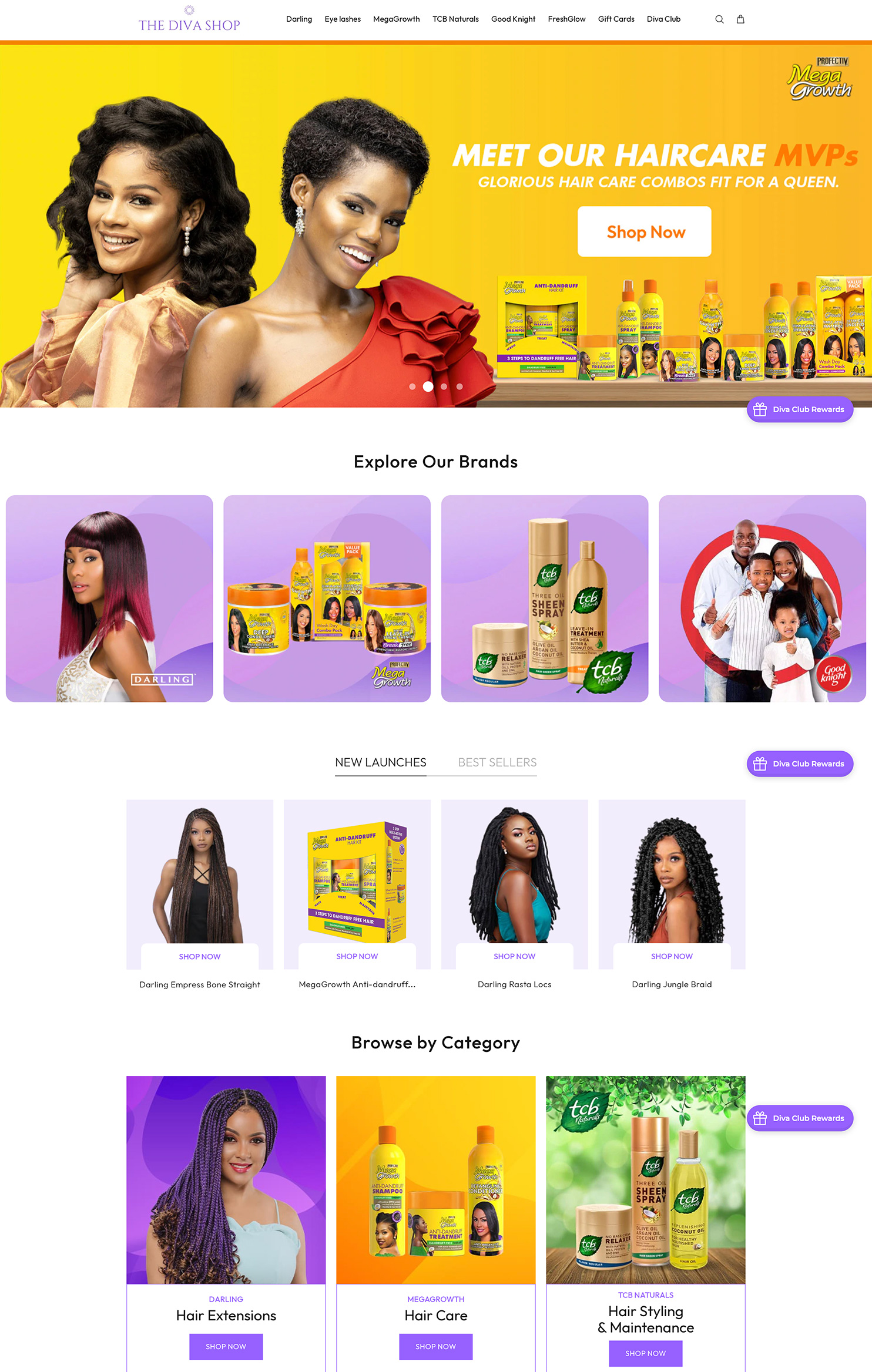

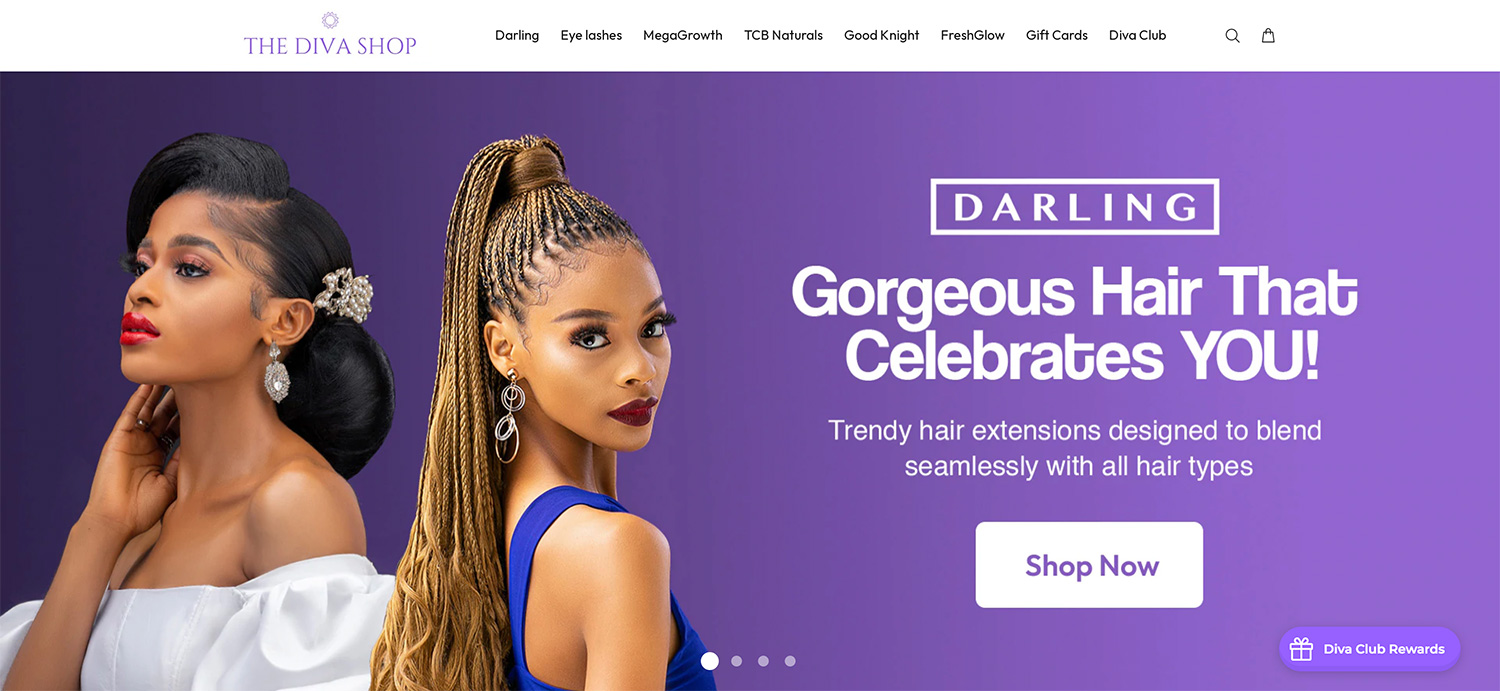

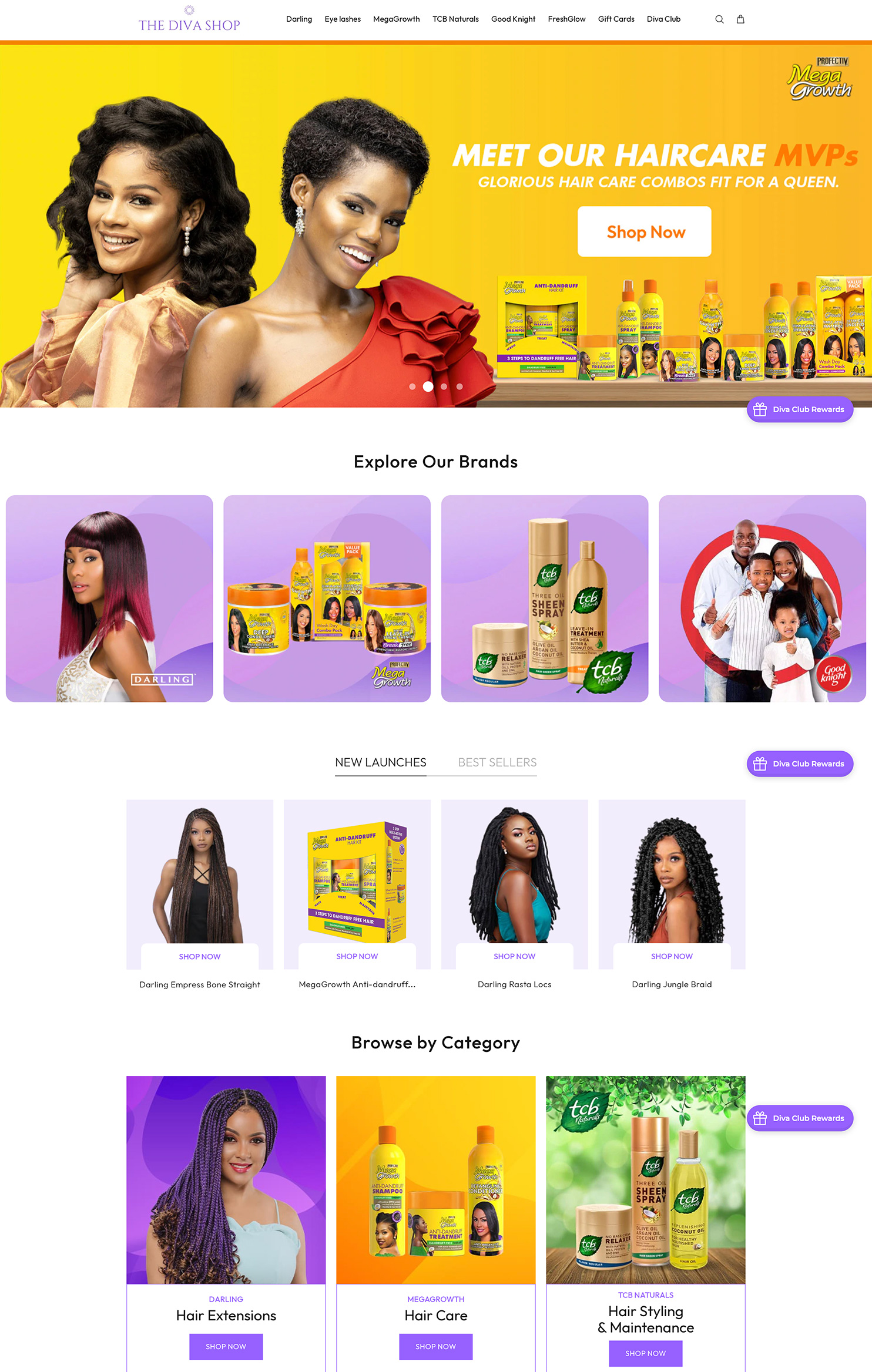

The Diva Shop, our D2C

channel in Africa

The Diva Shop, our D2C

channel in Africa

Transforming

modern trade

Modern trade is a key driver of growth across geographies, and we aim to ramp this up. Building blocks include account and portfolio prioritisation, category management, fill rate improvement, and strong partnerships with customers through joint business planning.

In India, we are investing in category management to build new-age categories such as Air Care and Household Insecticides. To this end, our teams are sharing and learning from our Indonesian and Latin American businesses on category management best practices. We are also investing in developing modern trade-specific analytics and shopper marketing capabilities.

Sri Lanka boasts a strong modern trade-driven FMCG space, and our objective is to optimise efforts to ensure that we take full advantage of the opportunities by driving visibility, focused marketing interventions, in-store sampling, etc. We also aim at deepening our partnerships with chains through strong mutual plans.

Modern trade accounts for nearly 70% of our business in Indonesia. We continued our long-term journey to drive modern trade excellence, with a continued thrust on strategic investments, prioritising winning accounts, which was particularly relevant with shopper shifts post-COVID-19, and focusing on joint business partnerships, which were crucial to winning in an unprecedented macro environment. This resulted in a successful foray into the Hygiene category. Our Saniter brand ramp up was primarily driven by modern trade and crossed unprecedented milestones.

In Africa, given modern trade continues to be the key, we are leveraging availability, strong in-store presence, and competitive pricing to build on the opportunity, particularly in South Africa. Our entire business in the USA is modern trade-led, with the channel split into retail and beauty stores. We continue to leverage strong channel partnerships and joint business planning to drive distribution and new product listing, compelling in-store presence, and competitive pricing.

Leveraging modern

trade to boost sales

Leveraging modern

trade to boost sales

Building on

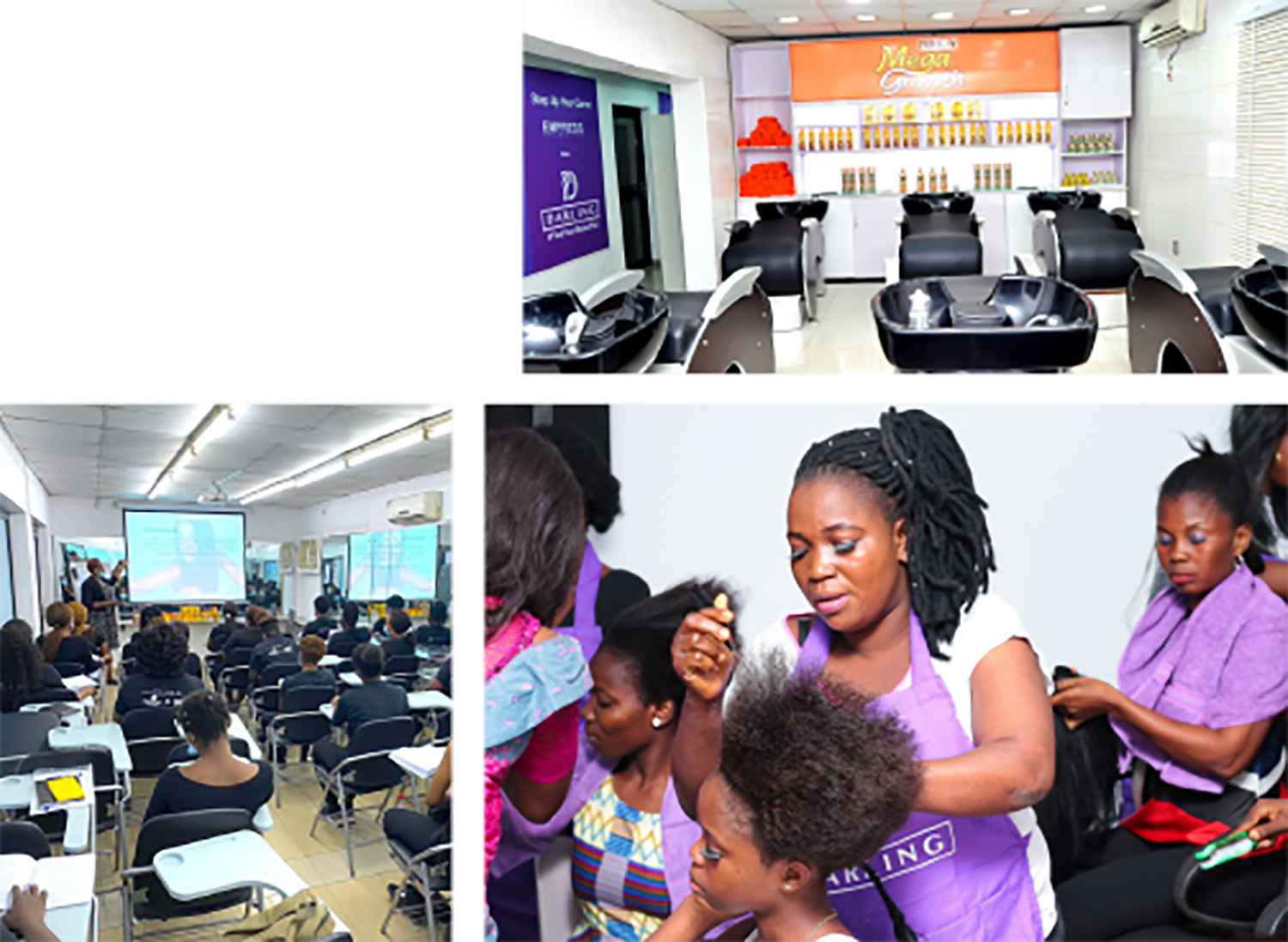

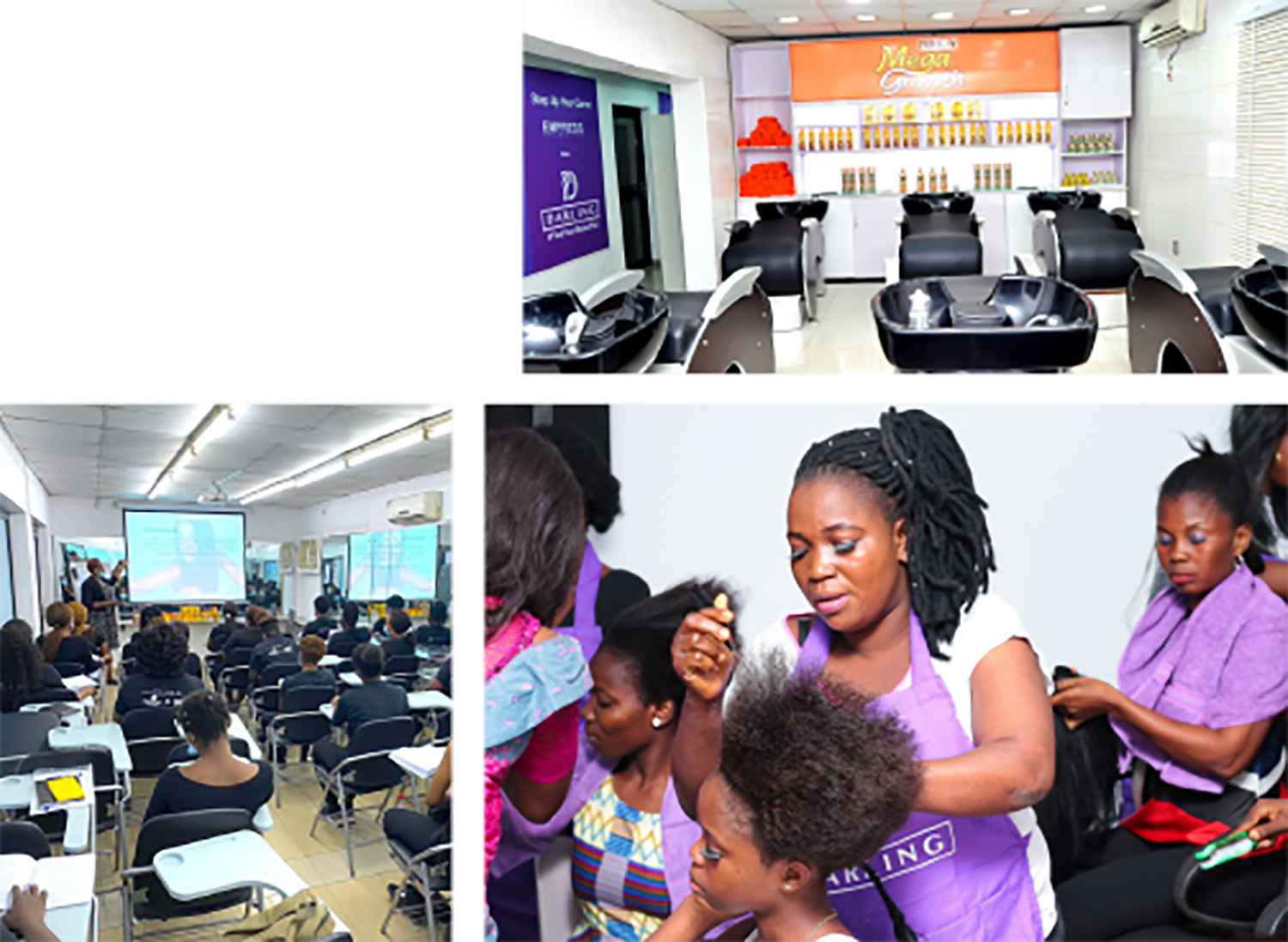

the salon channel

Inside our Darling Professional

Stylists’ Academy in Nigeria

We are moving beyond traditional retail to build other new-age channels such as salons. The restructuring of our salon channel in Africa will be a big focus as salon partnership programmes are key to building influence, driving penetration, and generating demand in Hair Fashion as well as Hair Care. We also intend to leverage this channel to drive last-mile distribution.

Inside our Darling Professional

Stylists’ Academy in Nigeria

Training and capability building

for frontline teams

Equipping our team members to best serve the changing landscape is critical. We continue to drive multiple capability building initiatives, which were enhanced over the past year and were moved online.

In India, our in-house training academy, the ‘Godrej Sales Academy’, moved completely online to encourage easy access and on-the-go learning. In other geographies too, we have leveraged online training modules for continuous skillset improvement in a tough macro environment, while also focusing on team engagement and motivation.

Ramping up

e-commerce

E-commerce represents strong opportunities to win in a fast-growing channel, while leveraging its unique reach to bring innovative products and brands to market.

Underpinning this, in India, we are building a strong data backbone to leverage the data-rich environment of e-commerce and drive our efficiency and effectiveness across the board. We are investing in ramping up capabilities in the e-commerce function by insourcing capabilities like graphic design, content writing, and search engine optimisation as well as performance marketing. We have a dedicated shopper marketing team to distil insights from e-commerce brands and platforms to extract maximum efficiency from our visibility and promo spends. To improve operational efficiencies, we are also automating our processes from the order receiving stage to the billing stage and leveraging data analytics to improve our forecasting methods. Our objective is to improve margins in the e-commerce channel through a better mix and optimisation of operational efficiencies.

Through joint business planning, promotion strategies, and online content, we have made significant upgrades to our capabilities, which are yielding results in terms of on-platform conversion rates and off-takes. We continue to deliver strong performance on e-com-focused product innovations such as Goodknight Mosquit o Nets, HIT Anti-mosquito Racquet, and aer Smart Matic.

Our e-commerce business in Indonesia continued to have strong growth. We have significantly scaled up our efforts and investments with a focus on winning platforms backed by strong joint business partnering, new product launches, strong cataloguing and store management, and a step jump in leveraging analytics.

In the USA, our efforts to strengthen e-commerce fundamentals paid off with the business growing strongly to become nearly 4% of our overall US business this year.

E-commerce in Africa has significant headroom for growth, particularly in the fashion and beauty segments. Given limited resident traffic on the third-party platforms, in Africa (unlike in India, Indonesia, and the USA), we launched our own D2C platform in Nigeria.

This has been more than just a sales channel, with significant upsides to leverage, like the immediate availability of new products, controlled brand building, consumer data, seeding new products, ability to cross-sell/upsell, experiment with untested product bundles and price assessment, and opportunities for focused consumer research. We have set up a new e-commerce team in Latin America and are investing in multiple ways to grow our presence on different digital platforms and marketplaces.

E-commerce-first innovations such as the

HIT Anti-mosquito Racquet continue to

deliver strong performance

E-commerce-first innovations such as the HIT Anti-mosquito Racquet continue to deliver strong performance

Leveraging technology

and analytics

We have integrated different technology solutions across the value chain in India, starting with our sales people on the ground, through our many channel partners. Predictive analytics enables our urban sales people to sell the right assortment at a store. We are moving our distributor billing software and handheld terminals to cloud-based servers to bring more agility to the sales ecosystem. We have completed cloud transformation for our urban and rural businesses. We are currently exploring the usage of Global Policy and Strategy locations to drive the in-market execution of our sales team in both urban and rural markets. We also have plans in place to move our distributors to an automated replenishment system by the end of the coming year, which will enable us to minimise sales loss due to stock-outs.

Going forward, we are building a strong analytics platform to forecast sales with higher levels of accuracy by considering external as well as internal factors. This is a key organisational priority and will enable us to predict demand better and thus improve operational efficiency.

Technology continues to play a key role in improving field-force productivity in our Indonesian business. Handheld terminals guide and track on-ground decision-making, and analytics and dashboards help drive sharper execution. Regional distributors are connected and serviced through an online portal with simplified e-claim settlements.

A trade spend optimiser tool helps drive return on in-store investments for modern trade. We will continue to integrate technology across all execution touchpoints. We have also built stronger visibility in e-commerce analytics on Amazon, which we are translating into action points.

In SAARC, we are leveraging potential tech partnerships and analytics to help augment our traditional trade expansion through systems like cloud-based document management systems, micro targeting, SOQ, and TPM. Through this, we aim to ensure that our primary aim remains to expand distribution in traditional trade in both Bangladesh and Sri Lanka and drive efficiencies in penetrated stores.

In SAARC, we are leveraging potential tech partnerships and analytics to help augment our traditional trade expansion through systems like cloud-based document management systems, micro targeting, SOQ, and TPM. Through this, we aim to ensure that our primary aim remains to expand distribution in traditional trade in both Bangladesh and Sri Lanka and drive efficiencies in penetrated stores. We are also leveraging automation to streamline other functions such as inventory management and claims management.

We are also leveraging automation to streamline other functions such as inventory management and claims management.

In Africa, salesforce automation has been expanded to cover most feet-on-street in South Africa and Nigeria. This has helped expand coverage and improve brand visibility across the subcontinent. The focus will now be on scaling up distribution, extracting efficiencies, and building accountability across all channels and regions.

We have also leveraged technology in consumer insights, like taking consumer insights from the D2C channel in Nigeria to product bundles and price points that can work, and shifting to virtual consumer and stylist interactions to continue having a strong pulse of the on-ground trends and for agile action planning.

Fostering win-win

partnerships

We ramped up channel partner engagement over the past 2 years. One of our foremost priorities has been to ensure the health and safety of our partners and their networks.

In India, we have introduced a medical insurance policy for all our sales people in extended networks. This initiative is one of the first in the industry wherein sales people on our distributor payrolls will also receive the benefit of our medical insurance policy. To increase digital connect, we scaled up

In India, we have introduced a medical insurance policy for all our sales people in extended networks. This initiative is one of the first in the industry wherein sales people on our distributor payrolls will also receive the benefit of our medical insurance policy. To increase digital connect, we scaled up our industry-pioneer Android app called ‘Bandhan’, which is a one-stop for all GCPL-related information, communication updates, and training for all our distributors. We also have a comprehensive approach to improve return on investment for our distributors to enhance engagement.

our industry-pioneer Android app called ‘Bandhan’, which is a one-stop for all GCPL-related information, communication updates, and training for all our distributors. We also have a comprehensive approach to improve return on investment for our distributors to enhance engagement.

Leveraging our Bandhan app

to connect and engage with

distributors on ground

Engaging with in-store

associates through Roanto,

our merchandising app

Engaging with in-store

associates through Roanto,

our merchandising app

Our regional distributor network in Indonesia contributed a significant share to the business. We continued to partner to help drive stronger returns and coverage. We supported our salesforce and distributors with timely medical assistance during COVID-19 waves.

Salons and stylists are our key partners in the Hair Care category in Africa. In addition to initiating training programmes for stylists, which help them become self-employed, we are scaling up salon connect programmes to drive penetration and usage as well as build engagement and advocacy.

Our partnership with retail chains in the USA marked an exclusive foray into Hair Extensions for both Godrej and organised retail. Walmart and Target offer a significant distribution network and unparalleled shopper footprint, and we have strong consumer understanding as the only Hair Extension brand in the USA with African roots and the only player with an integrated Hair Care portfolio. This provides a great opportunity for a lasting win-win partnership, unlocking tremendous value for the overall category while serving our consumers.