Godrej Consumer Products Limited (GCPL) consistently reports its financial and non-financial performance in accordance with regulatory requirements such as the Securities and Exchange Board of India (SEBI) (Listing Obligations and Disclosure Requirements) Regulations, 2015; the Companies Act, 2013; and Secretarial Standards. This marks our sixth Annual and Integrated Report, structured to comply with the International Integrated Reporting Framework (the

Our R&D teams lead new product development

across the geographies we operate in

Content of the report

We aim to provide an overview of our financial and non-financial performance through Integrated Reporting, demonstrating the creation of short and long-term value for our stakeholders.

This report offers insights into:

- Material issues and our operational context

- Governance framework

- Key strategies

- Value creation approach across capitals

- Performance identified against Key Performance Indicators (KPIs)

- Interrelation among material issues, strategies, performance, and value creation

- Financial and statutory reporting

Scope and boundary

This report covers GCPL, including its manufacturing facilities across India, Africa, Indonesia, Latin America, and the USA. Unless specified otherwise, all data and content herein are consolidated for our entire business operations.

Aligned with our commitment to transparent reporting and sustainable business operations, we have followed the taxonomy set by the Securities and Exchange Board of India's Business Responsibility and Sustainability Report (BRSR) and the Task Force on Climate- Related Financial Disclosures (TCFD) framework. Our adherence to these rigorous frameworks offers a thorough insight into our sustainability goals and the efficacy of our initiatives for our stakeholders.

Forward Looking Statements

The Integrated Annual Report includes forward-looking statements in the Management Discussion and Analysis, indicating the Company's objectives using terms such as 'may'. 'believe', 'outlook', 'plan', 'anticipate', 'continue', 'estimate', and 'expect'. These statements are grounded in reasonable assumptions but may be influenced by risks, uncertainties, and external factors, potentially resulting in deviations from expressed or implied outcomes.The forward-looking statements in this report are applicable only as of the statement date. GCPL is not obligated to publicly release revisions or updates to these statements after this report's date, except as required by law or regulatory authorities. Past performance is not indicative of future performance.

Reporting period

All data, both financial and nonfinancial, covers the period spanning April 1, 2023, to March 31, 2024. To offer a thorough assessment of our sustainability performance, we have included comparative figures from the previous fiscal year (2022-23) as well as from the baseline year (2011-12, excluding statutory financials). This approach allows for a holistic evaluation of our progress over time. By examining our activities implemented between April 1, 2023, and March 31, 2024, alongside historical data from preceding years, we aim to highlight ongoing trends and provide a basis for comparative analysis, facilitating an assessment of our overall advancement.

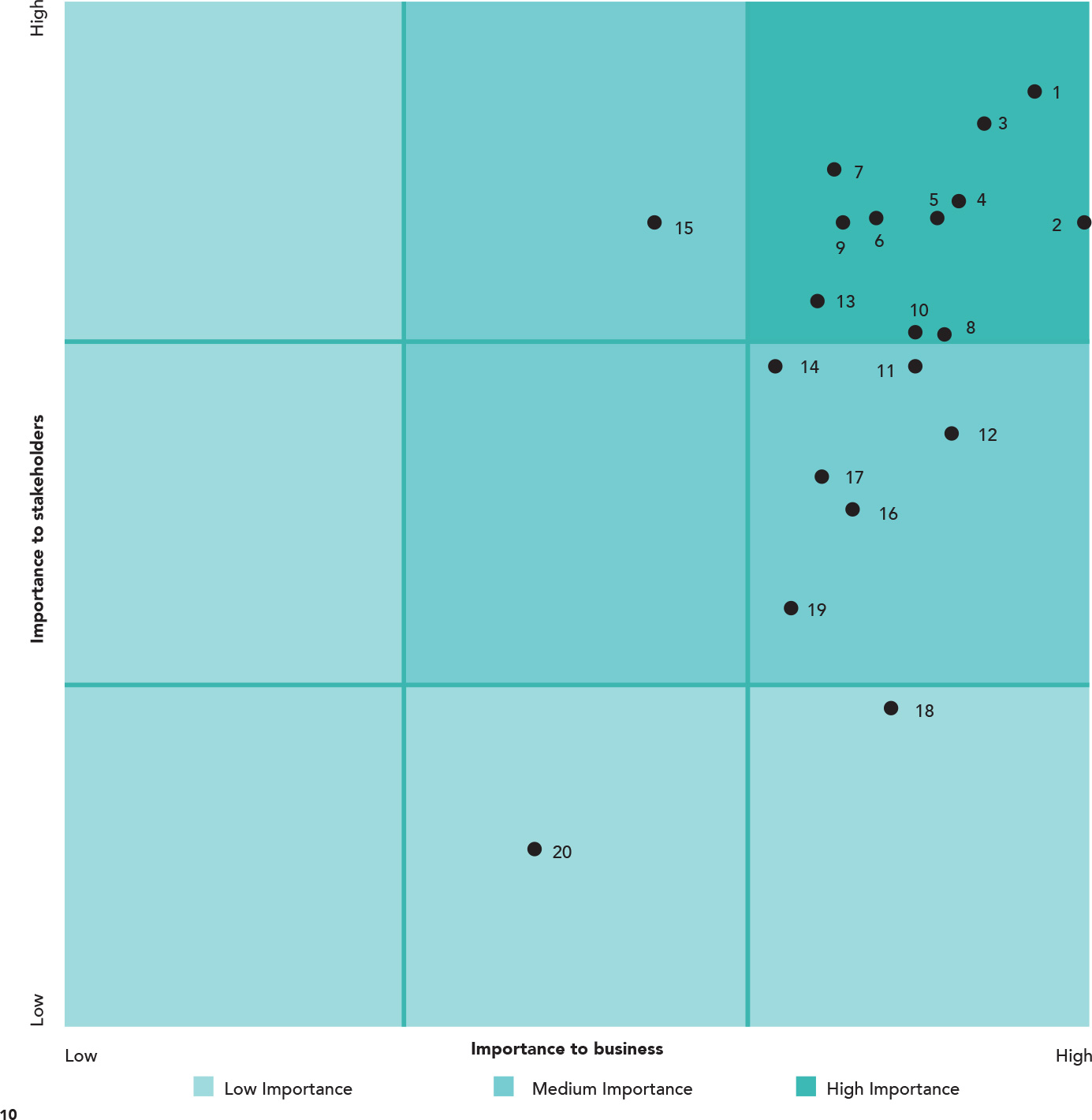

Double Materiality assessment

At GCPL, we put people and planet alongside profits. Our materiality approach is aligned with our strategic vision and value creation. We identified material issues by extensively engaging with our stakeholders and monitoring industry trends.

In the fiscal year 2023-24, we embraced a double materiality approach to align with our sustainability vision. We explored and evaluated Environmental, Social, and Governance (ESG) issues relevant to our business operations and our stakeholders. We also examined how material issues, business risks, objectives, and value creation are interconnected. The aim of this double materiality assessment is to prioritise the ESG topics most relevant to our operations and stakeholders, while considering the impact between our organisation and the broader sustainability landscape.

We integrated our materiality considerations into our Enterprise Risk Management (ERM) process where relevant, particularly focusing on areas such as Occupational Health and Safety (OHS), governance, and sustainable packaging that are overseen at a Board level. Our procedure involves identifying significant risks and opportunities with substantial financial implications and integrating them into the ERM framework.

Recently, we completed a new double materiality assessment in reference to the European Financial Reporting Advisory Group (EFRAG) guidance for materiality assessment released in February 2024, and the draft European Sustainability Reporting Standard (ESRS), ESRS 1 general requirement standard, released in November 2022, our Double Materiality Assessment is conducted in alignment with Corporate Sustainability Reporting Disclosure (CSRD) guidelines. We have used the Double Materiality framework to assess a sustainability topic from both impact perspective and/or financial standpoint. We are now in the process of including additional topics like Diversity, Equity, and Inclusion in our ERM approach.

Process flow of double materiality

This continuous initiative ensures that pertinent material issues are efficiently handled and monitored within our risk management structure.

Stakeholder engagement

Stakeholder engagement is crucial to our materiality assessment to ensure a diverse representation of interests across the regions where GCPL operates. As a leading FMCG company, we understand that our responsibilities extend beyond consumer products. The success of GCPL heavily relies on effectively managing sustainability factors to drive business value and make a positive impact on communities and the environment. Through the double materiality assessment, we aim to identify and prioritise the most significant sustainability factors affecting GCPL, while recognizing areas where GCPL can influence outcomes. To achieve this, we initiated interactions with key stakeholder groups to identify a comprehensive list of material issues. Key stakeholders were identified based on their influence, interest, and impact on the business. These included Leadership, Employees, Suppliers, Customers, Investors, NGO Partners, and Industry Associations. We tailored our questionnaire to stakeholders to gauge their perspectives and priorities.

We assessed each material issue for its relative importance across different stakeholder groups, and these insights were aggregated through stakeholder analysis.

Stakeholder prioritisation

We assessed the importance of stakeholders based on two critical parameters – their ability to influence GCPL’s performance and operations, and the extent of their influence due to GCPL’s performance and operations. We then assigned relative weightages based on these parameters. This helped us to accurately prioritise materiality topics based on stakeholder conversation and inputs and reflect the significance of each stakeholder in our business context.

|

Stakeholder |

Stakeholder group |

Ability of a stakeholder to strongly influence GCPL’s performance and operations |

Extent of influence on a stakeholder due to GCPL’s performance and operations |

|---|---|---|---|

| Internal Stakeholders | Leadership Team (L4) | High | High |

| Employees (L3-L1) | Medium | High | |

| External Stakeholders | Suppliers | Medium | Medium |

| Customers | Medium | Medium | |

| Investors | Medium | High | |

| NGO Partners | Low | Medium | |

| Industry Associations | Low | Medium |

Methodology & findings

For fiscal year 2023-24 double materiality assessment, we considered both GCPL’s domestic and international operations spanning India, Sri-Lanka, Bangladesh, Argentina, Chile, Africa, Indonesia, and the USA.

To kick off, we updated GCPL’s previous materiality assessment from 2020 and conducted secondary research on global frameworks and the FMCG sector landscape to draw out relevant sustainability topics. We identified a universe of 40 material topics to be considered for the assessment. Below is the preliminary list of sustainability topics:

Preliminary universe of 40 identified

material topics

-

SrEnvironment

-

1Climate Change

-

2Biodiversity & Land use

-

3Forestation

-

4Ecological Impacts

-

5Energy Management

-

6Emissions

-

7Toxic Emissions

-

8Product Carbon Footprint

-

9Water Management

-

10Waste Management

-

11Environmental Policy & Management Systems

-

12Community Relations

-

13Product Safety & Quality

-

14Labor Practice Indicators

-

SrSocial

-

15Privacy & Data Security

-

16Supply Chain Management

-

17Chemical Safety

-

18Health & safety

-

19Human Capital Development

-

20Materials Sourcing & Efficiency

-

21Customer Relationship Management

-

22Selling Practices & Product Labelling

-

23Product Design & Lifecycle Management

-

24Customer Privacy

-

25Access & Affordability

-

26Talent Attraction & Retention

-

27Sustainable Agricultural Practices

-

SrGovernance

-

28Innovation Management

-

29Business Ethics

-

30Tax Transparency

-

31Ownership & Control

-

32Corporate Governance

-

33Accounting

-

34Competitive Behaviour

-

35Management of the Legal & Regulatory Environment

-

36Critical Incident Risk Management

-

37Systemic Risk Management

-

38Policy Influence

-

39Transparency & Reporting

-

40Macro Economy & Geopolitical Risk

We selected these 40 topics for our stakeholder engagement, involving interactions with employees, suppliers, investors, consumers, industry partners, and NGO partners. We organised 47 one-on-one interviews – online and in-person – across geographies. The discussion enabled us to identify sustainability areas important to our stakeholders. Based on this, our preliminary list of 40 material topics was refined to a consolidated list of 20 material topics.

We then conducted an online survey and asked our stakeholders to rank the significance of each topic. This helped us to gather stakeholder perspectives on current and potential sustainability risks and opportunities. We collected 184 responses across all our stakeholder groups. Based on these inputs and the weightage assigned to each stakeholder group, we computed and prioritised the top 20 topics based on stakeholder preferences.

Final list of 20 material topics

|

Rank |

ESG indicator |

Material topics |

|---|---|---|

| 1 | S | Occupational Health & Safety |

| 2 | E | Product Safety and Quality Testing |

| 3 | G | Business Ethics and Ethical Marketing |

| 4 | G | Governance and Accountability |

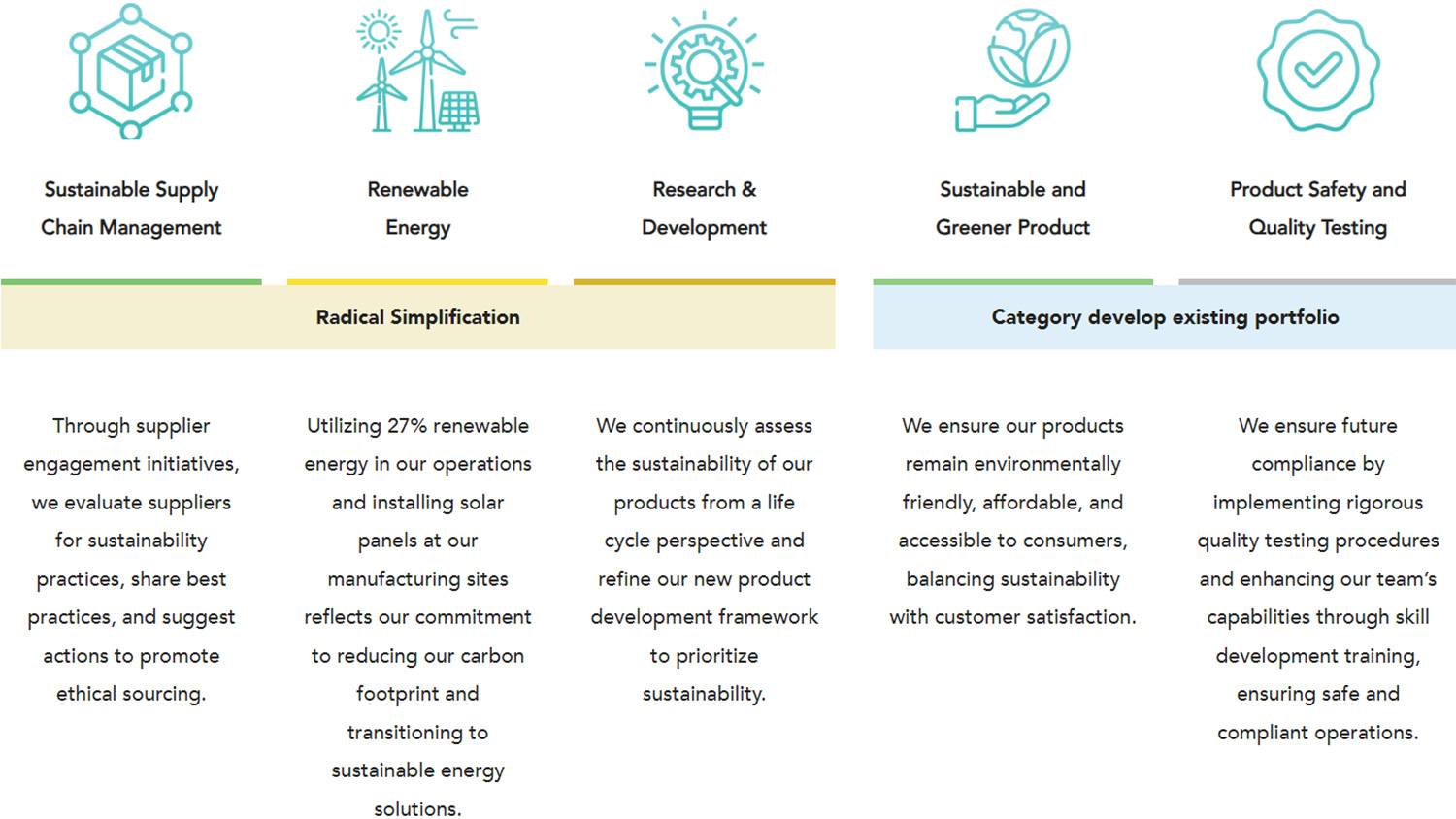

| 5 | G | Research & Development |

| 6 | E | Sustainable Packaging |

| 7 | E | Sustainable Supply Chain Management |

| 8 | E | Renewable Energy |

| 9 | E | Sustainable and Greener Products |

| 10 | S | Diversity & Inclusion |

| 11 | S | Human Capital Development |

| 12 | G | Changing Legal Landscape |

| 13 | S | Product Awareness |

| 14 | G | Demographic Risks |

| 15 | S | Consumer Awareness |

| 16 | E | Carbon Emissionss |

| 17 | S | Community Relationships |

| 18 | E | Water Conservation |

| 19 | S | Talent Attraction & Retention |

| 20 | E | Climate Change |

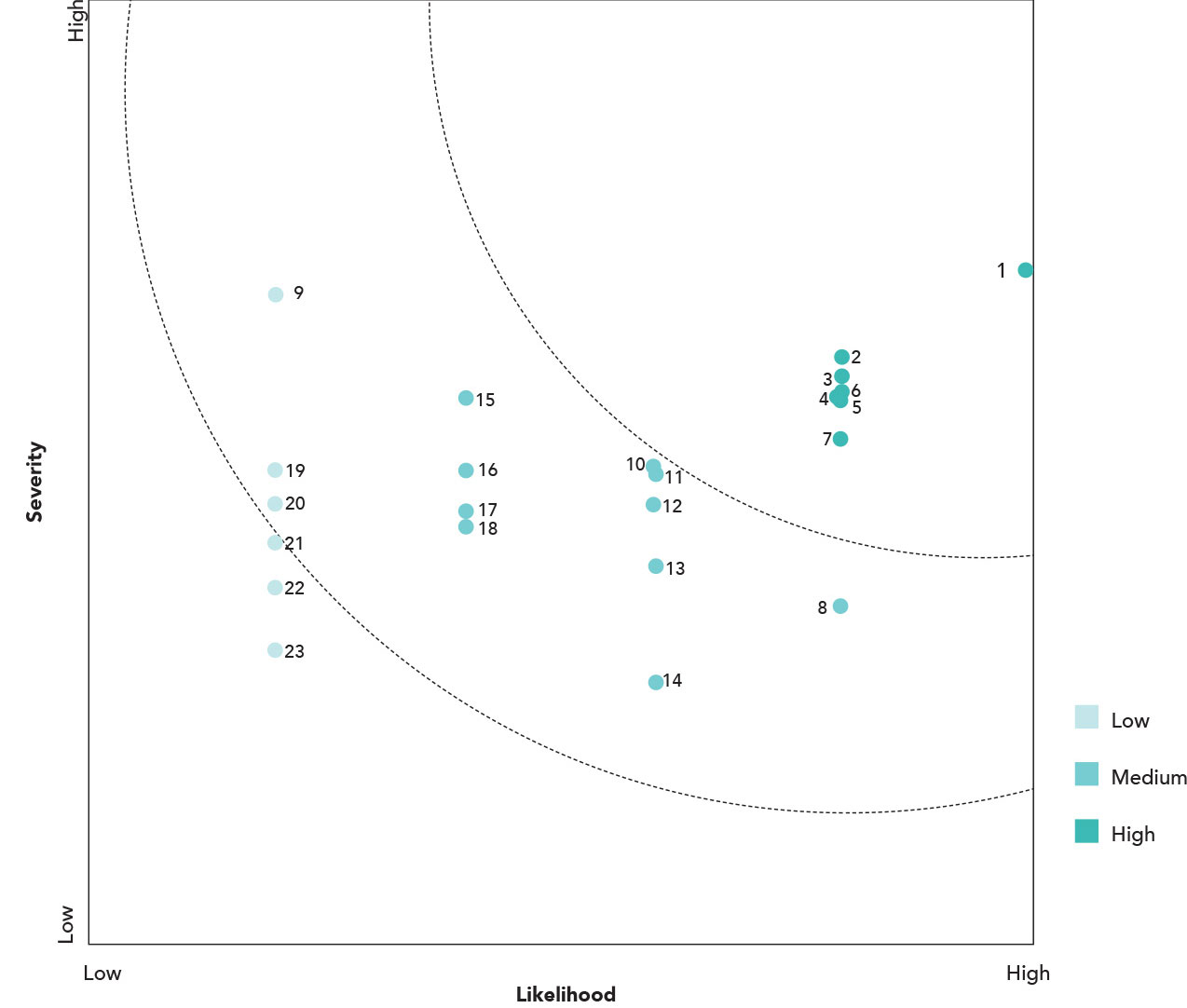

Double Materiality assessment

During stakeholder interactions, we also identified 23 subtopics related to each of these top 10 sustainability topics mentioned above. These subtopics were then evaluated with internal stakeholders to understand their potential impact and financial materiality on the company. We developed a questionnaire by defining a scenario for each subtopic where it presented a risk or opportunity to the company in reasonable terms. This was done to evaluate potential impact and financial implication by examining direct and indirect outcomes of such topics on the operations, value chain, service, environment, and society as a whole. Only the senior leadership team was involved in this assessment, as they are directly engaged in the company’s key decision-making processes, have insights into the business implications of ESG matters, and possess knowledge of GCPL’s financial operations. Each senior leaders rated the scale, scope and remediability of impact and rated the potential financial impact on “continuation of reliance” and “rating of adverse action” for financial assessment.

Once scoring was concluded, we derived the double materiality matrix with impact materiality vs financial materiality.

Results of impact materiality assessment

|

Rank |

Material topics |

|---|---|

| 1 | PCR Regulatory Mandates |

| 2 | Increasing Access of Affordable and Greener Products |

| 3 | Alternative Material for Tin and Aluminium Cans / Overall Reduction in Aluminium Usage |

| 4 | Collection of Post Consumer Plastic Waste |

| 5 | Palm Oil Sourcing |

| 6 | ESG Monitoring and Performance Management of Suppliers |

| 7 | Integration with Renewable Energy |

| 8 | Transparency in Information Disclosure |

| 9 | End-of-Life Recycling of Hair Extension products |

| 10 | Product Innovation |

| 11 | Plastic Packaging Intensity |

| 12 | Infrastructure and Policy in Emerging Markets |

| 13 | ESG Rating for Vendor Onboarding |

| 14 | Women in Senior Leadership |

| 15 | Emerging Regulatory Risk on Product Chemical Safety |

| 16 | Country-wise Product Marketing and Communication Strategy |

| 17 | Product Labeling and Greenwashing |

| 18 | Inclusion of Specially Abled People |

| 19 | Code of Conduct |

| 20 | SOP of Internal Quality Standards |

| 21 | Women Safety |

| 22 | Health and Safety Training |

| 23 | H&S of Value Chain Partners |

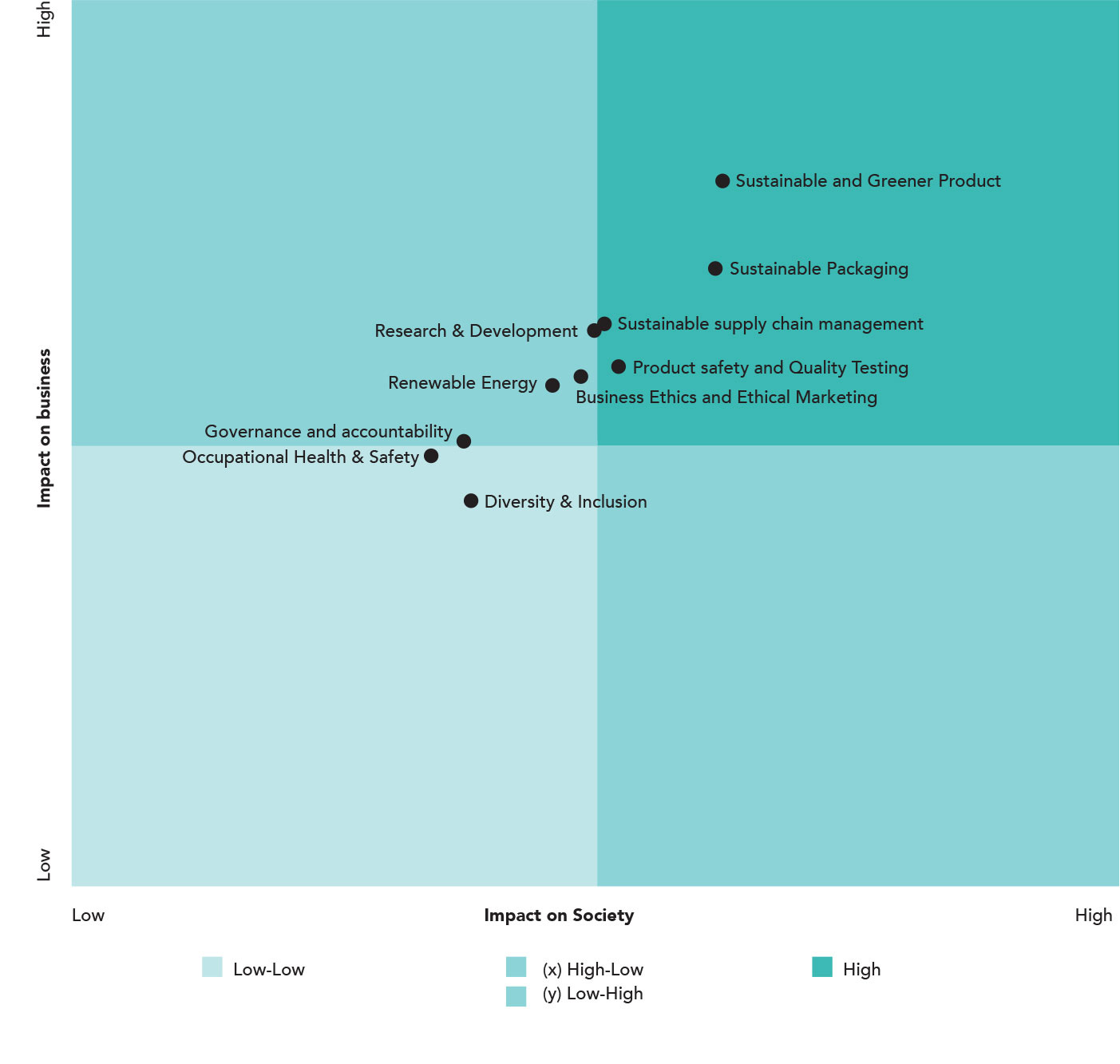

After scoring was completed, we constructed a double materiality matrix contrasting impact materiality versus financial materiality. Following the stakeholder ratings of material subtopics, the following matrix was developed at both subtopic and topic levels, highlighting critical priorities for GCPL.

Financial impact materiality matrix

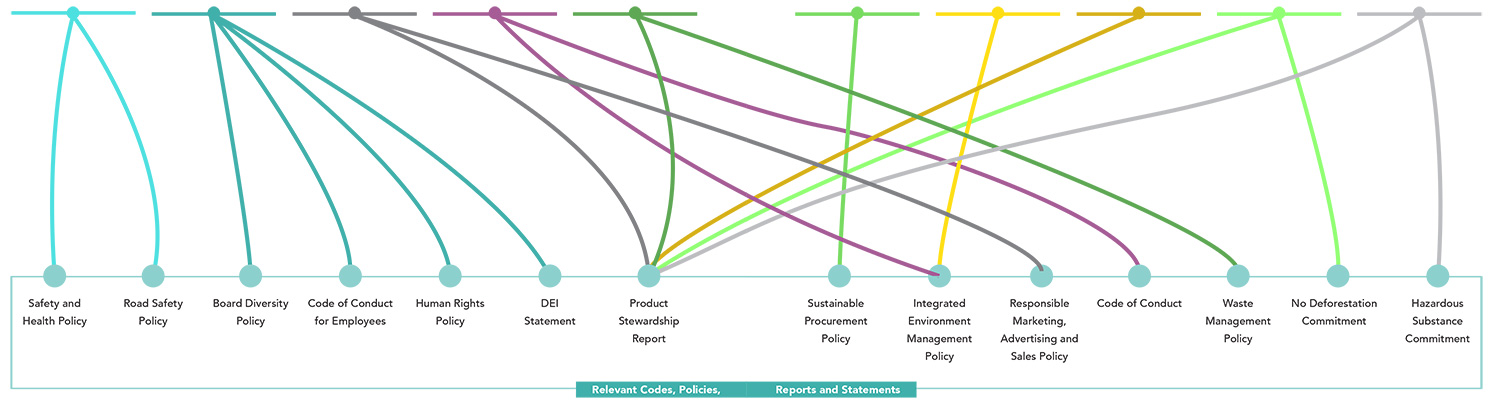

The double materiality assessment pinpointed crucial priorities for GCPL, encompassing worker safety, product and quality testing, business ethics, governance and accountability, sustainable packaging, supply chain management, renewable energy research and development, sustainable and greener products, and diversity and inclusion. Sub-topics identified through stakeholder engagement exercises were aligned with these priorities, evaluating their potential impact on both financial materiality and the company’s societal impact. Our senior management has signed off on the finalisation of material issues for fiscal year 2023-2024, based on our materiality assessment results.

Change in material topics

-

2020

-

Sustainable Packaging

-

Research & Development

-

Responsible Marketing and Communication

-

Building Inclusive and Prosperous Communities

-

Governance and Accountability

-

Occupational Health and Safety

-

Skill Development and Training

-

2024

-

Occupational Health & Safety

-

Product Safety and Quality Testing

-

Business Ethics and Ethical Marketing

-

Governance and Accountability

-

Sustainable Packaging

-

Sustainable Supply Chain Management

-

Renewable Energy

-

Research & Development

-

Sustainable and Greener Product

-

Diversity & Inclusion

Priority material issues for value creation

|

Material Issue |

Occupational Health and Safety |

|---|---|

| Boundary | Within and outside GCPL |

| Business Case | Ensuring health and safety is a top priority at GCPL, given the physical hazards confronting manufacturing and distribution staff which heighten the likelihood of workplace accidents. Inadequate training on OHS protocols not only endangers employees but also exposes the firm to secondary ramifications, including legal expenses, operational interruptions, heightened scrutiny from stakeholders, diminished employee morale, and reputational harm. |

| Impact | Risk |

| Relevant Stakeholders | Employees, workers, contractor workers and local community |

| Business Strategy/ Initiative |

We have a robust Health & Safety policy and strong safety and health management system to ensure highest adherence to health and safety, and a governance mechanism to ensure any incidents are duly investigated and resolved for the future. We ensure periodic review of safety procedures and the Central Safety Committee and committees at plants review monthly data for occupational health and safety. We have a consistent record in zero fatalities across our offices and manufacturing plants leading to high-morale and trust amongst employees and workers. |

| Target |

By 2026-27, we aim to have–

|

| Progress as of FY24 |

|

| Link to executive compensation | At GCPL, the executive compensation of all leaders comprises of 15% of people & planet goals. They are in line with the company’s vision to foster an inspiring workplace and build an equitable and greener planet. For health and safety, goals for executive compensation include implementing the human rights action plan that includes focus on health and safety, improving safety measures like reduction in work-related accident frequency and no fatal accidents |

|

Material Issue |

Sustainable Packaging |

|---|---|

| Boundary | Within and outside GCPL |

| Business Case | Enforcement of strict regulations on plastic, waste generation, and disposal arising from geographies such as India and Africa, may result in higher short-term costs for compliance. |

| Impact | Cost |

| Relevant Stakeholders | Investors, Employees, Customersy |

| Business Strategy/ Initiative | As most of GCPL products involves plastic packaging, we focus on reducing our plastic packaging intensity. It is determined by the weight of the packaging to overall product weight. GCPL has reduced plastic packaging intensity by over 20% from the base year of 2019-20. This has resulted in cost savings and reduced its Extended Producer Responsibility (EPR) requirements. |

| Target |

By 2025-26, we aim to –

|

| Progress as of FY24 |

|

| Link to executive compensation | At GCPL, the executive compensation of all leaders comprises of 15% of people & planet goals. They are in line with the company’s vision to foster an inspiring workplace and build an equitable and greener planet. For sustainable packaging, goals for executive compensation include using better plastics, reducing plastic usage, replacing virgin plastics with post-consumer recycled plastics |

|

Material Issue |

Renewable Energy |

|---|---|

| Boundary | Within GCPL |

| Business Case | Shifting to renewable energy sources will reduce GCPL’s emissions and generate significant long-term cost savings |

| Impact | Revenue |

| Relevant Stakeholders | Investors, and Employees, |

| Business Strategy/ Initiative | Currently, GCPL is utilizing over 27% renewable energy in its operations. We also use briquette fired boilers and microturbines for steam and invest in solar PV and apply for green tariffs wherever available. |

| Target | By fiscal year 2025-26, we plan to increase renewable energy consumption as part of our overall energy mix to 35% |

| Progress as of FY24 | 27% of GCPL’s energy is from renewable sources. |

| Link to executive compensation | At GCPL, the executive compensation of all leaders comprises of 15% of people & planet goals. They are in line with the company’s vision to foster an inspiring workplace and build an equitable and greener planet. For renewables, goals for executive compensation include to increase renewable energy use, decrease specific energy and reduce emissions |

Material issues of our external stakeholders

Product Safety and Quality Testing

Type of impact

Negative

Business Case

We understand the failure to adapt to ever evolving chemicals usage landscape especially across multiple geographies we operate in. We may face litigation risks from consumers and carry the risk of increased short-term costs of researching alternative chemicals.

Sustainable Packaging

Type of impact

Positive

Business Case

GCPL is proactively adapting best practices in sustainable packaging which reduces overall plastic intensity and even helps reduce transportation costs and subsequent emissions due to reduced weight. GCPL has also taken targets and made progress on reducing overall packaging weight and waste generated from packaging. Additionally, we are exploring greener alternatives to plastic packaging.

Materiality metrics for external stakeholders

|

Impact 1 |

|

|---|---|

|

Material Issues for External Stakeholders |

Sustainable Packaging |

| External stakeholders | Suppliers, consumers |

| Topic relevance on external stakeholder(s) | GCPL is proactively adapting best practices in sustainable packaging which reduces overall plastic intensity and even helps reduce transportation costs and subsequent emissions due to reduced weight of the product. |

| Output metrics | Reduction in plastic packaging intensity by 22% |

| Impact valuation |

|

| Impact metric | The reduction in packaging in our reconstituted product portfolio not only minimises plastic waste as well as leads to a more sustainable supply chain. The lighter weight of our reconstituted products results in a 44% reduction in fuel consumption during transportation. In turn, this translates to a 44% decrease in emissions caused by the transportation of our products to consumers. By reducing packaging, fuel consumption, and emissions, we are ensuring positive impacts on the environment while continuing to deliver high-quality, delightful products to our consumers at a green discount rather than a green premium. |

|

Impact 2 |

|

|---|---|

|

Material Issues for External Stakeholders |

Sustainable and Greener Products |

| External stakeholders | Consumers, investors |

| Topic relevance on external stakeholder(s) | A product portfolio with lower environmental impact is a market opportunity and a brand differentiator. Consumers look for quality products and being greener will ensure their affordability and accessibility. |

| Output metrics | Completed life cycle assessment of products comprising of 60% revenue |

| Impact valuation |

|

| Impact metric | In our manufacturing process we have reduced specific energy consumption by 35% from FY11 baseline, reduced specific emissions by 41%, reduced water intensity by 39% and achieved zero waste to landfill, making our products greener by 1/3. |

We regularly listen and take feedback from all our stakeholders. Here’s an overview of

our stakeholder engagement process and the steps we undertake to grasp the needs and

priorities of each stakeholder group.

|

Stakeholder group |

Leadership Team |

Employees |

Suppliers |

|---|---|---|---|

| Whether identified as Vulnerable & Marginalized Group | No | No | No |

| Frequency and manner of stakeholder engagement |

|

|

|

| Sustainability and other concerns |

|

|

|

| Our engagement approach |

|

|

|

|

Stakeholder group |

Customers |

Investors |

NGO Partners |

Industry Associations |

|---|---|---|---|---|

| Whether identified as Vulnerable & Marginalized Group | No | No | No | No |

| Frequency and manner of stakeholder engagement |

|

|

|

|

| Sustainability and other concerns |

|

|

|

|

| Our engagement approach |

|

|

|

|