Risk

management

At GCPL, we have a comprehensive and structured approach to risk management. Across our geographies, we have integrated our approach to risk management into the operating framework and reporting channels of our business.

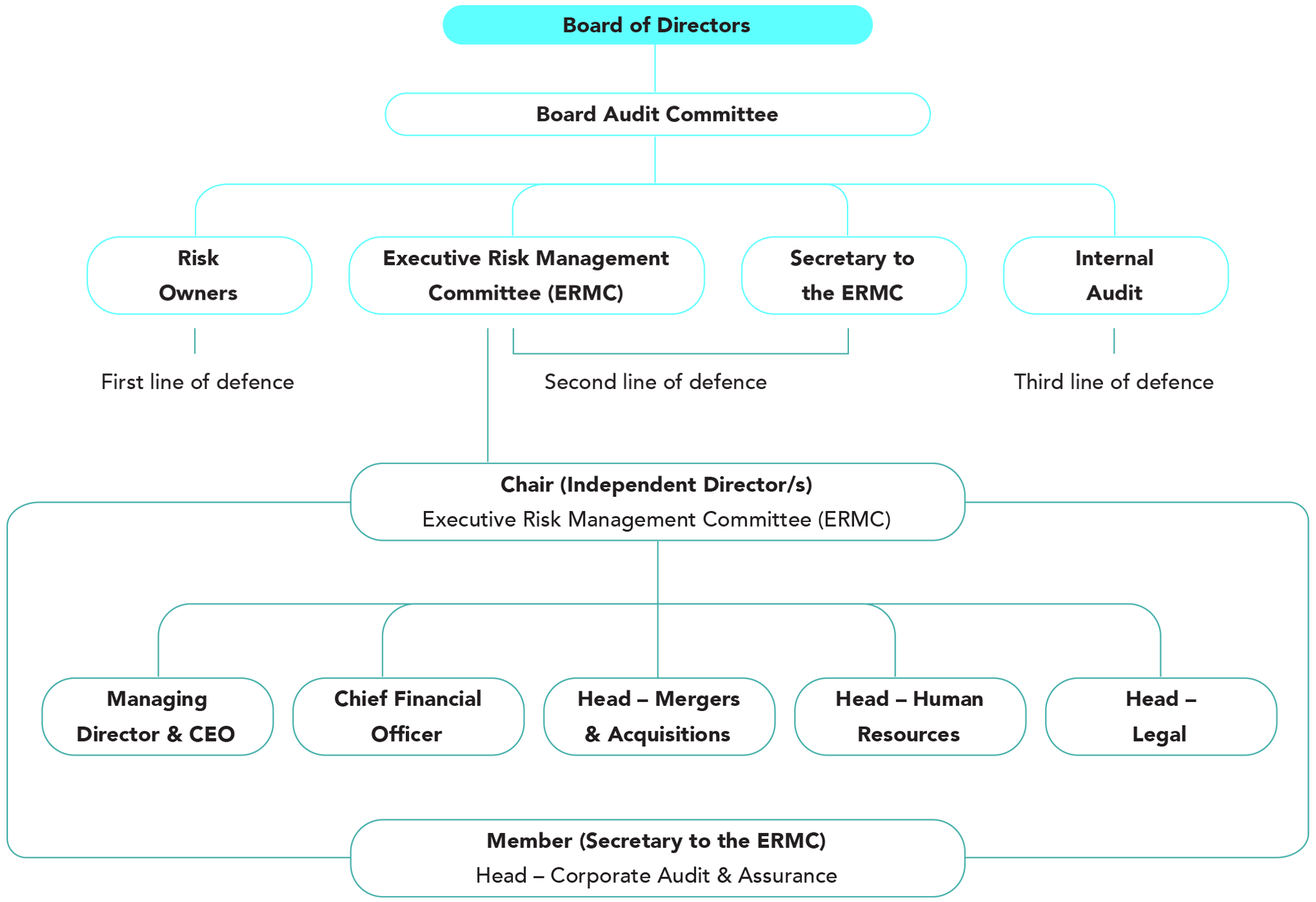

Risk governance structure

We have established a robust risk governance structure to ensure that risks are identified, assessed, and mitigated effectively. Led by Board-level oversight, we have dedicated risk owners as our first line of defence, followed by the second line of defence – the Executive Risk Management Committee (ERMC) that take charge of

Risk governance structure

We have established a robust risk governance structure to ensure that risks are identified, assessed, and mitigated effectively. Led by Board-level oversight, we have dedicated risk owners as our first line of defence, followed by the second line of defence – the Executive Risk Management Committee (ERMC) that take charge of risk oversight and provide guidance. Our third line of defence are the internal audit team that provide independent assurance and assess the effectiveness of our risk management process.

risk oversight and provide guidance. Our third line of defence are the internal audit team that provide independent assurance and assess the effectiveness of our risk management process.

Board of directors

Our Board of Directors plays a pivotal role in shaping our risk management approach. They set the tone at the top and define our risk appetite. Risk appetite is the level of risk we are willing to accept to achieve our strategic business goals. This ensures alignment between risk-taking and our overall mission. Their watchful eye on our risk exposure ensure that we don’t compromise prudent risk management practices. Their insights are instrumental for informed decision-making.

Board audit committee

The Board Audit Committee comprises of all Independent and non-executive directors. They play a crucial role in approving and authorising the risk management charter and policy. These foundational documents guide our risk management efforts. The committee provides practical guidance and instructions to the first two lines of defence – the risk owners and the ERMC. Their insights enhance our risk management practices. When specific risks require additional resources for effective mitigation, the Audit Committee approves and allocates those resources to tackle them effectively. The Audit committee also provides appropriate corrective action in case mitigation initiatives are not carried out as required. They regularly update the Board of Directors and suggests any adjustments to the risk appetite.

First line of defence – Risk Owners

Risk owners are appointed for material and emerging risks. Risk owners are at the frontline of our risk defence, and they are part of business operation teams. They assess, manage, evaluate, and monitor the risks and propose the risk mitigation plan. The implementation of the risk mitigation action plan is agreed upon by the ERMC and Board Committees, and any deviations are discussed with the Head of Function and Managing Director & CEO.

The risk owners may change over time, depending upon their changing roles and responsibilities within the organisation.

On a half-yearly basis, the risk owner formally reports about risk management within their area of operation at the ERMC meetings. This reporting is aimed at assessing how well material risks are being managed and if any additional risk has emerged that can adversely affect business operations. The risk report includes:

- Performance of the function in managing its material risks in light of the mitigation strategies

- Identification of any additional emerging risks

- Definitions of the mitigation strategy for the new material risks

Second line of defence - Executive Risk Management Committee (ERMC)

The ERMC ensures that we follow a structured risk management process. This committee is entrusted with the crucial task of risk identification, assessment, and mitigation for our company across various domains, including strategic, material, operational, transitional, technological, and environmental domains.

The ERMC shoulders the comprehensive responsibility of monitoring the company’s risk landscape and managing it effectively to ensure a robust and thriving business. This committee remains steadfast in its commitment to uphold transparency and safeguard the interests of the company and its stakeholders.

Based on the recommendations of the Managing Director & CEO or the Chief Financial Officer, the ERMC may nominate or invite additional members/directors, as required, to participate in specific meetings.

The Secretary to the ERMC is the highest-ranking person with a dedicated risk management responsibility at operational and performance levels. The Secretary acts as a Chief Risk Officer and oversees the functioning of the risk management process. The Secretary has to ensure that the ERMC meetings are held half-yearly or more frequently, if required.

The Secretary submits a half-yearly report on risk management for review and appraisal of the ERMC. In addition, at every 6 months, based on a pre-specified calendar, risk owners would formally present the risk management initiatives and status of their area of operation to the ERMC.

The ERMC is responsible for:

- Half-yearly reports to the Audit Committee and Risk Management Committee

- Half-yearly review of the risk mitigation status for material and emerging risks

- Annual assessment of risks in line with business/strategic planning

Third line of defence – Internal Audit

The internal audit team provides independent assurance on the risk management process. They assess based on risk significance and deep dives to examine controls, processes, and risk mitigation strategies that the business has adopted.

Risk governance structure

Risk management approach

We take a proactive approach to risk management, wherein an annual risk identification and assessment process is incorporated in line with our strategic business planning and annual business planning initiatives.

The annual business plan is a foundation for identifying and prioritising risks. Following prioritisation, a risk competency scan is conducted to determine existing management strategies that effectively address material and emerging risks to our business. This scanning process helps in pinpointing opportunities for enhancing risk mitigation.

For each material and emerging risk, the combined outcomes of the existing management strategies and identified improvement opportunities are documented in a formal risk management plan. Subsequently, the assessment of prioritised risks and their mitigation strategies is presented to the Board Risk Management Committee for evaluation and review.

Risk management approach

The risk assessment function is structurally independent of business and is overseen and coordinated by the Secretary to the ERMC. The risk assessment outcomes fall under the ownership of the respective business function heads. This collaborative approach ensures a comprehensive and efficient risk management strategy across the organisation.

Risk culture

Employees across all levels and geographies have risks as part of their individual goals and performance review. These risks range from measures to reduce occupational health and safety incidents, adherence to regulations and compliance, financial forecasting to reduction of volatile forex exposure. The risk goal weightage for employees ranges from 30% to 60% and is a part of their half-yearly HR employee performance review. Compliance and quality risk assessment are a part of our New Product Development (NPD) process, and the goal is aligned with the key performance indicators of R&D team members involved in NPDs.

New managers are inducted on Enterprise Risk Management training, which is organised quarterly. They are trained on inputs on risk definition, identification, rating, classification, prioritisation, mitigation, control, and review. Across all manufacturing facilities, we also conduct workshops on occupational health and safety risks and management throughout the year, encompassing over 100% of our manufacturing plant workforce.

Our employees are encouraged to share feedback for continuous improvement in risk management practices. A formal annual NPS survey is conducted across the company for all functions. Risk management is a part of that survey, and the feedback helps us improve our processes and systems.

Continuous listening survey is organised across the company seeking suggestions and feedback from all employees. Moreover, emerging risks and development of mitigation measures are discussed in regularly conducted departmental monthly review meetings. The line manager records valid risks identified by team members and communicates them to the ERMC for further action. At the plant level, we have a mobile app to identify occupational health and safety risks. These risks are tracked, reviewed, and mitigated through the app.

Risks and mitigation

| Risk category | Risk and risk description |

Risk appetite | Magnitude | Mitigation plan |

|---|---|---|---|---|

|

Financial |

Forex |

We budget for currency conversion loss, however our risk appetite seeks to optimise a high level of return and achieve right risk reward |

High |

At GCPL, the Forex policy is determined by a dedicated Forex Committee. This committee monitors all exposures and guides decisions on open exposures and hedging. The committee meets monthly and provides quarterly reports to the Board on forex exposures. |

|

Supply chain |

Commodity Price Volatility |

For commodities we aim to eliminate as far as possible any commodity price volatility through hedging and expanding our pool of commodity suppliers. We have defined a risk appetite with a predetermined limit exposure. |

High |

Our primary commitment remains to serve the needs of our consumers above all else. In challenging times, we continue to work in their best interest and have passed on only a fraction of the increased input costs to our consumers. Additionally, we have consistently maintained the quality standards of our products, refusing to compromise on quality in the face of rising input costs. To further mitigate this risk, we are actively working to secure high-quality palm oil from various regions and geographies, thereby reducing our dependency on major palm oil markets. |

|

Operational |

Occupational Health & Safety |

We have no appetite of risk of failure of health and safety measures in our operations. |

High |

This is a high-priority area for us. We have a dedicated Human Rights policy, strong SOPs (Standard Operating Procedures) to ensure the highest adherence to health and safety, and a governance mechanism to ensure any incidents are duly investigated and resolved for the future. We ensure a periodic review of safety procedures, and the Central Safety Committee and committees at plants review monthly data for occupational health and safety. |

|

Economic |

Hyperinflation & Currency Devaluation |

We are willing to accept the risk of working in emerging economies where there is hyperinflation. We have in place strategic mitigation strategy and business imperatives to manage this. |

Medium |

We are strategically utilising our manufacturing capabilities and human resources in regions experiencing hyperinflation to lower our production costs. Simultaneously, we are investing in local procurement initiatives to reduce reliance on imports and minimise the impact of global supply chain disruptions. By supporting the local economy, we aim to foster economic stability and contribute to the well-being of the communities we serve. |

|

Financial |

Changing consumer preferences |

We accept consumer preference changes are inevitable and we are constantly innovating to keep delighting our consumers by offering a green discount on our products rather than a premium. |

Medium |

We have conducted Life Cycle Assessment of more than 50% of our products (with a plan to cover 80% by 2025) to assess where in the value chain can our products be more sustainable on all environmental fronts– energy, water, plastic, and waste. We are working on the findings of the reports to make our products demonstrably greener. A great example of our green product is our innovative power-to-liquid Magic hand wash. It is the world’s most affordable hand wash. It uses half the plastic packaging compared to a regular hand wash refill and only a quarter of the fuel to be transported. We are also working, finding, and testing alternate packaging materials and increasing the use of post-consumer recycled plastic to move away from virgin plastic. |

|

Regulatory |

Evolving Regulations |

We will adhere to all regulations and laws where we operate. |

Low |

We have the highest levels of statutory compliance and ensure all regulations and law of the land are adhered to. We have an internal system called Legatrix that helps all manufacturing units to monitor adherence to compliance and regulations. It enables management with a one-stop view of the organisation’s compliances and control mechanism through comprehensive compliance dashboards and provides necessary information at the operating level by creating a comprehensive matrix on laws and their management. Further, our Corporate Affairs, Legal, and Audit teams are in consistently communicating with key government departments and industry bodies to track new and emerging regulations. They routinely assess and analyse regulations to evaluate how these will impact business and mitigation for the same. |

Emerging risks

1. Extreme weather events

Extreme weather events are an environmental risk for us. It can disrupt our supply chain leading to production delays or increased costs. Our consumer base, primarily in regions like India, Indonesia, Latin America and Africa, is particularly likely to experience extreme weather events. For instance:

- Rising temperatures are set to alter India’s summer monsoon, causing more intense but less frequent rainfall in the latter half of the 21st Century. This change may lead to water shortages and challenges for a significant part of the population. For instance, at our operational sites in South cluster, there’s been an observable annual increase of about 0.04 degrees Celsius in maximum temperature over the past 45 years. India’s maximum temperature has also risen by 0.99 degrees Celsius per century from 1901 to 2020. North East India has seen an average temperature rise exceeding 1.5 degrees Celsius in the last 50 years, surpassing the threshold outlined at the COP Paris meeting of the UNFCCC, highlighting the emerging risk posed by escalating temperatures.

- Across SAARC countries, extreme weather events such as glacier melt and changing rainfall patterns could raise water stress levels, posing threats to water security, ecosystems, and economic progress.

- In Indonesia, climate hazards like floods, droughts, and heatwaves are expected to intensify, risking agriculture and biodiversity.

- Climate change makes Sub-Saharan Africa more prone to natural disasters and conflicts, which affect communities and livelihoods. In Kenya, extreme weather projections include more frequent dry spells, longer heatwaves, increased precipitation, rising sea levels, and higher temperatures.

- Climate events like El Niño in Latin America have the potential to cause extreme weather events and disrupt the industry we operate in.

Extreme weather events pose emerging risks for us, including supply chain disruptions, and water scarcity.

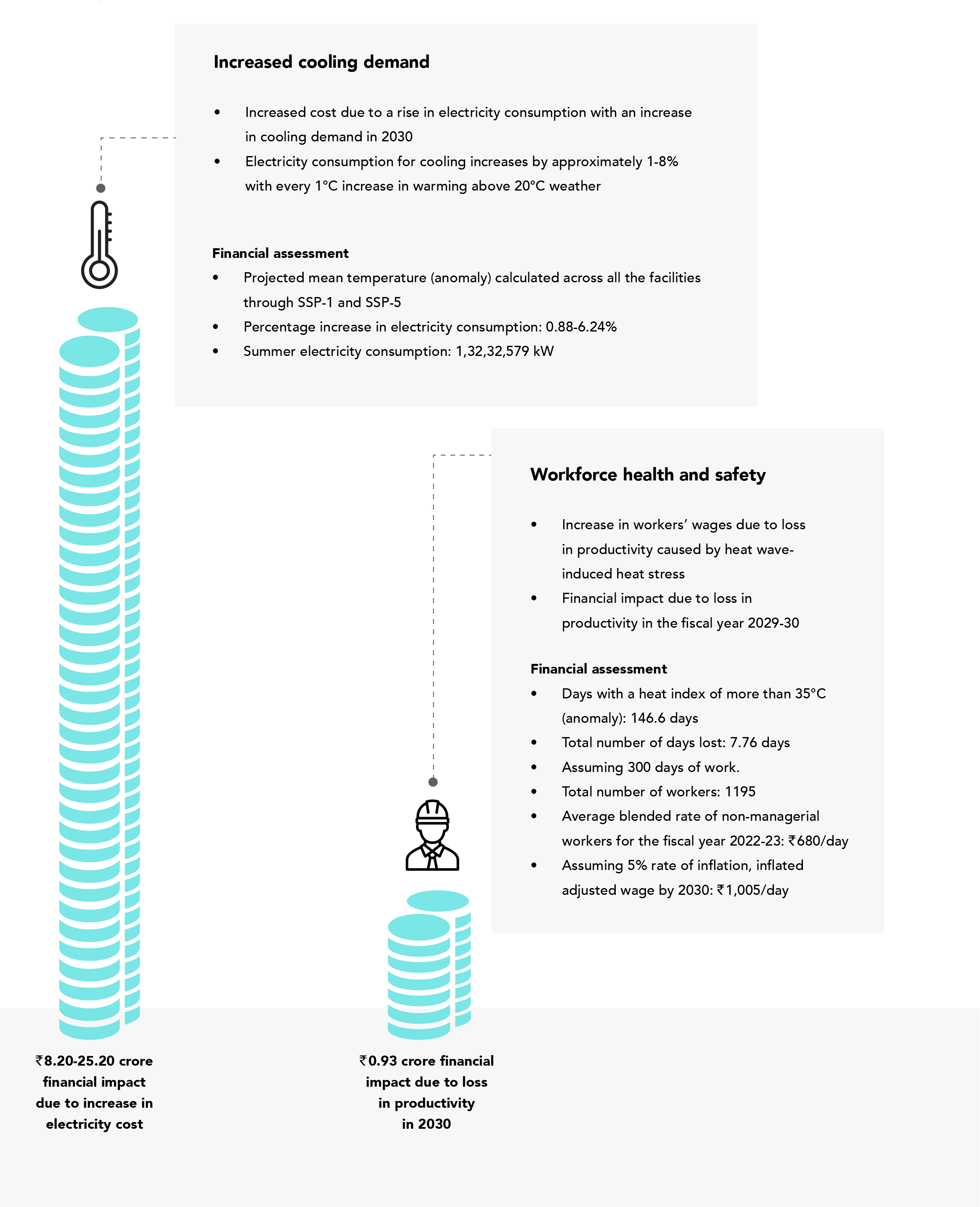

Impact of extreme weather events on our operations

From our assessment, we have determined that the potential ramifications of climate change will be particularly pronounced in our operational location in India in North and North-East manufacturing clusters and have a plan in the next 3 years to address these risks. We recognize that extreme weather events pose significant risks to our operations and supply chain. Climate change impacts, such as unpredictable weather patterns, water scarcity, and

From our assessment, we have determined that the potential ramifications of climate change will be particularly pronounced in our operational location in India in North and North-East manufacturing clusters and have a plan in the next 3 years to address these risks. We recognize that extreme weather events pose significant risks to our operations and supply chain. Climate change impacts, such as unpredictable weather patterns, water scarcity, and temperature fluctuations, can disrupt production, increase operational costs, and affect the availability of raw materials. Our operations, particularly in regions like India, Indonesia, and Africa, are highly vulnerable to these climate-related challenges. To ensure the sustainability and resilience of our business, we have undertaken a comprehensive assessment of these risks and are implementing targeted mitigation actions.

temperature fluctuations, can disrupt production, increase operational costs, and affect the availability of raw materials. Our operations, particularly in regions like India, Indonesia, and Africa, are highly vulnerable to these climate-related challenges. To ensure the sustainability and resilience of our business, we have undertaken a comprehensive assessment of these risks and are implementing targeted mitigation actions.

| Physical scenario considered |

Transition scenario considered |

|

|---|---|---|

| Below 2 °C | SSP-1 - aligned to RCP 2.6 |

IEA B2DS |

| Above 2 °C | SSP-5 - aligned to RCP 8.5 |

Mitigation action

Water Availability: Rainwater Harvesting: Installed at all manufacturing facilities to improve groundwater tables.

Community Support: Developed infrastructure in water-stressed areas to ensure water access for local communities. Watershed Management: Collaborating with farming communities to enhance water conservation over 3,300 hectares. Detailed Climate Assessments:

Focus Areas: Prioritizing Katha, Karaikal, Guwahati, and Puducherry for identifying climate risk hotspots.

Supplier Engagement and GHG Reduction: Targeting these areas to enhance supplier practices and reduce greenhouse gas emissions.

Sectoral Review: Evaluating potential risks and opportunities related to transitioning to a low-carbon economy using advanced modeling tools.

By proactively addressing these risks, we aim to safeguard our supply chain, reduce operational disruptions, and ensure long-term business continuity in the face of climate change.

2. Cyberattacks

Protecting our computer systems, networks, and electronic data from unauthorised access, theft, or damage due to cyberattacks is critical. Our reliance on digital technology and online platforms exposes us to increasing cyber threats. The vast amounts of sensitive data we store, including customer information, and proprietary technology, coupled with our use of online platforms for customer and supplier interactions and supply chain management, make us prime targets for cybercriminals aiming to steal data, disrupt operations, or demand ransom. We recognise that cyber threats such as phishing, malware, ransomware, and denial-of-service attacks pose significant risks to our business. Cyberattacks are a technological risk and have the potential to result in revenue loss, reputational damage, and legal repercussions. We are addressing specific vulnerabilities to enhance our defence against cyberattacks, such as

1. We face risk of leakage of sensitive information due to a lack of endpoint protection controls like Data Loss Prevention (DLP) for end-users’ laptops, email, Web, and OneDrive.

2. Unauthorised access or network compromise could occur due to our failure to comply with our Networking Compliance Standards.

3. Regulatory non-compliance risks arise from the unavailability of all database and application logs for the last 180 days, as per CERT-In requirements.

4. The potential loss and corruption of our organisation’s information in the event of a system crash due to a lack of controls for end-user data backup.

Global emerging risk for GCPL

- India’s growing reliance on digital infrastructure like the Unified Payments Interface, Aadhaar, and Open Network for Digital Commerce further increases our vulnerability to cyberattacks. For instance, in March 2024, a cyber espionage campaign breached India’s government and energy sectors, highlighting the urgency of robust measures against cyberattacks.

- Africa’s rapid economic growth has led to increased demand for internet and digital services, but the development of laws and regulations regarding cybersecurity has not kept pace. Cyberattacks, such as plans uncovered by an Indian cybersecurity firm involving hacking groups targeting the G20 summit, threaten critical information infrastructure and demand immediate action to strengthen protection measures.

- Indonesia’s digital transformation has brought opportunities and convenience but also heightened risks of cyberattacks. Close to one billion traffic anomalies associated with potential cyberattacks were recorded in 2022, emphasizing the need for proactive measures to safeguard digital assets.

Impact of cyberattack risk

1. Cyberattacks can disrupt operations, leading to shipment delays, lost sales, and decreased productivity.

2. Cyberattacks can result in financial losses from stolen sensitive data, operational disruptions, and the costs of recovery and repair.

3. GCPL, with an emphasis on customer satisfaction, places great importance on brand reputation to attract and retain customers. A cyberattack can erode trust and tarnish the brand, affecting customer retention and acquisition.

4. Breaches can also lead to legal liabilities if negligence is proven in protecting customer data or if data protection regulations are violated.

5. Our competitive edge lies in proprietary technology and manufacturing processes. Cyberattacks pose a risk of intellectual property theft, impacting our differentiation from competitors.

Mitigation action

In the realm of Information Security, GCPL has remained steadfast in its commitment to fortifying its digital defences, adapting to both Indian regulatory requirements and global best practices. Over the past year, GCPL has achieved significant milestones in its Information Security endeavours, reflecting a proactive approach to safeguarding its digital assets and maintaining the trust of its stakeholders.

Central to these achievements has been the enhancement of GCPL’s Information Security framework, aligning it with stringent Indian regulations and global standards. Additionally, GCPL has prioritized the cultivation of a cybersecurity-aware culture among its employees, fostering responsible security behaviour and bolstering overall resilience. The organization has also made notable strides in incident response capabilities, integrating various event and incident sources to streamline responses and mitigate security threats more effectively.

Building upon these accomplishments, GCPL has embarked on several strategic initiatives in the current year to further strengthen its Information Security posture. Notably, the attainment of ISO 27001 certification stands as a testament to GCPL’s adherence to international standards for Information Security Management Systems. Furthermore, the implementation of data leak prevention measures underscores GCPL’s proactive stance in safeguarding sensitive information and mitigating the risk of unauthorized data exposure. Work on ensuring compliance with the Digital Personal Data Protection Act 2023 has commenced, emphasizing

Building upon these accomplishments, GCPL has embarked on several strategic initiatives in the current year to further strengthen its Information Security posture. Notably, the attainment of ISO 27001 certification stands as a testament to GCPL’s adherence to international standards for Information Security Management Systems. Furthermore, the implementation of data leak prevention measures underscores GCPL’s proactive stance in safeguarding sensitive information and mitigating the risk of unauthorized data exposure. Work on ensuring compliance with the Digital Personal Data Protection Act 2023 has commenced, emphasizing In tandem with these initiatives, GCPL has focused on elevating its BitSight score to 800, indicative of the organization’s proactive approach to risk management and maintaining a high level of cybersecurity posture. Moreover, achieving a NIST maturity level of 3.5 reflects GCPL’s continuous improvement in Information Security processes and practices aligned with the NIST Cybersecurity Framework. Collectively, these efforts underscore GCPL’s unwavering dedication to Information Security excellence, positioning the organization to navigate the evolving cybersecurity landscape with resilience, agility, and a steadfast commitment to safeguarding its digital assets and maintaining stakeholder trust.

In tandem with these initiatives, GCPL has focused on elevating its BitSight score to 800, indicative of the organization’s proactive approach to risk management and maintaining a high level of cybersecurity posture. Moreover, achieving a NIST maturity level of 3.5 reflects GCPL’s continuous improvement in Information Security processes and practices aligned with the NIST Cybersecurity Framework. Collectively, these efforts underscore GCPL’s unwavering dedication to Information Security excellence, positioning the organization to navigate the evolving cybersecurity landscape with resilience, agility, and a steadfast commitment to safeguarding its digital assets and maintaining stakeholder trust.

We have taken key actions such as

1. Over 92% of all employees have completed the Acceptable Use Policy Signoff and Annual Security eLearning, contributing to ongoing improvement in our security culture maturity model.

2. We obtained ISO 27001:2022 certification, underwent annual surveillance audits, and secured INR 100 crore cyber & crime insurance coverage across all Godrej Industries Group companies.

3. We implemented a Zero Trust policy for network traffic segmentation and automated incident resolution playbooks.

4. Our Bitsight security rating is over 750 and we aim to elevate our score to maximum, i.e., 800 reconfirming our cybersecurity measures are advanced.

These measures ensure we are well-prepared to manage cyber risks effectively while maintaining operational efficiency and productivity.

Our TCFD report

Climate change presents risks and opportunities for the global economy, affecting businesses in various sectors. Clear information about these climate-related factors is crucial for informed decision-making by investors, markets, and consumers. For consumer goods companies like ours, climate risks and opportunities are influenced by factors such as changing climate patterns, policy shifts toward a low-carbon economy, and evolving consumer perceptions.

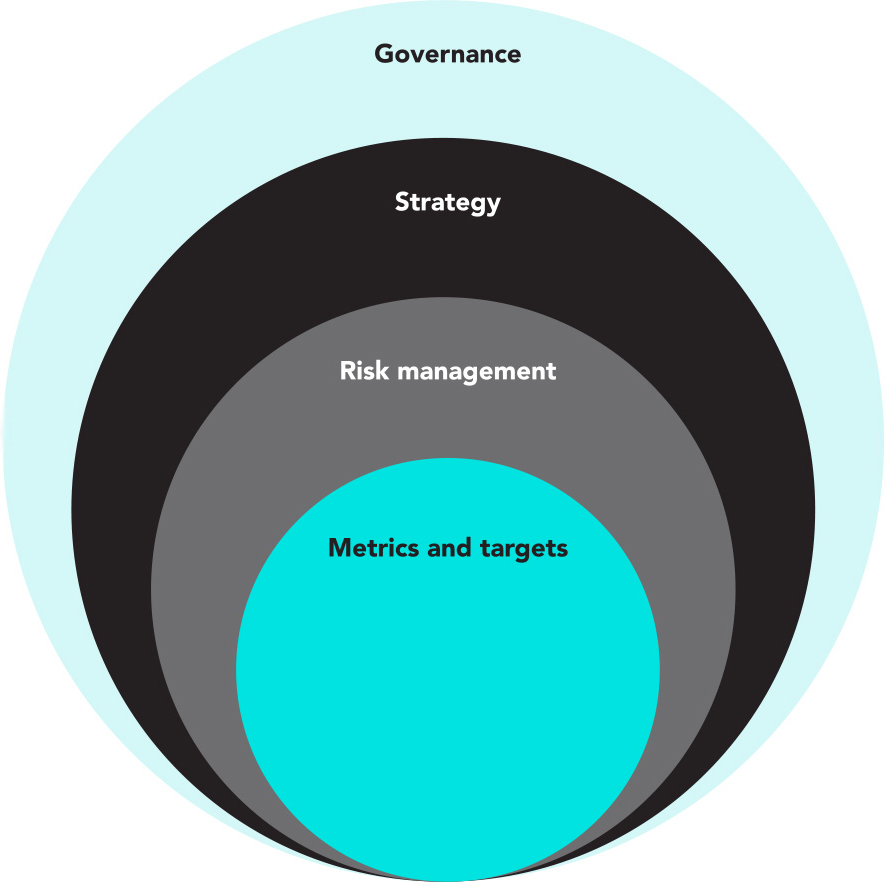

The TCFD framework guides organizations in disclosing climate-related financial information, helping them communicate threats and mitigation strategies effectively. These disclosures position companies as market leaders, enhancing stakeholder communication and strengthening business strategies. The framework includes four pillars: Governance, Strategy, Risk Management, and Metrics and Targets, with 11 recommended disclosures that help stakeholders understand how companies address climate-related issues.

We consistently report our climate change strategies through Integrated Annual Reports, CDP, and DJSI disclosures. However, we are aligning our disclosures more closely with the TCFD framework in the current reporting cycle. This includes information on climate governance, risk assessment, mitigation strategies, scenario analysis, metrics, and targets. We are also preparing our first standalone TCFD report.

Governance

Our governance structure, depicted in Figure below, is well-defined, encompassing the Board and management to address emerging risks such as climate change. Key stakeholders actively engage and strategize on these risks, ensuring effective governance mechanisms are in place.

The TCFD framework recommendations

Governance

Report on the organization’s

governance mechanisms involving

climate-related risks and opportunities.

Strategy

Report on the potential impacts

of climate-related risks and

opportunities on the business,

strategy, and financial planning.

Risk management

Report on how the company

identifies, assesses, and

manages climate-related risks.

Metrics and targets

Report on the metrics and targets

used to assess and manage

relevant climate-related risks

and opportunities.

Core elements of recommended climate-related financial disclosures

Board’s oversight of climate

risks and opportunities

The Board takes an active role in overseeing climate-related matters within the organization to ensure strategic alignment with sustainability goals. The Managing Director and CEO play a pivotal role in approving climate strategies and regularly reviewing sustainability performance using key indicators on a quarterly basis. To enhance accountability and performance, an annual mid-year review of Operating Plans is conducted across all organizational levels. Additionally, a dedicated Board-level Sustainability Committee, led by the Chair of the Board, is tasked with overseeing sustainability performance and providing strategic guidance on climate-related issues, demonstrating a top-down commitment to environmental responsibility.

Management’s integration of

climate oversight

Climate risks and opportunities are seamlessly integrated into day-to-day operations at the plant level, ensuring that sustainability considerations are embedded into every aspect of our activities. Each facility’s Operations team is actively engaged in meeting annual sustainability targets, thereby contributing to the achievement of long-term climate goals set by the organization. In India, our operations are primarily centralized in Mumbai, with production facilities strategically located in four regional clusters to optimize efficiency and minimize environmental impact. To drive local implementation of climate initiatives, each cluster appoints a dedicated Green Champion who collaborates closely with factory teams to implement measures such as energy efficiency improvements and renewable energy projects. For example, in India, production facilities based in four regional manufacturing clusters: North, South, Central, and North Eastern clusters. Each cluster has a Green Champion to coordinate with the respective plant teams that involve members from production, maintenance, and electrical departments. These teams lead implementation of climate-related measures, such as implementation of energy efficiency in operations

Climate risks and opportunities are seamlessly integrated into day-to-day operations at the plant level, ensuring that sustainability considerations are embedded into every aspect of our activities. Each facility’s Operations team is actively engaged in meeting annual sustainability targets, thereby contributing to the achievement of long-term climate goals set by the organization. In India, our operations are primarily centralized in Mumbai, with production facilities strategically located in four regional clusters to optimize efficiency and minimize environmental impact. To drive local implementation of climate initiatives, each cluster appoints a dedicated Green Champion who collaborates closely with factory teams to implement measures such as energy efficiency improvements and renewable energy projects. For example, in India, production facilities based in four regional manufacturing clusters: North, South, Central, and North Eastern clusters. Each cluster has a Green Champion to coordinate with the respective plant teams that involve members from production, maintenance, and electrical departments. These teams lead implementation of climate-related measures, such as implementation of energy efficiency in operations and renewable energy projects. We are leveraging modern technology and use a cloud-based monitoring platform to track and report on sustainability performance on a monthly basis, enabling real-time visibility and informed decision-making to drive continuous improvement in our environmental performance.

and renewable energy projects. We are leveraging modern technology and use a cloud-based monitoring platform to track and report on sustainability performance on a monthly basis, enabling real-time visibility and informed decision-making to drive continuous improvement in our environmental performance.

Our Sustainability and CSR head, the highest c-suite level management executive, are responsible climate targets of achieving scope 1 & 2 net-zero emissions by 2035. Along with this 15% of our senior management’s goal sheets are now dedicated to people & planet goals. Their KPIs include doubling energy efficiency by 2030 in with our EP100 commitment (w.r.t baseline of 2012), increasing renewable energy share and energy and emission intensity year-on-year in line with net-zero by 2035 targets. Each of our manufacturing clusters have plant cluster heads and green champions (sustainability officers) to look after performance of the plants on climate change front along with plant operations.

Governance structure

In addition to incentives, GCPL provides quarterly awards at the company level and annual awards at the group level to recognize the best performing individuals and teams in sustainability efforts. These awards serve to motivate and reward outstanding contributions towards environmental responsibility. The following members are entitled to these incentives:

| Entitled to incentives | Incentivisation details |

|---|---|

|

Head - Good & Green |

At the Godrej Group level, green goals are established, and the best-performing companies are acknowledged during the annual awards ceremony. The Head of Good & Green is tasked with overseeing GCPL’s performance in meeting its climate change objectives. |

|

Business Unit Manager |

Business Unit Managers are incentivized based on their performance against objectives set at the commencement of each financial year. These goals encompass both operational efficiency and climate action initiatives aimed at reducing environmental impact. |

|

Green Champion |

Green Champions are recognized and rewarded for their contributions to projects aimed at addressing climate change issues within the organization. Their efforts play a crucial role in advancing sustainability practices and fostering environmental responsibility. |

|

Process Operation Manager |

Operation Managers are acknowledged and incentivized for implementing improvements in the manufacturing process aimed at reducing emission intensity. Their efforts contribute to mitigating the environmental footprint of the company’s operations and advancing its climate change goals. |

Strategy

We remain committed to integrating climate change into our business strategy. We have established systems to connect climate change with our strategic goals and integrate related risks and opportunities into our Enterprise Risk Management (ERM) framework.

Climate change scenario analysis involves evaluating potential outcomes to assess associated risks and opportunities. The TCFD framework recommends considering various scenarios, including one aligned with the ambitious targets of the 2015 Paris Agreement (1.5°C future) and a business-as-usual (BAU) scenario, highlighting physical risks like flooding and heat waves. Transitional risks and opportunities arise as organizations move towards a low-carbon economy.

We have examined two Shared Socioeconomic Pathways (SSPs) provided by the International Panel on Climate Change: SSP-1 aligns with Representative Concentration Pathway (RCP) 2.6, and SSP-5 aligns with RCP-8.5. We have chosen the timeframe of 2030 for analysis to align with global development objectives, including the Sustainable Development Goals (SDGs), ensuring relevance to ongoing sustainability efforts.

SSP

SSP-1

Sustainability: Taking the Green Road (Low challenges to mitigation and adaptation)

SSP-5

Fossil-fueled development: Taking the Highway (High challenges to mitigation, low challenges to adaptation)

Narrative

This is the Paris Agreement-aligned scenario where the world shifts towards sustainable development, improved global commons management, reduced inequality, and low material growth.

This is the BAU scenario, where investments towards sustainability plateau, economic development staggers, and environmental degradation increases.

To assess physical risks, we modelled water scarcity, temperature, and precipitation variables under SSP-1 and SSP-5. We used tools such as the World Bank Climate Change Knowledge Portal and WRI

To assess physical risks, we modelled water scarcity, temperature, and precipitation variables under SSP-1 and SSP-5. We used tools such as the World Bank Climate Change Knowledge Portal and WRI Aqueduct to collect data from 2020 to 2039. As a result, we have identified prioritized facilities likely to experience severe climate impacts, including Katha, Puducherry, Guwahati, and Karaikal.

Aqueduct to collect data from 2020 to 2039. As a result, we have identified prioritized facilities likely to experience severe climate impacts, including Katha, Puducherry, Guwahati, and Karaikal.

Way forward for

addressing physical risks

Our TCFD assessment covered all our operations including new manufacturing sites that are coming up. As defined by the framework, we consolidated a repository of risks through site-level surveys, peer review and stakeholder consultation. Moreover we identified opportunities in transitioning to a low-carbon economy.

We sored each risk/opportunity using a 4-factor analysis by taking product of ‘Likelihood’, ‘Impact’, ‘Vulnerability’ and ‘Speed of Onset’. 4-factor risk which involves vulnerability and speed of onset, in addition to likelihood and impact, is more practical for climate change, owing to the nature of adaptability and time dependence of the realized effects. All the risks were then ranked to evaluate prioritised or material climate risks. We examined key parameters such as temperature, water scarcity, and precipitation, all of which will have a crucial role in shaping the impact of climate change on our business.

Our businesses are particularly vulnerable to climate-related risks, such as supply chain disruptions, increased cost of upstream and downstream operations, and regulatory penalties. Our largest pool of consumers are in tropical countries such as India, Indonesia, and Africa, and all of these countries are witnessing significant impacts of climate change—unpredictable weather and scanty or excessive rainfall.

From our assessment, we have determined that the potential ramifications of climate change will be particularly pronounced in our operational location in India at Karaikal, Katha, and Guwahati manufacturing sites and have a plan in the next 3 years to address these risks.

We have already started taking necessary steps to address the potential risks. For example, for water availability, we have incorporated rainwater harvesting system at all our manufacturing facilities to improve groundwater table. In these water stress areas, we have developed required infrastructure so that the communities don’t suffer due to lack of water. Besides, we are working with farming communities in four villages covering an area of 3300 Ha in implementing integrated watershed management programme.

To begin with climate strategy on mitigation and adaptation, we have considered Katha, Karaikal, Guwahati, and Puducherry for further detailed assessments. The focus will be on identifying cluster/facility-specific hotspots. This will help the company to improve supplier engagement, reduce greenhouse gas (GHG) emissions across the value chain, and consequently, lower operational and reputational risks.

The transition risk scenario analysis involved a thorough sectoral review to evaluate potential risks and opportunities. We utilized the EnROADS Simulator, developed by MIT Sloan and Climate Interactive, to model low-carbon economies aligned with the Well Below 2 Degrees (WB2DS) and 1.5°C futuristic scenarios. Through this analysis, the following risks and opportunities were identified:

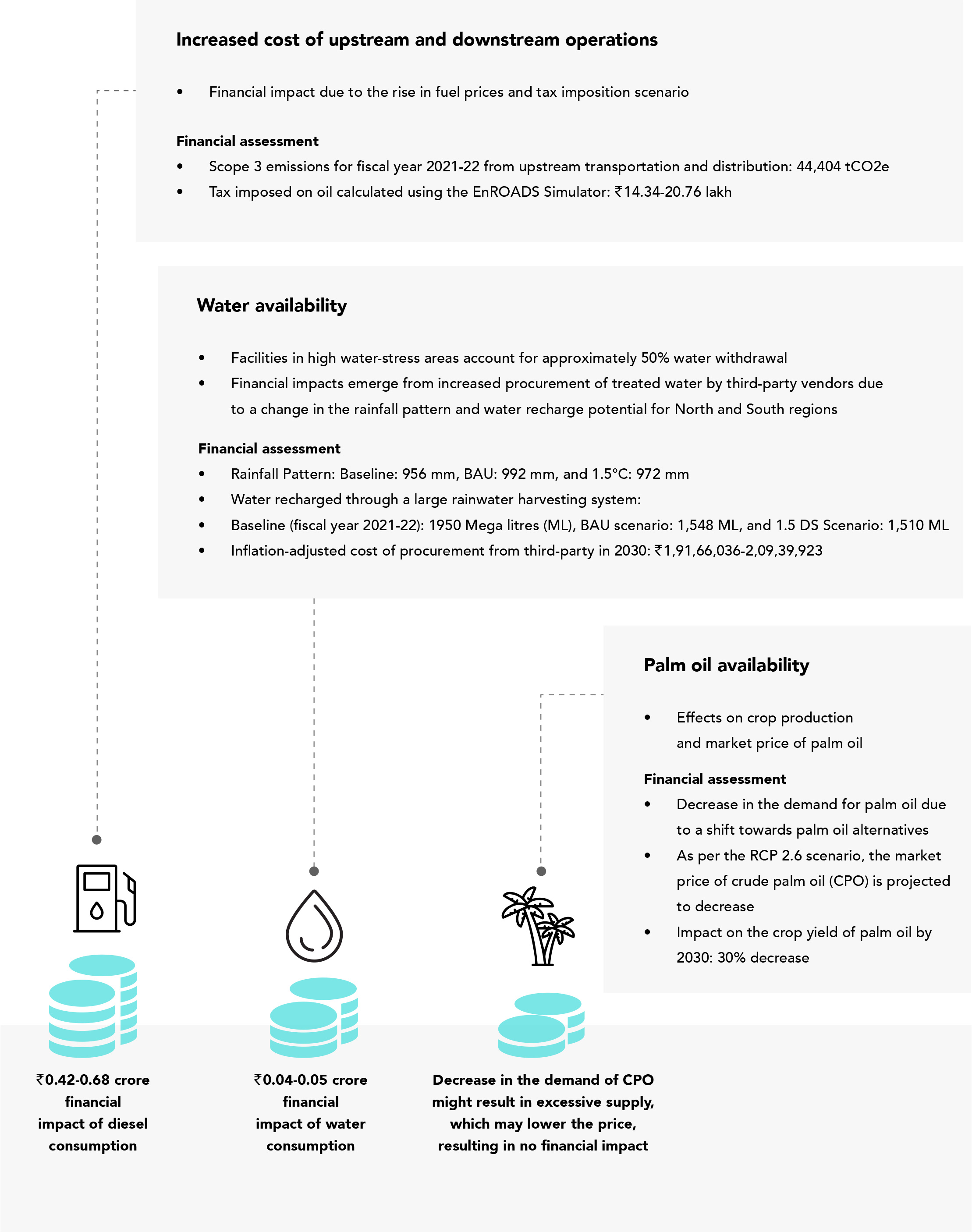

These identified risks and opportunities carry financial implications for the consumer goods sector. To assess their impact, we further evaluated the financial implications

These identified risks and opportunities carry financial implications for the consumer goods sector. To assess their impact, we further evaluated the financial implications of prioritized risks. Specific risks with significant financial impacts are summarized on the next page.

of prioritized risks. Specific risks with significant financial impacts are summarized on the next page.

Financial impact of climate-related risks

Financial impact of climate-related risks on the company

Physical climate

risk adaptation

Our TCFD assessment covered all our operations including new manufacturing sites that are coming up. As defined by the framework, we consolidated a repository of risks through site-level surveys, peer review and stakeholder consultation. Moreover we identified opportunities in transitioning to a low-carbon economy.

We sored each risk/opportunity using a 4-factor analysis by taking product of ‘Likelihood’, ‘Impact’, ‘Vulnerability’ and ‘Speed of Onset’. 4-factor risk which involves vulnerability and speed of onset, in addition to likelihood and impact, is more practical for climate change, owing to the nature of adaptability and time dependence of the realized effects. All the risks were then ranked to evaluate prioritised or material climate risks. We examined key parameters such as temperature, water scarcity, and precipitation, all of which will have a crucial role in shaping the impact of climate change on our business.

Our businesses are particularly vulnerable to climate-related risks, such as supply chain disruptions, increased cost of upstream and downstream operations, and regulatory penalties. Our largest pool of consumers are in tropical countries such as India, Indonesia, and Africa, and all of these countries are witnessing significant impacts of climate change—unpredictable weather and scanty or excessive rainfall.

From our assessment, we have determined that the potential ramifications of climate change will be particularly pronounced in our operational location in India at Karaikal, Katha, and Guwahati manufacturing sites and have a plan in the next 3 years to address these risks.

We have already started taking necessary steps to address the potential risks. For example, for water availability, we have incorporated rainwater harvesting system at all our manufacturing facilities to improve groundwater table. In these water stress areas, we have developed required infrastructure so that the communities don’t suffer due to lack of water. Besides, we are working with farming communities in four villages covering an area of 3300 Ha in implementing integrated watershed management programme.

Risk management

Our risk management process begins with a materiality assessment, where material issues are identified through stakeholder engagement and secondary research. We utilize a methodology that involves identifying issues across six capitals, engaging with over 450+ stakeholders, and developing a materiality matrix using specialized tools for issue prioritization. All stakeholder groups play a significant role in influencing our overall performance and operations.

Climate change is one of the material issues identified through this assessment, and it is integrated into our ERM. The Board-level Risk Management Committee and our Risk Management team oversee the risks and mitigation measures related to climate change, along with other key material topics identified. Our risk identification and management processes are aligned with our business strategy. We use analytical techniques such as scenario analysis to identify risks, assess their probability and impact qualitatively and quantitatively, and develop action plans for risk management.

These risk mitigation plans are presented to the Board-level Committee for input and are periodically updated. Climate change-related risks are evaluated alongside other business risks and classified into short-term (1-3 years), medium-term (3-5 years), and long-term (5-7 years) categories.

The risk mitigation strategy translates into action plans at two levels:

- Business level: We develop our sustainability strategy at the business level to manage major risks such as climate change and water-related risks. Progress on risk mitigation is monitored daily, monthly, quarterly, semi-annually, and annually.

- Site/plant level: The business strategy is cascaded down to the plant level, where action plans are created for each plant. Daily and monthly meetings are conducted to review progress.

We have established a comprehensive and structured approach to risk management, involving Board-level oversight, a dedicated Risk Management Committee, and a cross-functional team within the business to routinely assess risks across the company.

We actively seek feedback from employees through informal forums, discussions, and annual planning conferences to improve risk management practices. Regular open forums and monthly review meetings are also held to understand climate-related risks and develop mitigation measures.

Integrating climate-related risks in GCPL’s ERM system

Metrics and targets

We identify, record, and monitor key performance metrics authentically, which helps to analyze our organisation’s operational performance and establish goals and targets for continuous enhancement. A robust data management system is maintained to accurately record our performance and inform strategic decision-making.

Aligned with our Group’s vision and goals, we have established five objectives known as the ‘Greener India Targets,’ aimed for achievement by the year 2025-26. Below is a breakdown of these goals, our approach toward achieving them, and our progress during the reporting period:

| Focus area | Goal | Approach | Fiscal year 2023-24 performance |

|---|---|---|---|

|

Energy |

|

|

|

|

Emissions |

|

|

|

|

Water |

|

|

|

|

Waste |

|

|

|

Public policy and climate

advocacy

At GCPL, we understand the vital role businesses play in shaping public policy, particularly concerning climate change. In alignment with our commitment to sustainability and corporate responsibility, GCPL actively engages in public policy discussions and advocates for initiatives that address climate change and its impacts on our operations.

Trade association memberships and policy advocacy:

GCPL believes in the power of strong industry associations and memberships for collective growth and resilience. These partnerships provide us with a platform to share knowledge, foster innovation, and address key industry challenges effectively. Our trade association memberships and public policy advocacy are aligned with limiting average global warming to well below 2 degrees Celsius.

To ensure that our policy advocacy is conducted with integrity and credibility, we have established robust management structures and processes:

1. Database of Memberships: We maintain a centralized database of all trade association memberships, detailing the purpose of each association, our representatives, membership fees, and the value derived from each membership. This allows us to track the effectiveness of our engagements and ensure alignment with our business strategic goals.

2. Regular Reviews: We conduct regular reviews of our memberships and associations to assess the value derived from each engagement. These reviews help us determine whether our memberships continue to align with our evolving business objectives.

3. Functional Oversight: The senior leadership of our functions is responsible for managing trade association memberships within their areas of responsibility. They ensure that memberships contribute to their function’s objectives and manage departmental representation in these associations.

4. Internal Audit Compliance: Our Internal Audit team rigorously monitors all activities related to

4. Internal Audit Compliance: Our Internal Audit team rigorously monitors all activities related to association memberships to ensure compliance with legal requirements, ethical standards, and company policies. This ensures that our engagements uphold the highest standards of integrity and transparency.

association memberships to ensure compliance with legal requirements, ethical standards, and company policies. This ensures that our engagements uphold the highest standards of integrity and transparency.

Through our active participation in trade associations and advocacy efforts, we are committed to drive a positive change and contribute to a sustainable, net-zero future. We welcome policies that incentivize carbon emissions reduction and support initiatives that align with our operational areas, fostering a more sustainable and resilient business ecosystem.

We have made no contributions to any political parties in FY 2023-24. The following are the list of our industry associations for FY2023-24:

| Sr. no | Name of the trade and industry chambers/ associations |

Membership fees (INR) |

|---|---|---|

| 1 | Indian Beauty & Hygiene Association | 5,40,000 |

| 2 | The Indian Society of Advertisers | 6,70,000 |

| 3 | The Market Research Society of India | 4,96,800 |

| 4 | Bombay Chambers of Commerce | 8,100 |

| 5 | Advertising Standards Council of India | 19,79,400 |

| 6 | Home Insect Control Association | 22,67,200 |

| 7 | Federation of Indian Chambers of Commerce and Industry | 80,45,924 |

| 8 | Confederation of Indian Industry (India Plastics Pact) | 10,80,000 |

| Total | 1,50,87,424 |