Financial

capital

Manufactured

capital

Intellectual

capital

Key enablers

- Global category

structure - Enhanced, digitally

enabled consumer insights

- Democratising

our brands - Enhancing

go-to-market

- Laying the foundation for future growth possibilities

Risks identified

- Changing consumer preferences

- Hyperinflation and currency devaluation

- Commodity price volatility

We aim for steady, double-digit volume growth by leveraging our market leadership and expanding our category reach, ultimately creating lasting value for all stakeholders.

12

#1 brands

across 4 clusters

21%

EBITDA

growth

15%

Growth in

Africa and USA

e-commerce

₹14,096

Crore in

Revenue

Our chosen

portfolio

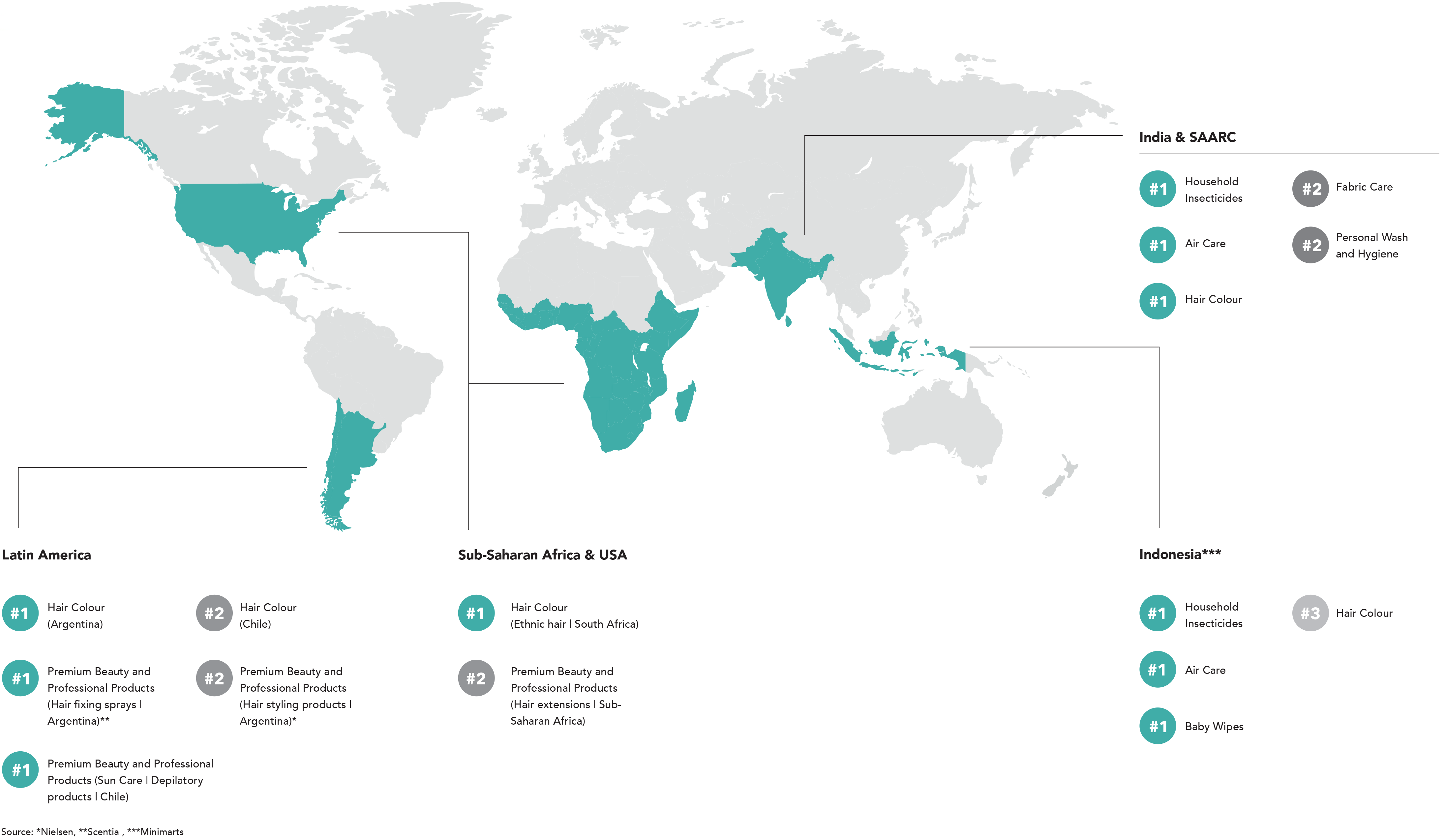

At GCPL, our passion lies in crafting affordable, beautifully designed products with our customers at the core. As industry leaders, we focus on driving innovationled growth and reshaping our product offerings. Accessibility and quality are paramount, especially in emerging markets where we have a strong presence.

Our footprint covers some of the largest and fastest-growing emerging economies globally. Despite this, key categories like Household Insecticides, Air Care, Hair Colour remain underdeveloped, presenting significant growth potential. We see this as a prime opportunity to leverage our expertise in product development, communication, and activations to create value. Our newly acquired categories, Deodorants and Sexual

Our footprint covers some of the largest and fastest-growing emerging economies globally. Despite this, key categories like Household Insecticides, Air Care, Hair Colour remain underdeveloped, presenting significant growth potential. We see this as a prime opportunity to leverage our expertise in product development, communication, and activations to create value. Our newly acquired categories, Deodorants and Sexual Wellness, also present immense growth opportunity in India and other emerging markets.

Wellness, also present immense growth opportunity in India and other emerging markets.

Our goal is to achieve consistent, doubledigit volume growth by leveraging our existing market leadership and expanding our category reach, ultimately benefiting all stakeholders in the long term.

India & SAARC

- Launched van distribution program for expanding direct rural outreach to cover 3x villages

- Set up new chemist and cosmetic sales channel for accelerated growth.

- Modern trade channel in India delivered a high double-digit growth trajectory

- E-commerce in India continued to be the fastest growing channel at >25% growth

- Doubled down our efforts on quick commerce.

- Geotagging of all general trade outlets in India, enabling optimal utilisation of our resources.

Indonesia

- In Indonesia, we shifted to distributor led model in general trade and simultaneously increased our reach and reduced the cost of operations.

- Multiple initiatives have been launched to leverage digital technologies and build closer connections with different partners across the supply chain

Our robust product lineup in Home and Personal Care categories enables us to deliver health and beauty benefits to consumers in emerging markets.

Our category development initiatives have yield motivating results in FY24, with penetration gains in most key categories. In India, Goodknight Liquid Vaporizer is penetrated ~25%, while in Indonesia and Africa, it ranges from 1% to 2%. In India, our mini Godrej Expert Rich Crème has helped grow Hair Color penetration by >500 bps. We will continue to invest in category development to boost growth in our current categories and generate longterm economic value.

As we innovate in emerging categories, we’ll prioritize expanding the reach of our flagship products and categories, which boast high profitability and growth potential as market leaders. This involves intensifying marketing and distribution efforts to significantly boost volume growth over the next 5 years across all our markets.

Africa & USA

- Strong e-commerce focus in the USA led to >15% growth across the channel accounting for ~8% of the total business

- In West Africa, we shifted to the outsourced distribution model with a national distributor resulting in strong double digit jump in distribution

- Our focus on growing our FMCG portfolio led to high double digit volume growth for Wet Hair in Africa

Our globalisation strategy

A broad emerging

markets portfolio

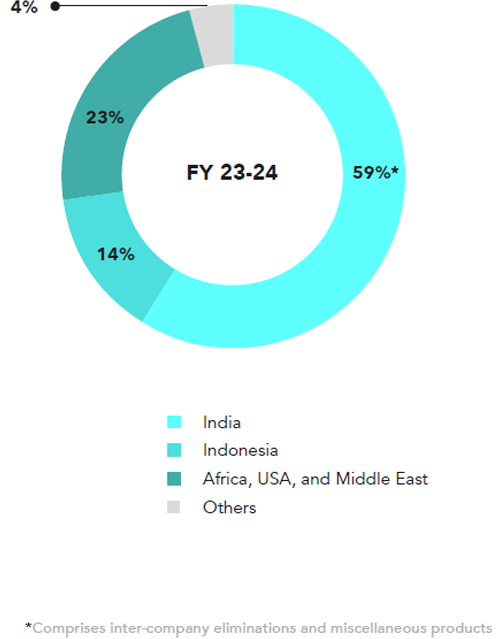

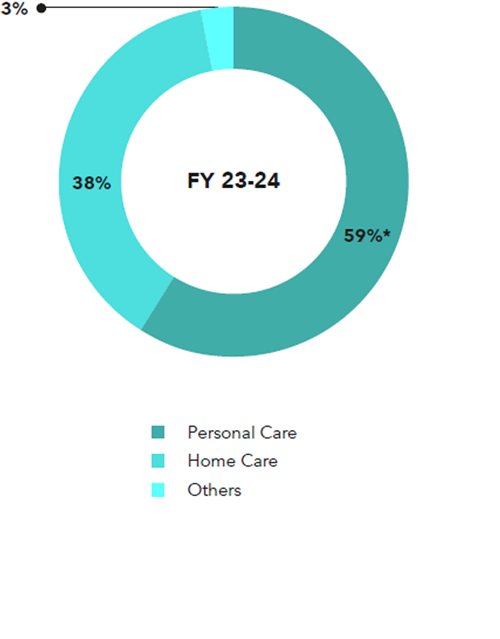

In the fiscal year 2023-24, 41% of our total

revenue was generated from international

operations.

Geography Salience

Category Salience

Portfolio of our

power brands

₹1,000 crore+

₹500-1,000 crore

₹200-500 crore

Strengthened brand positions

across key markets and geographies

Renewed global category structure

Since fiscal year 2021-22, we established a global category framework. This structure drives our global categories in Household Insecticides, Air Care, Hair Colour, and Hygiene. It will focus on product development (innovation and renovation) and brand equity (brand strategy and advertising), fostering three key value drivers:

Coherent global strategy and cross-geography synergies

- Goodknight Liquid Vapouriser, a long-standing success in India, is expanding its reach in the region and venturing into new markets like Indonesia, Bangladesh, and Nigeria.

- Godrej Shampoo Hair Colour, initially launched in India, then followed by Indonesia, has now entered the Argentina market with variations in product, packaging, and positioning while retaining its core technology.

- Products like Goodknight Smart Spray in India, Goodknight Power Shots in Africa, and HIT Fast Insect Killer share the same technology platform. These products have been successfully launched in various markets, with adaptations to suit local preferences.

- We have introduced Aer Matic from Indonesia to India with great success, and conversely, we are bringing Aer Power Pocket from India to Indonesia, Bangladesh, and the Middle East

Scaling up products across our

categories and geographies

Deeper capability on product and

communication development

We have formalized our global innovation and renovation pipeline across categories, managed through a structured stage-gate process. Our focus is on revitalizing our core products to maintain a strong product portfolio.

Communication development is now centralized, supported by our in-house creative teams: Light Box (our media development studio) and Design Lab (leading new product development across geographies).

We are standardizing our advertising development approach globally. For instance, in Air Care, we capitalized on the insight that the category is often embraced during home visits. We incorporated the concept of “talking rooms” into advertisements in India (aer) and Indonesia (Stella).

Better alignment across product development and brand equity

Our Product and Equity teams are streamlined and collaborative, reporting directly to the Head of Global Category and Innovation. They work closely together on most projects, engaging in cross-training activities focused on decision-making and functional skills. The aim is to ensure our Marketing team is proficient in all core principles of their role.

Brand leaders play a crucial role in strengthening brand consistency, acting as guides for both activities. We leverage insights into local consumer behaviour and preferences, drawing on global ideas and expertise to innovate and develop products tailored to the evolving needs of different regions and markets.

Our global presence is as asset as we apply our expertise to address shared challenges in diverse markets, despite their geographical differences. Additionally, we are committed to expanding operations and hiring locally in emerging markets to capitalize on regional expertise and experience.

Enhanced, digitally

enabled consumer insights

By taking a broad view of the landscape and considering current performance, trends, and shifts in consumer behavior, we gain insights into future possibilities for the evolution of both categories and brands to meet consumer needs. This approach helps us pinpoint

By taking a broad view of the landscape and considering current performance, trends, and shifts in consumer behavior, we gain insights into future possibilities for the evolution of both categories and brands to meet consumer needs. This approach helps us pinpoint opportunities that align with the trifecta—beneficial for the consumer, brand, and category. From a technological standpoint, we are committed to investing in consumer research and data analytics to identify trends and propel category growth.

opportunities that align with the trifecta—beneficial for the consumer, brand, and category. From a technological standpoint, we are committed to investing in consumer research and data analytics to identify trends and propel category growth.

Consumer obsession:

A sustainability lens

Long-term brand tracking serves as a valuable tool to gauge the resonance of our brand values with consumers, translating into awareness, preference, and loyalty. Conducting brand perception surveys helps us identify our primary consumer segments and understand their priorities, shopping habits, and the most effective methods of capturing their attention. These insights contribute to a deeper understanding of consumer trends.

Traditional brand perception tracking involves scientifically selecting a relevant target group, often category users, and conducting surveys at their homes to gauge awareness, perception, and usage of brands in the category, along with the effectiveness of advertising.

Gathering consumer insights

across various channels

In today’s dynamic market, we are embracing a more agile approach. Leveraging new technologies, we continuously monitor brand performance and consumer sentiment, adapting as needed. This includes tracking preferences across various metrics, from awareness to product feedback, usage behaviour, and receptiveness to new ideas.

In the fiscal year 2023-24, we covered over 50,000 consumers and their perception of our brands. We reached these consumers through various channels, online and offline, randomly at their homes or at central locations to gather insights. This survey covered nearly 90% of our brands by revenue.

By incorporating a sustainability lens into our existing surveys, we gained a deeper

understanding of the role sustainability plays in shaping consumer preferences.

We engaged our consumers to:

Assess attitudes

towards sustainability

We posed inquiries to gain insights into how sustainability aligns with our consumers’ priorities and values, and its impact on their perception of our brand.

Identify opportunities

for innovation

We inquired about consumer values and preferences to uncover opportunities for brand differentiation and gain a competitive edge.

We conducted a brand perception survey among 21–45-year-olds in India. The results showed that 67% of respondents considered ‘reusability’ and 32% considered ‘reducing plastic waste’ to be important. This led to the perception of our product being eco-friendly among approximately two-thirds of consumers.

By adopting an agile approach to brand perception tracking, we are striving to keep our brands current and appealing to consumers. Our goal is to make well-informed decisions that support long-term growth, bolster our reputation, and contribute to a sustainable future

Democratising

our brands

Our purpose has always been to serve the needs of consumers above everything else. We innovate continuously to create versions of our products in different sizes and at multiple price points to cater to as big a net of consumers as possible. Smaller value pack offerings such as Godrej Expert Rich Mini Crème and Godrej Selfie Shampoo Hair Color in India, , Goodknight Mini Liquid Vaporiser in India, and HIT Aerosol in Indonesia have revolutionised the market and made our products more accessible to a larger section of consumers. Our newly

Our purpose has always been to serve the needs of consumers above everything else. We innovate continuously to create versions of our products in different sizes and at multiple price points to cater to as big a net of consumers as possible. Smaller value pack offerings such as Godrej Expert Rich Mini Crème and Godrej Selfie Shampoo Hair Color in India, , Goodknight Mini Liquid Vaporiser in India, and HIT Aerosol in Indonesia have revolutionised the market and made our products more accessible to a larger section of consumers. Our newly launched GoodKnight Agarbatti, priced at an affordable INR 10, is the only Government Registered safe and effective alternative to illegal incense sticks in the market and aims to right structure the category. This also increases consumer loyalty, when they see a bespoke creation of a beloved brand that works for them specifically.

launched GoodKnight Agarbatti, priced at an affordable INR 10, is the only Government Registered safe and effective alternative to illegal incense sticks in the market and aims to right structure the category. This also increases consumer loyalty, when they see a bespoke creation of a beloved brand that works for them specifically.

2022

Godrej Expert Rich Crème (India)

2023

Goodknight Mini Liquid Vaporiser (India)

2024

Goodknight Agarbatti (India)

Revitalizing market

reach

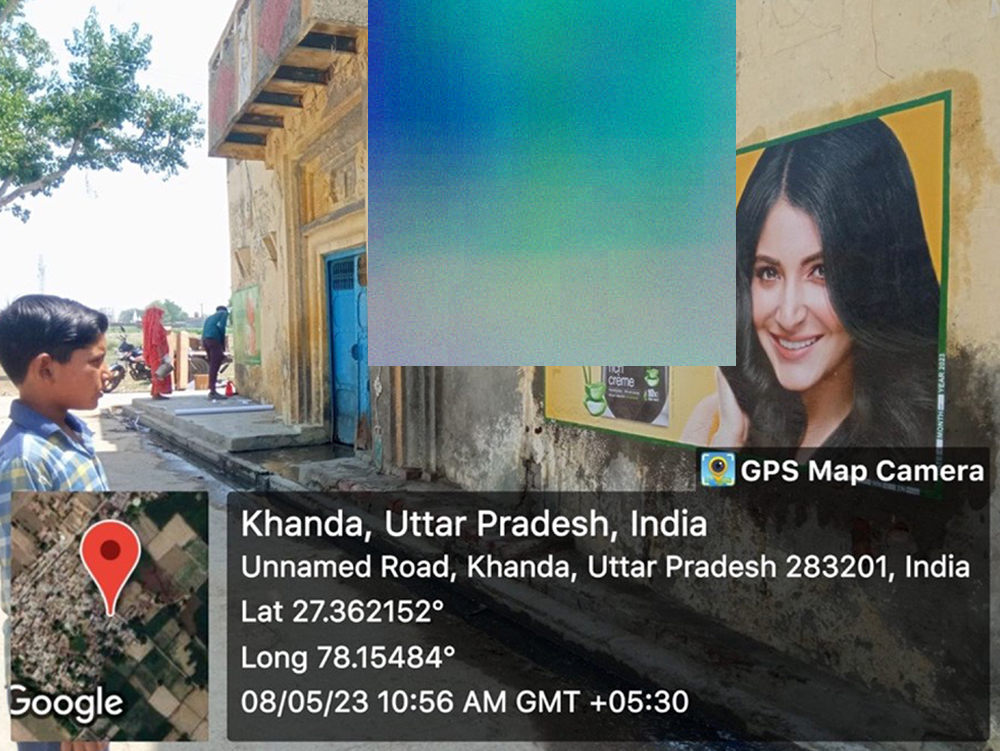

As we delve deeper into emerging markets, ensuring that consumers have access to our products on a regular basis is vital to our goal of achieving increased penetration. We are continuously expanding our distribution channels to increase our consumer reach, with a greater focus on unserved or poorly served rural and remote markets. Our van

As we delve deeper into emerging markets, ensuring that consumers have access to our products on a regular basis is vital to our goal of achieving increased penetration. We are continuously expanding our distribution channels to increase our consumer reach, with a greater focus on unserved or poorly served rural and remote markets. Our van distribution program “Vistaar” aims to reach 3X villages directly and exponentially expand our direct distribution in rural markets.

We are rapidly increasing our presence across multiple platforms—traditional and modern retail channels, e-commerce including quick commerce, and digital marketplaces—to ensure our products are always available to serve our consumers, regardless of where they are located.

distribution program “Vistaar” aims to reach 3X villages directly and exponentially expand our direct distribution in rural markets.

We are rapidly increasing our presence across multiple platforms—traditional and modern retail channels, e-commerce

including quick commerce, and digital marketplaces—to ensure our products are always available to serve our consumers, regardless of where they are located.

Expanding rural outreach through

van disitrbution program.

Our leadership engages with

our partners on ground

Channels of

the future

New technologies are transforming the sales and distribution landscape. In India, they are growing more than double than that of traditional channels, with quick commerce gaining significant popularity. Additionally, e-commerce has seen strong growth across India, Indonesia, and the USA, and modern trade, Cash and Carry, and, more recently, eB2B continue to grow. In India and Indonesia, we have also refocused attention on the role of

New technologies are transforming the sales and distribution landscape. In India, they are growing more than double than that of traditional channels, with quick commerce gaining significant popularity. Additionally, e-commerce has seen strong growth across India, Indonesia, and the USA, and modern trade, Cash and Carry, and, more recently, eB2B continue to grow. In India and Indonesia, we have also refocused attention on the role of traditional kirana or neighbourhood convenience stores. Similarly, in Africa, we have seen the acceleration of proximity shopping to overcome the challenges posed by the pandemic. This has reinforced the importance of last-mile distribution. New models will now be omnichannel, straddling a pyramid of online and offline sales.

In Bangladesh, the focus continues to be on building the traditional kirana (modir dukaan) backbone because modern trade and e-commerce are limited to urban centres. In Sri Lanka, we continue to focus on all channels, including traditional, modern trade, and e-commerce.

traditional kirana or neighbourhood convenience stores. Similarly, in Africa, we have seen the acceleration of proximity shopping to overcome the challenges posed by the pandemic. This has reinforced the importance of last-mile distribution. New models will now be omnichannel, straddling a pyramid of online and offline sales.

In Bangladesh, the focus continues to be

on building the traditional kirana (modir dukaan) backbone because modern trade and e-commerce are limited to urban centres. In Sri Lanka, we continue to focus on all channels, including traditional, modern trade, and e-commerce.

Insights into

consumer actions

India has been witnessing a K-shaped recovery of the economy with spends in the premium segments growing faster than the mass segment. Demand sentiment in rural has been weak. To cater to the fast growing premium segment, we have launched several premium innovations like Cinthol Foam Bodywash and AerO car fresheners. We have also entered new premium categories like Park Avenue Fine Fragrances and Kamasutra Sexual Wellness. For the mass segment, we are making our products more accessible and affordable. We launched access packs of

India has been witnessing a K-shaped recovery of the economy with spends in the premium segments growing faster than the mass segment. Demand sentiment in rural has been weak. To cater to the fast growing premium segment, we have launched several premium innovations like Cinthol Foam Bodywash and AerO car fresheners. We have also entered new premium categories like Park Avenue Fine Fragrances and Kamasutra Sexual Wellness. For the mass segment, we are making our products more accessible and affordable. We launched access packs of Godrej Expert Rich Crème, Godrej Selfie Shampoo Hair Color and Goodknight Mini Liquid Vaporizer, in India. In Indonesia, we relaunched an access pack of our hero brand HIT Aerosol. We also launched a low-cost hair colouring solution to cater to consumers’ shopping through general trade.

Godrej Expert Rich Crème, Godrej Selfie Shampoo Hair Color and Goodknight Mini Liquid Vaporizer, in India. In Indonesia, we relaunched an access pack of our hero brand HIT Aerosol. We also launched a low-cost hair colouring solution to cater to consumers’ shopping through general trade.

Partnerships

The interdependencies of our networks have always been crucial for the business. For the system to deliver successfully, we need all partners to be enabled and benefited. In addition to continuing our support towards our suppliers, distributors, wholesalers, and modern trade customers globally, we are establishing deeper partnerships with large scale salons across Africa.

Building partnerships with

salons across Africa

Expanding

penetration and reach

In India, we continue to focus on deepening our penetration in traditional trade. Specifically, we aim to expand our reach in underpenetrated areas of the country by driving rural reach and penetration through the launch of lower priced stock-keeping units in our key categories, which will result in greater accessibility of our products to rural consumers. In the past year, we created a blueprint of the ideal rural coverage. Guided by this blueprint, we have rolled out Project Vistaar through which we have expanded the Rural distribution by 2x outlets and 3x villages. The scale up in Direct Distribution has enabled GCPL to enhance Direct Reach across white space rural markets & increase quality of coverage in grey space markets. To strengthen our in-market execution, we have geo-tagged 100% of the Direct Coverage, and strengthened our Retail efficiency metrics. We had initiated tracking of tertiary sales in rural areas (measuring sales from sub stockists to rural retailers) and using that as a key performance indicator (KPI) for rural sales team. We launched the tertiary sales tracking system in the past year, which made us one of the first FMCG companies that not only tracks tertiary sales but also uses this data as a crucial KPI for our rural sales ecosystem.

We have experimented with moving the frontline salesforce to third-party payroll, which has resulted in improved productivity and reduced attrition. We have now moved 80% of the frontline salesforce to third-party payroll and plan to continue this transition going forward. Tapping into the emerging opportunity of a growing the

We have experimented with moving the frontline salesforce to third-party payroll, which has resulted in improved productivity and reduced attrition. We have now moved 80% of the frontline salesforce to third-party payroll and plan to continue this transition going forward. Tapping into the emerging opportunity of a growing the chemist channel remains a key strategic lever for us. To achieve this goal, we have created a strong network of pharma/over-the-counter drug distributors, and accordingly, created a new revenue stream. This channel helps us expand our reach into the previously untapped chemist outlets and with the addition of the Sexual Wellness portfolio our Chemist Channel has emerged as a significant growth driver. We have added 1 lac+ chemist outlets into our Direct Coverage post the setup of the OTC channel. Post the Raymond’s Consumer Business’ integration we identified the need to build a cosmetic Channel to enhance our Direct Reach in the untapped Cosmetic network. This channel will help us strengthen our Distribution in the newly acquired Perfumes and Deodorants portfolio.

chemist channel remains a key strategic lever for us. To achieve this goal, we have created a strong network of pharma/over-the-counter drug distributors, and accordingly, created a new revenue stream. This channel helps us expand our reach into the previously untapped chemist outlets and with the addition of the Sexual Wellness portfolio our Chemist Channel has emerged as a significant growth driver. We have added 1 lac+ chemist outlets into our Direct Coverage post the setup of the OTC channel. Post the Raymond’s Consumer Business’ integration we identified the need to build a cosmetic Channel to enhance our Direct Reach in the untapped Cosmetic network. This channel will help us strengthen our Distribution in the newly acquired Perfumes and Deodorants portfolio.

In Indonesia, we significantly accelerated our go-to-market transformation in general trade by outsourcing our direct operations to distributors. This transition has significantly reduced our operational complexity and released our Sales team’s bandwidth to focus on business development activities. In addition, this has reduced the cost of operations and allowed us to deepen our direct coverage. We also initiated door-to-door sampling drive to build demand and educate consumers on our Household Insecticides portfolio. Going forward, we aim to continue the momentum on distribution expansion and double down on new outlets while maximising output from our existing distribution base. We are ramping up our go-to-market efforts across Africa. In West Africa, where trade

In Indonesia, we significantly accelerated our go-to-market transformation in general trade by outsourcing our direct operations to distributors. This transition has significantly reduced our operational complexity and released our Sales team’s bandwidth to focus on business development activities. In addition, this has reduced the cost of operations and allowed us to deepen our direct coverage. We also initiated door-to-door sampling drive to build demand and educate consumers on our Household Insecticides portfolio. Going forward, we aim to continue the momentum on distribution expansion and double down on new outlets while maximising output from our existing distribution base. We are ramping up our go-to-market efforts across Africa. In West Africa, where trade is largely unorganised and wholesale-led, we are scaling up our last-mile distribution through direct distribution model with a national distributor and driving salon advocacy. The transition to a national distributer has simplified our operational complexity and helped in increasing our reach significantly.

is largely unorganised and wholesale-led, we are scaling up our last-mile distribution through direct distribution model with a national distributor and driving salon advocacy. The transition to a national distributer has simplified our operational complexity and helped in increasing our reach significantly.

We continued our door-to-door sampling drive to build demand and educate consumers on our recently launched Household Insecticides portfolio, in addition to expanding distribution to modern trade. This resulted in a significant shift in our non-wholesale channel contribution. We aim to continue the momentum in Nigeria and strengthen fundamentals at an accelerated pace in South Africa to unlock the full potential over the next few years.

Customer satisfaction measurement

| Satisfaction measurement | FY 20-21 | FY 21-22 | FY 22-23 | FY 23-24 | FY23-24 target |

|---|---|---|---|---|---|

| Net promoter score (NPS = Promoters-Detractors) | 50% | 50% | 50% | 51% | 50% |

| Data coverage | 100 | ||||

Enhancing Consumer Engagement

through Door-to-Door Sampling

Our approach to one-to-one consumer engagement through Door-to-Door (D2D) sampling has evolved significantly, now expanding to other product categories such as Aer Pocket.

Central to the success of our D2D program is the personalized approach of our promoters with consumers. They engage consumers directly at their doorsteps, offering product demonstrations and explaining product features. This one-on-one interaction not only builds trust but also effectively addresses consumer queries & encourages a deeper connection with our brand.

To ensure consistency and effectiveness across all engagements, we have implemented robust audit systems and continuous training programs for our promoters. These initiatives empower them with the necessary skills and knowledge to deliver informative and engaging experiences in every consumer interaction.

Our outreach efforts are projected to impact a significant number of consumers nationwide, driving product trials and enhancing brand loyalty. By expanding and refining our efforts in other product categories, we aim to strengthen consumer relationships & increase product adoption.

Start of Door-to-Door Sampling in Indonesia

In FY24, based on effective India model of door-to-door sampling we brough this lever of market development to Indonesia for our brands. We took the best practices from India business, supported by the central team and common technology know how to start the program. We adapted the model to suit the local nuances and scalability of the program.

We started with a pilot and post stabilization increased it to 2 cities. In FY 24 we reached ~1 million consumers through our door-to-door program. Seeing the

We started with a pilot and post stabilization increased it to 2 cities. In FY 24 we reached ~1 million consumers through our door-to-door program. Seeing the success, in terms of conversion and growth in those areas, we remain committed to invest and scale this program for formats which require market development. Like India, to ensure consistency and effectiveness across all engagements, we have implemented robust audit systems and continuous training programs for our promoters. These initiatives empower them with the necessary skills and knowledge to deliver informative and engaging experiences in every consumer interaction.

success, in terms of conversion and growth in those areas, we remain committed to invest and scale this program for formats which require market development. Like India, to ensure consistency and effectiveness across all engagements, we have implemented robust audit systems and continuous training programs for our promoters. These initiatives empower them with the necessary skills and knowledge to deliver informative and engaging experiences in every consumer interaction. has context menu

Building tomorrow’s growth:

foundation stones

Improving

efficiencies

We are enhancing efficiency throughout the value chain and boosting sales productivity by utilizing analytics and technology. Key drivers for future growth include minimizing sales losses through auto-replenishment and optimizing salesforce effectiveness with technology.

Building an

omnichannel play

In response to evolving shopper trends and environments, we are strengthening our capabilities to meet the demands of omnichannel retailing. This involves addressing and resolving channel conflicts externally, and internally, establishing the appropriate team structure to effectively serve this channel with flexibility.

Rapid

Simplification

In Africa & US, we continue to focus on driving profitability further by continuing the focus on simplification. We have significantly reduced the number of factories and SKUs in the last 2 years. Going forward, our transition into India based 3PL manufacturing for USA will lead to remarkable improvement in profitability

Exploring new

go-to-market formats

In West Africa , we are actively focusing on increasing our distribution coverage through direct distribution model via a national distributor. This has enabled us to achieve strong increase in coverage and increase in volumes despite high inflation

Transforming

modern commerce

Modern trade is a key driver of growth across geographies, and we intend to ramp this up. Building blocks include account and portfolio prioritisation, category management, fill rate improvement, and strong partnerships with customers through joint business planning. In India, we are investing in category management to build new-age categories such as Air Care, Household Insecticides and Liquid Detergents. To this end, our teams are sharing and learning on category management best practices from our Indonesian and Latin American businesses.

We are also investing in developing modern trade-specific analytics and shopper marketing capabilities. Modern trade accounts for nearly 65% of our business in Indonesia. In FY24, we successfully moved to re-distribution model in Indonesia for general trade while continuing direct services to Key accounts and E-com. It has allowed us to increase our range to general trade outlets and overall increase in the

We are also investing in developing modern trade-specific analytics and shopper marketing capabilities. Modern trade accounts for nearly 65% of our business in Indonesia. In FY24, we successfully moved to re-distribution model in Indonesia for general trade while continuing direct services to Key accounts and E-com. It has allowed us to increase our range to general trade outlets and overall increase in the outlets covered on a regular basis. We believe that structurally this will lead us to strengthen our brand presence in general trade system along with our enhanced investment on key brand formats in mass media. Performance in FY24 has been encouraging with active outlets increase of ~10% and underlying volume growth in high teens. We continued our long-term journey to drive modern trade excellence, with a continued thrust on strategic investments, prioritising winning accounts, and focusing on joint business partnerships. In Africa, given that modern trade continues to be key, we are leveraging availability, strong in-store presence, and competitive pricing to build on the opportunity, particularly in South Africa. Our entire business in the USA is modern trade-led, with the channel split into retail and beauty stores. We continue to leverage strong channel partnerships and joint business planning to drive distribution and new product listing, compelling in-store presence, and competitive pricing.

outlets covered on a regular basis. We believe that structurally this will lead us to strengthen our brand presence in general trade system along with our enhanced investment on key brand formats in mass media. Performance in FY24 has been encouraging with active outlets increase of ~10% and underlying volume growth in high teens. We continued our long-term journey to drive modern trade excellence, with a continued thrust on strategic investments, prioritising winning accounts, and focusing on joint business partnerships. In Africa, given that modern trade continues to be key, we are leveraging availability, strong in-store presence, and competitive pricing to build on the opportunity, particularly in South Africa. Our entire business in the USA is modern trade-led, with the channel split into retail and beauty stores. We continue to leverage strong channel partnerships and joint business planning to drive distribution and new product listing, compelling in-store presence, and competitive pricing.

Empowering frontline excellence:

Training & skill development

Equipping our team members to best serve the changing landscape is critical. We continue to drive multiple capability building initiatives, which were enhanced over the past year and were moved online.

In India, our in-house training academy, the ‘Godrej Sales Academy’, has been moved online to encourage easy access and on-the-go learning. In other geographies too, we have leveraged online training modules for continuous skillset improvement in a tough macroenvironment, while also focusing on team engagement and motivation.

Accelerating

e-commerce

In India, we fully integrated e-commerce more closely with our overall sales structure, building synergies on the omnichannel nature of shopper behaviour of our customer base. We embarked on the journey of leveraging e-commerce to expand our more premium categories such as Air Care, Household Insecticides, Liquid Detergents and saw some great results. This encouraged us to explore more of the channel’s potential to sharply target an audience base with higher spending capacity along with a bigger appetite for experimentation. E-commerce represents strong opportunities to win in a fast-growing channel, while leveraging its unique reach to bring innovative products and brands to market.

Underpinning this benefit, in India, we are building a strong data backbone to leverage the data-rich environment of e-commerce and drive our efficiency and effectiveness across the board. We are investing in expanding capabilities in the e-commerce function by insourcing capabilities such as graphic design, content writing, and search engine optimisation as well as performance marketing. We have a dedicated Shopper Marketing team to distil insights from e-commerce brands and platforms to extract the maximum efficiency from our visibility and promo spends. To improve operational efficiencies, we have automated our processes from the order-receiving stage to the billing stage and are using data analytics to improve our forecasting methods. We have been able to improve our margins in the e-commerce channel through a better mix and optimisation of operational efficiencies and continue to further improve it.

Through joint business planning, promotion strategies, and online content, we have made substantial upgrades to our capabilities, which are yielding results in terms of on-platform conversion rates and off-takes. We continue to deliver strong performance on e-com-focused product innovations such as Goodknight Mosquito Nets, HIT Anti-mosquito Racquet, HIT Anti Roach Gel and Aer Matic.

In Indonesia, the focus is on our main platforms where we are collaborating for joint business partnerships, which have translated into new product launches, catalogues, and programmes. Driving focused digital activity on online and offline platforms helps in creating a seamless consumer experience: from digital awareness to e-commerce purchases. In the USA, our efforts to strengthen e-commerce fundamentals paid off with the business growing strongly to become nearly 8% of our overall USA business this year. We also began creating special ecommerce only products to serve large online consumer segments, thereby increasing the basket size across transactions. We have established a new e-commerce team in Latin America and are investing in multiple ways to grow our presence on different digital platforms and marketplaces.

Unlocking brand

advocacy

In 2022, Godrej Expert Rich Crème introduced a mini pack priced at Rs. 15 to make the Crème format more affordable and accessible across all consumer segments. The primary objective was to increase penetration, particularly in rural India where adoption of this format lagged behind urban areas.

To capitalize on this opportunity, we focused on key rural regions such as Uttar Pradesh, Madhya Pradesh, Chhattisgarh, Maharashtra, and Bihar, which offered substantial market potential and room for expansion. Recognizing that traditional TV advertising alone would not suffice due to low TV penetration in these areas, we devised two strategic approaches to reach these “TV dark” consumers.

Firstly, we leveraged the increasing penetration of smartphones and internet services in these regions. Partnering with YouTube, we employed geo-targeting strategies to specifically reach consumers in rural areas with populations of less than 100,000. This digital approach ensured targeted outreach and engagement.

Secondly, we complemented our digital efforts with large-scale wall painting campaigns in villages with populations exceeding 5,000. These initiatives were designed to enhance awareness about the benefits and affordability of the Crème format priced at Rs. 15.

As a result of these initiatives, we successfully connected with previously untapped consumers in rural markets across these regions. The growth rates in these rural markets exceeded three times that of the national average, demonstrating the effectiveness of our targeted strategies in expanding market reach and penetration.

The HIT

newspaper

When encountering a cockroach, people instinctively grab the nearest object, often a newspaper, to eliminate it. However, this age-old practice underutilizes newspapers, which have historically served to educate, inform, and influence. Laal HIT, as a market leader in cockroach solutions, took a unique approach to redefine this scenario.

We transformed the competition into an ally through the HIT Newspaper. This innovative concept involved delivering a rolled-up newspaper encased in a cover with a rubber cockroach attached. As unsuspecting individuals reached for their morning paper,

We transformed the competition into an ally through the HIT Newspaper. This innovative concept involved delivering a rolled-up newspaper encased in a cover with a rubber cockroach attached. As unsuspecting individuals reached for their morning paper, they encountered the fake cockroach and instinctively attempted to swat it with the newspaper. This unexpected prank proved more effective than their morning coffee, turning the act into an engaging household game.

they encountered the fake cockroach and instinctively attempted to swat it with the newspaper. This unexpected prank proved more effective than their morning coffee, turning the act into an engaging household game.

Upon unfolding the newspaper, consumers discovered a message: “Maarooo! Newspaper se nahi, Laal HIT se” (Swat it! Not with the newspaper, but with Laal HIT). The clever campaign sparked widespread delight among consumers, prompting them to share their experiences through videos, reels, and stories on social media.

This campaign not only creatively utilized print media but also effectively engaged and

amused consumers, earning accolades for its ingenuity and impact.

The success of this initiative was recognized by the industry:

HIT makes a comeback

in Indonesia

In FY24, we built on the inherent strengths of our biggest brand to drive growth. Brand HIT was relaunched in Aerosol with an enhanced formulation which is now ~5x more effective. This along with a packaging refresh, introduction of 2 new fragrances and heightened media investments and onground activation grew consumer franchise. Penetration grew ~90bps with significant underlying volume growth.

Liquid vaporizers (LV) continue to gain penetration backed by increased media investments throughout the year and measured distribution drives. An underpenetrated market in LV gives ample opportunity to shift consumers from burning formats to safer, effective and attractive cost per night format and remains an attractive opportunity.

NYU colouring its way

in Indonesia

NYU hair colour business shined for this year with aggressive double digit volume growth and increased share in available stores. With local manufacturing, enhanced media investment and focus on general trade for distribution, the format is poised for interesting actions. Brand mind measures and equity has been consistently

NYU hair colour business shined for this year with aggressive double digit volume growth and increased share in available stores. With local manufacturing, enhanced media investment and focus on general trade for distribution, the format is poised for interesting actions. Brand mind measures and equity has been consistently improving across different regions. Our advertisement is focussed on building relevance while our distribution drives have led to an increase by ~4x in active outlets. We remain committed to scaling up NYU brand through enhanced investment in media and physical distribution.

improving across different regions. Our advertisement is focussed on building relevance while our distribution drives have led to an increase by ~4x in active outlets. We remain committed to scaling up NYU brand through enhanced investment in media and physical distribution.

Innovating dengue

prevention and protection

India faces an annual threat from dengue outbreaks, necessitating robust measures to safeguard communities. Our brand, HIT, launched a campaign aimed at raising awareness among consumers about the increasing incidence of dengue and encouraging them to adopt preventive measures through our “Flying Insect Killer Spray” AKA Kala Hit. Leveraging Google signals, we were able to strategically deploy targeted advertising to individuals actively seeking information on mosquito solutions, dengue and related topics.

Our approach was twofold: digital and traditional. Online, we strategically placed advertisements to reach concerned consumers precisely when they were searching for protective measures against dengue-carrying mosquitoes. Targeted YouTube campaigns enhanced brand recall and spurred consumer intent to purchase. We also collaborated with influencers who had personal experiences with dengue, which underscored the campaign’s message on prevention urgency.

Simultaneously, in the affected states, we complemented our digital efforts with strategic placements in local newspapers, ensuring our message reached a broader audience.

The success of the “Dengue Contextual” campaign has established a solid foundation for associating HIT FIK with dengue prevention efforts, positioning our brand as a leader in combating mosquito-borne diseases in India.

In Africa, our categories are heavily driven by the visual content and influencers. We plan to scale-up our strategy of co-creating content with influencers to enhance believability and impact, while driving new products and styles. We have also leveraged celebrity partnerships to amplify

In Africa, our categories are heavily driven by the visual content and influencers. We plan to scale-up our strategy of co-creating content with influencers to enhance believability and impact, while driving new products and styles. We have also leveraged celebrity partnerships to amplify our digital presence. Darling Nigeria partnered with Ayra Starr, an international pop sensation from Nigeria, who is immensely popular among our core target audience of young women across Nigeria and other African markets.

our digital presence. Darling Nigeria partnered with Ayra Starr, an international pop sensation from Nigeria, who is immensely popular among our core target audience of young women across Nigeria and other African markets.

In Argentina, our Hair Styling brand Roby started a campaign to strengthen our consumers’ self-esteem to embrace whoever they want to be. The brand launched a campaign called ‘You Have All What You Need’ and built partnerships with

In Argentina, our Hair Styling brand Roby started a campaign to strengthen our consumers’ self-esteem to embrace whoever they want to be. The brand launched a campaign called ‘You Have All What You Need’ and built partnerships with influencers by using our products to achieve different types of hairstyles to enhance their unique personalities. We partnered with nano, micro, and macro influencers, which allowed us to reach a larger audience in an organic manner.

influencers by using our products to achieve different types of hairstyles to enhance their unique personalities. We partnered with nano, micro, and macro influencers, which allowed us to reach a larger audience in an organic manner.

In Argentina, we have been focused on raising awareness on breast cancer prevention with our annual Let’s Dye October Pink campaign. In the last few years, our team has reached out to 3 million consumers annually and actively helped women understand the importance of early detection and diagnosis with the help of our brand Issue. We have also made donations to NGOs and other institutions that help breast cancer patients.

In Oct-2023, we introduced “The Pink Movement” - A breast cancer prevention campaign in Argentina. 80% of breast cancer cases in Argentina are diagnosed late and the chances of curing it is as low as 27%.

We supported this campaign in digital (social media ads and influencers) reaching +3.7M impacts.

Issue’s ‘Let’s Dye October

Pink’ campaign

First-party data has become more relevant than ever before. Our Villeneuve brand has been gathering simple but important information on visitors. This tiny step will allow us to enhance consumer experience by providing relevant and personalised messages.

Harnessing technology

and analytics

We have implemented various technology solutions throughout our value chain in India, starting with our sales team and extending to our channel partners. We continue to invest on technology led field force productivity improvements. We have geo-tagged our entire outlet universe which has enabled scientific redesign of salesmen routes and drive geo-adhered visits. We have launched a sales control centre which gives real time view of sales team performance and automated nudges to drive productivity. Predictive analytics empowers our urban sales teams to offer the right products in stores. In Modern Trade, our merchandisers are enabled through a AI based image recognition tool to detect and drive on-shelf-availability of our products. We have significantly enhanced our Media planning and deployment capabilities with ROMI based Media budget allocation across brands and scientific allocation across different media vehicles to optimise cost per reach.

Technology enabled Supply chain has been another key area of focus. Automated distributor order management has been implemented to improve fill rates. Technology solutions have been implemented for distribution planning and execution. Robust analytics platform to forecast sales more accurately, factoring in external and internal variables and also automation of financial forecasting has helped improve predictability and operational efficiency.

We recently completed a successful migration of our SAP ERP to S/4 HANA. We have adopted a cloud first approach and all our applications including our SAP ERP are now migrated to cloud. We are also transitioning our analytics platforms to cloud to drive business decision making.

Technology remains integral in enhancing field-force productivity within our Indonesian operations. Hand-held terminals facilitate and monitor on-ground decision-making, while analytics and dashboards drive more precise execution. Our online portal connects and supports regional distributors, simplifying e-claim settlements.

Additionally, a trade spend optimizer tool boosts returns on in-store investments for modern trade. Our goal is to further integrate technology across all execution touchpoints. Furthermore, We have strengthened our e-commerce analytics visibility on Amazon, translating insights into actionable strategies.

In the SAARC region, we harness the potential of tech partnerships and analytics to bolster our traditional trade expansion. We utilize cloud-based document management systems, micro-targeting, SOQ, and TPM to enhance efficiency and effectiveness.

Through this approach, we aim to expand distribution in traditional trade in both Bangladesh and Sri Lanka while enhancing efficiencies in existing stores. Automation is being utilized to streamline inventory and claims management processes.

In Africa, we have started the journey to simplify and automate business processes with the implementation of SAP in South Africa, Mozambique and Zambia. We continue this journey and cover all African markets next year. Salesforce automation now covers most field personnel in Nigeria and Ghana, enhancing coverage and brand visibility in the region. Our focus is on expanding distribution, improving efficiencies, and enhancing accountability across channels and regions.

Technology has also played a crucial role in consumer insights, leveraging data from the D2C channel in Nigeria to optimize product bundles and pricing strategies. Virtual interactions with consumers and stylists help us stay attuned to market trends and facilitate agile action planning.

Nurturing win-win

partnerships

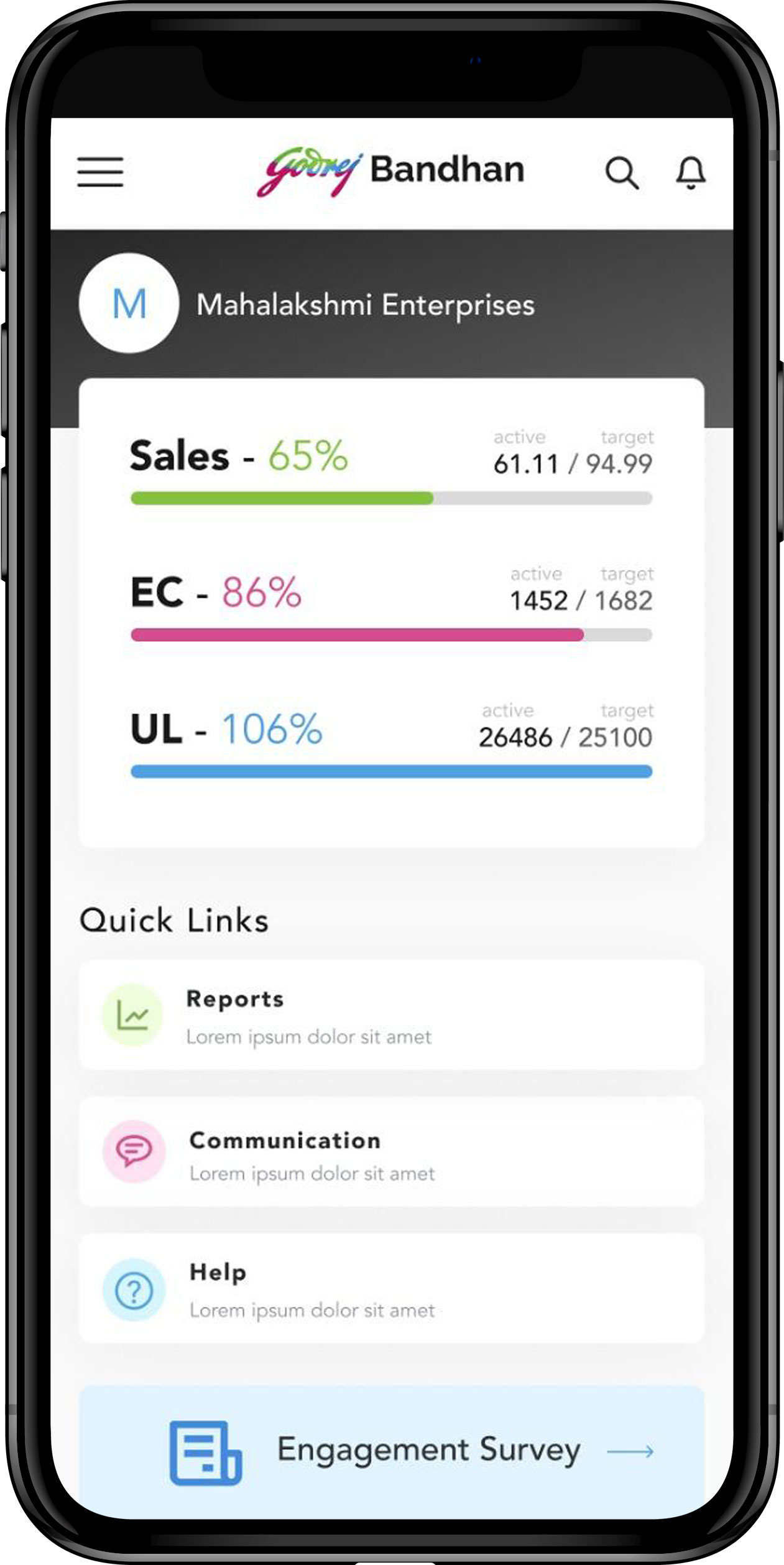

We enhanced digital connectivity by expanding our leading-edge android app ‘Bandhan,’ serving as a centralized hub for GCPL-related updates, communication, and distributor training. We have also adopted a holistic strategy to boost distributors’ return on investment to foster better engagement.

Bandhan, our industry-first

app, that fosters better

connect with distributors

Investment in media

and communication

In the era of information overload, it’s crucial to communicate our brand, values, and offerings consistently and clearly across various platforms. In fiscal year 2023-24, we continued to boost investments in brand communication across diverse media to maintain an ongoing dialogue with our consumers.

Being the market leader in Air Fresheners, Aer has always been at the forefront at building relevance for the category through awareness creation. As the most affluent consumers form the major portion of the target group, one of the key tasks was to devise a media strategy that reaches out to this set of consumers extensively and efficiently. They have seen significant changes in their media consumption habits. Many of them have either disconnected their regular TV connection or have started spending very little time on it, which is deemed inadequate to reach them solely through Linear TV.

To address the same, Aer leveraged on the Connected TV (users who watch OTT apps like Youtube, Netlfix etc on their smart TVs) as a new medium. Equipped with the insight that a large portion of affluent audiences have reduced their linear TV viewing, and now utilize CTV as their primary form of entertainment, we piloted campaigns on CTV across formats.

CTV for reaching affluent

audience

The results immediately validated the approach with instant upliftment in sales, specially across Organized Trade (Modern Trade and E-com) as a majority of affluent audiences are both CTV viewers and OT shoppers. Significant blips were also recorded in the Google Share of Search (Gsos) parameter which is an indicator of our campaigns reaching out to newer audiences and the viewers considering us for purchase.

We launched Godrej Aer-O (A hanging car air freshener at an attractive price point of Rs 99) and decided to leverage CTV extensively to build awareness after success in the earlier campaigns. Leveraging the finding that there is a strong correlation between CTV viewers and car owners, we designed a campaign which targeted a significant portion of car owners through one single but highly relevant medium. The campaign resulted in sizeable gains for Aer-O across all the top geographies.

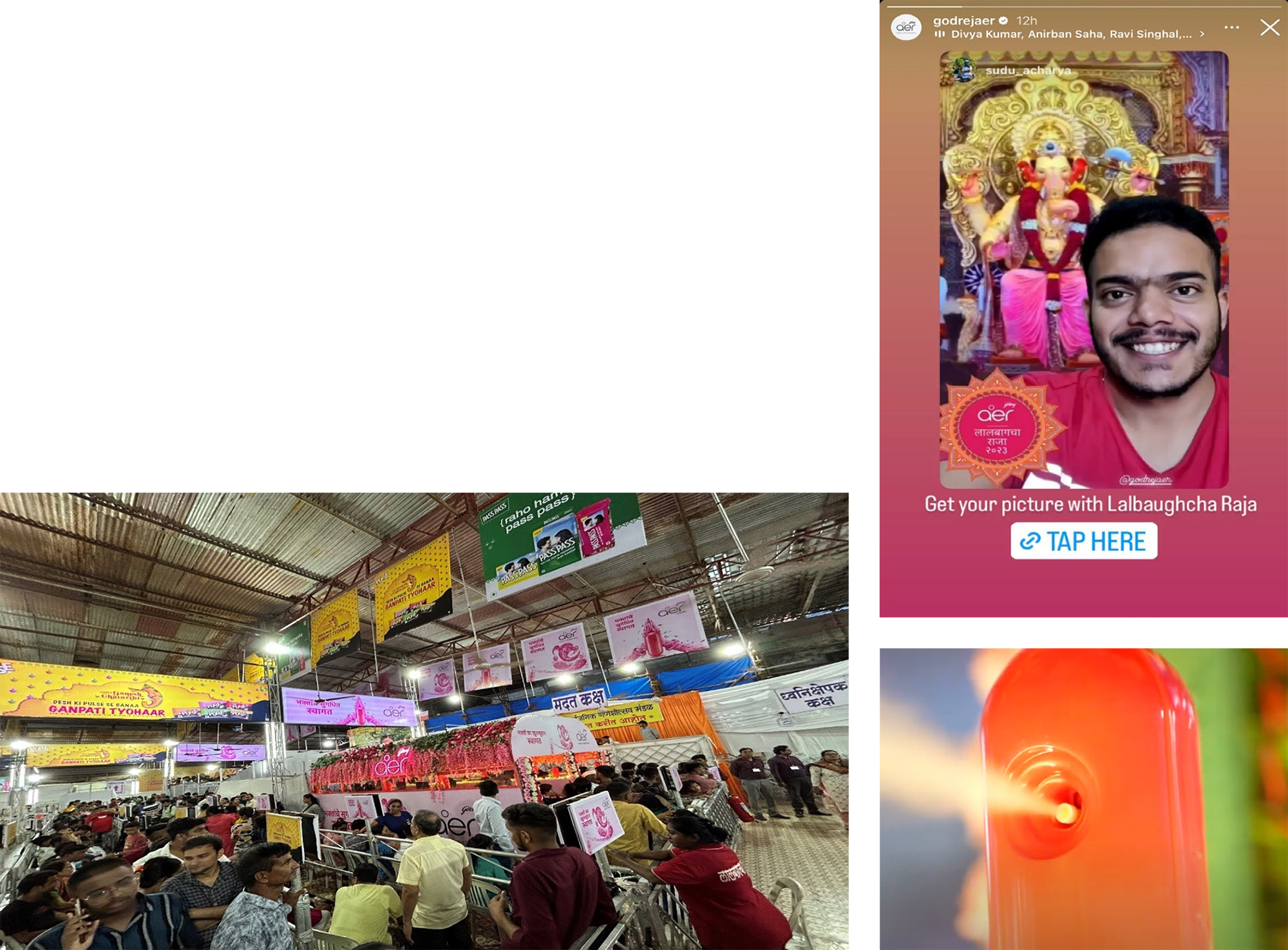

Aermatic tunnel activation

As Godrej Aer Matic hit new milestones during the year, we realized that the pleasurable experience of our signature fragrances should not be limited to living spaces. We also strove to captivate consumers during their outdoor celebrations, aiming to transcend mere branding and create a more immersive, engaging experience beyond the conventional advertising methods.

Unpleasant odours in densely populated areas, like certain localities in Mumbai, can diminish the festive atmosphere, Godrej Aer Matic’s campaign aimed to “Remedy the unspoken bad.” The strategy involved targeting areas with prevalent bad smells, such as fish markets and crowded festival sites, through a blend of traditional and digital media. The campaign employed engaging visual and audio advertisements to highlight how Godrej Aer Matic can transform the ambiance of any room or space, making it more inviting. Collaborations with local influencers and community leaders helped amplify the message, particularly during festivals, when the need for a fresh environment is most apparent

Unpleasant odours in densely populated areas, like certain localities in Mumbai, can diminish the festive atmosphere, Godrej Aer Matic’s campaign aimed to “Remedy the unspoken bad.” The strategy involved targeting areas with prevalent bad smells, such as fish markets and crowded festival sites, through a blend of traditional and digital media. The campaign employed engaging visual and audio advertisements to highlight how Godrej Aer Matic can transform the ambiance of any room or space, making it more inviting. Collaborations with local influencers and community leaders helped amplify the message, particularly during festivals, when the need for a fresh environment is most apparent In Khardanda, known for its fishy odors, Godrej AER Matic introduced a fragrance tunnel, transforming the area’s aroma, especially during the intense monsoon season coinciding with Ganesh Chaturthi. At Lalbaugh Ganesh Pandal, a festive hub, the campaign created an immersive aromatic experience with life-size AER Matic prototypes emitting signature fragrances. This initiative exceeded brand visibility, providing experiential insights into the product’s convenience and efficacy.

In Khardanda, known for its fishy odors, Godrej AER Matic introduced a fragrance tunnel, transforming the area’s aroma, especially during the intense monsoon season coinciding with Ganesh Chaturthi. At Lalbaugh Ganesh Pandal, a festive hub, the campaign created an immersive aromatic experience with life-size AER Matic prototypes emitting signature fragrances. This initiative exceeded brand visibility, providing experiential insights into the product’s convenience and efficacy.

The consumers responded positively to the campaign, sharing their feedback and applauding Godrej AER for making festivals more fragrant. We directly engaged with approximately 2 million people as they walked through the tunnel. These engagements led to new trials as well as market share gains in these geographies.