GCPL's corporate governance practices are shaped by its Board of Directors. The Board is committed to protecting the long-term interests of all our stakeholders, and considering this, it provides objective and prudent guidance to the Management. Information relating to procedures, composition, and Committees of the Board is provided below.

A. Board Procedures

GCPL currently has a 14-member Board, with seven Independent Directors, who are eminent professionals from diverse fields, with expertise in finance, information systems, marketing, and corporate strategy. None of the Independent Directors have previously had any material association with the Godrej Group. GCPL's Board has a lead Independent Director, in line with accepted best practices, to strengthen the focus and improve the quality of discussion at the Board level.

The Board meets at least once in a quarter to review the Company's quarterly performance and financial results. Board meetings are governed with a structured agenda. The Board periodically reviews the compliance reports with respect to laws and regulations applicable to the Company. Before the commencement of the Audit Committee meeting, members of the Audit Committee, which consists entirely of Independent Directors, have a discussion with the Statutory Auditors, in the absence of the Management Team or Whole-time Directors. For all major items, comprehensive background information is provided to the Board to enable them to take an informed decision. Once a year, Strategy meeting, is conducted as a part of Board Meeting, in which the Board interacts with the Management Team of the Company. The Independent Directors also have a meeting amongst themselves, after which they provide their insights to the entire Board and the Management Team.

During the year, the Company conducted familiarisation programmes for Independent Directors. The details for these are available under the link given below.

(i) Composition of the Board

The Board composition is as follows:

Category |

No. of Directors as on

March 31, 2017

|

No. of Directors as on

date of this Report

|

(i) Non-Independent Directors |

|

|

Executive Chairman |

1 |

1 |

Managing Director

|

1 |

1 |

Executive Director |

1 |

1 |

Non-Executive Promoter Directors |

3 |

4 |

Sub Total |

6 |

7 |

(ii) Independent Directors |

6 |

7 |

Total Strength (i + ii) |

12 |

14 |

(ii) Other relevant details of the Directors as on March 31, 2017

Name of Director |

Date of original Appointment |

Relationship with other Directors |

Category |

Number of Directorships held in Indian Public Limited Companies (including GCPL)* |

Committee Positions including

GCPL

Committee Chairperson

**

|

Committee member (excluding Committee Chairperson)

**

|

Shares Held

|

|

Adi Godrej # |

November 29, 2000 |

Brother of

Nadir Godrej, Father

of Tanya Dubash and Nisaba Godrej |

Promoter/ Executive Chairman |

5

(3)

|

2 |

1 |

500 |

Jamshyd Godrej |

March 1, 2001 |

None |

Promoter/

Non-Executive |

6

(4)

|

0 |

2 |

1,606,808*** |

Nadir Godrej |

November 29, 2000 |

Brother of

Adi Godrej |

Promoter/

Non-Executive |

10

(6)

|

1 |

3 |

917,454 |

Tanya Dubash |

May 2, 2011 |

Daughter of

Adi Godrej, Sister of Nisaba Godrej |

Promoter/

Non-Executive |

7

(2)

|

1 |

1 |

1,071,054 |

Nisaba Godrej # |

May 2, 2011 |

Daughter of Adi Godrej, Sister of

Tanya Dubash |

Promoter/ Executive |

4

(1)

|

None |

None |

1,071,061 |

Vivek Gambhir ## |

April 30, 2013 |

None |

Managing Director/ Executive |

2

(1)

|

None |

2 |

39,123 **** |

|

Narendra Ambwani

|

May 2, 2011

|

None

|

Non-Executive / Independent

|

8

(4)

|

1

|

8

|

1,000 |

Bharat Doshi

|

April 1, 2001

|

None

|

Non-Executive / Independent

|

4

(2)

|

1

|

2

|

13,714 |

|

Omkar Goswami

|

June 18, 2008

|

None

|

Non-Executive / Independent

|

10

(7)

|

1

|

8

|

Nil |

|

Aman Mehta

|

April 26, 2006

|

None

|

Non-Executive / Independent

|

6

(6)

|

2

|

4

|

Nil |

|

D. Shivakumar

|

April 1, 2009

|

None

|

Non-Executive / Independent

|

2

(1)

|

None

|

2

|

Nil |

|

Ireena Vittal

|

April 30, 2013

|

None

|

Non-Executive / Independent

|

8

(6)

|

None

|

9

|

Nil |

http://godrejcp.com/Resources/uploads/compliance_other_updates/FamiliarisationProgrammeforIDs201617.pdf

* Does not include directorship in Private Companies, Section 8 Companies, and Foreign Companies

** Does not include Chairmanship/Membership in Board Committees other than Audit Committee and Stakeholders' Relationship Committee, and in companies other than public limited companies registered in India

*** Held as one of the Trustee of Raika Godrej Family Trust

**** Under the Employee Stock Grant Scheme of the Company, Mr. Vivek Gambhir additionally holds 33,067 options that are convertible into equivalent equity shares on their vesting and exercise. The options will vest in tranches and the same has to be exercised within 1 month of the respective vesting dates

# Ms. Nisaba Godrej has been appointed as the Executive Chairperson of the Company w.e.f. May 10, 2017 while Mr. Adi Godrej will continue to be the whole time Director and assume the position of Chairman Emeritus.

## Mr. Vivek Gambhir has been re-designated as Managing Director & CEO w.e.f. May 9, 2017.

Notes

- Figures in bracket denotes directorship in listed companies.

- Brief profiles of all the Directors is available on the Company website www.godrejcp.com/

(iii) Re-appointment of Directors liable to retire by rotation

The Board has five Directors whose period of office is liable to be determined for retirement by rotation, and among these five Directors, one-third i.e. two Directors, shall retire at the Annual General Meeting (AGM). Thus, Mr. Nadir Godrej and Mr. Jamshyd Godrej shall retire at the ensuing AGM of the Company and, being eligible, are considered for re-appointment. Their brief resume is annexed to the Notice of the AGM.

(iv) Appointment of new Directors on the Board

The Board, at its meeting held on January 30, 2017 has approved the appointment of Ms. Ndidi Nwuneli and Mr. Pirojsha Godrej as Additional Directors on the Board of the Company with effect from April 1, 2017. Ms. Ndidi Nwuneli meets the criteria for Independent Director as per the provisions of the Companies Act, 2013 and SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015 (Listing Regulations) and Mr. Pirojsha Godrej being part of the promoter group would be a Non-Independent Director. Ms. Ndidi Nwuneli is appointed as a member of Audit Committee and Nomination & Remuneration Committee consequent to her appointment on the Board. As per the provisions of Section 160 of the Companies Act, 2013, the Company has received a notice from a member specifying intention to propose the appointment of Mr. Pirojsha Godrej and Ms. Ndidi Nwuneli as Directors in the forthcoming AGM. Furthermore, a specific resolution is included in the Notice of AGM for the appointment of Ms. Ndidi Nwuneli as an Independent Director for a period of 5 years with effect from April 1, 2017.

(v) Change in Leadership Positions

The Board at its meeting held on May 9, 2017, approved the changes in the leadership positions of the Company. Ms. Nisaba Godrej, who was an Executive Director, will now be the Executive Chairperson, and Mr. Adi Godrej will continue as Whole time Director and assume the position of Chairman Emeritus with effect from May 10, 2017. Mr. Vivek Gambhir, Managing Director, has been designated as Managing Director and CEO with effect from May 9, 2017.

B. Committees of the Board

The Company has constituted Audit Committee in accordance with Section 177 of the Companies Act, 2013 and Regulation 18 of the Listing Regulations. The Stakeholders' Relationship Committee formed in accordance with Regulation 20 of the Listing Regulations and Section 178 of the Companies Act, 2013 inter alia looks into the investor grievances. The Company has also formed a Nomination & Remuneration Committee in accordance with Section 178 of the Companies Act, 2013 and Regulation 19 of the Listing Regulations, which looks after the appointment, remuneration, and performance evaluation of the Directors. The Company also has a Risk Management Committee in accordance with Regulation 21 of the Listing Regulations.

Composition of Committees as on March 31, 2017

|

Name of Directors

|

Category

|

Position in the Committee

|

|

Audit Committee

|

Nomination & Remuneration Committee

|

Stakeholders' Relationship Committee

|

Risk Management Committee

|

|

Adi Godrej

|

Promoter, Executive

|

None

|

None

|

Member

|

None

|

|

Jamshyd Godrej

|

Promoter, Non Executive

|

None

|

None

|

Member

|

None

|

|

Nadir Godrej

|

Promoter, Non Executive

|

None

|

None

|

Chairman

|

None

|

|

Tanya Dubash

|

Promoter, Non Executive

|

None

|

None

|

None

|

None

|

|

Nisaba Godrej

|

Promoter, Executive

|

None

|

None

|

None

|

Member

|

|

Vivek Gambhir

|

Executive

|

None

|

None

|

Member

|

Member

|

|

Narendra Ambwani

|

Independent

|

Member

|

Chairman

|

None

|

None

|

|

Bharat Doshi

|

Independent

|

Chairman

|

Member

|

None

|

None

|

|

Omkar Goswami

|

Independent

|

Member

|

Member

|

None

|

Chairman

|

|

Aman Mehta

|

Independent

|

Member

|

Member

|

None

|

None

|

|

D. Shivakumar

|

Independent

|

Member

|

Member

|

None

|

None

|

|

Ireena Vittal

|

Independent

|

Member

|

Member

|

None

|

None

|

|

Total Strength of the Committee

|

|

6

|

6

|

4

|

5

|

|

No. of Independent Directors in the Committee

|

|

6

|

6

|

-

|

1

|

|

No. of Non-Independent Directors in the Committee

|

|

-

|

-

|

4

|

2

|

|

Members of Senior Management in the Committee

|

|

-

|

-

|

-

|

2

|

Mr. V. Srinivasan, Chief Financial Officer & Company Secretary, was the Secretary for all the Committees during fiscal year 2016-17. He is also the Compliance Officer of the Company and is responsible for redressal of investor grievances

C. Attendance Details for Board/Committee Meetings and the Last AGM

|

Name of Meeting

|

Board

|

Audit Committee

|

Nomination & Remuneration Committee

|

Stakeholders' Relationship Committee

|

Risk Management Committee

|

AGM July 29, 2016

|

|

No. of Meetings held

|

4

|

4

|

4

|

12

|

2

|

|

|

Attendance of the Director

|

|

|

|

|

|

|

|

Adi Godrej

|

4

|

NA

|

NA

|

11

|

NA

|

Yes

|

|

Jamshyd Godrej

|

4

|

NA

|

NA

|

7

|

NA

|

Yes

|

|

Nadir Godrej

|

4

|

NA

|

NA

|

12

|

NA

|

Yes

|

|

Tanya Dubash

|

4

|

NA

|

NA

|

NA

|

NA

|

Yes

|

|

Nisaba Godrej

|

4

|

NA

|

NA

|

NA

|

1

|

Yes

|

|

Vivek Gambhir

|

4

|

NA

|

NA

|

8

|

2

|

Yes

|

|

Narendra Ambwani

|

4

|

4

|

4

|

NA

|

NA

|

Yes

|

|

Bharat Doshi

|

4

|

4

|

4

|

NA

|

NA

|

Yes

|

|

Omkar Goswami

|

4

|

4

|

4

|

NA

|

2

|

Yes

|

|

Aman Mehta

|

4

|

4

|

4

|

NA

|

NA

|

Yes

|

|

D. Shivakumar

|

4

|

4

|

4

|

NA

|

NA

|

Yes

|

|

Ireena Vittal

|

4

|

4

|

4

|

NA

|

NA

|

Yes

|

Notes:

- The Board, Audit Committee, and Nomination & Remuneration Committee meetings were held on May 3, 2016; July 29, 2016; November 7, 2016; and January 30, 2017

- The maximum gap between any two Board meetings did not exceed 120 days during the year

- The Stakeholders' Relationship Committee meetings were held on April 6, 2016; May 12, 2016; June 28, 2016; August 1, 2016; August 11, 2016; September 9, 2016; October 6, 2016; November 15, 2016; December 13, 2016; January 5, 2017; February 13, 2017; and March 9, 2017

- The Risk Management Committee meetings were held on July 8, 2016 and January 24, 2017. Members from Senior Management team i.e. Omar Momin & Sunil Kataria have attended 2 and 1 Meeting respectively

- Leave of absence was granted to the Directors / Committee Members whenever they could not be physically present for the meeting

- 'NA' indicates not a member of the Committee

D. Terms of reference of Board Committees

(i) Audit Committee:

The terms of reference for the Audit Committee includes the matters specified in Section 177 of the Companies Act, 2013 as well as in Part C of Schedule II of the Listing Regulations such as:

(1) supervision of the Company's financial reporting process and disclosure of its financial information to ensure that the financial statement is correct, sufficient, and credible;

(2) recommendation for appointment, remuneration, and establishment of terms of appointment of auditors of the Company;

(3) approval of payment to statutory auditors for any other services rendered by them;

(4) review, with the Management, the annual financial statements and auditor's report thereon before submission to the board for approval, with particular reference to the following:

(a) matters required to be included in the Director's Responsibility Statement to be included in the Board's Report in terms of clause (c) of sub-section (3) of Section 134 of the Companies Act, 2013,

(b) changes, if any, in accounting policies and practices and reasons for the same,

(c) major accounting entries involving estimates based on the exercise of judgment by the Management;

(d) significant adjustments made in the financial statements arising out of audit findings,

(e) compliance with listing and other legal requirements relating to financial statements,

(f) disclosure of any Related Party Transactions,

(g) modification of opinion(s) in the draft audit report;

(5) review, with the Management, quarterly financial statements before submission to the Board for approval;

(6) review, with the Management, the statement of application of funds raised through an issue, such as public, rights, or preferential issues, the statement of funds used for purposes other than those stated in the offer document/prospectus/notice, and the report submitted by the monitoring agency monitoring the utilisation of proceeds of a public or rights issue, and making appropriate recommendations to the Board to initiate steps in this matter;

(7) review and monitor the auditor's independence and performance, and effectiveness of the audit process;

(8) approval or any subsequent modification of transactions of the Company with related parties;

(9) scrutiny of intercorporate loans and investments;

(10) valuation of undertakings or assets of the Company, wherever necessary;

(11) evaluation of internal financial controls and risk management systems;

(12) review, with the Management, the performance of the Statutory Auditors and internal auditors and adequacy of internal control systems;

(13) review the adequacy of the internal audit function, if any, including the structure of the internal audit department, staffing and seniority of the official heading the department, reporting structure coverage, and frequency of internal audit;

(14) discussion with internal auditors of any significant findings and follow-up there on;

(15) reviewing the findings of any internal investigations by the internal auditors into matters in which fraud or irregularity is suspected or of an occurrence of a material failure of internal control systems and reporting the matter to the board;

(16) discussion with the Statutory Auditors, before the audit commences, regarding the nature and scope of the audit as well as post-audit discussion to ascertain any area of concern;

(17) identification of the reasons for substantial defaults in payments to depositors, debenture holders, shareholders (in case of non-payment of declared dividends), and creditors;

(18) review the functioning of the Whistle Blower mechanism;

(19) approval of the appointment of Chief Financial Officer after assessing the qualifications, experience, and background of the candidate;

(20) performance of any other function as is mentioned in the terms of reference of the Audit Committee.

(ii) Nomination & Remuneration Committee:

The terms of reference of the Nomination & Remuneration Committee are as follows:

(1) formulating criteria for determining the qualifications, positive attributes, and independence of Directors and recommending to the Board of Directors a policy relating to the remuneration of the Directors, Key Managerial Personnel, and other employees;

(2) formulating criteria for evaluating the performance of Independent Directors and the Board of Directors;

(3) devising a policy on the diversity of the Board of Directors;

(4) identifying individuals who are qualified to become directors and who may be appointed in Senior Management, in accordance with the criteria laid down, and recommend to the Board of Directors their appointment and removal;

(5) deciding whether to extend or continue the term of appointment of Independent Directors, on the basis of the reports of their performance evaluation. The criteria for the evaluation of Independent Directors include skills, experience and level of preparedness of the Directors, attendance and extent of contribution to Board debates and discussion, and how the director leverages his/her expertise and networks to meaningfully contribute to the Company.

(iii) Stakeholders' Relationship Committee

The terms of reference of the Stakeholders' Relationship Committee is redressal of grievances of shareholders, debenture holders, and other security holders. The Committee shall consider and resolve the grievances of the security holders of the Company, including complaints like transfer/transmission of shares, non-receipt of Annual Report, and non-receipt of declared dividends as well as those required under the Companies Act, 2013.

(iv) Risk Management Committee

The terms of reference of the Committee are as follows:

a) spearhead risk management initiatives within the Company;

b) review status of actions planned;

c) review progress and status of mitigation for the 'Risks that matter';

d) set standards for risk documentation and monitoring;

e) improve risk management techniques and enhance awareness.

A. Annual General Meeting

Date and Time: Monday, July 31, 2017, at 3.00 p.m.

Venue : Godrej One, 1st Floor

Auditorium, Pirojshanagar, Eastern

Express Highway, Vikhroli (East),

Mumbai - 400 079

B. Financial Calendar

|

Financial year:

|

April 1, 2016 to March 31, 2017

|

C. Dividends for FY 2016-17

|

Dividend Type

|

Declared at

Board Meeting Dated

|

Dividend rate per share on shares of face value Rs. 1 each

|

Record Date

|

|

1st Interim for fiscal year 2016-17

|

July 29, 2016

|

₹ 1.00

|

August 22, 2016

|

|

2nd Interim for fiscal year 2016-17

|

November 7, 2016

|

₹ 1.00

|

November 30, 2016

|

|

3rd Interim for fiscal year 2016-17

|

January 30, 2016

|

₹ 1.00

|

February 21, 2017

|

|

4th Interim for fiscal year 2016-17

|

May 9, 2017

|

₹ 12.00

|

May 31, 2017

|

|

TOTAL

|

|

₹ 15.00

|

|

Note: Since your Company has adopted IND AS, accounting of dividends will be done based on the payment of dividend and hence, the 4th Interim Dividend of the fiscal year 2015-16 has been accounted for in the fiscal year 2016-17. Similarly, the 4th Interim Dividend of the fiscal year 2016-17, will be accounted in the fiscal year 2017-18.

D. Listing

The Company's shares are listed and traded on the following Stock Exchanges:

|

Name & Address of the Stock Exchange

|

Segment

|

Stock/Scrip Code

|

ISIN number for NSDL/CDSL

|

|

BSE Limited

Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai - 400001

|

Equity

|

532424

|

INE102D01028

|

|

The National Stock

Exchange of India Limited Exchange Plaza,

Bandra Kurla Complex, Bandra (East), Mumbai - 400051

|

Equity;

Futures & Options (F&O)

|

GODREJCP

|

The applicable annual listing fees has been paid to the Stock Exchanges before the due date.

http://www.godrejcp.com/investor-updates.aspx

E. Market Price Data

The monthly high and low prices of GCPL at BSE and NSE in equity series for the year ended March 31, 2017, are as follows:

|

Month

|

|

BSE

|

|

NSE

|

|

|

|

High

|

Low

|

High

|

Low

|

|

Apr-16

|

1,433.00

|

1,310.00

|

1,434.00

|

1,308.60

|

|

May-16

|

1,535.55

|

1,305.00

|

1,536.85

|

1,302.20

|

|

Jun-16

|

1,614.80

|

1,464.00

|

1,620.00

|

1,462.90

|

|

Jul-16

|

1,676.40

|

1,551.50

|

1,689.90

|

1,551.35

|

|

Aug-16

|

1,630.00

|

1,480.20

|

1,613.00

|

1,478.25

|

|

Sep-16

|

1,710.00

|

1,530.00

|

1,715.00

|

1,520.05

|

|

Oct-16

|

1,669.05

|

1,556.75

|

1,668.00

|

1,552.10

|

|

Nov-16

|

1,604.00

|

1,285.55

|

1,611.65

|

1,272.20

|

|

Dec-16

|

1,520.90

|

1,413.15

|

1,523.70

|

1,411.15

|

|

Jan-17

|

1,615.40

|

1,497.20

|

1,615.80

|

1,492.90

|

|

Feb-17

|

1,748.90

|

1,539.00

|

1,751.00

|

1,536.00

|

|

Mar-17

|

1,712.00

|

1,595.00

|

1,720.00

|

1,591.10

|

Source: Websites of the respective stock exchanges

Note: The high and low prices are in rupees per traded share

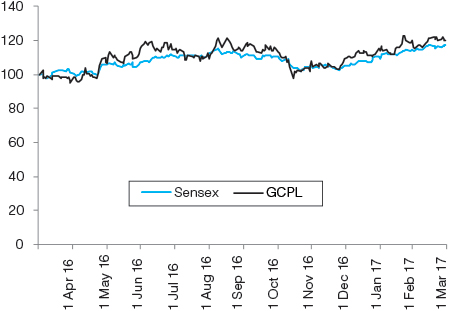

F. GCPL's share price at BSE versus Sensex

GCPL's share performance compared with the BSE Sensex for fiscal year 2016-17 is as follows:

Note:

- Both BSE Sensex and GCPL share price are indexed to 100 at the beginning of the fiscal year

G. Registrar and Transfer Agents

Computech Sharecap Limited,

147, M.G. Road,

Opp. Jehangir Art Gallery,

Mumbai - 400001.

Tel. No.: +91 22 22635000/01

Fax No. : +91 22 22635005

Email ID: gcpl@computechsharecap.com

Website: www.computechsharecap.com

H. Share transfer

GCPL's share transfers and other related operations are performed by Computech Sharecap Limited, registered with SEBI as a Category I Registrar. Share transfer is normally effected within a maximum of 15 days from the date of receipt, if all the required documentation is submitted.

I. Distribution of Shareholding

Distribution of shareholding by size class as on March 31, 2017

|

Number of Shares

|

Number of Shareholders

|

Shareholders %

|

Number of shares held

|

Shareholding %

|

|

1 - 500

|

74,910

|

91.00

|

8,188,088

|

2.40

|

|

501 - 1000

|

4,649

|

5.65

|

3,134,356

|

0.92

|

|

1001 - 2000

|

1,444

|

1.75

|

2,036,004

|

0.60

|

|

2001 - 3000

|

332

|

0.40

|

825,839

|

0.24

|

|

3001 - 4000

|

130

|

0.16

|

465,606

|

0.14

|

|

4001 - 5000

|

108

|

0.13

|

499,795

|

0.15

|

|

5001 - 10000

|

214

|

0.26

|

1,543,314

|

0.45

|

|

10001 & above

|

532

|

0.65

|

323,907,814

|

95.10

|

|

Total

|

82,319

|

100.00

|

340,600,816

|

100.00

|

Distribution of shareholding by ownership as on March 31, 2017

|

Category

|

Shares held (No.)

|

% of holding

|

|

Promoter's Holding

|

|

|

|

Promoters

|

215,496,082

|

63.27

|

|

Institutional Investors

|

|

|

|

Mutual Funds

|

2,096,189

|

0.62

|

|

Banks

|

31,322

|

0.01

|

|

Financial Institutions

|

608,559

|

0.18

|

|

Insurance Companies

|

4,628,114

|

1.36

|

|

Foreign Institutional Investors

|

96,817,567

|

28.43

|

|

Others

|

|

|

|

Private Corporate Bodies

|

3,392,858

|

1.00

|

|

Indian Public

|

16,176,289

|

4.75

|

|

NRI/OCB's

|

1,353,836

|

0.40

|

|

Total

|

340,600,816

|

100.00

|

J. Shares held in the Physical and Dematerialised Forms

Breakup of physical and dematerialised shares as on March 31, 2017

|

|

Number of Share

|

%

|

Number of Folios

|

%

|

|

Physical

|

5,237,266

|

1.54

|

31,322

|

38.05

|

|

Demat

|

335,363,550

|

98.46

|

50,997

|

61.95

|

|

Total

|

340,600,816

|

100.00

|

82,319

|

100.00

|

Shares in the demat form have more liquidity compared with shares in the physical form. Therefore, the Company recommends that shareholders holding shares in physical form shall convert their shareholding to demat form.

K. Outstanding GDRs/ADRs/Warrants/Convertible Instruments and their Impact on Equity

GCPL does not have any outstanding GDRs/ADRs/warrants/convertible instruments.

L. Commodity Price Risk or Foreign Exchange Risk and Hedging Activities

The Company has foreign exchange risk, and the mitigation of the same is managed by the Forex Committee. The Company has entered into forward contracts to hedge some of the risks. Details of hedged and unhedged positions are available in the Notes to Financial Statements section of the Annual Report.

M. Plant Locations

The Company's plants are located at the following places:

|

Name of the State/ Union Territory

|

Location of Plant

|

|

Jammu & Kashmir

|

SICOP Industrial Estate, Kathua

|

|

Himachal Pradesh

|

Thana, Baddi; Katha, Baddi

|

|

Sikkim

|

Namchi

|

|

Assam

|

Village Sila, Guwahati; Kalapahar, Lokhra, Guwahati

|

|

Meghalaya

|

Burnihat, Rebhoi District

|

|

Madhya Pradesh

|

Malanpur, District Bhind

|

|

Pondicherry

|

Kattukuppam, Manpet Post, Mannadipet Commune

|

|

Tamil Nadu

|

Nedungadu Commune, Karaikal and Thirunallar Commune, Karaikal; Maraimalainagar, Kanjipuram

|

N. Address for Correspondence

Members can contact us at our Registered Office:

Godrej Consumer Products Limited,

4th Floor, Godrej One,

Pirojshanagar, Eastern

Express Highway,

Vikhroli (East),

Mumbai - 400 079

Tel. No. : +91 22 25188010/20/30

Fax No. : +91 22 25188040

Email ID: investor.relations@godrejcp.com

Website: www.godrejcp.com

CIN : L24246MH2000PLC129806

Investor correspondence should be addressed to M/s.Computech Sharecap Limited at the details mentioned in Point No. G above. To allow us to serve shareholders with higher speed and efficiency, the Company strongly recommends email-based correspondence on all issues, which do not require signature verification for being processed.

O. Electronic Credit of Dividend

The Company encourages the shareholders to opt for electronic credit of dividend. The system is administered by the Reserve Bank of India, which ensures faster credit of dividends because dividends are directly credited in electronic form in the bank account of the shareholders. Moreover, by availing this facility, shareholders avoid the risk of loss of dividend warrants in transit or fraudulent encashment. Shareholders who hold shares in the physical form and have not opted for the above system may provide the required data to Computech Sharecap Limited in the requisite form, which can be obtained from the Company's Registered Office or M/s. Computech Sharecap Limited or the Company website www.godrejcp.com under the Investers tab. Shareholders holding shares in the demat form are requested to provide details to NSDL/CDSL through their respective depository participants.

It may be noted that if the shareholders holding shares in demat form provide details directly to the Company, the Company will not be able to process the form. Hence, shareholders are requested to update the details directly with their Depositary Participant.

P. Consolidation of Shares under one folio

The Company urges shareholders holding shares under different folios to consolidate the shares under one folio. This would substantially reduce paperwork and transaction costs, and benefit the shareholders and the Company. Shareholders can do so by writing to the Registrar with details such as folio numbers, order of names, shares held under each folio, and the folio under which all shareholding should be consolidated. Share certificates need not be sent.