How would you sum up fiscal year 2025 in terms of overall performance?

Fiscal year 2025 was a year of learning—and some unlearning. We started the year with a clear strategic agenda: grow volumes in India and Indonesia in the high single digits and drive structural profitability in our other international businesses. Our scorecard on this was mixed. In India, we delivered 5% volume growth, which was below our expectations, largely due to a sharper-than-anticipated consumption slowdown in the second half. Indonesia grew volumes at 6%, in line with the plan. But the real challenge came on the profitability front.

Our consolidated EBITDA grew by only about 1-2%—far lower than our mid-teens aspiration. This was almost entirely due to a short but sharp spike in palm oil costs in September, compounded by an import duty hike. Normally, duty hikes are followed by a price correction. But this time, both went up at once, creating a double impact. We made the deliberate choice to not take knee-jerk pricing actions. We absorbed the hit, knowing that palm prices would normalize, which they are now heading towards.

Despite these headwinds, I would call this a strategically strong year. We made real progress on several things that matter—innovations like Fab and Aer scaled up meaningfully, we doubled down on rural expansion with Project Vistaar, commissioned two new world-class manufacturing sites, and launched our newest business in Pet Care. Our international portfolio, especially in Africa and Latin America, saw structural margin expansion. And we stayed consistent on media and brand investments even when margins were under pressure.

So, while the optics on revenue and profit delivery were below par, the strategic momentum is intact—and in many ways stronger. Fiscal year 2025 has clarified where we need to stay the course and where we need to do things differently. It reaffirmed our belief in building a focused, future-ready, category-creating GCPL.

GCPL has long championed

category development.

How has that played out this year?

Category development continues to be our most fundamental and distinctive lever for growth. It is how we drive penetration by solving real consumer problems—through sharp focus on relevance, access, availability and trials. This four-fold model has helped us unlock growth across markets and categories this year.

A standout success was in Household Insecticides, where we applied learnings from India to expand our electrics portfolio in Bangladesh and Indonesia.

Liquid vaporisers, already a large category in India, was relatively nascent in these markets. We realigned pricing to India levels, significantly increased media investments, addressed safety concerns in Bangladesh with tailored messaging and activated home-to-home sampling reaching more than 2 million households. The result: significant volume growth in both countries—over 30%—and transformation of Bangladesh from a coils market to one led by electrics. It mirrors what we saw in India during our highgrowth phase a decade ago.

Closer to home, Air Care in India delivered over 20% growth and an ~700 bps market share gain. The Aer brand scaled on the back of a sharp consumer insight—using air care to create guest-ready homes, especially during festivals like Diwali. Access was boosted through a ₹99 car product, Aer O, which expanded its usage in cars significantly. Once again, sampling and creative execution played a critical role, with Aer now leading our push to scale our internal Creative Lab’s content globally.

In Hair Colour, we accelerated the roll-out of our ₹15 shampoo hair colour sachet across multiple markets. While we were not the first movers in India, we have now taken the lead in scaling this format globally. The relevance trigger—5-minute application— was simple but powerful. Growth here has been driven more by visibility and distribution than trials, with strong market share gains and margin accretion, especially in Latin America and Indonesia.

We also deepened our innovation pipeline across formats—Renofluthrin in agarbattis and electrics, HIT Anti-Roach Gel and HIT Matic among them. Altogether, we enabled over 10 million product trials this year through largescale sampling, outreach and media activation. The big learning this year was a reaffirmation: when we invest behind the right insight, simplify execution, and build access, categories grow, and so do we.

Our Household Insecticides Electrics portfolio in Bangladesh

and Indonesia witnessed an over 30% volume growth.

We boosted access for Aer O with a new ₹99 price point,

expanding its usage in cars significantly.

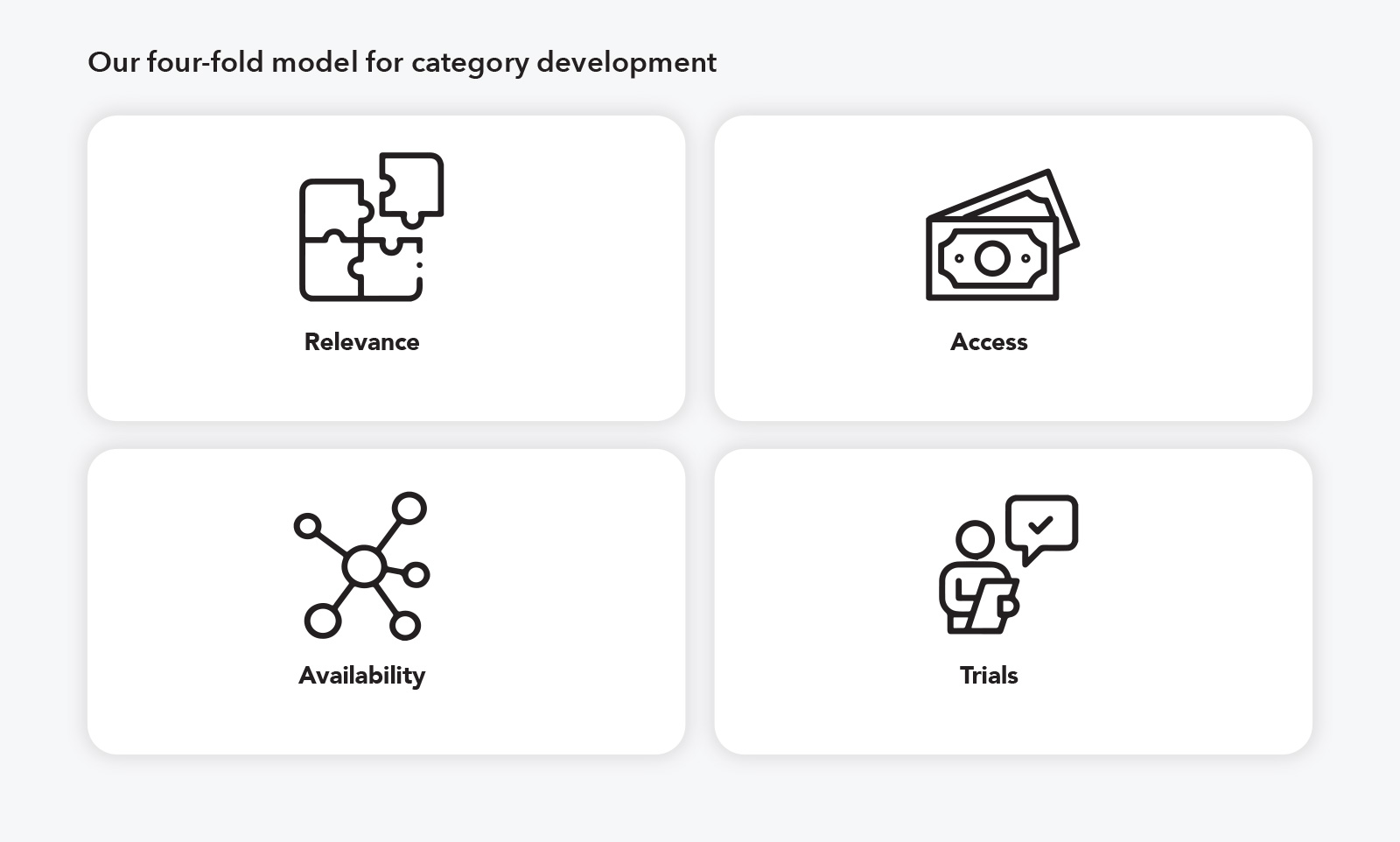

The GCPL Goodness Manifesto, which links our purpose, vision, strategy, and

operating philosophy, guides our choices and ways of working

Spending time connecting

members from with our teams on ground

You spoke about investing ahead in

India. What were the key moves here?

India continues to be our largest and most strategic market, and our investment approach here is guided by a clear belief—that FMCG, especially home and personal care (HPC), still has significant runway for volumeled growth. Despite recent macro headwinds, the long-term fundamentals remain strong. Globally, HPC categories tend to outpace GDP growth until per capita incomes reach $10,000—and India is far from that threshold. The opportunity is not in questioning the category’s relevance, but in unlocking it better.

Our growth model for India has three pillars. First, profitable share gain in Soaps, where we have sharpened our focus on mix and margins. Second, a turnaround in Household Insecticides, where we are addressing the challenges of format downgrades. And third, expansion into future-facing categories— under-penetrated spaces like air care, liquid detergents, hair colour, body wash and sexual wellness.

In Household Insecticides, we have taken bold steps to address the biggest drag on category growth: the rise of incense sticks powered by illegal molecules. Our diagnosis was that efficacy, not format, was the issue—and that incense sticks were winning because they used an illegally imported molecule like Metofluthrin. We’ve responded with Renofluthrin, a superior, made-in-India molecule for which we’ve secured medium-term exclusivity. This has now been rolled out across agarbattis, coils and electrics. The early results are promising. Agarbatti, for instance, is now a ₹100+ crore business with ~8% market share, and 50% share in outlets where we are distributed. The balance we’re aiming for is to grow share without accelerating the overall market shift to incense sticks. We’ve also begun taking prices up—from ₹10 to ₹15 in some markets—to ensure medium-term profitability.

Meanwhile, Goodknight Electrics has started trending towards a turnaround. Historically flat, it saw double-digit volume growth in Q4, with high-teens value growth. We also hit a record high market share in electrics, gaining 200 bps. This suggests the new molecule strategy is working. We have complemented this with premium innovations like HIT Matic and the ₹99 HIT Anti-Roach Gel, catering to consumers looking for superior formats.

On the HPC side, we are betting on categories of the future. A prime example is Air Care, which has seen explosive growth. We gained 1,000 bps in market share and have built a repeatable model: invest behind strong consumer-tested insight (like “guest-ready homes”), launch blockbuster innovations every 1-2 years, and scale them through media and retail distribution. We are currently piloting two new formats—Aer Plug, a premium electric diffuser, and Aer Mini, a mass pocket-sized air freshener. Both play to different ends of the spectrum— premiumisation and democratisation—and give us levers for both margin and volume growth.

Another big win has been Godrej Fab, our entry into main wash detergents. In just over a year, Fab has hit ₹250 crore in annualised revenue run-rate (ARR), with a growth trajectory resembling that of a digital-first brand. This will likely be a multi-year growth engine and help us build leadership in a large, under-penetrated category.

Hair Colour has also seen strong volume momentum. Our ₹15 crème SKU has doubled penetration over the past two years and now drives a significant portion of growth. This is a category where upgradation from powder to crème is the core vector of growth.

Crème penetration is currently at ~30%, and we believe we can meaningfully increase our share as this shift accelerates. We also invested in sharper advertising this year, and early testing has been positive.

Body Wash, on the other hand, is a category where we were behind the curve. We are now playing catch-up with differentiated innovation. Cinthol Body Wash, launched largely on e-commerce and quick commerce, is seeing promising repeat rates, especially in digital-first channels. We are using a “ladder” approach—launching on quick commerce, building digital buzz through Connected TV and social, and then scaling into modern trade, general trade, and eventually rural. It is a model we intend to replicate across other premium formats.

The broader learning is that our India strategy must balance three time horizons— improving the core, defending and reviving lagging categories, and investing ahead in high-growth, high-margin spaces. This year, we made important bets across each of these, and while some are still in the early stages, the building blocks for a more resilient and diversified India growth engine are clearly in place.

In just over a year, our liquid detergent,

Godrej Fab, hit ₹250 crore in

annualised revenue run-rate (ARR).

With new launches Aer Plug, a premium electric diffuser,

and Aer Mini, a mass pocket-sized air freshener, we

continue to bet on categories of the future.

And what about Park Avenue and Kamasutra?

How is that bet shaping up?

Park Avenue and Kamasutra are part of our long-term play to build presence in what we believe are categories of the future—deodorants, perfumes and sexual wellness. These are fast-growing, youth-led segments that are structurally attractive and underpenetrated in India. They offer significant runway for premiumisation and are highly brand-driven in the long term. That is why we made the choice to acquire and integrate these brands into our portfolio. Fiscal year 2025 was our first full year of integration, and while we made progress, it was not without its challenges.

We entered the year with the ambition to grow this business by 20-25%. We closed the year closer to 10%. This shortfall was shaped by structural realities—these categories are still dominated by wholesale trade, deep discounting and fragmented channels. Our approach, by contrast, is centered around brand equity, premium formats and sustainable margin structures. That shift takes time to establish.

That said, we have taken decisive steps in the right direction. We rationalised the revenue base by ~20% from ~₹622 crore to ~₹500 crore, cleaned up the portfolio, and significantly increased ATL spends—from ~₹35 crore to over ~₹100 crore.

We simplified the brand architecture and focused on building stronger consumer relevance. Encouragingly, we doubled EBITDA from ~₹50 crore to ~₹100 crore during the year, driven by mix improvement, cost discipline and marketing leverage.

We also launched new formats, particularly in perfumes, where early traction has been promising. Our belief in this portfolio remains intact. These are categories with strong tailwinds. The task ahead is to reshape them from the inside out—by rethinking price-pack architecture, improving GTM execution, and building long-term brands. We are committed to the journey.

Building relevance through our latest product innovations,

Park Avenue Eau De Parfum and Amazon Woods.

You launched GCPL’s newest brand this year.

What’s the vision for Godrej Ninja and the

pet care category?

Pet care is a long-term opportunity, with rising pet ownership and growing interest in holistic wellness. We launched Godrej Ninja in Tamil Nadu with a premium dry food portfolio. It was a collaborative effort with Godrej Agrovet, combining their formulation capability and our distribution and brand strengths. The category is still nascent but poised for high growth over the next two decades. We’re building this play patiently—with strong consumer insight, responsible marketing and long-term brand building. Early consumer response has been promising.

India’s pet care market is valued at approximately ₹6,000 crore, with pet food accounting for ~₹5,000 crore. Despite the growing number of pet parents, packaged pet food penetration remains low. Only about 10% of Indian pet owners feed packaged food, and even then, only about 40% of the time. This indicates significant headroom for growth in the category.

By combining Godrej Agrovet’s expertise in animal nutrition with our marketing and innovation capabilities, we aim to address the nutritional needs of Indian pets and establish a trusted brand in the pet care industry. This initiative aligns with our long-term vision to tap into high-growth, future-forward categories. GCPL remains the complete owner of the business and the brand.

We launched Godrej Ninja in Tamil Nadu with a premium dry food

portfolio, a collaborative effort with Godrej Agrovet, combining their

formulation capability and our distribution and brand strengths.

What are you most excited about

inclusive, in your international portfolio?

Our international business has undergone a significant shift over the past year. Structurally, we have turned a corner. EBITDA margins across Africa, Latin America and the Middle East now stand at 17%—a major improvement from historical levels. This came on the back of bold simplification. We exited non-core and loss-making businesses, especially in discretionary segments like hair extensions in East Africa. We reduced SKUs by over 20%, consolidated operations through shared services, and brought sharper cost control across the board.

But what excites me most is not just the structural reset—it is the potential of taking Indian innovations global. For the first time, we are truly building brands that are born in India but designed to win across geographies. Godrej Aer Pocket, for instance, has emerged as one of our fastest-growing export products. Our Godrej Expert Shampoo Hair Colour—an Indialed innovation—is seeing strong traction in Latin America, where we have tailored the offering to local hair types and retail formats.

We have now established GCPL International Operations—a focused team that looks at distribution, innovation, marketing and execution across 80+ export countries, with a highly lean centralised set-up.

We are also running digital campaigns in 15 priority markets via a centralised Google-YouTube desk based in India. This enables faster, more cost-effective content deployment, with better targeting and localisation. We have also scaled our internal creative capabilities through our Creative Lab, allowing us to produce one campaign and adapt it globally.

This is a big mental model shift. Earlier, our exports were reactive—today, we are building global brands from day one. This shift is not just operational, it is cultural. It reflects our belief that GCPL can be a consumer products company with ideas and impact that travel across the world.

We are scaling up our global

blockbuster portfolio

Your media and creative approach seems to have

fundamentally shifted. What is driving this change?

We have reimagined how we think about creativity—not as a function, but as a strategic growth driver. Historically, we operated with multiple agencies, fragmented briefs and inconsistent execution across geographies. This made our marketing ecosystem slow, inefficient and diluted the power of our ideas. We recognised the need to simplify, centralise and scale.

That’s where our Creative Lab comes in—an in-house creative studio that now powers campaigns across markets. We moved to a single-agency, global category model.

This means we develop one central idea, and then adapt it for each geography with local casting, language and cues. Our Godrej Expert shampoo hair colour ad is a great example—shot once, adapted for India, Indonesia and Latin America. The result? Faster turnaround, tighter brand coherence, and better ROI. We’ve saved around 40 basis points in cost, and our creative hit rate has improved sharply.

But it is not just about efficiency. What this unlocks is consistency in brand storytelling. It allows us to speak with one voice globally, while staying relevant locally.

It also empowers our teams to act fast. We’ve moved from campaign cycles to realtime content sprints, driven by a dedicated Google-YouTube desk based in India. Today, we run targeted digital campaigns in 15 countries from a single hub.

Creative is now as core to our business as innovation or distribution. It is no longer a support function—it’s a capability we are building deliberately, to win in a world where relevance, agility and distinctiveness matter more than ever.

Our in-house Creative Lab develops one central idea and then adapts

it for each geography with local casting, language and cues. This has

resulted in faster turnaround, tighter brand coherence and better ROI.

Can you share some of the big bets

for fiscal year 2026?

Our focus going into fiscal year 2026 is clear: fewer, bigger, better bets that can drive scale, margin, and future readiness. One of our top priorities is reshaping the deodorants category. We believe the current MRP and channel architecture in India is structurally broken. Our approach will be to rewire the price-pack-channel configuration, introduce more relevant innovation and invest in building brand equity instead of discountdriven sales. We are taking a more firstprinciples approach to a category that has strong long-term potential but needs fixing.

Another key bet is scaling Godrej Fab—our liquid detergent—to ₹500 crore. This will require sharper distribution, increased trials and more targeted communication. We’ve seen strong early success, and now the goal is to unlock the next level of growth.

In Household Insecticides, we will double down on Renofluthrin-based innovations and build on the early success of HIT ARG and HIT Matic. These formats help us premiumise the portfolio while delivering stronger efficacy.

We are also expanding Project Vistaar to over 6 lakh rural outlets. This will deepen rural reach and help us build penetration in our core categories. This is not just a distribution push—it is an investment in long-term demand creation.

Another key focus is the continued build-out of our pet care business. After launching in Tamil Nadu, the next phase will be about refining the model, expanding into new states, and shaping the category through purposeful brand building.

Lastly, we will continue to take Indian innovations global. Aer, Goodknight Liquid

Vapourisers and our shampoo hair colour formats are scaling well internationally. We’re now designing products with global scale in mind from the start—this unlocks synergies and improves return on innovation.

In short, fiscal year 2026 is about backing a few high-conviction bets and executing them with precision. It’s how we aim to build a structurally stronger, marginaccretive, future-ready GCPL.

Investing in deep rural reach through our

van distribution model Project Vistaar

What progress have you made

on sustainability this year?

Sustainability is not new to GCPL. It has been part of our DNA for over a century. Our legacy is built on the belief that businesses must serve a larger societal purpose. We have always tried to do well by doing good, and that continues to guide our approach today. Fiscal year 2025 saw us deepen this commitment further. We were ranked #2 globally on the Dow Jones Sustainability World Index (Global Consumer Goods category), a recognition of the systemic, integrated nature of our work. But more than the recognitions, we focus on the impact.

We have embedded climate risk into our Enterprise Risk Management framework. Priority climate-related risks such as decreased efficiency of workforce due to rising temperatures, and suppliers unable to meet requirements that align with low-carbon transition among others, are included in our enterprise risk registers.

We have mapped the biodiversity across all our manufacturing clusters and have developed biodiversity registers. We are now in the process of rolling out biodiversity action plans. Our watershed management initiatives now recharge over 12x the water we consume annually. On the social side, we completed human rights due diligence across 31 plants and 20,000+ workers, including contractual labour and have rolled out action plans that are being implemented by our clusters. We refreshed our supplier ESG engagement and now do a much more detailed assessment to map our suppliers from an ESG lens. This assessment now covers over 70% of our procurement base. Through our community waste management initiatives, we diverted close to 15,000 MT of waste from landfills, while creating safe and formalised livelihoods for waste workers. We’ve also introduced regenerative practices and nature-positive farming pilots.

Along with what we do in our operations and our communities, we also have a responsibility to our people and shareholders to represent what is in their best interest on climate change and its impact on our operations. We acknowledge climate change risks and have been advocates of the goals of the Paris Agreement. Our trade association memberships and public policy advocacy are aligned with limiting average global warming to 1.5 degrees Celsius. We endorse all decarbonisation policies that are aligned to our areas of operation.

Sustainability at GCPL is not a separate agenda—it’s a lens through which we view decisions. It shapes our strategy, defines our partnerships, and helps us build trust—with consumers, communities and future generations.

We’re embedding climate risk into our Enterprise Risk Management framework: our manufacturing

sites now undergo biodiversity assessments; we conducted human rights due diligence across 31

plants and 20,000+ workers; and we’ve diverted close to 15,000 MT of waste from landfills.

And how are you thinking about people,

inclusion and leadership at GCPL today?

We’ve always believed that our people are our biggest strength—and that belief has only grown stronger. At GCPL, inclusion isn’t just a metric; it is a value. It flows from our Group’s long-standing commitment to trust, respect and equity. Our diversity milestones—over 55% women representation including all workforce, white collar, blue collar and contractors, 2 out of 3 leadership hires in fiscal year 2025 being women—are important, but they are not the end goal. True inclusion means building a workplace where everyone feels seen, heard and valued.

This year, we have taken visible steps in that direction. Our new manufacturing plant in Tamil Nadu will be staffed with 50% women and 5% team members from the LGBTQIA+ and PWD communities. We have also focused on building inclusion capabilities—through sensitisation, policy reform and leadership commitment. Our belief is simple: the more perspectives we include, the stronger our ideas, culture and execution will be.

On leadership, our focus continues to be on building from within. Through the Godrej Learning Lab, we curate cross-functional, high-impact learning journeys for top talent.

We believe in giving our people big opportunities early and backing them with the right support. Nearly 90% of our identified top talent was served with formal development inputs last year. For us, leadership is not just about business delivery—it is about shaping the next generation of purposeful, values-led leaders for GCPL and beyond.

We’re laser-focused on building an inclusive workplace. Our new

manufacturing plant in Tamil Nadu will be staffed with 50% women

and 5% team members from the LGBTQIA+ and PWD communities.

We have also focused on building inclusion capabilities through

sensitisation, policy reform and leadership commitment.

One final question—how do you see the future?

What excites you most?

What excites me is the opportunity to build GCPL into a truly future-ready institution. The building blocks are falling into place: categories of the future, globally scalable innovations, a more inclusive and capable team and a sharper and leaner operating model.

There is much more to do. But we now have the clarity of what matters, and the discipline to stay the course. What gives me optimism is the belief that with the right intent and execution, we can build something lasting—not just a successful company, but an inspiring one.

Through the Godrej Learning Lab, our focus continues to be

on shaping the next generation of leaders from within.

Previous