Risk

management

At GCPL, our risk management approach is comprehensive and deeply embedded within our operational and reporting frameworks across geographies.

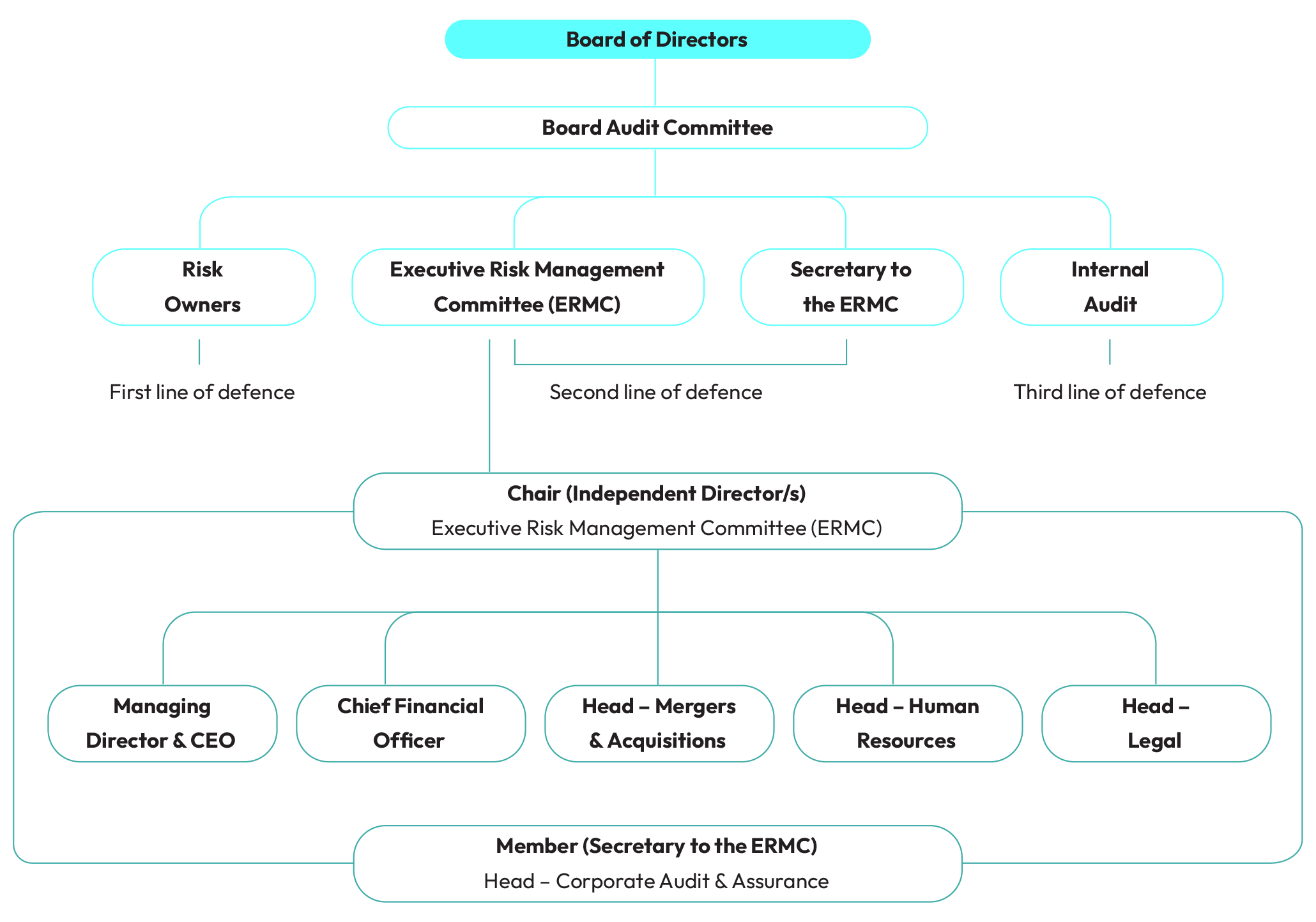

Risk governance structure

We have instituted a strong and multi-tiered risk governance structure to proactively identify, assess, and mitigate risks. Oversight begins at the Board level, with risk ownership forming the first line of defence. The second line is led by the Executive Risk Management Committee (ERMC), which provides oversight and strategic direction. Independent

Risk governance structure

We have instituted a strong and multi-tiered risk governance structure to proactively identify, assess, and mitigate risks. Oversight begins at the Board level, with risk ownership forming the first line of defence. The second line is led by the Executive Risk Management Committee (ERMC), which provides oversight and strategic direction. Independent assurance is delivered by our internal audit team, constituting the third line of defence, to evaluate the overall effectiveness of the risk management framework.

assurance is delivered by our internal audit team, constituting the third line of defence, to evaluate the overall effectiveness of the risk management framework.

Board of directors

The Board of Directors plays a critical role in steering our risk management agenda. They establish the tone at the top, define our risk appetite, and ensure it is aligned with our strategic objectives. Risk appetite outlines the degree of risk we are willing to undertake in pursuit of business growth. The Board closely monitors our risk exposure to ensure alignment with prudent risk-taking and longterm value creation. Their oversight supports sound, informed decision-making at every level.

Board audit committee

The Board Audit Committee comprises of all Independent and non-executive directors. They play a key role in shaping the risk management ecosystem. They formally review and approve the Risk Management Charter and Policy, which serve as the cornerstone of our approach. The committee provides structured guidance to the risk owners and the ERMC and ensures that risk management activities are aligned with the organisation’s strategy. Where required, the Committee sanctions additional resources to mitigate specific risks and prescribes corrective measures in cases where mitigation is inadequate. The Committee also keeps the Board updated with periodic reviews and recommends any recalibration of the risk appetite, if necessary.

First line of defence - Risk Owners

Risk owners are designated for both material and emerging risks. Embedded within operational teams, they serve as the first line of defence by actively assessing, managing, and monitoring risks within their respective domains. They develop and propose mitigation plans, which are reviewed and approved by the ERMC and relevant Board Committees. The concerned team escalates any deviation from the agreed plan to the respective Head of Function and the Managing Director & CEO. Risk ownership may evolve based on changes in roles and responsibilities across the organisation.

Every six months, risk owners formally report on their respective risk areas during ERMC meetings. These updates evaluate the effectiveness of current mitigation efforts and identify any newly emerging risks that could potentially impact business continuity.

The risk report includes:

- Performance of the function in managing its material risks in light of the mitigation strategies

- Identification of any additional emerging risks

- Mitigation strategy and actions for the new material risks

Second line of defence - Executive Risk Management Committee (ERMC)

The ERMC ensures the deployment of a systematic and consistent risk management process across the organisation. This committee plays a central role in identifying, assessing, and mitigating risks spanning strategic, material, operational, transitional, technological, and environmental domains.

Charged with overseeing the company’s risk landscape, the ERMC is responsible for ensuring risks are managed in a manner that strengthens business resilience and continuity. The committee remains firmly committed to maintaining transparency and safeguarding the interests of both the company and its stakeholders.

On the recommendation of the Managing Director & CEO or the Chief Financial Officer, the ERMC may nominate or invite other members or directors to attend specific meetings as deemed necessary.

The Secretary to the ERMC, who is the senior-most individual tasked exclusively with risk management responsibilities, acts as the de facto Chief Risk Officer. The Secretary leads the risk management function at both the operational and performance levels and is accountable for ensuring that ERMC meetings are convened at least twice a year, or more frequently if required. The Secretary also submits a comprehensive half-yearly risk management report for

review by the ERMC. Additionally, on a biannual basis and as per a predefined schedule, risk owners formally present their risk management initiatives and the status of their domains to the ERMC for structured evaluation.

The Secretary to the ERMC, who is the senior-most individual tasked exclusively with risk management responsibilities, acts as the de facto Chief Risk Officer. The Secretary leads the risk management function at both the operational and performance levels and is accountable for ensuring that ERMC meetings are convened at least twice a year, or more frequently if required. The Secretary also submits a comprehensive half-yearly risk management report for review by the ERMC. Additionally, on a biannual basis and as per a predefined schedule, risk owners formally present their risk management initiatives and the status of their domains to the ERMC for structured evaluation.

The ERMC is responsible for:

- Half-yearly reports to the Audit Committee and Risk Management Committee

- Half-yearly review of the risk mitigation status for material and emerging risks

- Annual assessment of risks in line with business/strategic planning

Third line of defence - Internal Audit

The internal audit team provides independent assurance on the risk management process. They formulate an annual audit plan based on the risk significance and performs assessment and audits of the internal control system, processes and implementation of risk mitigation strategies that the business has adopted. The internal audit reports provide an objective assessment and even recommendations to strengthen internal controls.

Risk governance structure

Risk management approach

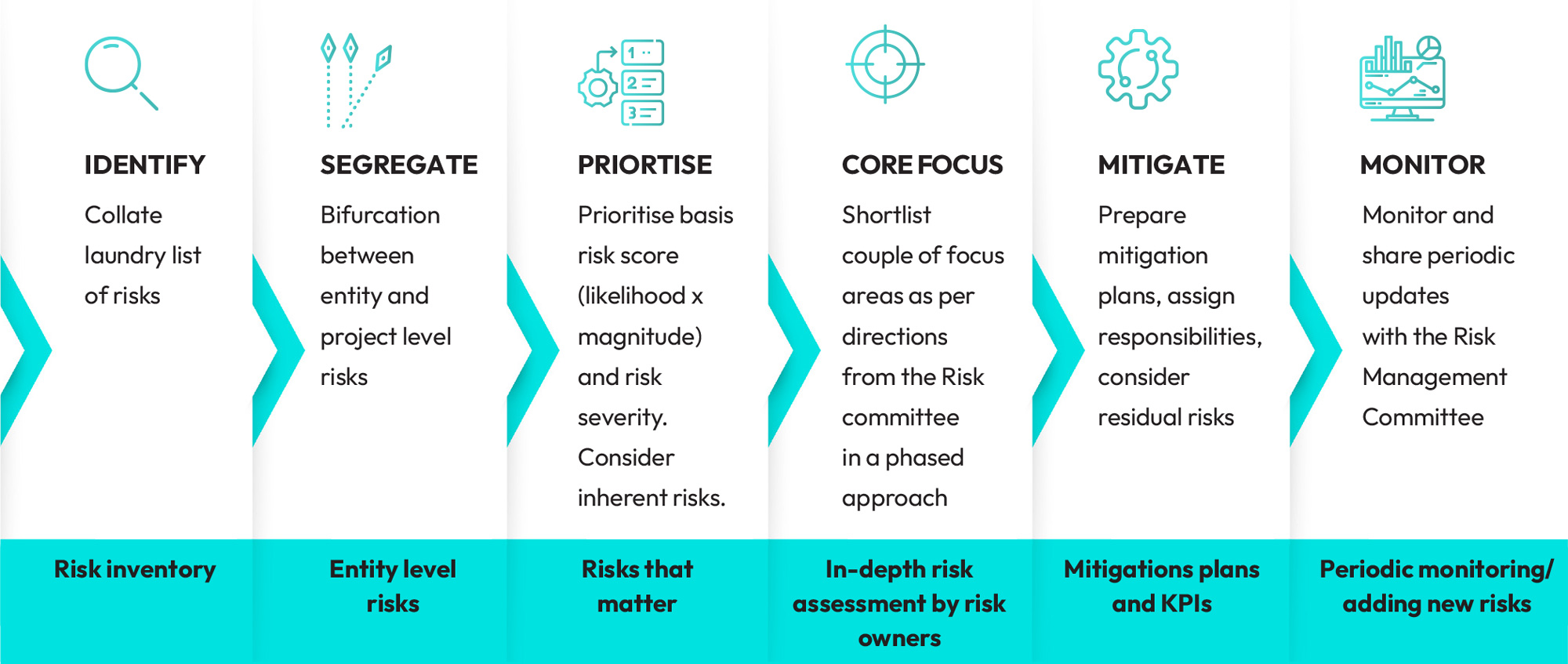

Our risk management approach is proactive and closely integrated with the company’s strategic and annual business planning cycles. Each year, a structured risk identification and assessment process is carried out in parallel with the formulation of our annual business operating plan.

The annual business operating plan serves as a baseline for recognising and prioritising key risks. Once prioritised, a risk competency scan is conducted to evaluate the effectiveness of current management strategies in addressing both material and emerging risks. This scan also identifies areas where further enhancement of risk mitigation efforts is warranted.

For each material and emerging risk, the combined outcomes of the existing management strategies and identified improvement opportunities are documented in a formal risk management plan. This plan is subsequently presented to the Board Risk Management Committee for thorough evaluation and review of both the prioritised risks and the corresponding mitigation strategies.

Risk management approach

The risk assessment function is structurally independent of business and is overseen and coordinated by the Secretary to the ERMC. The risk assessment outcomes fall under the ownership of the respective business function heads. This collaborative approach ensures a comprehensive and efficient risk management strategy across the organisation.

Risks are prioritised basis a risk score that considers likelihood/probability and magnitude. This is turn defines the impact/ overall severity of the risks. We follow a 2x2 matrix framework with each of the 4 quadrants defining the impact of risk. For FY25, entity-level risk assessment results indicated commodity risks in high impact Quadrant 1, operational risks in Quadrant 3, inflation, currency devaluation and geopolitical risks in Quadrant 2, and evolving regulations and cyber-attacks in Quadrant 4. We also incorporated the double materiality assessment results in the framework. The identified and analysed risks are managed by relevant functions that are responsible for formulating and implementing risk management strategies, plan of action and its implementation.

Risk Impact Assessment

Risk culture

Employees across all levels and geographies have risks as part of their individual goals and performance review. These risks range from measures to reduce occupational health and safety incidents, adherence to regulations and compliance, financial forecasting to reduction of volatile forex exposure.

All our Board of Directors are familiarised on risk management process, risks that matter, and the internal audit reports of risks controls at least twice a year. At the Godrej Learning University, our Groupwide learning management system, we have a dedicated course on Enterprise Risk Management. The course details the fundamental concepts of risk management include planning for risk management, identifying risks, analysing risks, planning risk response and implementation, and monitoring and controlling risks.

The course deep dives into recording identified risks into risk registers and analysing with our magnitude and likelihood matrix. It concludes with incorporating riskbased thinking and Failure Mode and Effects Analysis (FMEA). The course is assigned to team members taking up risk goals and

moreover it is available to everyone across the company to access and learn ERM. Across all manufacturing facilities, offices and our headquarters, we also conduct workshops on occupational health and safety risks and management throughout the year, covering 100% of our employees and workers.

The course deep dives into recording identified risks into risk registers and analysing with our magnitude and likelihood matrix. It concludes with incorporating riskbased thinking and Failure Mode and Effects Analysis (FMEA). The course is assigned to team members taking up risk goals and moreover it is available to everyone across the company to access and learn ERM. Across all manufacturing facilities, offices and our headquarters, we also conduct workshops on occupational health and safety risks and management throughout the year, covering 100% of our employees and workers.

Our employees are encouraged to share feedback for continuous improvement in risk management practices. A formal annual NPS survey is conducted across the company for all functions. Risk management is a part of that survey, and the feedback helps us improve our processes and systems. Continuous listening survey is organised across the company seeking suggestions and feedback from all employees. Emerging risks and development of mitigation measures are discussed in departmental monthly review meetings. The line manager records valid risks identified by team members and communicates them to the ERMC for further action. At the plant level, we have a mobile app to identify occupational health and safety risks. These risks are tracked, reviewed, and mitigated through the app.

Risk appetite

GCPL’s risk appetite is evaluated by the Board of Directors. These principles are defined to help the ERMC and the risk owners to take appropriate levels of risks in line with business objectives.

The biggest risks we face are often systemic risks that are inherent to the entire market. The high impact risks that aren’t systemic need to reach medium or low impact level risk quadrant over time.

We will adhere to all regulations and laws where we operate. All risk owners including but not limited to leaders, managers, employees, finance controllers, compliance officers, among others should adhere to regulations and laws related to their business function and local geography.

Business activities that have a high risk of corruption and/or unethical behaviour should have strong measures of controls and should be regularly analysed and tested. Relevant preventive measures and trainings should further strengthen the environment for these activities.

Risks and mitigation

| Risk category | Risk and risk description |

Risk appetite | Magnitude | Mitigation plan |

|---|---|---|---|---|

|

Financial |

Forex |

We budget for currency conversion loss; however our risk appetite seeks to optimise a high level of return and achieve right risk reward. |

High |

At GCPL, the Forex policy is determined by a dedicated Forex Committee. This committee monitors all exposures and guides decisions on open exposures and hedging. The committee meets monthly and provides quarterly reports to the Board on forex exposures. |

|

Supply chain |

Commodity Price Volatility |

For commodities we aim to eliminate as far as possible any commodity price volatility through hedging and expanding our pool of commodity suppliers. We have defined a risk appetite with a predetermined limit exposure. |

High |

Our primary commitment remains to serve the needs of our consumers above all else. In challenging times, we continue to work in their best interest and have been very prudent to pass on any increased input costs on to our consumers. Additionally, we have consistently maintained the quality standards of our products, refusing to compromise on quality in the face of rising input costs. To further mitigate this risk, we have actively worked to secure high-quality PFAD from various regions and geographies, thereby reducing our dependency on major markets. |

|

Operational |

Occupational Health & Safety |

We have no appetite of risk of failure of health and safety measures in our operations. |

High |

This is a high-priority area for us. We have strong SOPs (Standard Operating Procedures) to ensure the highest adherence to health and safety. Our Safety and Health policy has a robust governance mechanism that investigates any incident and resolves for future. We have a periodic review of safety procedures, and the Central Safety Committee and committees at plants that review monthly data, plans actions and organises trainings for health and safety. |

|

Economic |

Inflation & Currency Devaluation |

We are willing to accept the risk of working in emerging economies where there is inflation and currency devaluation. We have in place mitigation strategy and business imperatives to manage this. |

Medium |

We are strategically utilising our resources in regions experiencing hyperinflation to lower our production costs. Simultaneously, we are investing in local procurement initiatives to reduce reliance on imports and minimise the impact of global supply chain disruptions. By supporting the local economy, we aim to foster economic stability and contribute to the well-being of the communities we serve. |

|

Financial |

USA tariffs impacts |

Due to the evolving nature of this risk, we are monitoring the situation and have a medium appetite for this risk based on our business exposure in the USA market and category. |

Medium |

Even baseline rate of tariff nullifies the African Growth and Opportunity Act (AGOA). We are evaluating pricing vis-à-vis competition and are also exploring export options. |

|

Regulatory |

Evolving Regulations |

We will adhere to all regulations and laws where we operate. |

Low |

We have the highest levels of statutory compliance and ensure all regulations and law of the land are adhered to. We have an internal system called Legatrix that helps all manufacturing units to monitor adherence to compliance and regulations. It enables management with a onestop view of the organisation’s compliances and control mechanism through comprehensive compliance dashboards and provides necessary information at the operating level by creating a comprehensive matrix on laws and their management. Further, our Corporate Affairs, Legal, and Audit teams are in consistently communicating with key government departments and industry bodies to track new and emerging regulations. They routinely assess and analyse regulations to evaluate how these will impact business and mitigation for the same. |

Emerging risks

1. Biodiversity loss

The cost of timber has almost doubled in the last decade. UNEP’s Global Resource Outlook 2024 report states that our need for resources will jump by 60% by 2060. Businesses are inextricably linked to nature, drawing upon various resources ranging from timber and agricultural raw materials to water and minerals. As our resource ecosystems are stretched thin, business dependencies on nature will become a huge risk.

Impact of biodiversity loss

Three key commodities we source have a risk of deforestation – rubber, palm fatty acid distillate and paper. We manufacture a variety of products that uses rubber and palm fatty acid distillate as a raw material and use paper for packaging.

Natural rubber is a key material used to produce a wide variety of goods. Natural ‘rubber tree’ grows in tropical regions however, its planting practices often involve clearing natural forests, resulting in serious biodiversity loss and net carbon emissions. In India, we source rubber entirely from privately owned plantations which are classified as agro-forestry, and therefore do not carry the same risk of deforestation. However, these plantations are subject to the same physical climate risks and are hence considered as an emerging risk.

We also use palm fatty acid distillate (PFAD, which is a by-product of palm oil refining). Oil palm development in some key producing markets has been known to often replace tropical forests and other species-rich habitats to meet the growing demand.

Lastly, as we increase our paper-based packaging solutions to reduce reliance on plastic packaging, the most commonly mentioned impacts of the timber industry is forest degradation. Extracting timber or other products changes the tree age structure, composition of tree species and vertical stratification, thereby affecting local temperature, light, moisture, soil and litter conditions.

Mitigation actions

We recognise that biodiversity loss is one of the most critical environmental issues of our time that directly impacts our planet’s health. Large-scale removal of forests for agriculture commodities leads to loss of biodiversity, disruption of ecosystems, and increased greenhouse gas emissions. Forests play a vital role in maintaining the ecological balance of our planet. By committing to safeguard forests, we aim to mitigate climate change, conserve biodiversity, and promote well-being for all.

- For rubber, we source only from India where it is an agricultural commodity and not a forest commodity with complete traceability.

- For paper, we have replaced over 80% of our virgin paper with FSC certified recycled paper for use in soap stiffeners, soap wrappers, corrugated boxes, printed cartons, leaflets, sticker & labels, and other paper-based packaging materials.

- For PFAD, we work closely with our suppliers to ensure highest quality PFAD with lowest environmental impact. We will continue to improve our standard on this. Moreover, to further mitigate this risk, we have actively worked to secure high-quality PFAD from various regions and geographies, thereby reducing our dependency on major palm oil markets.

- We depend on nature for raw materials, water and a clean environment. The International Union for Conservation of Nature (IUCN) which is the globally recognised authority on the natural world’s condition, reveals that over 750 animal and plant species in India are threatened. Understanding what’s around us is the first step in preventing this loss. We have mapped the natural landscapes around our sites to gain critical insights that will drive sustainable decision-making. We have also documented stories of local challenges, as well as traditional practices that have sustained communities in harmony with nature for generations as a guide for our actions.

Biodiverisity mapping across our India sites

2. Cyber espionage

Protecting our computer systems, networks, and electronic data from unauthorised access, theft, or damage due to cyberattacks remains a critical priority. As our reliance on digital technology and online platforms continues to grow, we face an increasing array of cyber threats. The vast amounts of sensitive data we store including customer information and proprietary technology, combined with our extensive use of online platforms for customer engagement, supplier interactions, and supply chain management, make us attractive targets for cybercriminals seeking to steal data, disrupt operations, or extort ransom. We recognise that cyber threats such as phishing, malware, ransomware, and denial-of-service (DoS) attacks pose significant and evolving risks to our business. These cyberattacks represent a technological business risk with the potential to cause revenue loss, reputational harm, and legal or regulatory consequences.

Global emerging risk for GCPL

- India’s growing reliance on digital infrastructure like the Unified Payments Interface, Aadhaar, and Open Network for Digital Commerce further increases our vulnerability to cyberattacks. For instance, in March 2024, a cyber espionage campaign breached India’s government and energy sectors, highlighting the urgency of robust measures against cyberattacks.

- Africa’s rapid economic growth has led to increased demand for internet and digital services, but the development of laws and regulations regarding cybersecurity has not kept pace. Cyberattacks, such as plans uncovered by an Indian cybersecurity firm involving hacking groups targeting the G20 summit, threaten critical information infrastructure and demand immediate action to strengthen protection measures.

- Indonesia’s digital transformation has brought opportunities and convenience but also heightened risks of cyberattacks. Close to one billion traffic anomalies associated with potential cyberattacks were recorded in 2022, emphasizing the need for proactive measures to safeguard digital assets.

Impact of cyber espionage

- 1. Can disrupt operations, leading to shipment delays, lost sales, and decreased productivity.

- 2. Can result in financial losses from stolen sensitive data, operational disruptions, and the costs of recovery and repair.

- 3. GCPL, with an emphasis on customer satisfaction, places great importance on brand reputation to attract and retain customers. Cyber espionage can erode trust and tarnish the brand, affecting customer retention and acquisition.

- 4. Breaches can also lead to legal liabilities if negligence is proven in protecting customer data or if data protection regulations are violated.

- 5. Our competitive edge lies in proprietary technology and manufacturing processes. Cyber espionage poses a risk of intellectual property theft, impacting our differentiation from competitors.

Mitigation action

To proactively identify and address security weaknesses, we conduct regular vulnerability assessments (VA), penetration testing (PT), breach simulations, and red teaming exercises. These structured processes have enabled us to uncover specific vulnerabilities and prioritise remediation. All identified gaps over the past year have been addressed through the deployment of targeted cybersecurity solutions, including:

- 1.Endpoint Protection: Implemented Data Loss Prevention (DLP) controls for end-user devices, email, web traffic, and cloud storage (e.g., OneDrive) to prevent sensitive data leakage.

- 2.Network Access Control (NAC): Strengthened compliance with Networking Standards and restricted unauthorised network access through NAC implementation.

- 3.Log Retention: Deployed a centralised log retention solution to meet regulatory requirements, ensuring availability of database and application logs for the mandated 180-day period under CERT-In guidelines.

- 4.Data Backup: Rolled out controls and solutions to enable secure backup of end-user data, reducing the risk of data loss or corruption due to system failures.

- 5.Web Application Security: Initiated rollout of a Web Application Firewall (WAF) to protect against web-based threats such as injection attacks and cross-site scripting. While progress is ongoing, the full deployment is not yet complete, and some areas remain temporarily exposed.

We continue to invest in cybersecurity technologies, reinforce policy compliance, and enhance organisational awareness as part of our commitment to protecting our digital infrastructure and minimising cyber risk exposure.

We have also prioritized the cultivation of a cybersecurity-aware culture among our employees, fostering responsible security behaviour and strengthening our overall resilience. Our systems are ISO 27001 certified. We implement data leak prevention measures with the deployment of a Governance, Risk, and Compliance (GRC) tool which has enhanced GCPL’s ability to manage and mitigate risks effectively while ensuring regulatory compliance. We have also improved our BitSight score to 790, indicating the Company is maintaining a high level of cybersecurity posture.

We have taken key actions such as

- Over 90% of all employees have been provided awareness training on data leak prevention. Employees have also completed the Acceptable Use Policy Signoff and Annual Security eLearning, contributing to ongoing improvement in our security culture maturity model.

- The ISO 27001:2022 certification underwent annual surveillance audits, and we continue to be insured for INR 100 crore for cyber & crime insurance coverage across all Godrej Industries Group companies.

- We reported a 65% decrease in recurring cyber vulnerabilities and took down over 40 fraudulent domains.

These measures, among others, ensure we are well-prepared to manage cyber espionage effectively while maintaining operational efficiency and productivity.

Our TCFD report

Climate change presents risks and opportunities for the global economy, affecting businesses in various sectors. Clear information about these climate-related factors is crucial for informed decision-making by investors, markets, and consumers. For consumer goods companies like ours, climate risks and opportunities are influenced by factors such as changing climate patterns, policy shifts toward a low-carbon economy, and evolving consumer perceptions.

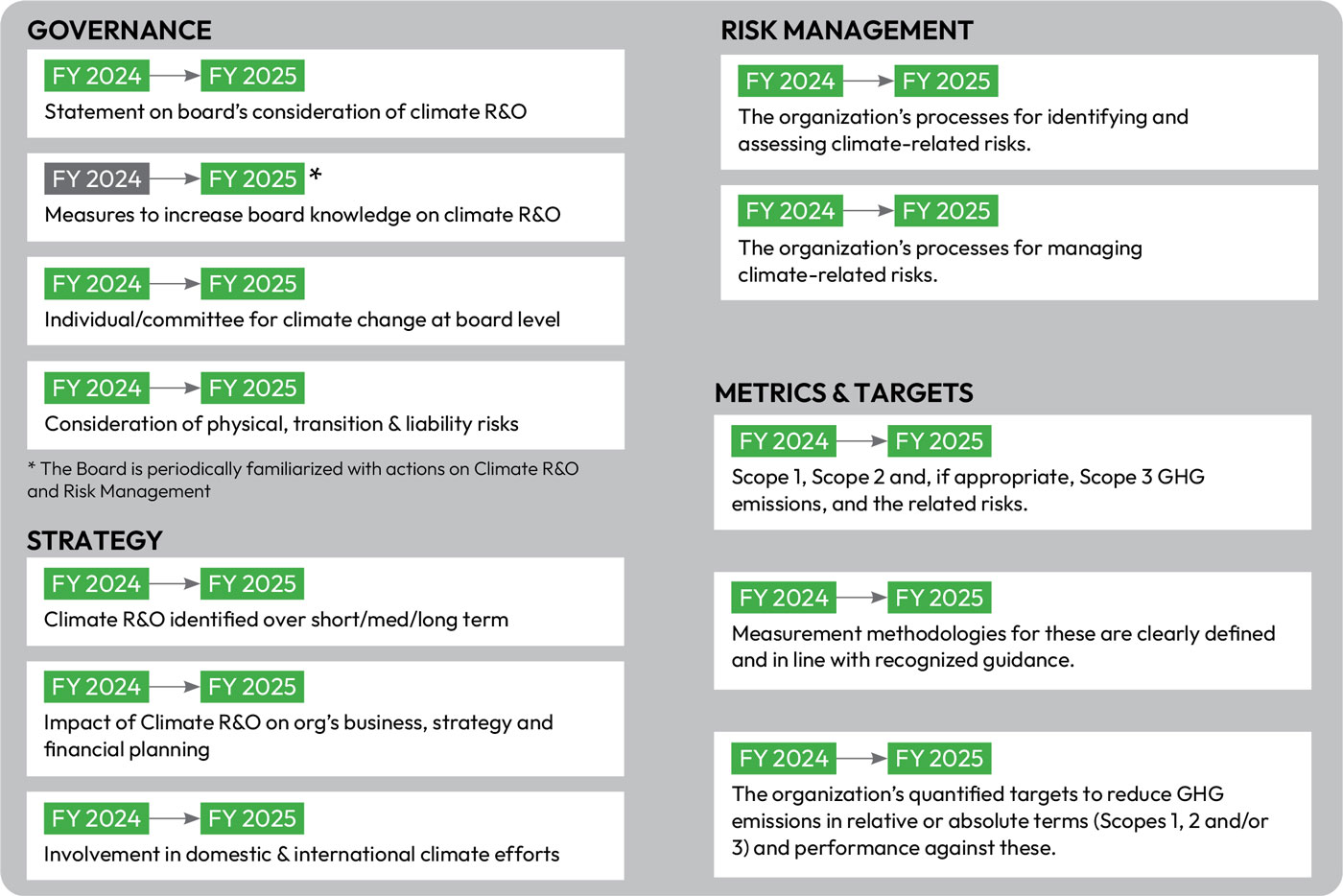

The TCFD framework guides organizations in disclosing climate-related financial information, helping them communicate threats and mitigation strategies effectively. These disclosures position companies as market leaders, enhancing stakeholder communication and strengthening business strategies. The framework includes four pillars: Governance, Strategy, Risk Management, and Metrics and Targets, with 11 recommended disclosures that help stakeholders understand how companies address climate-related issues.

We consistently report our climate change strategies through Integrated Annual Reports, CDP, and DJSI disclosures. However, we’re aligning our disclosures more closely with the TCFD framework in the current reporting cycle. This includes information on climate governance, risk assessment, mitigation strategies, scenario analysis, metrics, and targets. We’re also preparing our first standalone TCFD report.

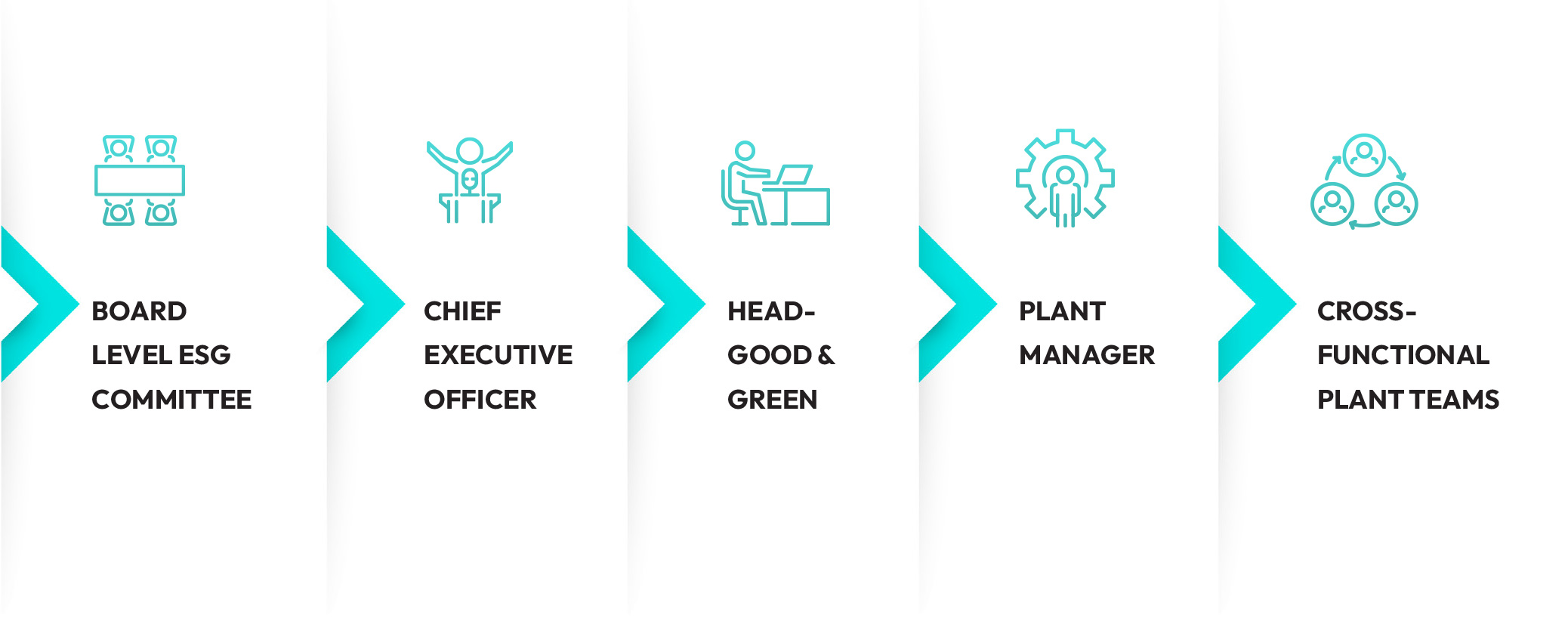

Governance

Our governance structure, depicted in Figure xx, is well-defined, encompassing the Board and management to address emerging risks such as climate change. Key stakeholders actively engage and strategize on these risks, ensuring effective governance mechanisms are in place.

The TCFD framework recommendations

Governance

Report on the organization’s

governance mechanisms involving

climate-related risks and opportunities.

Strategy

Report on the potential impacts

of climate-related risks and

opportunities on the business,

strategy, and financial planning.

Risk management

Report on how the company

identifies, assesses, and

manages climate-related risks.

Metrics and targets

Report on the metrics and targets

used to assess and manage

relevant climate-related risks

and opportunities.

Core elements of recommended climate-related financial disclosures

Board’s Oversight of Climate

Risks and Opportunities

The Board takes an active role in overseeing climate-related matters within the organization to ensure strategic alignment with sustainability goals. The Managing Director and CEO play a pivotal role in approving climate strategies and regularly reviewing sustainability performance using key indicators on a quarterly basis. To enhance accountability and performance, an annual mid-year review of Operating Plans is conducted across all organizational levels. Additionally, a dedicated Board-level Sustainability Committee, led by the Chair of the Board, is tasked with overseeing sustainability performance and providing strategic guidance on climate-related issues, demonstrating a top-down commitment to environmental responsibility.

Management’s Integration of

Climate Oversight

Climate risks and opportunities are seamlessly integrated into day-to-day operations at the plant level, ensuring that sustainability considerations are embedded into every aspect of our activities. Each facility’s Operations team is actively engaged in meeting annual sustainability targets, thereby contributing to the achievement of long-term climate goals set by the organization. In India, our operations are primarily centralized in Mumbai, with production facilities strategically located in four regional clusters to optimize efficiency and minimize environmental impact. To drive local implementation of climate initiatives, each cluster appoints a dedicated Green Champion who collaborates closely with factory teams to implement measures such as energy efficiency improvements and renewable energy projects. For example, in India, production facilities based in four regional manufacturing clusters: North, South, Central, and North Eastern clusters. Each cluster has a Green Champion to coordinate with the respective plant teams that involve members from production, maintenance, and electrical departments. These teams lead implementation of climate-related measures, such as implementation of renewable energy projects. We are leveraging modern technology and use a cloud-based monitoring platform to track and report on sustainability performance on a monthly basis, enabling real-time visibility and informed decision-making to drive continuous improvement in our environmental performance.

Climate risks and opportunities are seamlessly integrated into day-to-day operations at the plant level, ensuring that sustainability considerations are embedded into every aspect of our activities. Each facility’s Operations team is actively engaged in meeting annual sustainability targets, thereby contributing to the achievement of long-term climate goals set by the organization. In India, our operations are primarily centralized in Mumbai, with production facilities strategically located in four regional clusters to optimize efficiency and minimize environmental impact. To drive local implementation of climate initiatives, each cluster appoints a dedicated Green Champion who collaborates closely with factory teams to implement measures such as energy efficiency improvements and renewable energy projects. For example, in India, production facilities based in four regional manufacturing clusters: North, South, Central, and North Eastern clusters. Each cluster has a Green Champion to coordinate with the respective plant teams that involve members from production, maintenance, and electrical departments. These teams lead implementation of climate-related

measures, such as implementation of renewable energy projects. We are leveraging modern technology and use a cloud-based monitoring platform to track and report on sustainability performance on a monthly basis, enabling real-time visibility and informed decision-making to drive continuous improvement in our environmental performance.

Our Sustainability and CSR head, the highest c-suite level management executive, are responsible climate targets of achieving scope 1 & 2 net-zero emissions by 2035. Along with this 15% of our senior management’s goal sheets are now dedicated to people & planet goals. Their KPIs include doubling energy efficiency by 2030 in with our EP100 commitment (w.r.t baseline of 2012), increasing renewable energy share and energy and emission intensity year-on-year in line with net-zero by 2035 targets. Each of our manufacturing clusters have plant cluster heads and green champions (sustainability officers) to look after performance of the plants on climate change front along with plant operations.

Governance structure

In addition to incentives, GCPL provides quarterly awards at the company level and annual awards at the group level to recognize the best performing individuals and teams in sustainability efforts. These awards serve to motivate and reward outstanding contributions towards environmental responsibility. The following members are entitled to these incentives:

| Entitled to incentives | Incentivisation details |

|---|---|

|

Head - Good & Green |

At the Godrej Industries Group level, green goals are established, and the best-performing companies are acknowledged during the annual awards ceremony. The Head of Good & Green is tasked with overseeing GCPL’s performance in meeting its climate change objectives. |

|

Business Unit Manager |

Business Unit Managers are incentivized based on their performance against objectives set at the commencement of each financial year. These goals encompass both operational efficiency and climate action initiatives aimed at reducing environmental impact. |

|

Green Champion |

Green Champions are recognized and rewarded for their contributions to projects aimed at addressing climate change issues within the organization. Their efforts play a crucial role in advancing sustainability practices and fostering environmental responsibility. |

|

Process Operation Manager |

Operation Managers are acknowledged and incentivized for implementing improvements in the manufacturing process aimed at reducing emission intensity. Their efforts contribute to mitigating the environmental footprint of the company’s operations and advancing its climate change goals. |

Strategy

We remain committed to integrating climate change into our business strategy. We’ve established systems to connect climate change with our strategic goals and integrate related risks and opportunities into our Enterprise Risk Management (ERM) framework.

Climate change scenario analysis involves evaluating potential outcomes to assess associated risks and opportunities. The TCFD framework recommends considering various scenarios, including one aligned with the ambitious targets of the 2015 Paris Agreement (1.5°C future) and a business-as-usual (BAU) scenario, highlighting physical risks like flooding and heat waves. Transitional risks and opportunities arise as organizations move towards a low-carbon economy.

We’ve examined two Shared Socioeconomic Pathways (SSPs) provided by the International Panel on Climate Change: SSP-1 aligns with Representative Concentration Pathway (RCP) 2.6, and SSP-5 aligns with RCP-8.5. We’ve chosen the timeframe of 2030 for analysis to align with global development objectives, including the Sustainable Development Goals (SDGs), ensuring relevance to ongoing sustainability efforts.

SSP

SSP-1

Sustainability: Taking the Green Road (Low challenges to mitigation and adaptation)

SSP-5

Fossil-fuelled development: Taking the Highway (High challenges to mitigation, low challenges to adaptation)

Narrative

This is the Paris Agreement-aligned scenario where the world shifts towards sustainable development, improved global commons management, reduced inequality, and low material growth.

This is the BAU scenario, where investments towards sustainability plateau, economic development staggers, and environmental degradation increases.

To assess physical risks, we modelled water scarcity, temperature, and precipitation variables under SSP-1 and SSP-5. We used tools such as the World Bank Climate Change Knowledge Portal and WRI Aqueduct to

To assess physical risks, we modelled water scarcity, temperature, and precipitation variables under SSP-1 and SSP-5. We used tools such as the World Bank Climate Change Knowledge Portal and WRI Aqueduct to collect data from 2020 to 2039. As a result, we’ve identified prioritized facilities likely to experience severe climate impacts, including Katha, Puducherry, Guwahati, and Karaikal.

collect data from 2020 to 2039. As a result, we’ve identified prioritized facilities likely to experience severe climate impacts, including Katha, Puducherry, Guwahati, and Karaikal.

Way forward for

addressing physical risks

Our TCFD assessment covered all our operations including the new manufacturing sites that are coming up. As defined by the framework, we consolidated a repository of risks through site-level surveys, peer review and stakeholder consultation. Moreover, we identified opportunities in transitioning to a low-carbon economy.

We sored each risk/opportunity using a 4-factor analysis by taking product of ‘Likelihood’, ‘Impact’, ‘Vulnerability’ and ‘Speed of Onset’. 4-factor risk which involves vulnerability and speed of onset, in addition to likelihood and impact, is more practical for climate change, owing to the nature of adaptability and time dependence of the realized effects. All the risks were then ranked to evaluate prioritised or material climate risks. We examined key parameters such as temperature, water scarcity, and precipitation, all of which will have a crucial role in shaping the impact of climate change on our business.

Our businesses are particularly vulnerable to climate-related risks, such as supply chain disruptions, increased cost of upstream and downstream operations, and regulatory penalties. Our largest pool of consumers is in tropical countries such as India, Indonesia, and Africa, and all these countries are witnessing significant impacts of climate change such as unpredictable weather and scanty or excessive rainfall. From our assessment, we have determined that the potential ramifications of climate change will be particularly pronounced in our operational location in India at Karaikal, Katha, and Guwahati manufacturing sites and have a plan in the next 3 years to address these risks.

We have already started taking necessary steps to address the potential risks. For example, for water availability, we have incorporated rainwater harvesting system at all our manufacturing facilities to improve groundwater table. In these water stress areas, we have developed required infrastructure so that the communities don’t suffer due to lack of water. Besides, we are working with farming communities in four villages covering an area of 3300 Ha in implementing integrated watershed management programme.

To begin with climate strategy on mitigation and adaptation, we have considered Katha, Karaikal, Guwahati, and Puducherry for further detailed assessments. The focus will be on identifying cluster/facility-specific hotspots. This will help the company to improve supplier engagement, reduce greenhouse gas (GHG) emissions across the value chain, and consequently, lower operational and reputational risks.

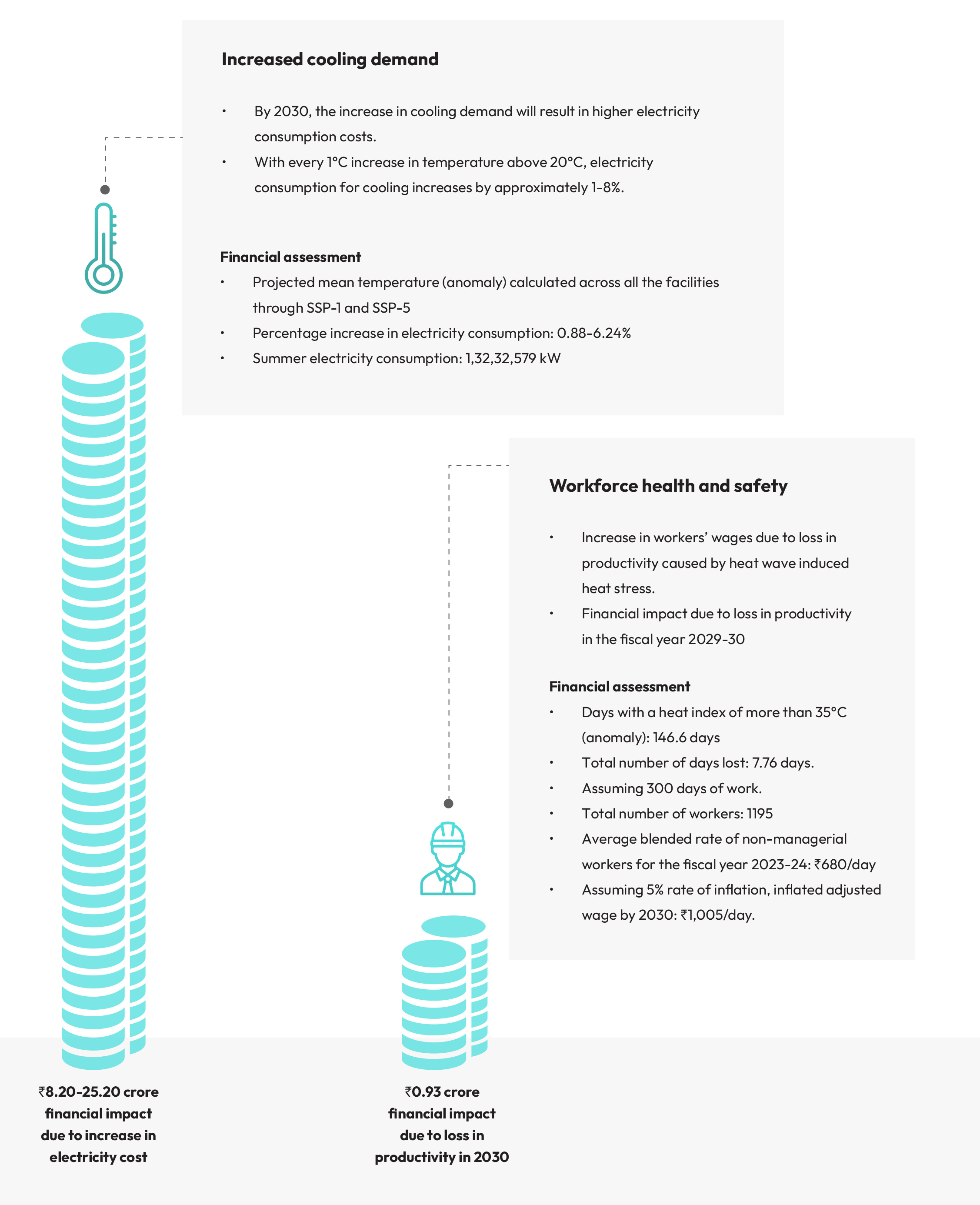

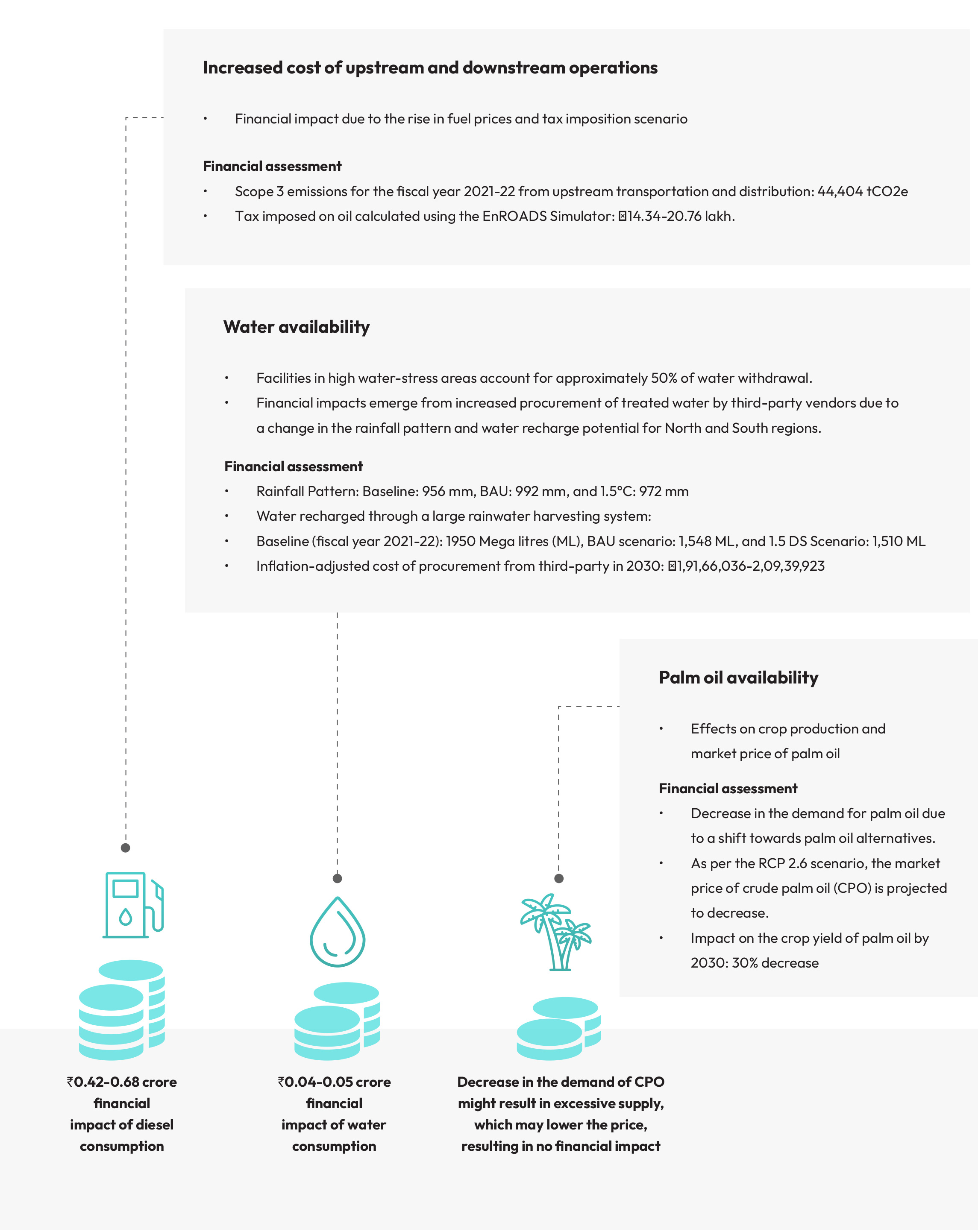

The transition risk scenario analysis involved a thorough sectoral review to evaluate potential risks and opportunities. We utilized the EnROADS Simulator, developed by MIT Sloan and Climate Interactive, to model low-carbon economies aligned with the Well Below 2 Degrees (WB2DS) and 1.5°C futuristic scenarios. Through this analysis, the following risks and opportunities were identified:

These identified risks and opportunities carry financial implications for the consumer goods sector. To assess their impact, we further evaluated the financial implications of

These identified risks and opportunities carry financial implications for the consumer goods sector. To assess their impact, we further evaluated the financial implications of prioritized risks. Specific risks with significant financial impacts are summarized on the next page.

prioritized risks. Specific risks with significant financial impacts are summarized on the next page.

Financial impact of climate-related risks

Financial impact of climate-related risks on the company

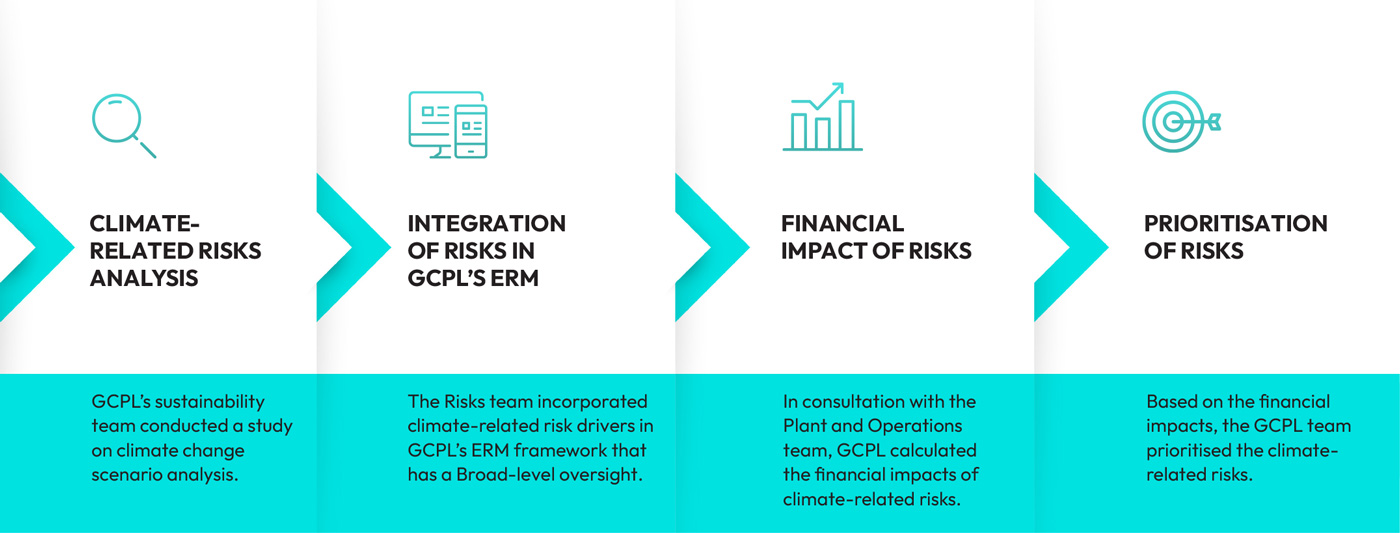

Risk management

Our risk management process begins with a materiality assessment, where material issues are identified through stakeholder engagement and secondary research. We utilize a methodology that involves identifying issues across six capitals, engaging with over 450+ stakeholders, and developing a materiality matrix using specialized tools for issue prioritization. All stakeholder groups play a significant role in influencing our overall performance and operations.

Climate change is one of the material issues identified through this assessment, and it is integrated into our ERM. The Board-level Risk Management Committee and our Risk Management team oversee the risks and mitigation measures related to climate change, along with other key material topics identified. Our risk identification and management processes are aligned with our business strategy. We use analytical techniques such as scenario analysis to identify risks, assess their probability and impact qualitatively and quantitatively, and develop action plans for risk management. These risk mitigation plans are presented to the Board-level Committee

for input and are periodically updated. Climate change-related risks are evaluated alongside other business risks and classified into short-term (1-3 years), medium-term (3-5 years), and long-term (5-7 years) categories.

Climate change is one of the material issues identified through this assessment, and it is integrated into our ERM. The Board-level Risk Management Committee and our Risk Management team oversee the risks and mitigation measures related to climate change, along with other key material topics identified. Our risk identification and management processes are aligned with our business strategy. We use analytical techniques such as scenario analysis to identify risks, assess their probability and impact qualitatively and quantitatively, and develop action plans for risk management. These risk mitigation plans are presented to the Board-level Committee for input and are periodically updated. Climate change-related risks are evaluated alongside other business risks and classified into short-term (1-3 years), medium-term (3-5 years), and long-term (5-7 years) categories.

The risk mitigation strategy translates into action plans at two levels:

- Business level: We develop our sustainability strategy at the business level to manage major risks such as climate change and water-related risks. Progress on risk mitigation is monitored daily, monthly, quarterly, semi-annually, and annually.

- Site/plant level: The business strategy is cascaded down to the plant level, where action plans are created for each plant. Daily and monthly meetings are conducted to review progress.

We have established a comprehensive and structured approach to risk management, involving Board-level oversight, a dedicated Risk Management Committee, and a cross-functional team within the business to routinely assess risks across the company.

We actively seek feedback from employees through informal forums, discussions, and annual planning conferences to improve risk management practices. Regular open forums and monthly review meetings are also held to understand climate-related risks and develop mitigation measures.

Integrating climate-related risks in GCPL’s ERM system

A Journey to Maturity of TCFD Disclosure

As part of our ongoing commitment to climate transparency, here is our TCFD Maturity Map FY 2025. This showcases our progress and dedication to aligning with the TCFD framework in a clear and structured manner.

LIMITED MATURITY

MODERATE MATURITY

FULL MATURITY

Metrics and targets

We identify, record, and monitor key performance metrics authentically, which helps to analyze our organisation’s operational performance and establish goals and targets for continuous enhancement. A robust data management system is maintained to accurately record our performance and inform strategic decision-making.

Aligned with our Group’s vision and goals, we have established five objectives known as the ‘Greener India Targets,’ aimed for achievement by the year 2025-26. Below is a breakdown of these goals, our approach toward achieving them, and our progress during the reporting period:

| Focus area | Goal | Approach | Fiscal year 2024-25 performance |

|---|---|---|---|

|

Energy |

|

|

|

|

Emissions |

|

|

|

|

Water |

|

|

|

|

Waste |

|

|

|

Public Policy and Climate

Advocacy at GCPL

At GCPL, we understand the vital role businesses play in shaping public policy, particularly concerning climate change. In alignment with our commitment to sustainability and corporate responsibility, we actively engage in corporate climate advocacy and play a constructive role in the global effort to combat climate change and its impacts. We are committed to supporting climate policies in line with the Paris Agreement, limiting the global temperature increase to 1.5°C.

Trade Association Memberships and Policy Advocacy:

We believe in the power of strong industry associations and memberships for collective growth and resilience. These partnerships provide us with a platform to share knowledge, foster innovation, and address key industry challenges effectively. Through our Corporate teams, we advocate directly to policymakers and indirectly through trade associations on strategies that promote our transition to a low-carbon economy. We promote:

- Development of solutions to achieve circular economy for plastic packaging

- Transparent reporting on climate impact

- Incentives for decarbonisation

- Development of responsible value chain

- Behaviour changes at consumer-level

- Respect the principles of just transition

For direct advocacy, we regularly provide our industry response to draft discussion papers issued by national governments, or global committees like Science Based Targets Initiative (SBTi). We also promote safe use of household insecticides in India

by demanding to stop on buying or selling of illegal mosquito repellent incense sticks laced with unapproved harmful chemicals. This can cause health issues such as asthma, bronchitis, reactive airways disease and other respiratory ailments.

For direct advocacy, we regularly provide our industry response to draft discussion papers issued by national governments, or global committees like Science Based Targets Initiative (SBTi). We also promote safe use of household insecticides in India by demanding to stop on buying or selling of illegal mosquito repellent incense sticks laced with unapproved harmful chemicals. This can cause health issues such as asthma, bronchitis, reactive airways disease and other respiratory ailments.

For advocacy through trade associations, we represent our views on how industry and governments can best align with the aims of the Paris Agreement and focus on both policymaking and policy outcomes that will help us achieve that.

To ensure that our policy advocacy is conducted with integrity and credibility, we have established robust management structures and processes:

- 1. Database of Memberships: We maintain a centralized database of all trade association memberships, detailing the purpose of each association, our representatives, membership fees, and the value derived from each membership. This enables us to track the effectiveness of our engagements and ensure alignment with our business strategic goals.

- 2. Regular Reviews: We conduct regular reviews of our memberships and associations to assess the value derived from each engagement. These reviews help us determine whether our memberships continue to align with our evolving business objectives.

- 3. Functional Oversight: The senior leadership of our business functions are responsible for managing trade association memberships within their areas of responsibility. They ensure that memberships contribute to their function’s objectives and manage departmental representation in these associations. For example, our Global R&D team leads our association with CII’s India Plastic Pact that aims to find solutions and innovate to drive the transition towards a circular economy for plastic packaging.

- 4. Internal Audit Compliance: Our Internal Audit team rigorously monitors all activities related to association memberships to ensure compliance with legal requirements, ethical standards, and company policies. This ensures that our engagements uphold the highest standards of integrity and transparency.

Through our active participation in trade associations and advocacy efforts, we are committed to drive a positive change and contributing to a sustainable, net-zero

future. We welcome policies that incentivize carbon emissions reduction and support initiatives that align with our operational areas, fostering a more sustainable and resilient business ecosystem.

Through our active participation in trade associations and advocacy efforts, we are committed to drive a positive change and contributing to a sustainable, net-zero future. We welcome policies that incentivize carbon emissions reduction and support initiatives that align with our operational areas, fostering a more sustainable and resilient business ecosystem.

We have made no contributions to any political parties in FY 2024-25.

The following are the list of our industry associations for FY 2024-25:

| Sr. no | Name of the trade and industry chambers/ associations |

Reach of the trade and industry chambers/ associations | Position | Membership fees (INR) |

|---|---|---|---|---|

| 1 | The World Business Council for Sustainable Development | Global | Executive Committee | 45,31,015 |

| 2 | Confederation of Indian Industry | India | Founding member - India Plastics Pact, Chair - CAG on Films and Flexibles | 37,52,597 |

| 3 | United Nations Global Compact Network | Global | Member | 12,47,100 |

| 4 | The Market Research Society of India | India | Member | 5,63,145 |

| 5 | Advertising Standards Council of India | India | Member | 5,25,000 |

| 6 | The Indian Society of Advertisers | India | Executive Council | 5,00,000 |

| 7 | Indian Beauty & Hygiene Association | India | Executive Committee | 5,00,000 |

| 8 | EcoVadis | Global | Member | 2,09,804 |

| 9 | Home Insect Control Association | India | Director | 2,00,000 |

| 10 | Federation of Indian Chambers of Commerce & Industry | India | Member | 11,000 |

| 11 | Bombay Chambers of Commerce | India | Member | 8,500 |

| Total | 1,20,48,160 |