Financial

capital

Manufactured

capital

Intellectual

capital

Key enablers

- Global category

structure - Enhanced, digitally enabled

consumer insights

- Democratising

our brands - Enhancing

go-to-market

- Laying the foundation for future growth possibilities

Risks identified

- Inflation and currency devaluation

- Commodity price volatility

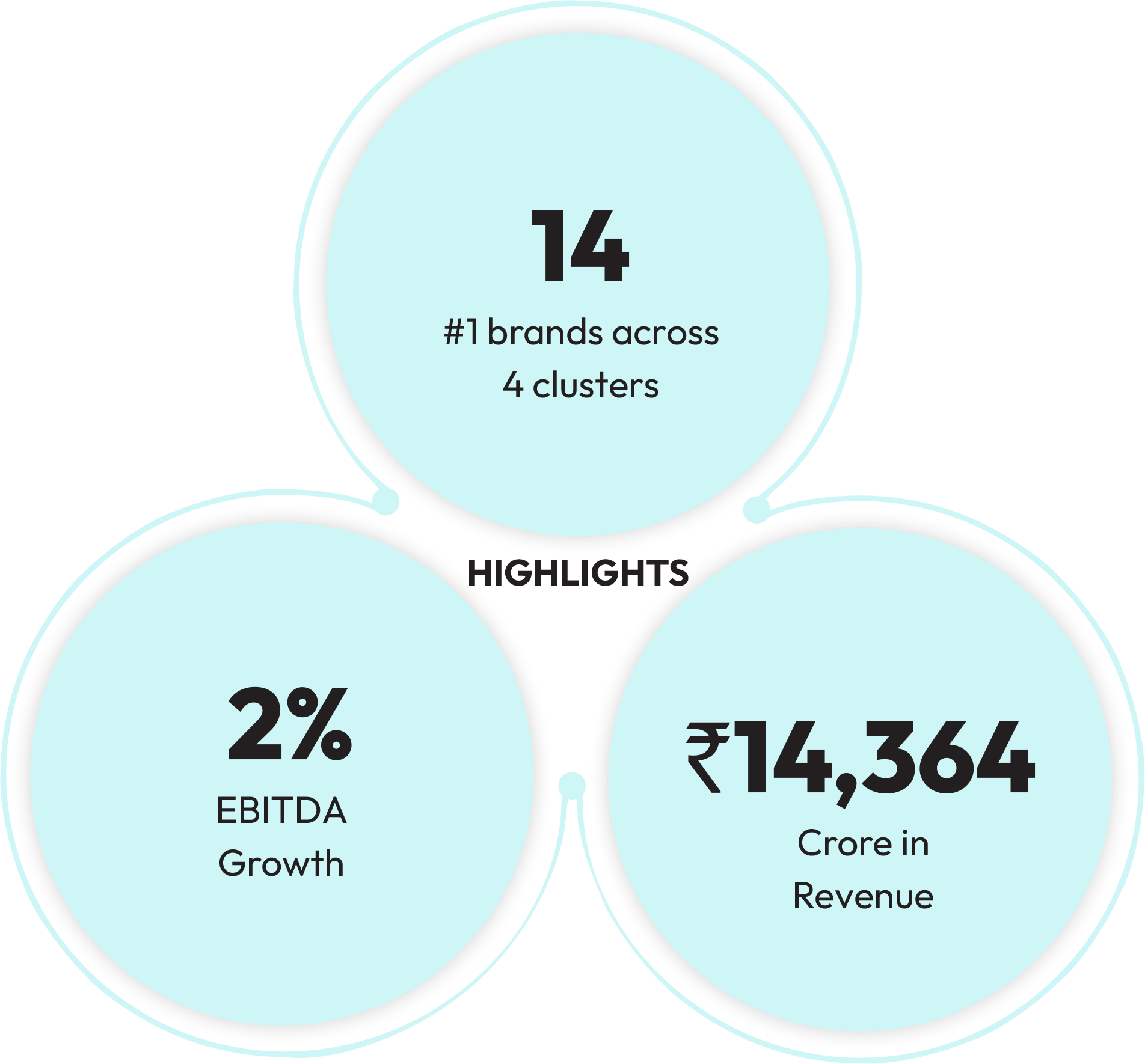

We aim for steady, double-digit volume growth by leveraging our market

leadership and expanding our category reach, ultimately creating lasting

value for all stakeholders.

Our chosen

portfolio

Our passion lies in delivering high-quality, affordable, and beautifully designed products with consumers at the core. As industry leaders, we focus on innovation-driven growth, continuously enhancing our portfolio to meet evolving consumer needs. Accessibility and quality remain our priorities, especially in emerging markets where we have a strong presence.

Our footprint spans some of the largest and fastest growing emerging economies globally. However, key categories like Household Insecticides, Air Care, and Hair Colour remain underpenetrated , presenting significant growth potential. We view this as an opportunity to apply our expertise in product development, communication, and activations to create value. Our innovations – GoodKnight Agarbatti,

Our footprint spans some of the largest and fastest growing emerging economies globally. However, key categories like Household Insecticides, Air Care, and Hair Colour remain underpenetrated , presenting significant growth potential. We view this as an opportunity to apply our expertise in product development, communication, and activations to create value. Our innovations – GoodKnight Agarbatti, Godrej AerO, Godrej Fab liquid detergent have delivered strong success in the initial years, and present significant growth potential.

Godrej AerO, Godrej Fab liquid detergent have delivered strong success in the initial years, and present significant growth potential.

Our goal is to achieve consistent, industry leading volume growth by leveraging our existing market leadership and expanding our category reach, ultimately benefiting all stakeholders in the long term.

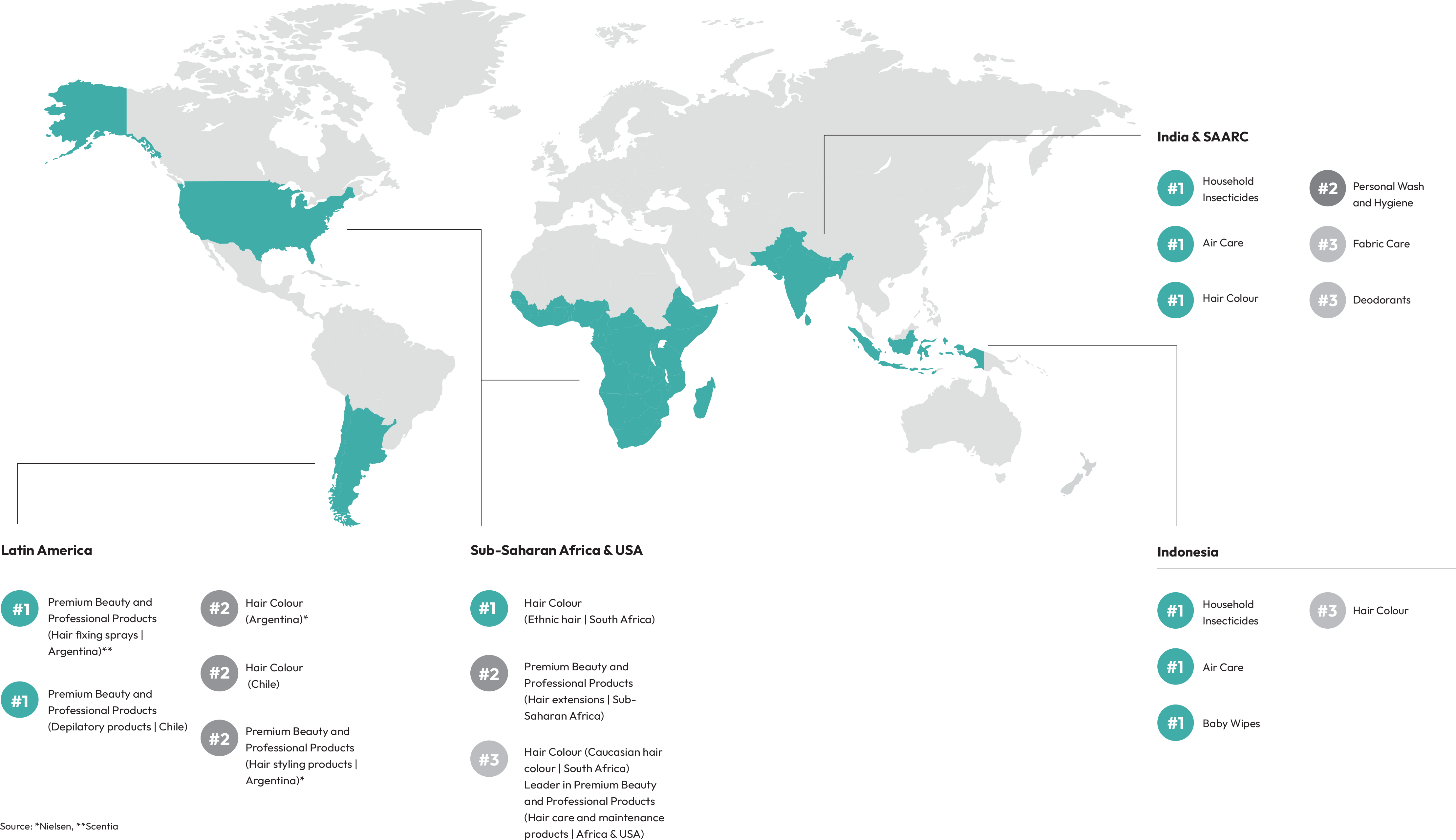

India & SAARC

- Launched van distribution program for expanding direct rural outreach to cover ~2.5X villages

- Set up new chemist and cosmetic sales channel for accelerated growth

- Scaled the GoodKnight franchise in Bangladesh with formulation changes, access pack and sampling program

- E-commerce in India continued to be the fastest growing channel at >25% growth

- Improving productivity of sales manpower by driving in-market discipline with tech interventions

- Geotagging of all general trade outlets in India, enabling optimal utilisation of our resources

Indonesia

- Outsourced the entire distribution for general trade to large-scale distributors to reduce operational complexity, significantly increase direct coverage, and reduce the cost of operations.

- Launched multiple initiatives to leverage digital technologies and build closer connections with different partners.

Our robust product lineup in Home and Personal Care enables us to deliver health and beauty benefits to consumers in emerging markets. Our category development initiatives have continued

to deliver strong penetration gains in FY 2024-25. In Indonesia and Bangladesh, Liquid Vaporizer has gained ~200 bps of penetration in 2 years, growing at high double digit volume growth. In India, our mini Godrej Expert Rich Crème has contributed to a hair color penetration increase of ~1000 bps. We will continue to invest in category development to boost growth in our current categories and generate long-term economic value.

Our robust product lineup in Home and Personal Care enables us to deliver health and beauty benefits to consumers in emerging markets. Our category development initiatives have continued to deliver strong penetration gains in FY 2024-25. In Indonesia and Bangladesh, Liquid Vaporizer has gained ~200 bps of penetration in 2 years, growing at high double digit volume growth. In India, our mini Godrej Expert Rich Crème has contributed to a hair color penetration increase of ~1000 bps. We will continue to invest in category development to boost growth in our current categories and generate long-term economic value.

As we innovate in emerging categories, we will prioritize expanding the reach of our flagship products and categories, which boast high profitability and growth potential as market leaders. This involves intensifying marketing and distribution efforts to significantly boost volume growth over the next five years across all our markets.

Africa & USA

- Strong emphasis on e-commerce in the USA, which constitutes

- ~7% of the total business

- In West Africa, we shifted to the outsourced distribution model with a national distributor

Our globalisation strategy

A broad emerging

markets portfolio

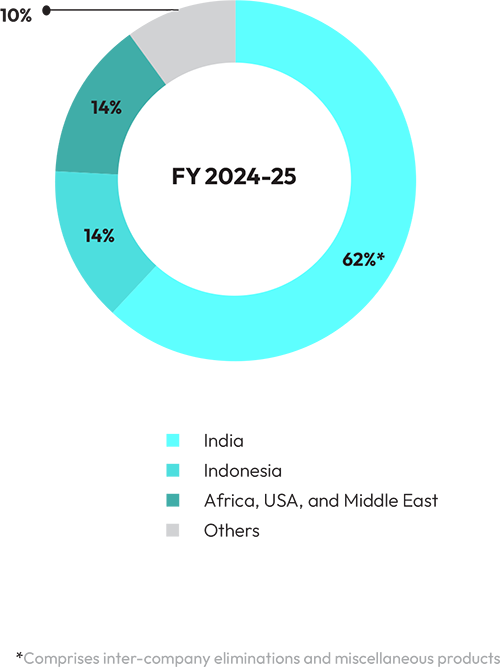

In the FY2024-25, 38% of our total revenue was

generated from international operations.

Geography Salience

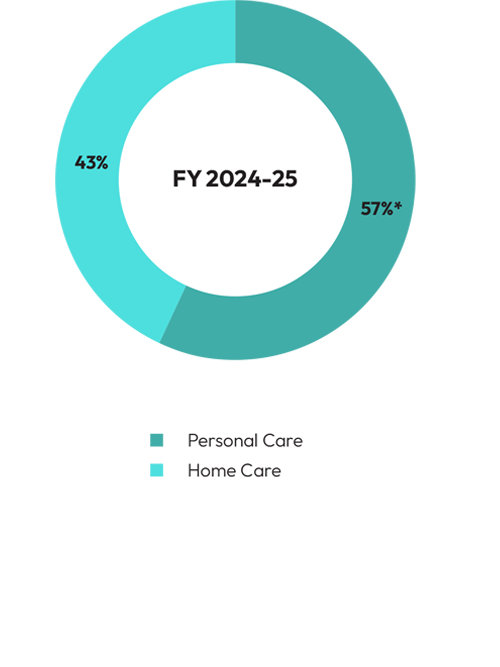

Category Salience

Portfolio of our

power brands

₹1,000 crore+

₹500 crore+

Strengthened brand positions

across key markets and geographies

Renewed global category structure

In FY 2021-22, we introduced a refreshed global category framework to drive innovation and strengthen brand equity across our core segments: Household Insecticides, Air Care, Hair Colour, and Hygiene. This structure is designed to enhance product development (innovation and renovation) and brand strategy (positioning and communication), anchored in three key value drivers:

Coherent global strategy and cross-geography synergies

- Expanding Flagship Products: Goodknight Liquid Vaporizer, a longstanding market leader in India, is scaling its presence across Indonesia, Bangladesh, and Nigeria.

- Localized Adaptations: Godrej Shampoo Hair Colour, originally launched in India, has successfully entered Indonesia with customized product formulations, packaging, and positioning while retaining its core technology.

- Cross-Market Product Expansion: We have successfully introduced Aer Matic from Indonesia to India, while Aer Power Pocket is now expanding from India to Indonesia, Bangladesh, Middle East and Latin America.

- These three Indian products have emerged as global blockbusters, registering a 60% year on year growth in international markets.

Scaling up products across our

categories and geographies

Deeper capability on product and

communication development

We are strengthening our global innovation and renovation pipeline through a structured stage-gate process, ensuring a robust and future-ready product portfolio. Our focus is on revitalizing core offerings while driving category growth.

To enhance communication effectiveness, we have centralized creative development through in-house teams:

- Creative Lab – Our dedicated media development studio.

- Design Studio – A hub for pioneering design thinking, innovation, and development of new products and solutions across geographies.

We are also standardizing our advertising strategy globally. In Air Care, for example, we leveraged the consumer insight that air fresheners are commonly used during home visits. This inspired our “talking rooms” concept in advertisements, successfully implemented for Aer in India and Stella in Indonesia.

Better alignment across product development and brand equity

We have streamlined our Product and Equity teams, ensuring close collaboration under the direct leadership of the Head of Global Category and Innovation. These teams undergo cross-training in decision-making and functional expertise, fostering a holistic marketing approach.

Brand leaders play a crucial role in driving consistency while adapting to regional market dynamics. By integrating deep consumer insights with global expertise, we create products tailored to evolving preferences across diverse geographies.

Our global presence is a strategic advantage, allowing us to address shared challenges across markets while capitalizing on regional expertise. As part of our commitment to sustainable growth, we are expanding local operations and talent acquisition in emerging markets, leveraging regional knowledge to drive market leadership.

Enhanced, digitally enabled

consumer insights

By adopting a comprehensive perspective on the market landscape and evaluating current performance, emerging trends, and shifts in consumer behaviour, we gain valuable insights into potential future developments for both categories and brands to fulfil customer needs. This

By adopting a comprehensive perspective on the market landscape and evaluating current performance, emerging trends, and shifts in consumer behaviour, we gain valuable insights into potential future developments for both categories and brands to fulfil customer needs. This approach enables us to identify opportunities that create mutual benefits for consumers, brands, and the broader category. From a technological standpoint, we prioritize investments in consumer research and data analytics to anticipate trends and drive category growth.

approach enables us to identify opportunities that create mutual benefits for consumers, brands, and the broader category. From a technological standpoint, we prioritize investments in consumer research and data analytics to anticipate trends and drive category growth.

Consumer obsession:

A sustainability lens

Long-term brand tracking is a vital tool for assessing the alignment of our brand values with consumer sentiment, reflected in awareness, preference, and loyalty. We conduct brand perception surveys to identify key consumer segments, understand their priorities and shopping behaviours, and determine the most effective engagement strategies. These insights deepen our understanding of evolving consumer trends. Traditional brandperception tracking involves the scientific selection of a relevant target audience, typically category users, and conducting in-home surveys to assess brand awareness, perception, and usage, as well as the effectiveness of advertising.

Gathering consumer insights

across various channels

In response to the rapidly changing market landscape, we have embraced a more agile approach. We leverage advanced technologies to continuously monitor brand performance and consumer sentiment, enabling timely adaptations. This includes tracking various metrics, such as awareness, product feedback, usage behaviour, and openness to new ideas.

During the FY 2024-25, we engaged with over 50,000 consumers to assess their perception of our brands. We gathered these insights through multiple channels, both online and offline, including random in-home visits and central-location surveys. This study covered nearly 90% of our brands by revenue.

We have integrated a sustainability lens into our existing surveys to gain deeper insights into

how sustainability influences consumer preferences and perceptions.

We engaged our consumers to:

Assess Attitudes

Toward Sustainability

We sought to understand how sustainability aligns with consumer priorities and values, as well as its influence on brand perception.

Identify Opportunities

for Innovation

We identified opportunities for brand differentiation and competitive advantage, by exploring consumer values and preferences.

Our brand perception survey among individuals aged 21–45 in India included targeted sustainability metrics. Our findings revealed that over 65% of respondents valued ‘reusability,’ while over 30% prioritized ‘reducing plastic waste.’ Consequently, approximately two-thirds of consumers perceived our product as eco-friendly, and we aim to get to 75%.

By adopting an agile approach to brand perception tracking, we strive to keep our brands relevant and appealing. Our objective is to make well-informed decisions that drive long-term growth, enhance our reputation, and contribute to a more sustainable future.

Democratising

our brands

Our core purpose has always been to prioritize consumer needs above all else. To enhance accessibility, we continuously innovate by offering our products in various sizes and price points, ensuring they cater to a wide consumer base.

Smaller value-pack offerings, such as Godrej Expert Rich Mini Crème and Godrej Selfie Shampoo Hair Colour in India, Godrej Magic Handwash in India, and HIT Aerosol in Indonesia, have transformed the market by making our products more affordable and accessible.

Godrej Magic Handwash is our revolutionary hand wash and the world’s first powder-to-liquid handwash. Born out of the need to democratise sanitation and handwashing in India, it’s a sustainable product and available at a very affordable price point starting at just INR 10.

With Godrej Fab, we are leveraging our expertise in the liquid detergent category and making it accessible to everyone, thereby democratising access to quality laundry care. It caters to consumers who seek an enhanced laundry experience at a competitive price point of INR 99 for a litre.

Our Goodknight Agarbatti, priced at an affordable INR 10, is the only government-registered, safe, and effective alternative to illegal incense sticks, helping to formalize the category. By tailoring products to meet specific consumer needs, we strengthen brand loyalty and reinforce our commitment to providing trusted, high-quality solutions.

Godrej Expert Rich Crème (India)

Godrej Magic Handwash (India)

Goodknight Agarbatti (India)

Godrej Fab (India)

Revitalizing market

reach

Making sure that customers can regularly access our products is essential to our objective of attaining more penetration as we expand into emerging areas. In order to reach more consumers, we are constantly growing our distribution networks, paying more attention to underserved or unserved rural and remote markets. In FY 2024-25, we

Making sure that customers can regularly access our products is essential to our objective of attaining more penetration as we expand into emerging areas. In order to reach more consumers, we are constantly growing our distribution networks, paying more attention to underserved or unserved rural and remote markets. In FY 2024-25, we were able to reach 2X villages directly thanks to our van distribution program “Vistaar,” which also allowed us to rapidly grow our direct distribution in rural markets.

We are rapidly increasing our presence across multiple platforms, such as traditional and modern retail channels, e-commerce including quick commerce, and digital marketplaces, to ensure our products are always available to serve our consumers, regardless of where they are located.

were able to reach 2X villages directly thanks to our van distribution program “Vistaar,” which also allowed us to rapidly grow our direct distribution in rural markets.

We are rapidly increasing our presence across multiple platforms, such as traditional and modern retail channels, e-commerce

including quick commerce, and digital marketplaces, to ensure our products are always available to serve our consumers, regardless of where they are located.

Expanding rural outreach through

van disitrbution program.

Our leadership engages with

our partners on ground

Channels of

the future

New technologies are reshaping the sales and distribution landscape, with digital channels growing at more than twice the rate of traditional ones in India. Quick commerce is gaining significant traction, while e-commerce continues to expand across India, Indonesia, and the USA. Additionally, modern trade, Cash and Carry, and the emerging eB2B segment are experiencing steady growth.

In India, we have renewed our focus on kirana stores and neighborhood convenience shops, recognizing their enduring relevance. Similarly, in Africa, the acceleration of proximity shopping has underscored the critical role of last-mile distribution. Future distribution models will be omnichannel, integrating both online and offline sales.

In Bangladesh, efforts remain centred on strengthening the traditional kirana (modir dukaan) network, as modern trade and e-commerce are largely confined to urban areas. Meanwhile, in Sri Lanka, we continue to invest across all key channels, including traditional retail, modern trade, and e-commerce.

Partnerships

Recognizing the interconnected nature of our business ecosystem, we remain committed to strengthening our relationships with suppliers, distributors, wholesalers, and modern trade partners globally for successful delivery. Additionally, we are deepening our engagement with large-scale salons across Africa, fostering strategic partnerships that drive mutual growth and long-term success.

Building partnerships with

salons across Africa

Expanding penetration

and reach

In India, we continue to focus on deepening our penetration in traditional trade. Specifically, we aim to expand our reach in underpenetrated areas of the country by driving rural reach and penetration through the launch of lower priced stock-keeping units in our key categories, which will result in greater accessibility of our products to rural consumers. In the past year, we took a digital-first approach to build the blueprint of our ideal rural coverage. Guided by this blueprint, Project Vistaar has already helped us pin-pointing white-space demand and has already doubled our Rural footprint. The resultant scale-up in in Direct Distribution has widened GCPL’s reach into previously untapped markets. With 100% of our outlets now geo-tagged, we are upgrading our digital stack, integrating next-generation geospatial data science & field activation technology to extend these gains across & future-proof our route-to-market model.

We have experimented with moving the frontline salesforce to third-party payroll & have further digitized our field-market working through launch of Ajna, a WhatsApp integrated tool for on-the-go field force tracking. This has resulted in improved productivity and reduced attrition from 35% in FY 2023-24 to 22% in FY 2024-25. We have now moved 60% of the frontline salesforce to third-party payroll for better controls and plan to continue this transition going forward. Tapping into the emerging opportunity of a growing the chemist & cosmetic channel remains a key strategic lever for us. To achieve this goal, we have created a strong network of pharma/over-the-counter drug/cosmetic distributors, and

We have experimented with moving the frontline salesforce to third-party payroll & have further digitized our field-market working through launch of Ajna, a WhatsApp integrated tool for on-the-go field force tracking. This has resulted in improved productivity and reduced attrition from 35% in FY 2023-24 to 22% in FY 2024-25. We have now moved 60% of the frontline salesforce to third-party payroll for better controls and plan to continue this transition going forward. Tapping into the emerging opportunity of a growing the chemist & cosmetic channel remains a key strategic lever for us. To achieve this goal, we have created a strong network of pharma/over-the-counter drug/cosmetic distributors, and accordingly, created a new revenue stream. This channel helps us expand our reach into the previously untapped chemist and cosmetic outlets and with the addition of the Park Avenue and Kamasutra portfolio our Chemist & Cosmetic Channel has emerged as a significant growth driver. We have added over 1 lakh chemist outlets and 50,000 cosmetic outlets into our direct coverage post the set-up of this channel.

accordingly, created a new revenue stream. This channel helps us expand our reach into the previously untapped chemist and cosmetic outlets and with the addition of the Park Avenue and Kamasutra portfolio our Chemist & Cosmetic Channel has emerged as a significant growth driver. We have added over 1 lakh chemist outlets and 50,000 cosmetic outlets into our direct coverage post the set-up of this channel.

In Indonesia, we have accelerated our go-to-market transformation in general trade by outsourcing direct operations to distributors. This strategic move has significantly reduced operational complexity, freed up our sales team’s bandwidth, and allowed a greater focus on business development activities. Additionally, it has lowered operational costs and expanded our direct coverage. We also launched a door-to-door sampling drive to stimulate demand and educate consumers about our Household Insecticides portfolio.

The performance in FY25 has been promising, with distribution of key product increasing by low double digit growth and a high teens volume growth. Moving forward, we will continue to expand our distribution efforts, focusing on increasing new outlet coverage while maximizing the output of existing distribution channels supported by digital technologies.

In West Africa, where trade is largely unorganized and wholesale-led, we are enhancing last-mile distribution through a direct distribution model with a national distributor and driving salon advocacy. Transitioning to a national distributor has

In West Africa, where trade is largely unorganized and wholesale-led, we are enhancing last-mile distribution through a direct distribution model with a national distributor and driving salon advocacy. Transitioning to a national distributor has streamlined operations and significantly boosted our reach. Additionally, we continued our door-to-door sampling drive in the region to build demand and raise awareness of our recently launched Household Insecticides portfolio while also expanding distribution through modern trade. This has led to a substantial shift in our non-wholesale channel contribution. Looking ahead, we plan to build on this momentum in Nigeria, further strengthening our foundation, and aim to accelerate growth in South Africa to unlock its full potential in the coming years

streamlined operations and significantly boosted our reach. Additionally, we continued our door-to-door sampling drive in the region to build demand and raise awareness of our recently launched Household Insecticides portfolio while also expanding distribution through modern trade. This has led to a substantial shift in our non-wholesale channel contribution. Looking ahead, we plan to build on this momentum in Nigeria, further strengthening our foundation, and aim to accelerate growth in South Africa to unlock its full potential in the coming years

Customer satisfaction measurement

We run an annual customer satisfaction and relationship depth survey to gauge overall customer satisfaction, NPS across geography & categories, and competitor analysis. Over 250 customers/distributors participated in the survey we conducted in FY 2024-25.

| Satisfaction measurement |

FY 2021-22 | FY 2022-23 | FY 2023-24 | FY 2024-25 | FY 2024-25 target |

|---|---|---|---|---|---|

| Net promoter score (NPS = Promoters-Detractors) |

50% | 50% | 51% | 51% | 50% |

| Data coverage | 100 | ||||

Enhancing Consumer Engagement

through Door-to-Door Sampling

Our approach to one-to-one consumer engagement through Door-to-Door (D2D) sampling has evolved significantly, now extending to additional product categories, including Aer Pocket. At the core of our D2D program’s success is the personalized interaction between our promoters and consumers. By engaging directly at consumers’ doorsteps, promoters provide product demonstrations, explain features, and address queries, fostering trust and deeper brand connections.

To maintain consistency and effectiveness across all engagements, we have established robust audit systems and continuous training programs for our promoters. These initiatives equip them with the skills and knowledge needed to deliver informative and engaging experiences with every consumer interaction. Our outreach efforts are expected to reach a significant number

To maintain consistency and effectiveness across all engagements, we have established robust audit systems and continuous training programs for our promoters. These initiatives equip them with the skills and knowledge needed to deliver informative and engaging experiences with every consumer interaction. Our outreach efforts are expected to reach a significant number of consumers nationwide, driving product trials and strengthening brand loyalty. By expanding our efforts into additional product categories, we aim to further enhance consumer relationships and increase product adoption.

of consumers nationwide, driving product trials and strengthening brand loyalty. By expanding our efforts into additional product categories, we aim to further enhance consumer relationships and increase product adoption.

Start of Door-to-Door Sampling in Indonesia

In FY 2024-25, we expanded the program to 10 cities in Indonesia, reaching approximately 3 million consumers through our door-to-door initiative. The conversion rate remained comparable to that of our well-established India business, demonstrating the program’s

In FY 2024-25, we expanded the program to 10 cities in Indonesia, reaching approximately 3 million consumers through our door-to-door initiative. The conversion rate remained comparable to that of our well-established India business, demonstrating the program’s effectiveness. With dedicated resources, ongoing support from the India Centre of Excellence (CoE), and robust audit measurements, we remain committed to investing in and scaling this program, particularly for formats that require market development.

effectiveness. With dedicated resources, ongoing support from the India Centre of Excellence (CoE), and robust audit measurements, we remain committed to investing in and scaling this program, particularly for formats that require market development.

Building tomorrow’s growth:

foundation stones

Enhancing

Efficiencies & Future

Growth Drivers

We are focused on improving efficiencies across the value chain to boost sales productivity, leveraging analytics and technology. Key growth drivers include minimizing sales losses through auto-replenishment systems and optimizing salesforce effectiveness with technological solutions.

Building an

Omnichannel

Strategy

In response to changing shopper trends and environments, we are strengthening our capabilities to meet the demands of omnichannel retailing. This approach involves not only addressing external channel conflicts but also establishing the appropriate internal team structures to serve these channels effectively and with flexibility.

Simplification

for Profitability

In both Africa and the US, we continue to prioritize simplification as a key strategy for driving profitability. Over the past few years, we have significantly reduced the number of factories and SKUs.

Exploring New

Go-to-Market

Formats

In West Africa, we are enhancing our distribution coverage through a direct distribution model with a national distributor.

Transforming

modern commerce

Modern trade is a key driver of growth across various geographies, and we are committed to accelerating its expansion. Key building blocks include account and portfolio prioritization, category management, fill rate improvements, and fostering strong partnerships with customers through joint business planning. In India, we are investing in category management to build emerging categories such as Air Care, Household Insecticides, and Liquid Detergents. Our teams are also sharing best practices in category management from our businesses in Indonesia and Latin America to enhance local capabilities. Additionally, we are focusing on developing modern trade-specific analytics and shopper marketing capabilities.

In Indonesia, modern trade accounts for nearly 63% of our total business, with Minimarket being two customers (Indomaret & Alfamart) contributing half of the Modern

In Indonesia, modern trade accounts for nearly 63% of our total business, with Minimarket being two customers (Indomaret & Alfamart) contributing half of the Modern Trade business. When we transition general trade to distributor model, we continue to service Modern Minimarket through our direct service model. With this focus we manage to improve our service level at 98% and this achievement well appreciated by our key customer. We manage to achieve high single digit growth in flat / no growth modern trade market.

Trade business. When we transition general trade to distributor model, we continue to service Modern Minimarket through our direct service model. With this focus we manage to improve our service level at 98% and this achievement well appreciated by our key customer. We manage to achieve high single digit growth in flat / no growth modern trade market.

In Africa, where modern trade remains crucial, we are leveraging availability, strong in-store presence, and competitive pricing to maximize opportunities, particularly in Africa. In the USA, our entire business is driven by modern trade, with a split between retail and beauty stores. We continue to capitalize on strong channel partnerships, joint business planning, and competitive strategies to drive distribution, secure new product listings, enhance in-store presence, and maintain competitive pricing.

Empowering frontline excellence:

Training & skill development

As the business landscape evolves, equipping our team members with the necessary skills and knowledge to thrive is essential. To support this, we continue to implement a range of capability-building initiatives, which have been enhanced over the past year and transitioned to online platforms for greater accessibility.

In India, our Godrej Sales Academy has been successfully moved online, enabling easy access and on-the-go learning for team members. Similarly, in other regions, we have adopted online training modules to ensure continuous skill development, even in the face of challenging macroeconomic conditions. Along with training, we place a strong emphasis on team engagement and motivation to foster a culture of excellence across all geographies.

Accelerating

e-commerce

The increasing contribution of ecommerce to our India sales revenue created the need for the business to be fully integrated with the overall sales structure. The journey till FY 2022-23 included building capabilities within the team which included a dedicated shopper marketing team, insourcing design and content for better efficiency, automating processes such as order to billing. Externally, we began witnessing the rise of quick commerce. In FY 2023-24 we started defining our ways of working to adapt to the changing dynamics, integrating tech-based dashboards to track on-shelf metrics and building the new categories led by the integration of the Park Avenue and Kamasutra brands.

For FY 2025, we had clear priorities - scaling up innovations and ecommerce forward categories, improving our performance marketing execution and riding on the quick commerce wave. During the year we have partnered to build a consolidated performance marketing dashboard which minimizes manual intervention & provides data-based insights to the team for faster action and improved ROAS. We devised GTM strategies and deployed metrics to track new launches which enabled the success of Cinthol Bodywash, Park Avenues Perfumes and Park Avenue Gift sets. These, along with strategic account partnerships, ensure that these brands continue to see healthy

For FY 2025, we had clear priorities - scaling up innovations and ecommerce forward categories, improving our performance marketing execution and riding on the quick commerce wave. During the year we have partnered to build a consolidated performance marketing dashboard which minimizes manual intervention & provides data-based insights to the team for faster action and improved ROAS. We devised GTM strategies and deployed metrics to track new launches which enabled the success of Cinthol Bodywash, Park Avenues Perfumes and Park Avenue Gift sets. These, along with strategic account partnerships, ensure that these brands continue to see healthy off-takes, better conversion rates and increasing market share. We also witnessed several wins on the existing categories: Godrej AER, Godrej Fab and Genteel witnessing market share gains. At a format level quick commerce grew the fastest, contributing a third to our ecommerce business. Our focus remained engaging with our partners, participating in platform events & closely tracking our assortment linkages.

off-takes, better conversion rates and increasing market share. We also witnessed several wins on the existing categories: Godrej AER, Godrej Fab and Genteel witnessing market share gains. At a format level quick commerce grew the fastest, contributing a third to our ecommerce business. Our focus remained engaging with our partners, participating in platform events & closely tracking our assortment linkages.

For FY 2026, our theme is to continue our explosive growth in a sustainable manner with a razor-sharp focus on profitability. We will further build on the initiatives we identified in FY 2025 to deliver this. Some of these include closely looking at our SKU mix and critically questioning the role of SKUs which are profit-dilutive; sharply measuring our promotional spends and using our performance marketing dashboard to improve the return on our marketing spends. We will also codify our learnings from last year to accelerate new launches planned for the year. On a portfolio front, we remain committed to leading with our homecare, fabric care and fragrances portfolio. Additionally, we recognize the capability of the channel as an engine providing first-hand consumer feedback and geographic trends to the organization and for us, this means continuing our investment in technology to gather some of these insights. An example being pin-code level data for decision making. We will also be looking at technology as a lever to further improve our operational efficiency and are exploring solutions like price modelling and machine-learning based marketing spends allocation.

In Indonesia, we focus on key e-commerce platforms especially quick commerce, where we are fostering joint business partnerships to support new product launches and catalogue development. Our efforts are focused on creating a seamless consumer experience by driving targeted digital activities across both online and offline platforms, from digital awareness to e-commerce purchases.

In the USA, our strengthened e-commerce efforts have led to impressive growth, with e-commerce now accounting for nearly 7% of our overall U.S. business. We have also begun developing e-commerce-only products, catering to large online consumer segments and increasing transaction basket sizes.

Winning in digital commerce

As digital commerce continues to reshape consumer behaviour in India, category-specific strategies have played a critical role in unlocking growth. Across perfumes, bodywash, and home care, tailored approaches to discoverability, convenience, and emerging channels have enabled sharp portfolio scale-ups.

1. Unlocking Perfume Growth through Gifting and Festive Discoverability

Perfumes see nearly one-third of their demand driven by gifting intent, making seasonal peaks like festivals crucial for brand visibility. By aligning perfume promotions with key cultural moments, we were able to drive higher discovery and conversion. Methods such as curated gift packs and high-

Perfumes see nearly one-third of their demand driven by gifting intent, making seasonal peaks like festivals crucial for brand visibility. By aligning perfume promotions with key cultural moments, we were able to drive higher discovery and conversion. Methods such as curated gift packs and high-impact digital visibility across marketplaces ensured relevance during peak intent periods. These efforts not only lifted volume but also reinforced Park Avenue perfumes as a high-affinity gifting category in the e-commerce context.

impact digital visibility across marketplaces ensured relevance during peak intent periods. These efforts not only lifted volume but also reinforced Park Avenue perfumes as a high-affinity gifting category in the e-commerce context.

2. Building Future-Ready Categories via

Quick Commerce

Quick commerce has emerged as a high-potential channel for impulse-led and replenishment-driven categories. Bodywash, a growing category with strong trial potential, was strategically activated on Blinkit with Cinthol Foam bodywash. Impression driven scale up was key to reaching a large base of urban shoppers with instant delivery promises and contextual nudges, we accelerated trials and gained valuable insights into consumer preferences.

3. Meeting Urban Convenience Needs

with HIT Matic

Urban Indian consumers increasingly seek products that offer high efficacy without compromising on convenience—a need that had remained under-addressed in the online home care segment. The scale-up of HIT Matic on Amazon filled this gap effectively. Leveraging sharp interventions in search optimization, enhanced content, and reliable availability, we unlocked latent demand. Positive consumer feedback, reflected in ratings and reviews, further reinforced product trust and helped drive category creation for automatic insecticides.

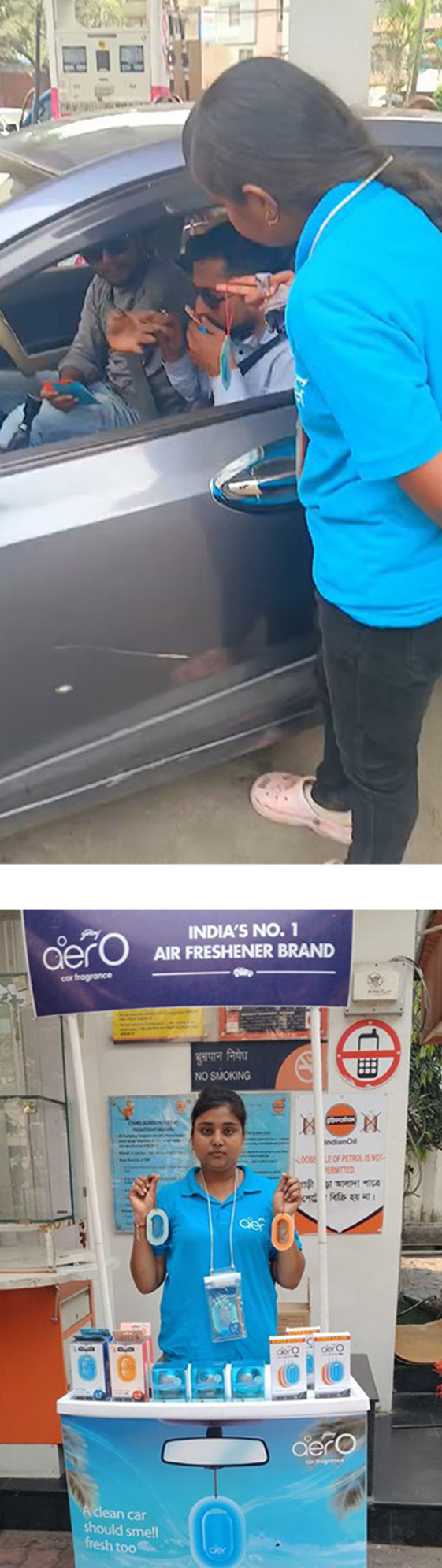

Godrej Aer-O| Generating trails at

scale at Petrol filling stations

Ever since its launch in August 2023, Godrej Aer-O (India’s first branded hanging car air freshener at an attractive price point of Rs. 99) has been at the forefront of driving car freshener adoption among car owners. While we leveraged mass media to create large scale awareness, we decided to drive trials for our unique offering at the most relevant catchment area for the category – Petrol filling stations.

We decided to build upon GCPL’s core strength and sizeable experience of marketing activations, which has been instrumental in helping us drive category adoption for Godrej Aer Pocket and GoodKnight vaporizer liquid. We kickstarted our journey by partnering with India’s leading Maharatna PSU Indian Oil Corporation Ltd. for sampling space at some of their select petrol pump outlets in key metro cities.

We started off by setting up sales counters at designated spaces and by deploying promoters from our talented and well-trained manpower pool. The promoters not only sold from the counters but also moved around petrol dispensers, waiting and filling areas, trying to engage with consumers at every possible touchpoint. They encouraged

We started off by setting up sales counters at designated spaces and by deploying promoters from our talented and well-trained manpower pool. The promoters not only sold from the counters but also moved around petrol dispensers, waiting and filling areas, trying to engage with consumers at every possible touchpoint. They encouraged consumers to experience the unique and stylish hanging format inside their cars, while also showcasing the distinctive and appealing fragrances.

consumers to experience the unique and stylish hanging format inside their cars, while also showcasing the distinctive and appealing fragrances.

The activation turned out to be a major success as it helped engage directly with the most relevant target group, car owners, at scale. While mass media drove awareness, this activation helped address various queries of consumers. The activation clocked higher than benchmark conversion rates and with highly efficient targeting, this activation demonstrated strong cost-effectiveness and impact.

Leveraging our core strengths in experiential sampling-led category development, we have institutionalized the selling model making it easily replicable and ready for rapid scale-up. This initiative is well-positioned to drive Aer-O trials at scale, especially among non-users of car fresheners.

Developing best in class Household

Insecticide products

The financial year of 2024-25 was a major milestone in our Household Insecticide portfolio. We re-launched two of our biggest brands – GoodKnight and HIT.

GoodKnight now, with an indigenously developed molecule – Renofluthrin, has 2X the efficacy of any other liquid vaporiser in India. Kala HIT (Flying Insect Killer) is now 4X powerful with its new molecule – Metofluthrin. We also made it more affordable for consumers by reducing prices upto 20%. Both the products have new sleek and modern packaging to reflect evolving consumer preferences in design.

This is a significant leap in our product portfolio especially because Household Insecticide products take many years to develop and obtain necessary regulatory approvals. We had a large-scale launch event in Mumbai to unveil GoodKnight Flash, followed by a panel discussion with paediatricians and health ministry officials on eradication of vector-borne diseases. The event was attended by ~100 journalists & content creators.

To showcase the efficacy of Renofluthrin, there was a live demonstration of the new GoodKnight Liquid Vaporiser in a glass chamber with mosquitoes. The launch received over 250 features across print, electronic and digital media. We backed these new products with significant investments across TV and Digital media to drive awareness amongst consumers about their benefits. These new launches have been initially well received by consumers, with liquid vaporisers gaining market share and Kala HIT growing volumes.

HIT continues to gain

consumer traction

In Indonesia, HIT continued to build on the momentum of last year’s exceptional performance. Despite a subdued HI season, which resulted in single-digit brand growth, HIT successfully expanded penetration by ~20 bps and gained market share in measured channels.

Liquid vaporizers (LV) continued their growth trajectory, with increased penetration and volume, supported by heightened media investments and targeted distribution initiatives throughout the year. Our ongoing market assessment and consumer research reaffirmed our belief that Indonesia’s

LV segment remains underpenetrated, presenting a significant opportunity to transition consumers from traditional burning formats to a safer, more effective, and cost-efficient alternative.

To further strengthen this segment, we revitalized the LV format with a refreshed pack design, prominently featuring the “Good Knight” brand architecture. This update reinforced the importance of ensuring a mosquito-free, restful sleep for families, enhancing the product’s appeal and positioning in the market.

Stella comes back

strongly

Our air care business in Indonesia had experienced slow growth over the past few years, primarily due to subdued category expansion. As Stella, our market-leading brand, plays a pivotal role in this segment, a comprehensive brand strategy was developed to reignite category growth and restore Stella’s momentum.

In FY 2024-25, we implemented a multi-faceted approach to drive Stella’s growth trajectory. A significant increase in media investments, coupled with new product launches, refreshed packaging across formats, and relevant communication strategies, formed the core of this revival

plan. Two major innovations contributed significantly to Stella’s growth. “Stella Electric” was introduced to democratize ambient air care solutions, offering a superior in-home experience by upgrading consumers from hanging formats. As Indonesia’s first innovation of its kind, it has shown promising traction across deployed channels. Additionally, leveraging insights into Indonesian consumers’ fragrance preferences, we launched the “Balinese Jasmine Sensation” range across all major formats. Since its launch in August 2024, it has continued to grow, strengthening consumer engagement and Stella’s brand equity

In FY 2024-25, we implemented a multi-faceted approach to drive Stella’s growth trajectory. A significant increase in media investments, coupled with new product launches, refreshed packaging across formats, and relevant communication strategies, formed the core of this revival plan. Two major innovations contributed significantly to Stella’s growth. “Stella Electric” was introduced to democratize ambient air care solutions, offering a superior in-home experience by upgrading consumers from hanging formats. As Indonesia’s first innovation of its kind, it has shown promising traction across deployed channels. Additionally, leveraging insights into Indonesian consumers’ fragrance preferences, we launched the “Balinese Jasmine Sensation” range across all major formats. Since its launch in August 2024, it has continued to grow, strengthening consumer engagement and Stella’s brand equity

With these innovations, a revitalized pack design that enhances shelf visibility, and heightened media investments, Stella achieved double-digit growth, driving a ~120bps increase in penetration and significant market share gains across measured channels

NYU spreading its colours

The NYU hair colour business continued its strong growth trajectory, achieving another year of high double-digit expansion following an already successful previous year. This momentum was driven by strategic media investments, unconstrained supply enabled by local manufacturing, and a strong focus on general trade for distribution. Brand mind measures and equity saw further growth across multiple regions. Our latest advertisement, inspired by global insights from LATAM on convenience, has been well received, effectively strengthening brand perception and contributing to market share gains in key measured channels.

With the support of advanced R&D, NYU shampoo hair colour was re-launched with an enhanced 5-minute colour transformation claim, positioning it as the best-in-class offering within its format.

Winning market share in

Sexual wellness

In April 2023, GCPL has acquires PAKS business when the market share of KS in condoms segment was 10%. Post acquisition, GCPL has done two things to win in this segment.

The first was to set up a dedicated go-to-market (GTM) channel for chemist to sell this category along with other chemist channel relevant categories of both GCPL exiting portfolio and the acquired PAKS portfolio. Additionally, we initiated advertising efforts. Condoms broadly have four segments: Textured, Thins, Climax Delay and Flavors along with some other niche segments. Among these, Climax Delay condoms address a specific need that,

The first was to set up a dedicated go-to-market (GTM) channel for chemist to sell this category along with other chemist channel relevant categories of both GCPL exiting portfolio and the acquired PAKS portfolio. Additionally, we initiated advertising efforts. Condoms broadly have four segments: Textured, Thins, Climax Delay and Flavors along with some other niche segments. Among these, Climax Delay condoms address a specific need that, while prevalent, has seen limited consumer awareness. Hence, in order develop this market and build the Climax Delay segment, we have begun advertising to the relevant consumer audience across TV, CT and Mobile platforms.

while prevalent, has seen limited consumer awareness. Hence, in order develop this market and build the Climax Delay segment, we have begun advertising to the relevant consumer audience across TV, CT and Mobile platforms.

As a result, we have started gaining traction in the Climax Delay segment. Retailers who had never stocked KS condoms are now doing so specifically for its Long Last variant. Sales of this variant have increased across both online and offline channels, contributing to overall brand growth. As of the end of March 2025, KS condoms hold a market share of 12.1%.

Godrej No. 1 Relaunch

The Indian soaps category has reached near-total penetration, with shelves across retail outlets overflowing with multiple brands vying for attention. In such a cluttered landscape, packaging becomes a critical differentiator — it is often the first touchpoint for consumers and the most effective tool to drive recall and hence choice at the point of sale.

Godrej No.1, one of the highest-selling soap brands in the country, has always stood for natural ingredients and a superior bathing experience. To enhance its appeal, we undertook a strategic packaging & communication revamp.

The new design balances brand’s core equity of goodness delivered through natural ingredients and modernity — helping us strengthen connect with existing users while appealing to younger, first-time buyers. To ensure consumers were aware of this change, we launched a focused communication campaign with a television commercial at its heart. This was amplified across both traditional and digital media, maximizing reach and reinforcing familiarity with the new pack on shelves.

Simultaneously, we ensured rapid transition across retail and distribution channels, with dedicated efforts to build awareness among retailers and channel partners. This helped us avoid disruption and ensured a seamless switchover for a brand of this scale. The pack change commercial was followed by a new thematic campaign titled ‘Dil Se Khoobsurat’ to reinforce the brand’s evolved proposition and emotional connect.

The impact was sizeable — Godrej No.1 gained 50 basis points in market share (MAT

Mar '25) following the packaging relaunch, validating the power of pack design and integrated communication in influencing consumer choice in high-penetration categories.

The impact was sizeable — Godrej No.1 gained 50 basis points in market share (MAT Mar '25) following the packaging relaunch, validating the power of pack design and integrated communication in influencing consumer choice in high-penetration categories.

As we continue to evolve with our consumers, innovations in design, storytelling, and media execution will remain key levers to maintaining Godrej No.1’s leadership and relevance in India’s most competitive personal care category.

Brand campaigns

in LATAM

Between July and December, we executed a high reach TV campaign for Issue Express in Argentina, generating more than 3,200 GRPs (gross rating points). Issue Express became one of the main growth drivers for Godrej Latin America, exceeding expectations with results four times higher than initially forecasted and driving incremental category penetration in Argentina.

In October 2024, as part of the 10th edition of our annual Let’s Dye October in Pink campaign, Godrej Latin America, in partnership with Mamotest, donated 1,000 mammograms to support early detection of breast cancer in women from economically vulnerable backgrounds. The campaign was amplified through digital platforms, streaming, influencers, radio and press, reaching over 5.5 million impressions.

FY 2024-25 marked a strategic milestone for our Argentina business unit with the entry into the Home Care category. We launched AER. In the last quarter of the fiscal year, we introduced the first product, Aer Power Pocket, and began work on expanding the full portfolio. In FY 2026, we plan to launch a digital campaign to build brand awareness and drive market share in this new category.

In Chile, we launched the 360° campaign “Ilicit te Viene”, addressing a key barrier in the category, hair damage. The campaign introduced Ilicit’s new formula, enriched with revitalizing oils and hyaluronic acid, offering visible results and healthier-looking hair.

We also launched Issue's first-ever television campaign in Chile, supporting the rollout of Issue Express with the adaptation of a successful TVC from the Argentinian market.

These efforts, along with the introduction of Eco Keratina, contributed to Ilicit becaming the #1 hair color brand in Chile (Nielsen).

Investing in TV advertisements

and influencers in Africa

In Africa, our focus on improving quality of products and consistent investments in form of TV advertising and influencer marketing are showing strong outcome across all the categories.

In Darling range of hair extensions, we focused on basics of launching on-trend styles. We constituted a “Hair fashion board” which is a cross-functional team of internal experts in hair fashion category who were tasked with launch of relevant, key, on-trend styles across all key markets. We launched few but impactful styles that became instant hit in several markets through cross-learning and cross-pollination. For example, Natural Twist, a high performing style from Nigeria launched few years back was launched in Mozambique, Zambia and South Africa

In Darling range of hair extensions, we focused on basics of launching on-trend styles. We constituted a “Hair fashion board” which is a cross-functional team of internal experts in hair fashion category who were tasked with launch of relevant, key, on-trend styles across all key markets. We launched few but impactful styles that became instant hit in several markets through cross-learning and cross-pollination. For example, Natural Twist, a high performing style from Nigeria launched few years back was launched in Mozambique, Zambia and South Africa and has instantly become the most popular crochet in the market. We supported demand generation on these styles through TV advertising and viral social media campaigns through influencers.

and has instantly become the most popular crochet in the market. We supported demand generation on these styles through TV advertising and viral social media campaigns through influencers.

In Hair Care, Mega Growth in Nigeria showed continuous improvement after consistent investment behind a new green link tested communication. We have strongly invested in the non-relaxer business under Mega growth and it is showing positive results.

We launched aer pocket in Africa which has met with phenomenal success. Consumers have showered their love through viral product reviews and campaigns

Harnessing technology

and analytics

We have significantly scaled up our digital capabilities globally. Technology is deeply integrated across our value chain starting from our sales team and extending to our channel partners.

In India, we continue to invest in technology led field force productivity improvements. Our entire outlet universe is geo-tagged which has enabled scientific redesign of salesmen routes and drive geo-adhered visits. The sales control

centre has significantly helped improve productivity through real time view of sales team performance and automated nudges. Predictive analytics empowers our urban sales teams to offer the right products in stores. Technology has also been a key enabler in the superior planning and execution of our deep rural distribution programs. In modern trade, our merchandisers are enabled through an AI-based image recognition tool to detect and drive on-shelf-availability of our

In India, we continue to invest in technology led field force productivity improvements. Our entire outlet universe is geo-tagged which has enabled scientific redesign of salesmen routes and drive geo-adhered visits. The sales control centre has significantly helped improve productivity through real time view of sales team performance and automated nudges. Predictive analytics empowers our urban sales teams to offer the right products in stores. Technology has also been a key enabler in the superior planning and execution of our deep rural distribution programs. In modern trade, our merchandisers are enabled through an AI-based image recognition tool to detect and drive on-shelf-availability of our products. We also extensively leverage data and analytics to drive sharper execution on e-commerce platforms.

products. We also extensively leverage data and analytics to drive sharper execution on e-commerce platforms.

We have ramped up our investments in Data and AI. We have set up a robust data lake foundation on cloud which powers AI/ML use cases like demand forecasting, price and promotions planning, assortment planning, commodity buying etc. Robust analytics platform to forecast sales more accurately, factoring in external and internal variables and the automation of financial forecasting has helped improve predictability and operational efficiency in India and is now being extended to our global markets. Our media planning and deployment is driven by ROMI based media budgeting across brands and scientific allocation across different media vehicles to optimize cost per reach.

Technology enabled supply chain has been another key area of focus. Automated distributor order management has been implemented to improve fill rates. Technology solutions are also being implemented for strengthening production planning and distribution planning. Industry 4.0 initiatives, especially in our new factories in Chennai and Malanpur, is also an area of focus.

We have set up a finance shared service centre for our India, SAARC and Africa businesses and deployed various technology solutions to drive efficiency in shared service operations.

In our Indonesia operations, hand-held terminals facilitate and monitor on-ground decision-making, while analytics and dashboards drive more precise execution. In Modern Trade, AI-based image recognition tool has been implemented to drive on-shelf availability. To enhance collaboration with channel partners, we have implemented an online distributor portal, simplified claim settlements and automated the distributor order management to improve fill rates.

Additionally, a trade spend optimizer tool boosts returns on in-store investments for modern trade. Our goal is to further integrate technology across all execution touchpoints. We’ve strengthened our analytics capability on ecommerce platforms, translating insights into actionable strategies. In Indonesia, we are also deploying AI for improved safety and Industry 4.0 technologies to enhance manufacturing productivity.

In the SAARC region, we harness the potential of tech partnerships and analytics to bolster our traditional trade expansion. We utilize cloud-based distributor management systems to enhance efficiency and effectiveness. Through this approach, we aim to expand distribution in traditional trade in both Bangladesh and Sri Lanka while enhancing efficiencies in existing stores. We use automation to streamline inventory and claims management processes.

We recently completed a successful migration of our SAP ERP to S/4 HANA. We have subsequently moved our Africa businesses to SAP. With this, all GCPL businesses globally are now on single instance of SAP leading to simplification and reduced complexities. Salesforce automation now covers most field personnel in Nigeria and Ghana, enhancing coverage and brand visibility in the region. Our focus is on expanding distribution, improving efficiencies, and enhancing accountability across channels and regions. Virtual interactions with consumers and stylists help us stay attuned to market trends and facilitate agile action planning. Technology has also played a pivotal role in optimizing our shop floor operations and improving labour productivity in our African hair fashion business.